Credit makes you look good but only if you play by the rules. In this episode, Merrill Chandler guides you on how to manage your installment loans to create positive scores for your FICO. He clarifies the difference between the types of credit and tiers of financial institutions. He also exposes the truth behind 0% interest offers for an auto loan. Catch his tips on how to solidify your fundability™.

—

Watch the episode here

Listen to the podcast here

Installment Loan Quality

In this episode, we’re going to be discussing and you are going to discover how your installment loans create an almost impenetrable fortress against negative or derogatory accounts if you know what you’re doing. If you know the rules of the game, you can win the game. We’re going to be talking about how installment loans contribute to your personal profile and the positive results or the negative results that occur based on how you manage them.

We’re going to be discussing how your installment loans and those behaviors trigger positive points and create resiliency in your personal profile. First of all, as we talked about on your revolving account portfolio, remember we said that there is a message that revolving accounts send. It says, “Look at all the money you have access to and yet how responsible I am.” Installment loans matter because it sends a completely different message. It says, “Look at all this money you gave me, house loan, car loan, student loans. You gave me all this money in one lump sum and look how faithfully I’m paying it back.” This is presuming that you’re paying it back faithfully, but the message is “look how faithfully I pay it back.” If we know what we’re doing on these installment loans, we’re going to create a foundation of powerful credit reporting.

The bigger the loan amount, the more valuable it is #GetFundable Click To TweetLet me give you an example. I think of installment loans like the ballast in a boat. The ballast is that part deep in the keel that has weights. Back in the day when they had the scooters, the 16th, 17th, 18th centuries had all these ships. That’s where they kept their cannonballs. When they ran out of cannonballs, they’d have to find rocks to put in there because you want to be able to turn your ship without sinking in the water. If you don’t have enough ballast, you can tip this boat. Ballast is everything and loans create that heft, that center of gravity, that heaviness that keeps your profile deep in the funding waters.

Understanding FICO

FICO counts the total number of positive payments on all of your loans. If you have a file of less than twenty total accounts, open or closed, good or bad, you’re characterized as having a thin file. This thin file then has measurements, a 30-day late or a collection account or a lien or a judgment. They all count heavily against that because you don’t have enough accounts and you don’t have enough months of positive payment. A thick file where you have twenty or more and let’s presume that you’ve made all your payments faithfully, you had several or numerous home loans, several or numerous car loans all paid perfectly.

Every single month that you make that payment, you’re putting more weight, a cannonball, a rock in the keel of your boat. You are creating this so that it sits deep in the funding waters. If you have all of this ballast in your borrower profile, then if you have a 30-day late, it may affect you less. You may take a 20 or 30-point hit rather than a 50-point or 100-point hit because that one 30-day late is a percentage of all the possible times that you’ve paid on time. FICO gives you credit for all those positive payments. It is insanely important to not only have the right loans but pay them on time and accumulate all of these positive payments.

Let’s define what an installment loan is. An installment loan comes in various vehicles, but it’s only one kind of credit instrument. It has a fixed loan amount, a fixed payment amount and a fixed term, which means the term is the payback period, 24, 36, 48, 60, 72 months, etc. That’s it. If it has a fixed loan, fixed payment and fixed term, it’s an installment loan not a revolving account. Many people think credit is credit and it’s not. You’ve got to understand your loans are one thing and your revolving accounts, your credit cards, etc. are something completely different. What is the perfect installment loan portfolio? There are two very important features for your installment loan portfolio.

One, we prefer tier one 100% value installment loans. That’s the preference, just like we prefer tier one revolving accounts. The other thing is there are minimums that are required by FICO to capture the most number of points. For example, FICO for having a home loan, for having a mortgage on a credit report, you’re going to get fifteen to twenty points. It doesn’t matter if it’s one-day-old or one-reporting-cycle-old, you’re going to get fifteen to twenty points. It’s the same with an auto loan. You’re going to pick up fifteen to twenty points just for having an auto loan. I cannot tell you how many students and clients have complained to my team members or me. They’re like, “I just paid off my car. My score dropped twenty points.” I’m like, “Have you paid attention in your Get Fundable! Bootcamp? Did you watch your client videos? Because we say specifically, and I’m telling you that an auto loan needs to be on your profile to round out the loan mix section of FICO’s scoring model and as a result, lender underwriting models. You don’t have to have an auto loan, but you get penalized for not having one. You don’t have to have a home loan, but you get penalized for not having one.” I’m telling it like it is.

I don’t know of a single client who has an 800-plus borrower profile that has neither a home loan nor an auto loan. It doesn’t happen because that’s part of your loan mix. Technically, it doesn’t matter how big the home loan is. If it’s a $50,000 or $100,000 home loan, as long as it says mortgage or real estate loan, you’re set. It doesn’t matter if it’s a $5,000 or a $2,000 auto loan, as long as it says auto loan on it, you get credit for the loan mix section of profile building. Here’s the other thing though. The bigger the loan amount, the more valuable it is. You don’t get more points for having an expensive loan in the loan mix section, but you get more underwriting points for being able to handle higher loan amounts. This is important if you’re trying to build your profile and optimize it for business lending. If you want $50,000 and $100,000 business lines of credit, but the max amount of credit you have is a $20,000 auto loan and no mortgages, it’s unlikely you’re going to get a $50,000 or higher business line of credit. There is no evidence you know how to handle that amount of debt instrument. We want one home loan and we want one auto loan wherever possible. This is vital.

Identifying Different Loan Institutions

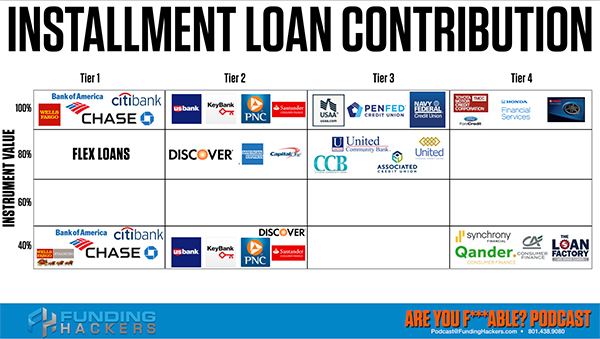

Are installment loans created equal? The answer is a resounding no. Let’s go through the same metrics that we did for revolving accounts. At the top we have tiers. That’s the value of the financial institution. Tier one is the best. Tier four is the least. We have instrument values 100%, 80%, 60% and 40%. Tier one is Bank of America, Wells, Chase and Citibank. Each one of those institutions can have what are called flex loans. A flex loan is more of a marketing gimmick. Be aware. If you’re still receiving offers, what do we say? Do not take advantage of a credit offer. Many times for installment loans, flex loans will be offered to you via mail or contact from your banker, etc. The other thing is that there are 40% versions, departments or divisions of the tier one bank. Wells Fargo Financial may carry a premium interest or a high interest or the subprime auto loans. Bank of America, Citibank, Chase, they change all the time but many of these banks have a division that offers loans for higher interest rates. Those loans are what are called subprime loans. The tier 100% are prime loans and 40% are subprime loans.

The same banks and institutions fall in tier two for installment loans. You got US Bank, KeyBank, PNC, Santander, all the regional banks are tier two 100%, but Discover, American Express and Capital One online also offer loans. They’re usually higher interest. They’re subprime loans and we give them at 80% and some of the same regional banks have subprime divisions. If it ever says financial, you know you’re going to be paying a higher interest rate and you’re going to be working with the same tier but a different value contribution of the loan. Wherever possible, we prefer tier one 100% loans on your personal profile.

On the business side, it’s way more liberal because they don’t track the value contributions of the different tiers on the business side yet. FICO is moving in that direction, but they do not do so yet. If it says financial in the name or financial services as part of the name of that institution, then you are in a separate division of US Bank, KeyBank or BB&T or whomever. Look for financial services. Usually, financial services are not part of a revolving account. It is only for subprime lending. Tier three, same thing. You got the national scope, credit unions, federal savings and loan, USAA, PenFed, Navy Federal at 100% and then at 80% you have the community banks and the credit unions.

Any loan coming from a credit union that’s local to you and local can mean multiple states, but it’s local. It’s not a national scope credit union. They’re going to be tier three 80% contribution to your profile. I’ve had clients and students complained this isn’t fair. Fair is not a thing in the funding game. Fair is what the lender is willing to do for the lender based on how good the borrower looks, how they look on paper, what’s their point value. Going back to the NBA player parable, the NBA draft. Do they have stats where one of these lenders wants to draft them onto the team? That is the only thing that matters. It’s not fair to somebody that doesn’t make the NBA draft. They didn’t make the draft because they haven’t got game, they haven’t got the stats, they haven’t got the proof. It’s not about fair, but on tier four, Ford Motor Credit, Toyota Motor Credit Corporation, Honda Financial Services, Yamaha.

As these financial services companies have revolving accounts for motorcycles, ATV, WaveRunners, etc., you know as well as I do that they also have installment loans and most of these are auto loans. They could be boat loans depending on what they are, but auto loans. We think we’re getting a good deal because Toyota Motor Credit Corporation is offering 0% interest and we’re like, “I want that deal.” I’m going to tell you something about that deal. Rarely does an auto dealership offer financing where they either say 0% interest for 60 months or whatever it is or cash back rebate. A rebate you can apply to the total of the car. The thing is if you do the math, I have not seen once where the 0% interest doesn’t exactly match the rebate offered in cash against the purchase of the car. It’s the same. Don’t get your undies in a bungee because Ford Motor Credit says, “I’m going to give you interest-free financing.”

I’m telling you it’s a tier four institution. It will show on your borrower profile as a consumer finance account and FICO will downgrade it’s fundability™. Take the lowest possible interest rate and take the cash rebate. They’re the same thing but take the rebate and then get a better institution to finance the automobile. The rebate and the zero interest come out to be exactly the same or very near the same. If you can qualify for zero interest, usually it’s tier one, it requires 720 or higher credit scores. If you qualify for 0% interest, that same interest rate is going to get you the best interest rate possible that’s going to equal the rebate. It’s easy to take advantage of, but these are tier four finance companies. Finance companies always downgrade or degrade the fundability™ of your borrower profile. Your borrower profile sucks when you have these on here. Take the rebate and move on.

If something says 'financial,' you know you're going to be paying a higher interest rate #GetFundable Click To TweetThe equivalent of retail merchant cards, the mall store cards, etc. We have the Synchrony Financial, Qander Consumer Finance, Consumer Finance, LoanFactory, all of these are the tier four worst of the worst, 40% contribution. These are actual finance companies. Do you realize that one of the FICO criteria is an inquiry of a finance company? If you try and get financing from one of these, these are not complete lists. These are not the only participants. These are the types and kinds. FICO downgrades your fundability™ when you even apply for one of these tier four institutions. You didn’t know this either, but if you go for a check-cashing, where they pull your credit like a cash advance or a title loan and you pull an inquiry, that’s a huge extra doc on your borrower profile and FICO penalizes you and passes that along to all the underwriting software.

Where you’re looking for money, the quality of the money you’re looking for is crazy important. You cannot just think, “Let me go grab some new credit.” In a couple of episodes, we’re going to be talking about spirit animal totems, credit totems. Think of it as the horoscopes of financial animals. These animal totems represent the unconscious behavior that FICO and underwriting software measures. We’ll be able to talk about this. I’m going to come back in that episode and I’m going to talk about what kinds of animals, especially the animal totems that look for this credit instrument. Be wise, be aware and take care of yourselves and each other. Make sure that you’re doing everything you can to be F-able because all the financial success in the world comes when you are F-able. It’s been a pleasure. I will see you next time. Have a wonderful day.