Having many credit cards may have its advantages, but it can be a total headache when the bill comes especially when you’ve used one card after another. In this episode, Merrill Chandler talks about reporting dates and how to pay your bills on the right period without sacrificing your fundability™. When talking about credit, it boils down to how lenders perceive you as a borrower. A lender withhold is one thing that can crush the soul of a borrower profile. Merrill lets you in on what lenders are doing or not doing in order to make borrower profiles worse than they should be so they can charge you higher interest rates. He also talks about a withhold that lenders are keeping from us that significantly limits our funding abilities.

—

Watch the episode here

Listen to the podcast here

Reporting Dates

I love playing with all the ways that we can shout this message out to the world. It’s the only question that matters. The only question that counts is are you f-able? We’re going to be discussing something, I don’t want to call it a manipulation. I don’t want to call it a lie. Let’s call it a lender withhold. A withhold that is crushing the soul of your borrower profile, your credit profile. We will knock it out of the park and find out what lenders are doing or what they’re not doing in order to make your credit profiles worse than they should be so they can charge you higher interest rates.

The Lender Withhold

Sometimes there’s a very thin line between making a profit and what some people call conspiracy. I don’t know what this is because it is awfully suspicious. We’re going to be talking about a withhold that lenders keep from us that significantly limit your funding abilities. Let’s take a look at this. First things first, I’ve said it before. You’re going to hear me say it again. In any relationship you’ve been in and you’ve withheld something, it was treated by your partner as a lie, right? “I didn’t lie to you.” “You withheld it from me.” A withhold is a lie. How many of you have been slapped across the face with those words?

Intentionally, I’m calling this suspicious lender activity a withhold. I don’t know that it’s a lie, but I also don’t know that it’s not planned. When you go out there and buy toasters and appliances, they call it obsolescence. That’s a withhold to keep us updating our appliances, buying new things, getting new stuff. The new car smell goes away intentionally, so we need to buy a new car, whatever it is. In this case, the furthest I’m willing to go is to call it a suspicious lender activity. This withhold does significantly impact your fundability™. Let’s take a look here and we’re going to go through step-by-step because for all of you who are reading, you’ve got to come back and look at the blog at GetFundable.com. Make sure to see the graphics because there’s a lot of actionable intel that you need to be able to see.

More Than Making Timely Payments

You’ve got to come back to this episode because there is too much going on that you’re going to need to see. I’m going to explain it the best I very can. Is there more to your credit score than making timely payments? The answer is yes. I’ve implied that and I’ve said it boldly and out loud, but when I’m out doing real estate conferences, when I’m out working with borrowers and real estate investors or business owners out in the world, invariably somebody will come up to me and say, “I’ve got a great credit score. Why do I need you?” As I’ve said before, I always ask, “Where’s your $500,000? Where’s your $1 million in business credit instruments that says that you’re fundable, that you’re doing a good job, that you deserve that 800-plus credit score?

Lender Withhold: You don’t lose points, but you don’t gain extra points if you pay any time before the due date and not on the due date.

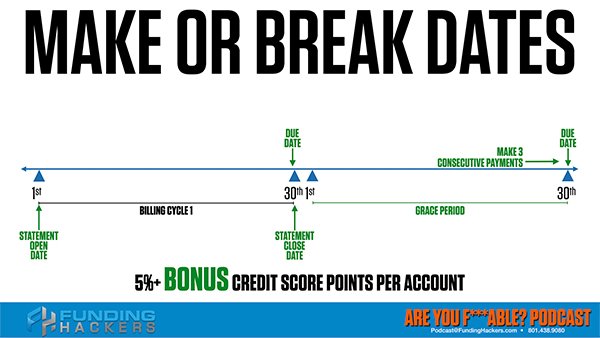

They always tell me that they owe their credit score to paying their bills on time. There is far more to getting a fundable profile than paying your bills on time. Let’s take a look at a couple of things. This is for educational purposes because some of you know this, some of you have never gone through this. We need to know this stuff. I call it to make or break dates. I’m going to describe it in great detail, but in this example, we say between the 1st and the 30th is your billing cycle. There’s a statement open date on the 1st, then there’s a statement closed date on the 30th. That’s your billing cycle. Every charge that occurs during that billing cycle goes on to your total balance. We’re not going to get into the fact that yes, you can pay every day or every week to lower what ends up on your due date, but we’re saying that in this case, the billing cycle is what we’re discussing.

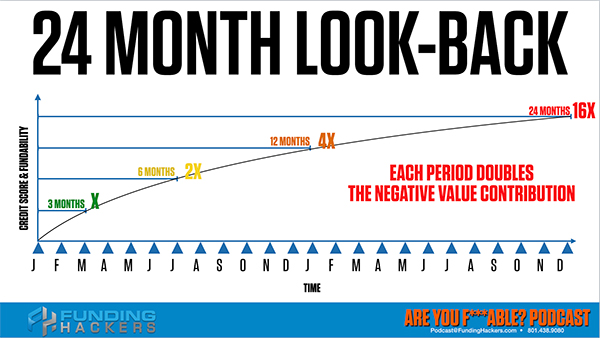

Also, there’s a grace period. The grace period can be as short as ten or fifteen days. It can be as long as 30 days. In here we’re showing that there’s a 30-day grace period, that the due date is not for one month after the close of the statement. The next set of dates we need to understand is that if you make three consecutive payments, remember we’re going back to that 24-month lookback period, if you make three, six, twelve or 24 monthly payments all on the due date, take it down to zero on the due date, you’re going to accumulate more and more positive underwriting and FICO points.

Hitting that delinquency, depending on where you are on the credit score pyramid, may greatly crash your fundability™ #GetFundable Click To TweetThe whole thing we’re trying to accomplish is that you are showing fastidiousness. You’re showing that you know how to honor and respect the lenders’ money. Three, six, twelve and 24, it’s the same criteria of all other 24-month lookback period increments. If you make those payments fastidiously, you’re going to add additional credit score points to your profile. This is where you go from a 720 to a 760 or an 810 to an 840. The longevity of making these payments and due dates to zero on time is important.

Things That Create Point Loss

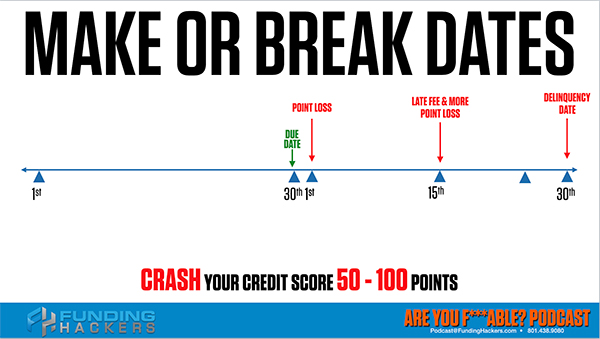

Let’s take a look at the things that can create a loss. First of all, did you know that there is a point loss if you pay the day after your due date? We say our due date is on the 30th. There is point loss, credit score point and fundability™ point loss when you pay on a day after the due date. This is one of the data points that are kept on your consumer disclosure files. Remember those raw data files we talked about in the past. As I’ve said before, we’re going to be doing a total complete analysis of the consumer disclosures from each of the three credit bureaus as well as a deep dive into how to interpret your FICO credit report. For now, know that in the consumer disclosure files, those raw data files tell you the date that you paid it.

Lender Withhold: Having an artificially high balance and artificially low fundability™ kills your score and your fundability™.

You don’t lose points, but you don’t gain extra points if you pay any time before the due date and not on the due date. You may make weekly payments, but you need to make a payment on the due date at least so that you can trigger the software. After the 15th of the month, there is a point in time, whether it’s the 10th, the 15th, the 20th, every single lender says that there is a late fee date. Whatever that late fee date, there’s also an additional credit score and fundability™ decrease, a penalty, when you pay. They’re charging you the late fee to motivate you to pay sooner because the further you get down towards that 30-day late, the more default tendency there is.

The lenders are saying, “Why can’t this person make their payments?” You’ll notice they start circling the wagons, they’ll start lowering credit limits. If you do this too many times and pay on the late fee date, they’re going to start circling the wagons, lowering limits and raising interest rates. Those are the two big dates, the day after the due date, there’s point lost and there’s more point lost whenever your due date is where there’s a penalty. The next one after that is the delinquency date, which is always called 30 days late. This is a warning, but if you’re ever pushing that delinquency date, if you’re ever getting close, you need to call your lender and find out for that account when it is delinquent. What is the last moment you can pay that without getting the 30-day late?

You don't lose points, but you don't gain extra points if you pay any time before the due date and not on the due date. You may make weekly payments, but you need to make a payment on the due date at least so that you can trigger the software… Click To TweetHere’s the problem. 30 days late on February may mean March 1st or 2nd. 30 days late in July may not mean if your due date is on July 1st, it may not mean that it’s August 1st. It may mean that it’s July 30th. You’ve got to know every account, what that delinquency date is, when it goes delinquent. Do not get hung up on the 30-day late thing. That’s what it’s called, but it may not necessarily be 30 days late. You’ve got to find out lender by lender. The other thing is anytime you hit that delinquency, the 30 days late depending on where you are on the credit score pyramid, you may crash your profile score fundability™ by 50 to 100 points. We got to know this.

When You’re Not Getting Credit

In recap, if you pay early and do not pay something on the due date, you’re missing out on points. You’re not penalized, but you’re missing out on additional points. If you pay on the 1st, you get a loss. If you pay on the late fee date, whatever that is, 10th, 15th, 20th, you get a loss as well as you have to pay more money. The delinquency date crushes your profile. Given those parameters, the question we ask now is, “Does your score reflect paying account balances off every month?” I’m going to tell you, for most of you, they do not. Let me ask you a question. Do you pay to zero on the due date one or more of your credit cards every month? We’re not talking about your mortgage, we’re not talking about auto loans, we’re talking about credit cards. Do you pay them to zero on the due date? Because I’m going to tell you that you’re probably not getting credit. Like it says, you’re not getting credit for making those balances paid off every single month.

Lender Withhold: If you haven’t gotten your myFICO report and monitoring, then you don’t have the right tools. That’s like going to a money tree without a bucket.

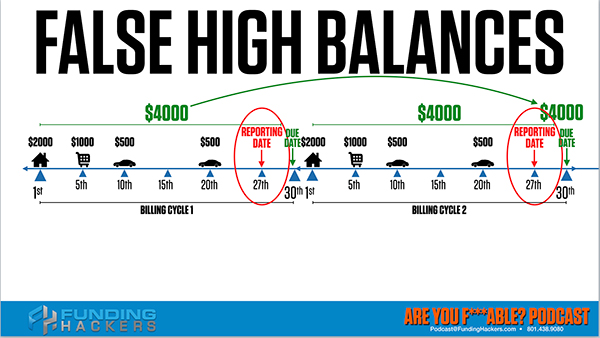

Let’s see what we mean. We’re going to weave an example. There’s going to be a lot of words in describing this process. Let’s pretend you have a $5,000 credit card and you spend $4,000 a month, 80% of it you spend on making your house payment, car payments, living expenses, but you put it on the card. You use your card to make those payments so that you can get the rewards in the points and the rebates. Are we all clear? You probably do it. I know millions of people do it this way. As you believe you paid to zero every month on the due date, but are you getting credit for it? What is going on?

Let’s take a look at this and see what’s happening behind the scenes that you don’t know about. This is crazy and it’s going to change your fundability™. Now, your fundability™ may be horribly affected and when we change it, it’s going to crazy positive effect your profile. I call it false high balances because are two features of the credit reporting process, the account reporting process, that is impacted. What does the lender acknowledge you for doing? What does FICO acknowledge you for doing? The lender sees what you’re doing and will give automatically limited increases or shut down your accounts based on your behavior. The lender is measuring the performance data inside of your account, but whatever’s getting reported to FICO, that is what is being reported to every other lender out there who may ask about or inquire about your credit reputation.

Having an artificially high balance and artificially low fundability™ kills your score and your fundability™ #GetFundable Click To TweetYour borrower profile is showing all this data to the world. Let’s look at how false high balances might be a problem. On the 1st to the 30th, we pay $4,000. In this example, we pay $4,000, $2,000 in a mortgage, $1,000 in family expenses and two auto payments. All of those are finished by the 20th of the month. When the billing cycle closes, we’ve charged $4,000 that is going to then be due 30 days later because we’re saying it’s a 30-day grace period. Everything done let’s say in January is then due at the end of the month on February 28th. Next, and this is important, while we are waiting for that new $4,000 to be paid off in the middle of February, we are also charging our house payment on the 1st, expenses on the 5th, the first car loan on the 10th and the second car loan on the 20th for an additional $4,000. We haven’t paid off the January statement of $4,000 but January’s waiting to be paid and we are now charging in February those very same expenses on our credit card.

Presumably, we’re paying December’s on the 30th of January, let’s say. It’s not because you’re not keeping your word, but one of the reasons why we stop losing credibility and start incurring fundability™ point losses and credit score losses is because if you miss a payment from that due date, then there’s $4,000 due on the 30th, $4,000 due from the previous 30th, but then on the first there’s a $2,000 addition on your card that hasn’t been paid off. You haven’t paid it off, so now we’re at 6,000, on the 5th we’re at $7,000 because the previous statement has not been paid. Now you are above and beyond the limit, significantly beyond the limit. If you’re back to zero on the due date here, then you’re back to zero and you’re accumulating new charges. Even if you’re late one day, five days, in this case, you’re $7,000 on a $5,000 limit. We are now upside down and FICO and underwriting penalize us terribly.

The Little Talked About Withhold

Let’s say we have made that payment. As it goes through, in comes the little known and little talked about withhold. This withhold is not sent to you in a big revelation inside of your new account when you set up a new account. It may be in the fine print, but it doesn’t say what the date is. You have a reporting date. Every month, this account reports to the credit bureaus. Citibank is reporting on the reporting date every single month your account information. That is where the trouble begins. If you don’t know what you’re doing, you’re going to end up being penalized terribly. These false high balances, let’s say that the reporting date is on the 27th. Go look at the graphics. Go watch the video.

Let’s say the reporting date, Citibank reports this credit card to the three credit bureaus on the 27th. What does that mean? What that means is that first, your reporting date is the key to fundability™ because how much is going to be reported to the credit bureaus? Think about it. We’re looking at this example. If the due date is on the 30th and 1st through the 20th, I’ve charged up $4,000 before the previous due date, before the previous statement is due, I’m going to show $4,000 as a balance that’s reported even though three days later, I pay it to zero and I have a zero balance. The zero balance is not what is getting reported to the credit bureaus. Let’s look at that.

When your balance is optimized and when you have killer scores, you can have a killer fundability™ #GetFundable Click To Tweet1st through the 20th, I charge up $4,000. The due date hasn’t approached yet to for me to retire all of that from the previous statement period. I ended up getting $4,000 out of my $5,000 limit reported to the bureaus. That is an 80% utilization on this account. That means I’m being scored by FICO because this is what’s being reported to the credit bureaus and FICO calculates the score based on what is reported. While you may have a zero balance for the lender and the lender’s looking at you going, “You’re super awesome. Thank you for paying for 24 months. Thank you for paying to zero every month.” They may give you automatic limit increases. They may give you perks and extra points and all kinds of awesome stuff, but that’s not what’s getting reported to the credit bureaus and not what’s being scored by FICO.

Artificially High Balance And Artificially Low Fundability™

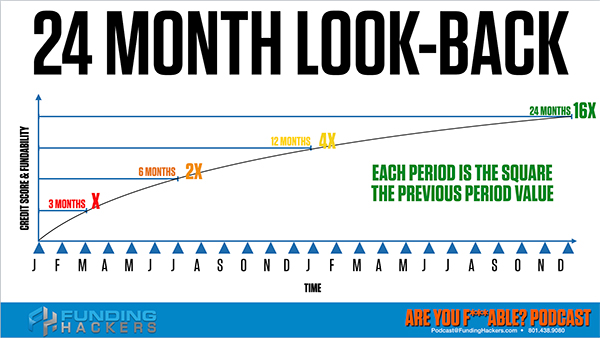

You have an artificially high balance and artificially low fundability™. It kills your score and it kills your fundability™. Let’s go back to the 24-month lookback period. If you’ve done this behavior for three months, it’s X against you. If you didn’t catch this, if you’ve been paying your balance to zero for six months but you’re getting caught with your balances up reported high and your score goes down, then you’ve got twice the damage. Twice the points are being counted against you because in this case, you’re carrying that 80% that’s being reported every month for six months. If you didn’t catch it twelve months ago, it’s being reported for the last twelve months. Most of us, if you have a habit, the resources, everything to pay all your credit card balances to zero, you’ve been doing it for a minute.

If you’ve been doing it for 24 months but balances have been reported on you for the same 24 months, you have got chronic high balances in this process. You’re getting killed. Each period is the square of the previous period, not doubles. It’s a logarithmic calculation. It’s a travesty. We’re not told this stuff. That’s why I call it a withhold. We’re not told this stuff. It’s not a big piece of paper that says, “Be sure to know what your reporting date is so that you have,” whatever’s a low balance, let’s say 7%, “No more than 7% at the reporting date.”

Fixing The Problem

There is a way to stop the madness and fix the problem. Let me go over these hints. Let’s go over these and we’re going to establish what those steps are. Number one, first of all, you have to determine your reporting date. I’m going to tell you it’s going to look like a mess because when you call your lender, they may not even know what the reporting date is. I’ve written down some guidelines and I’ll go over them so that you guys can at least have a fighting chance. In our Get Fundable! Bootcamp, we go through this process and you’re able to ask questions and get everything dialed so that you know exactly how to stop this madness for your profile. Find out the information. There’s a free video there. If you haven’t watched it yet, that explains the whole nature of these withholds and the three secrets to fundability™.

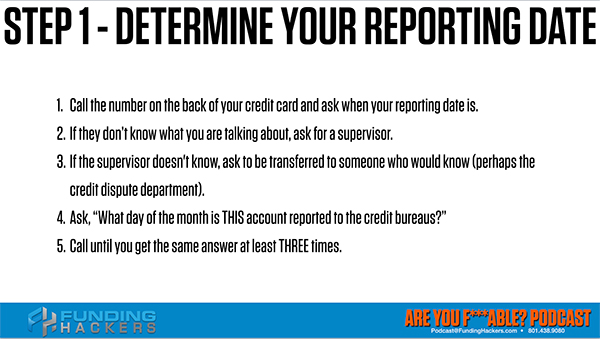

In determining your credit reporting date, step one, call the number on the back of the credit card and ask when your reporting date is. If they don’t know what you’re talking about, ask for a supervisor. If the supervisor doesn’t know, asked to be transferred to someone who would know, perhaps the credit dispute department. Here’s the language to use. I highly recommend this language. Ask what day of the month is this account reported to the credit bureaus. As I’ve taught you in every single other episode, call until you get the same answer at least three times. Sometimes it’s a nightmare.

Let me tell you a story. Trish was one of our credit advisors way back in the day. She was a new hire and as I said, everybody goes through the process of creating their own fundability™. In this case, she had a Discover card. It was a high-value card as we’ve learned. In this evaluation, she was going to keep this tier two, 80% card because it was over $10,000. It was over a couple of years old and it was a positive account on her profile. It fits all the high-value credit instrument criteria. She gets on the phone, I’m standing there at her desk and she dials up Discover and says, “What day of the month is this account reported to the credit bureaus?” I forgot the dates, it was a long time ago, but the point is they said, “The 22nd.” She looked at me and was like, “That was easy.” I’m like, “Call again.”

She calls again, gets a completely different person and that person when asked the question says, “The 5th of the month,” without a second of hesitation, like it was the truth. She looks at me and goes, “This is weird.” I’m like, “You keep calling until you get the same answer three times.” She went through all five of these steps. First of all, don’t take the first answer. Seriously, ask the question of as many different customers service reps as it takes to get three. I can’t guarantee that that’s the truth. I’m saying if three people say the same date, you’re probably okay. This, as you can tell, is a pain in the butt, but it is so worth it because if you find out your reporting date is in the middle of your billing cycle, you’re not getting credit for paying it to zero.

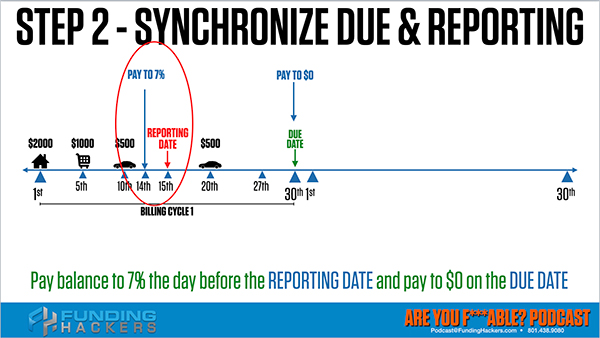

We got to stop that. You have to get credit for paying to zero. I’m going to show you exactly how that works. Let’s take a look at step two. Step two says that you need to synchronize your due date and reporting date. What does that mean? That means from here on out for the rest of your financial life, you’re going to make at least two payments on each of your credit cards. This is why we don’t want you to have seventeen credit cards, you sweet credit card stackers. This is why three to five is manageable. Will working with us allows you to find out what the tolerances are for your profile, but I’m giving you what the truth is. The day before the reporting date, you want to pay your balance down to no more than 7%. When it’s at 7%, it hits the reporting date and a report no more than 7%. On the due date, you pay it to zero. You get credit for two things. When you paid to 7% the day before the reporting date, it’s going to report a balance that you are in charge of. That balance is purposeful.

You can make as many payments as you want before this. I don’t care if you pay every week. Make a charge and pay it off. I don’t care. What I care about is that there is a balance of 7% the day before the reporting date. That’s what I care about. I want you to make sure. Even if it takes charging it up to 7%, then do it for very intentional and purposeful reasons. It then reports that 7% and then on the due date, you pay it down to zero. Don’t touch that card in between those numbers. Technically, if it reports on the 27th at 7%, you can charge it up to your 38% if you have to, but on the due date you pay it to zero.

It doesn’t matter where that reporting date is. In that case, it was the 27th. What if we put the reporting date down on the 15th or the 10th? You paid to 7% on the day before to the reporting date. Regardless of when it is, make sure it’s at 7% before the reporting date. You can then use it at will between the reporting date and the due date. As long as you pay it to zero on the due date. I’m going to tell you a couple of extra things. First of all, Ethan, I asked if I could quote him and he said yes because it’s not algorithmic-specific, but it was more than we knew before. We asked what’s the perfect balance at the reporting date. He said less is better than more, some are better than none. In our estimations, we found two things generically speaking for every borrower, 7% is a safe bet of that sum is better than none. 7% will create a very positive experience for both your fundability™ and your credit score.

What we also found when we started building our systems out that there are specific balances. Some are even dollar balances and not percentages. They’re specific balances that can even optimize your profile and your fundability™ even more. Those you have to be in the system. We’ve got to calculate that because as I’ve said, the pie chart, you’ve got to have a small pie or you have a big pie. There are ways to which your contribution, every single one of your credit cards as a piece of the pie chart has a contributing factor to the revolving account’s portfolio. If you believe in good enough, 7% is good enough. There are more optimized balances to have, but at 7% of the limit, if you have $10,000, you want $70 at the time of reporting.

This provides a positive effect. Like you’ve been spending the last three, six, twelve or 24 months in sending the wrong message to lenders, the sooner you start this process, the sooner you find your reporting balances, the sooner you find and start reporting the good optimized balances or relatively optimized balances. You’re going to start reporting the three, six, twelve and back up to 24. This is squared, so each period is the square positive value contribution of the previous one. We need to start that going as fast as possible. If you need help, go to the damn bootcamp. If you can do it on your own, get it done on your own. You’ve got to figure this out because if you pay it to zero, I almost guarantee and the way to find out is to go to your myFICO report.

Your MyFICO Report

If you haven’t gotten your myFICO report and monitoring, then you don’t have the right tools. That’s like going to a money tree without a bucket. If you don’t have your myFICO credit report and you’re reading all of these shows, you’re missing the boat. You’ve got to have the tools to be able to check your particular fundability™ in what FICO measures on your accounts. The second you get that, go through your revolving accounts. In an episode soon, we’re going to be reviewing how to interpret the myFICO credit profile from myFICO.com. Once you look at that, look at the accounts that you say you pay it to zero every month. Look at them and then look at what the actual balance is.

You believe you’ve been paying it to zero and perhaps for even 24 months you have not been getting credit for paying your zero due dates. You’ve been carrying a balance and that is crushing the soul of your golden goose, your funding machine, your personal profile. Optimize balances, at least 7%. Find out how to get even better balances. Optimize balances and create killer scores. It creates killer fundability™. You got to figure out what it’s worth to solve all this. It’s going to take you some time. If you want to crash course this, go check out the bootcamp at GetFundable.com. What we are doing here is establishing all the metrics. One of the episodes that are coming up is where we go through all, not just the FICO 40, but the 150 criteria that FICO uses in different ways to create your fundability™. The FICO 40 is what’s being measured through the current software versions, the credit score software versions. We’re optimizing 150 ways. We want to make sure that you are dialed into every part of this.

Thank you for being here. Thank you for caring enough about your fundability™ too to go through this. I know I’m a fire hose. I know that sometimes I don’t tell enough stories. I know sometimes I speak too fast. I know that there are ways that I can improve everything that I’m doing and please make sure you write on the comments of the episodes. Give me feedback. What did you like? What didn’t you like? What do you want to know more about? Write in the comments of all of the episodes so that I can see what’s going on for you. Know in my heart of hearts, there is so much to talk about, so many things that I can reveal to you and that you can discover that’s going to your entire life. Keep reading and share this with your friends. Make sure we’re all f-able. If you’re f-able, it’s not fun unless everybody else is f-able around you.