New borrowers can easily be misled by lenders when it comes to using credits scores for approval. In this episode, we are going to be talking about how lenders, FICO, and the entire funding game players use credit scores to distract rookie borrowers from what is being measured. Merrill Chandler talks about credit profile versus score and the true indicators of fundability™. He also discusses an ideal borrower’s profile, one that lenders can easily approve, and shares some critical client examples showing complications on personal credit profile, credit line approval, and authorizing someone with horrible credit.

—

Watch the episode here

Listen to the podcast here

Profile Versus Score

In this episode, we’re going to be talking about how lenders, FICO and the entire funding game players use credit scores to distract rookie borrowers from what is being measured.

—

Credit scores, we’ve talked about them. I’ve told you they’re the third or fourth most important funding criteria. They’re in charge of determining what your interest rates are and what your limits will be, but they are not in charge of your approvals. Let’s find out what else lenders do with the scores to distract rookies. My job is to make you a professional borrower. This is what rookies do and we’re going to talk about that. The first thing I want you to be reminded of is this is one of the biggest and hugest land mines ever. I’m here to remind you what that looks like. How many times when it comes to borrowing money, does it look like this for us?

Credit Profile And Score: Lenders cannot deny you because of age, but they can deny you for lack of experience or the wrong types of profiles.

Credit Score Versus Profile

Here’s the thing, can you have a great score and still be unfundable? The answer invariably is yes. We’re going to be talking about why your scores can be high and be unfundable. Why you could have derogatory accounts and not be fundable. If scores are not the true indicator of fundability™, what are? What should we be looking at? More importantly, what do lenders look at to determine your fundability™? First things first, your credit score is not a fundability™ indicator. It’s an indicator of rate, term and the amount of the limit. It is not whether or not you’re going to get approved. It has less or little impact than any of the other indicators. What impact your fundability™ and what’s the true indicator of fundability™ is the quality of your borrower profile.

The Unfundable Profile

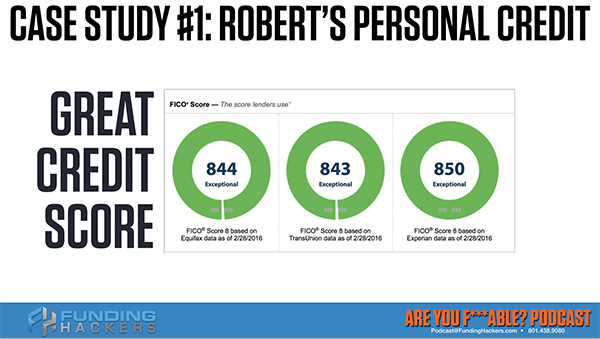

The borrower profile is everything. Credit profile equals fundability™. Let’s take a look at our first case study is Robert’s personal credit. Many of us would kill to have Robert’s credit scores, 844, 843, 850. Two of them are with one point of each other. The max distance, remember how we talked about the spread. If it’s over twenty points, it gets kicked out into manual underwriting. If it’s under five to ten points, your peachy or at least stays in automatic underwriting. Here, we’ve got no more than seven-point spread. We’re thinking, “We’ll kill for these.” We would love to have these credit scores, except when Robert came to us, it was an unfundable credit profile.

Credit Profile And Score: High-value personal profile, high-value borrower profile, high-value credit profile are all similar in nature describing the same thing.

In the last episode, we talked about how you can file an application, you can get your inquiry submitted, but the bottom line is will a lender lend to you off of all the criteria? In this case, this is an unfundable profile. What we mean by the unfundable profile is getting the types of credit instruments that you’re after. Robert’s profile was a Lowe’s account, a Best Buy account, a Home Depot account and a local Credit Union credit card. I believe it was $5,000. The interesting thing is there’s what’s called peer lending. Peer lending dictates that you’re going to get a yes from like-kind lenders. You’re going to get a big yes. There are many tier-four cards. These are tier-four credit instruments. This is a tier-three, but it’s an 80% value contribution. This is a consumer profile.

This is an unsophisticated borrower. It’s not pejorative. It’s a rookie or somebody who is barely getting into the game or doesn’t understand the rules of the game. It’s an amateur borrower’s profile. That amateur borrower’s profile means that wherever you go, you’re going to be approved. If you’ve got those scores, 858, 844, 843, that means if you go to Amazon Express, Victoria’s Secret or The Limited, you’re going to get the very best interest rates on those types of cards. Your 800 plus credit score tells future lenders that for these types of accounts, this quality of a profile, rookie consumer, amateur, this level, this quality of a profile will merit the very best interest rates, the very best limits, the very best, everything of like-kind lenders.

Credit Profile And Score: Payment status and payment consistency go together.

These are known as consumer finance accounts as myFICO.com credit reports indicate. They have a negative effect on your profile. There are what are called negative indicators that point out that these accounts are on your profile and they diminish your fundability™ because they’re looking for professional borrowers. Lenders want to lend to professional borrowers except for merchants. Merchants want anybody, “Just buy my merchandise.” This is what an 800-plus credit score means. It means you will qualify for similar exact types of quality of accounts. If you’ve got lots of tier-fours and you have an 800-plus credit score, you’re going to qualify for more tier-fours. What is not going to happen ever is Wells Fargo giving you a $50,000 business line of credit on your Home Depot reputation. It is not going to happen. It hasn’t ever and won’t ever. You’re not going to get these types of trade lines, these types of accounts on the business side. You might get a personal one, but that changes the personal profile. This is Robert’s personal profile. You’re not going to get business lines of credit, commercial loans, etc. based on that reputation.

The Authorized User

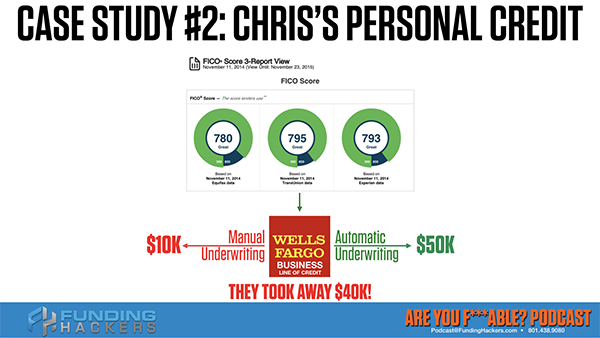

Let’s go to our second case study, Chris. Chris came to us with good scores. Some of us would kill for those scores, but the issue is that780 to 795, there are fifteen points. We’re still under the margin of error for manual underwriting. It stays in automatic underwriting. Chris came to us because he was pissed off. When he went for a business line of credit in automatic underwriting, they said that he was awarded a $50,000 business line of credit. He was thrilled out of his mind except it was a conditional approval. Conditional approval is the banker speak, “We got to put this into manual underwriting.” You got kicked out of automatic underwriting.

The borrower profile is everything. Credit profile equals fundability™ #GetFundable Click To TweetWhen they were in manual underwriting, they took $40,000 away and approved him for a $10,000 business line of credit. Why? Because automatic underwriting is doing calculations and math as we did in the previous episode. Remember, I said there are only three or four of the metrics in that example. There are other metrics that are being modeled. I want to show you what a couple of those are right now. When they pulled the credit and gave him a conditional approval, they noticed that the Chase account that was on his credit profile was a twenty-year-old account and he was only 30 years old. It was a vast difference.

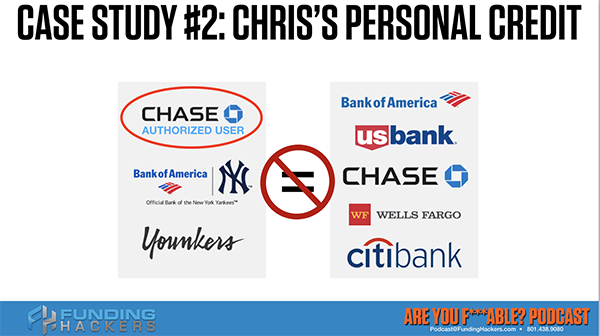

The Chase account was twenty years old and Chris was only 30 years old, which means he would’ve gotten this account when he was ten years old. I come to find out that in the manual underwriting, they discovered that in the Chase account, he was an authorized user on his father’s. Notice, the data points didn’t sync up and as a result, he got kicked out into manual underwriting. This is a perfect example just like 36 months on the previous podcast we did. The 36% over the twenty-average utilization over the 24-month lookback period. They’re measuring that stuff. They’re looking at how old are the accounts versus the age of the individual. They cannot deny you because of age, but they can deny you for lack of experience or the wrong types of profiles.

He was an authorized user on his father account. That Chase account was a $50,000 account, which proves once more and more time proves my account that if Chris was the owner of the Chase account all by himself, then he would have qualified for that $50,000 business line of credit because he had proved over twenty years. We don’t have to go that long to prove, three months, six months, twelve months, 24 months is sufficient. He had proven over twenty years with Chase that he had never been late and treated that Chase’s money with deference and respect.

He was originally approved, but they found out that that wasn’t his case. Let me tell you what the deal is with authorized users. Out of the mouth of the FICO score development team on the personal side, we asked specifically in one of our 100 questions, how are authorized users scored? We were told specifically and directly that if you’re an authorized user, the max you get and it is altered in the different versions of the software, but I’m generalizing, they get up to but not more than 40% of the possible points as an authorized user. Let’s say there are 100 possible points for a Chase card. They only get 40% of them. If someone is using it to raise their score, it’s no bueno because you’re only getting 40% of the possible points.

What they also said was that because that authorize user has full access to the account, in the calculations, they don’t know who made the charges to the account. The authorized user, if that account goes negative, just like it’s going to destroy and drop the owner of the account of credit score and fundability™, it’s also going to devastate the authorized users. You get 40% of the positive, but you get 100% of the negative for being the authorized user. I want to tell another story about authorized users. Forgive me if I share these a couple of times but some of them are just devastating circumstances.

We had one client come in. He had been optimizing his personal side while he was prepping for his business funding. He had worked so hard to get his profile into a position where he got approved for a Chase card. He’s a different person than Chris but got approved for a Chase card. He was so excited and it was one of those Chase sapphire or something where they give you 50,000 points if you spend $3,000 in 90 days.

Against our recommendations, he went up and charged $9,000 of the $10,000. It was huge. It was 90% utilization within the first 30 days. That’s error number one. At the same time, he also put one of his friends who had horrible credit. He put that friend on as an authorized user to help that friend’s credit and Chase shuts the entire line down. He made two mistakes. Number one, he put an authorized user on his account that had horrible credit. Since that authorized user technically has access to the full line and he had shown irresponsible borrower behavior in the past, that’s a huge mark against the owner of the account. The owner went up and charged 90% on that card. That’s the worst things you can do in the first 30 days.

There were two marks against him. Chase shut it down and he has not recovered from Chase at all. He’s still making payments on the Chase account, but his optimization plan had to go to a completely different direction because he burned a tier-one bank by not playing by the rules of the game. I bring that up in this circumstance because I want to show you that being an authorized user or providing somebody as an authorized user does not help them if you’re giving them authorized user status and it may harm you. If you’ve got the card for years and you’ve got a perfect payment history, there’s a less negative impact because you’ve made a statement and you’ve proven yourself to that lender, but authorized users do not significantly improve it. Here’s the other thing, because we’re talking in this section about scores are used to distract borrowers from being rookie borrowers from what’s being measured.

Your personal profile is the funding machine for your business #GetFundable Click To TweetHere’s a perfect example. People out there, you’ll find on the internet and keep looking because we’ve done some Facebook Lives where we’re taking on individuals who are selling trade lines. They’re selling all access to authorized users. They say your score can go up and the thing is your score can go up, but the 99th percentile is not going to help your fundability™. There are a couple of places when somebody is recovering from a bankruptcy or some devastating financial injury, as we’ve been using the basketball metaphor. If they’re on the bench because of a financial injury, then it’s a high negative impact. An authorized user helps your score a little bit, but it doesn’t help your fundability™ at all because no one is going to approve an authorized user for $50,000 business lines of credit.

They failed here. They took $40,000 away because that $50,000 automatic underwriting with conditional approval went into manual underwriting. That authorized user is not fundable. He did not get that Wells Fargo account opened. He got $10,000 because he had other funding criteria and like we’d said in another episode, even manual underwriting, they’ll approve you, but you now have to prove up. He didn’t get as much as what he would have received in an automatic underwriting. Manual underwriting, you get less money and worse rates. You’ve got to be aware of what they’re grading. We’re not grading up credit score points. We don’t care about the credit score points.

We don’t care that his scores are good or great because it didn’t do him any good when it came. Those scores did not do him any good because he didn’t have the right kind of profile. The Chase didn’t make sense, Bank of America was a co-branded card with the New York Yankees and he had a Yonkers department store card. It’s the same as Robert in case study number one. He’s not going to get the funding that is possible when you have a high-value personal borrower profile. Remember those words, “High-value personal profile, high-value borrower profile, high-value credit profile.” They’re all similar in nature describing the same thing. As we said, 80% of all business approvals for small businesses and entrepreneurs are based on a fundable borrower profile and a fundable profile trumps any score.

I will take a 720-credit score from a fundable profile over an 820 unfundable profile. You see how this is working. We don’t care about the score until we’re fundable and all scores follow fundability™. You can have an 800-plus fundable profile and that’s why I’m saying that language over and over. The next that we got to understand is your personal profile is the goose that lays the golden eggs. Your personal profile is the funding machine for your business. We had a comment from one of our superhero clients. He was a student that became a client and he sent in our Insider Secrets a testimonial that I wanted to read. I want you to understand and he even says this in magic language.

Your Golden Eggs

Let me give you an example of what some of these golden eggs are, business credit cards, FICO-driven hard money loans, unsecured business loans, commercial loans, trophy business credit lines, trust and prestige in a partnership. These are the eggs that the golden goose, your personal profile, will lay. I’m going to read this to you because it is worth every single word and sentence. It was pure magic. This is on our Insider Secrets, our client group. He said, “I started my journey with CreditSense last fall at the very first live boot camp in Minneapolis, Minnesota and became a client credit eagle in training in April 2019. This team is amazing and has continued to coach me and teach me the rules of the game to help me optimize both my personal and business profiles. I’ve had several wins along the way already with profile optimization, score improvements, automatic credit limit increases on my personal cards and had my first eagle flight with my first Chase business credit card on my QFE, my Qualified Funding Entity. With an initial limit of $33,000 and I’m on my way to $1 million in funding in the next 12 to 24 months. Thank you, Merrill and team, for showing me the path from being a credit average to credit savage. I’m getting the ball rolling. There’s so much amazing content and so much to learn. #FundingHacker, #CreditSense, #CreditEagle, #CreditSavage, #IAmF*able, #RespectTheGoldenGoose.”

I share that with you because of #RespectTheGoldenGoose. Thank you. I’m super proud. He’s amazing and we have had many wonderful conversations in his optimization path towards fundability™. It’s already got results coming in. We’re only a few months into his process and he’s already taking down business credit instruments that are legit business instruments that promote everything that we’re talking about. I share that with you because your personal profile is the golden goose so #RespectTheGoldenGoose. Those are what we’re after. We want the best mortgages, the best loans, the best credit lines and the best of everything.

What Makes Up A Borrower Profile And How It’s Measured

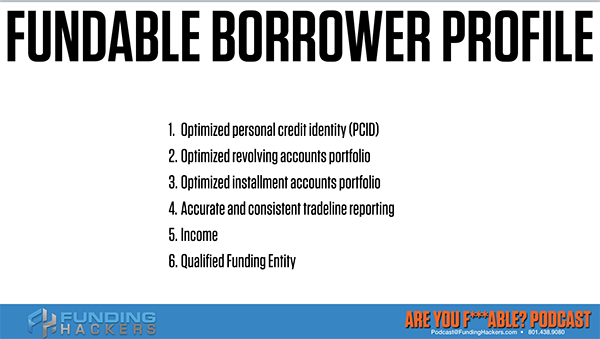

Let’s talk about what makes up a borrower profile and how is it measured? A fundable borrower profile has an optimized personal credit identity. The whole section on this, we’ve already talked about this earlier. We went through the optimized personal credit identity. You should already be pros at that. If not, go to GetFundable.com, check out the Bootcamp and get your profile sorted out. Second, we want to optimize our revolving accounts portfolio. That’s coming up in a few episodes. I’m going to knock it out of the park. I’m going to show you exactly what is valuable, what’s not valuable. I showed you some slides of junk profiles and junk credit instruments that are downgrading your fundability™ and FICO admits they’re downgrading. They are putting negative indicators saying, “Too many consumer finance accounts.”

Number three, optimized installment accounts portfolio. Remember, we used the term portfolio to describe the collection of your revolving accounts, credit cards, charge cards and etc. That portfolio is the collection of your auto loans, your mortgages, your student loans and personal loans. ATVs and grand piano loans, not revolving installment accounts. We’ll define all those. We have a wonderful section coming up to describe that. Accurate and consistent trade line reporting. You have to have consistency between all three bureaus at myFICO.com. Get that report. Get that monitoring because that is where you’re going to see the truth, not just of your unweighted credit scores, but the actual scores lenders are using.

The insider secret to improve your fundability™? Pay more than the minimum payment and never make the same payment amount twice#GetFundable Click To TweetWe got to know this and then income is a function. There’s household income, there’s individual income and there is traffic from your business. There are amazing ways to hit your funding guidelines with your income. We work with people who are on a fixed income. We have worked with people who have eight-figure incomes. We’ve got everybody in between. Income takes longer, but you are not out of the gate if you have a small or fixed income. There’s the Qualified Funding Entity. This is what our client was talking about, the QFE. The Qualified Funding Entity is an entity that lenders look at and said, “I will lend to that entity.”

What Next?

There are things that are completely unfundable out of the gate, even in the name. I will tease you with it now but your name, if it has one of the red flag words, is going to get crushed. If you want to know more, go to our website root around and go to the boot camp. Get fast forward on all this stuff, even what you’re bingeing. The next thing is after you have a quality profile, once you’ve put together all of these things and you have what’s going on, a fundable profile, then what do you do? What’s after that? I said it again and I’m going to say it 100 times after this, a 24-month lookback period.

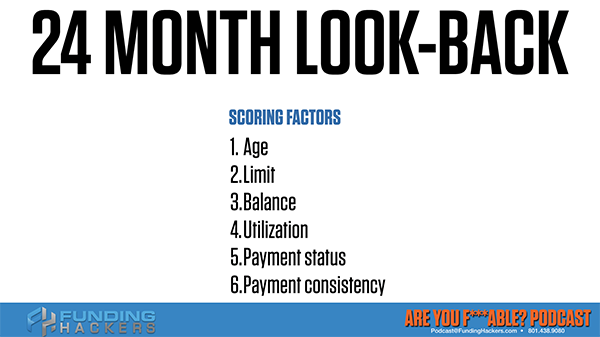

Let’s take a look at it. It’s time to do a deeper dive there, 24-month lookback period. There’s a bunch of things in addition to this, but we’re covering the big ones. The age of a loan or a credit card or an account. What is the limit or the original loan amount? The higher the better. We’re all about strategic data. I’m not trying to get you in debt. All of these have to make sense, but time and money are interchangeable. The more money you have, the less time fundability™ takes. The less money you have, the more time it takes and it’s okay. Everybody takes time, but you need to know what they’re measuring on the 24-month lookback period.

What is the age in these 24 months and is it a rolling 24 months? What is the balance? What is utilization? We already saw previous episodes about how that comes into play. They calculate at your most recent 24 months for the average balance or average utilization and they project that on to your usage to see if you even qualify for that new credit instrument. There’s payment status and that payment status is not just paid as agreed, but how many months have you been paying exactly on the due date? Not the day before, you don’t get as many points. Not the day after, you don’t get as many points. Most of us think, “I’m paying it early. I’m getting more points.” As we’re going to discuss, we’re going to be talking about one of the most devastating secrets that lenders hold back from us.

We’re going to pull back the curtain and we’re going to find out exactly what lenders are doing so that you can have a spectacular payment status and improve your fundability™ incredibly and then payment consistency. The reverse of that is that you never make the minimum payment. You always want to keep the algorithm guessing. What message does it send when you make the same payment every single month? It says, “I can’t afford anything else.” The insider secret is what is it measuring? It’s measuring exactly how much of the payment. You don’t have to make a big payment, but don’t just make the minimum payment. Make more than that and never make the same payment amount twice. Payment status and payment consistency go together.

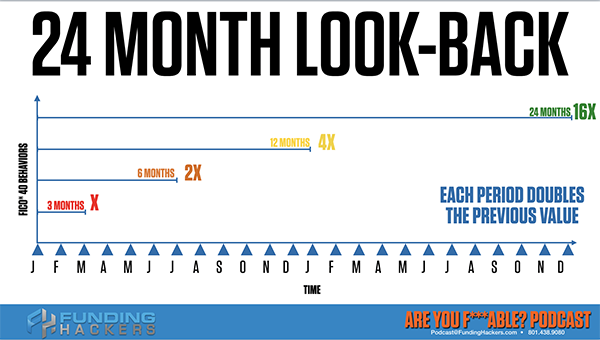

This is crazy stuff. You got to know this game or you’re going to continue to lose. You’re going to continue to get dunked on. Let’s look at the 24-month lookback period. First of all, we have FICO 40. FICO doesn’t call it that, we do, the FICO 40 behaviors. I’ve got 24 months and by the way, all you Jasons in the world, I want you to know that you have been memorialized inside of the calendar. I discovered this when I put this together. The name Jason is memorialized from July through November. I noticed. I don’t know what it means, but these are the patterns that I find. This is why I’m good at what I do. This is what I see. I connect dots even as random as it is. I don’t know if you knew that there’s Jason in the name of the calendar, but now you do. That’s what we’re looking for, patterns, connecting dots and making all this make sense.

The next thing that we’re looking at is the first increment that is measured by the 24-month lookback period is three months. We’re going to call three months X. There are six months and we’re going to call that 2X. There are twelve months, which we call 4X, then we’re going to say that there are 24 months, which is 16X. If you see the pattern, each period is the square of the previous period. That’s why it’s logarithmic. It’s a slow start and a steep incline. It is the square of the next period. What’s fascinating about this is that each of these values being the square means that the longer you do a behavior for good or bad, the better or worse it’s going to be. The language says each period doubles the previous value and that is an error. Each period is the square of the previous value.

What we need to understand is that 24-month lookback period, if you have a high utilization for three months and then pay it off, there’s only X amount of damage against your 24-month lookback period. If you carry that same high balance for six months, then you have twice the damage. Twelve months is four times the damage and sixteen times the damage if you’ve been going for 24 months with that same high utilization. If you’ve been paying your credit card off for three, six, twelve or 24 months to zero on the due date, then you’re getting the juice from FICO for having done it for the entire 24-month lookback period. If you only go three months of paying on time and are paying it to zero and then you go back to high utilization, then the three months starts over. You start that three-month trails off and it’s replaced and gone after three months.

This is vital for us to be able to understand. We have been led to believe that scores matter. Our wrap up for this episode is simply saying that scores are useful in determining rates, terms and amounts of approvals. They are not the important factor in the approvals. Whether or not you get approved is based on something completely different. Our goal is two-fold. One gets approved and then get approved for the highest possible limits or loan amounts and the lowest possible interest rates. We got to focus on what is being measured and this whole episode goes through that. If you haven’t done so, go to GetFundable.com, check it out. Study the graphics. Do not miss out on what they’re measuring. The score is not in charge of approvals. God speed, God bless and we will see you next time.