In this episode, fundability™ expert Merrill Chandler teaches you how to order business credit reports so you can spot deal killers and red flags. Using CreditSense, LLC, follow his step-by-step guide on which options to choose, what data to input, and how much to pay for them.

—

Watch the episode here

Listen to the podcast here

How To Order Business Credit Reports And Spot Deal Killers And Red Flags

In this episode, we’re going to be talking about how to order your business credit reports so you can find out if there are deal killers or red flags on any of the items that would hamper you from building your fundable business entity. We’ve discussed in numerous previous episodes what I’m going to refer to as BCRs, Business Credit Reports versus Personal Credit Reports, PCRs. Your business credit reports are very important. As we’ve discussed in the previous episode, we do not have the same laws and rules governing our business credit reporting. There are specific rules that allow lenders, credit bureaus, etc. on the personal side with your Experian, TransUnion and Equifax personal credit reporting process. Those rules do not exist on the business side.

It’s still a little bit like the Wild Wild West as David Smith from FICO and I discussed in our previous episode. The Wild Wild West means that they can say and do things on the business credit reporting that are not allowed on the personal. We’ve got to be aware of those. First things first, we’ve got to get copies of them so we know whether or not your business can be a qualified funding entity. One of the main qualifications is, are there red flags? Are there deal killers? Are there trade lines that are showing that this is not a good entity? It is very difficult to dispute business credit reporting whereas it is simple to do personal credit reporting.

We’re going through and show you how to order those credit reports. Once again, we’re going to use CreditSense. I’ve gone to Experian.com or SBCR, which is Small Business Credit Report, SBCR.Experian.com and that’s where you begin this process. In my case, I’m in Salt Lake City and Utah is my domicile. I’m getting a credit report based on the domicile not foreign filed entities or anything else in other states. The credit report is based on the main corporation because you only get one credit report per business. You can have multiple addresses listed on that credit report as extra offices or ancillary offices, but you better have only one business credit report.

I got CreditSense Salt Lake City, Utah and my company. I want to pull up my company because you can pay to acquire other company credit reports. If we click on “Get credit report now,” this is one of the things that I want to show you. In this case, you will notice that in “Chooses the right product for your selected business,” it says that my credit report has trade lines. It has given me all of these options. If you do not have trade lines, if you only have information regarding your identity, from your secretary of state or department of corporations, they may list an $8 feature here, but because I have trade lines, they are giving me these options.

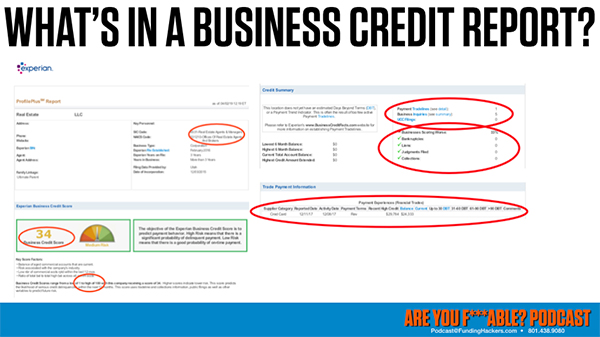

Use business credit reports as actionable intel #GetFundable Click To TweetSelect the least expensive option because you’re going to find the red flags or the deal killers in the least expensive. In this case, I could either do the credit score report. It’s a score report, a summary of the business and credit info and a summary of the financial payment. These are all summaries. In this case, $39 each would be sufficient. If I want more in-depth, I could go through and get a financial detail and in-depth credit history, etc. Those are the things that you want to establish what is it that you’re looking for. For our purposes, the main point of all of this is for you to be able to find out your identity data, SIC code data and NAICS code data.

You want to know whether or not you have a negative one. If you don’t have any negative listings on your profile, then this is sufficient. If you want to find out more, getting the in-depth credit history is probably worth the extra $10. If you want to monitor your own profile, they’re showing it as $179 annually and if you want to see what your business is worth. Be careful if you want to see what your business is worth because they’re going to make you input all of your financial data. Once you’ve got that financial data, you cannot take it back. I’m not here to tell you what to do. I’m going to tell you what I do. I use these business credit reports as actionable intel.

I want to know what the BCID, Business Credit Identity, is all about. I’m not about supplying Dun & Bradstreet and Experian business with more data than they need to identify me. What happens is, especially on Dun & Bradstreet, if you fill out all your financial data, you implicitly give them permission to put you on the list to market to other companies because your business is a $500,000 a year or a $10 million a year business. You’re giving them the data. We’ve got future episodes where we’re going to be doing a deeper dive on how to use these credit reports to create the best FICO SBSS liquid score and the best funding approvals. We got more on that from what we learned at FICO World 2019. For now, use the data you’re putting in here to create the business credit identity. Synchronize that and make sure it’s the same across all three reports. I showed you my personal reports when we did the business application for Southwest.

In this episode, we’re not going into detail about how to do that. We’re simply showing you how to order them. We already did an in-depth review of my reports, both Dun & Bradstreet and Experian. Equifax, while it is a viable candidate for business credit reporting, it is the data source of last resort for FICO’s liquid credit score, SPSS liquid credit. That score uses Dun & Bradstreet first. If there’s not enough detail there, it goes to Experian. If you’ve got a business credit history, it’s going to be between those two. You always want to find out what someone is seeing in case they pull the less used Equifax business credit. There’s a business valuation report added on for $99. That’s up to you. I don’t do that. I’m already a member so they’re asking me to log in. The second I log in, it gives me the report from that previous episode. I’m going to have you go back to that episode about reconciling your data points. Reconciling those data points is its own episode. I just want to have a special session where I can show you how you can order the credit reports.

If you're going to take your qualified funding entity to the next level, you've got to check out your current businesses #GetFundable Click To TweetLet’s go to Dun & Bradstreet. It’s BusinessCredit.DNB.com and click on the products. This Credit Evaluator Plus is what I pull and what we recommend for finding out the data points. It’s a report for one company. It easily identifies how much credit you should extend to this company or what our credit profile looks like when we’re pulling our own, assess the risk factors and see if there are any legal filings, meaning suits, bankruptcies, Chapter 11s in the case of a business or more importantly, UCC filings. Some lenders file UCC filings, which pledge up the equity that you have available in your business.

All of that, you would click add to cart. This is “Managed my business credit.” There’s a credit signal if you want to be able to see people inquiring about yours. That’s an offered service. The Credit Evaluator Plus, that’s the $61 for one report. Add that to the cart, create your information, pay for it and you’re in. That is how you get access to your Dun & Bradstreet. Once you create the account, you’re going to be able to update that account. They’re going to ask you to input things. Once you set up an account, you’re going to be able to go in at the IUpdate.DNB.com that we did in that same episode, reconciling your data point. That episode is going to give you information so you can update your data and keep it current.

As I’ve shown you where we had moved but didn’t update the Secretary of State or Department of Corporations and now, there’s a whole chain of events including the United States Postal Service all weighing in and giving data to these business databases to make it more difficult for easy automatic underwriting approvals. We want to make sure we stay on top of that. Put in your information and do everything that they’re requiring you to do. That is BusinessCredit.DNB.com/product/credit-evaluator-report. You’ll be in there to be able to pick up how to grab that one.

Our final one we want to review is in case you need to order your Equifax as well. It is the database of last resort out of the mouth of David Smith from FICO. Equifax Business Credit Report is the third in line. You would find a company and when you look for that company, you input the data. I’m going to put in CreditSense and the address. I’m putting in my old address, 455 North because that’s what it has on record. Let’s put in CreditSense and Utah and put in only the main ones that they demand that we have. Utah, those are the only ones that are required. You hit the search button.

Once I am at the search button, it brings up CreditSense 455. It hasn’t been updated yet even though on the state I have updated this. I’m training my team on how to effectively assist their clients, especially our Valley clients to make these changes and keep everything updated. There’s the CreditSense. There’s CreditSense, LLC, which is a previous version. I explained all of this in the previous episode. We’re going to select that one. This is where it gives me the information to do it. Expand my choices. There is 749 and, “Show a sample report.”

One thing to watch out for is that CreditSense, I made it one word. Chris and some people use it in two words. We want to make sure that you try to find your company in every version of your name because if for some reason it got put wrong, you’re going to end up with wrong data or looking at the wrong iteration of your business. You’d be able to at least find out what the confusion is. We’re back to expand the choices, five company multipack and 797. That’s how you order your business credit reports. As I said, the most important one start out with Experian and Dun & Bradstreet. The order doesn’t matter, but those are the two main ones, then go to the Equifax.

The address here is SB.EConsumer.Equifax.com/bizdirect/smallbusinessselect.ehtml, then check your data. Equifax and Experian both require that you send in a copy of your credit report marked up with a letter telling them how to update it. Dun & Bradstreet has an iUpdate free of charge. You can go in and update it and then they verify it. Equifax and Experian both require you to write a letter and get the updates. It’s a simple episode, but if you’re going to take your qualified funding entity to the next level, you’ve got to check out your current businesses.

Here’s the drag. If you’ve got multiple businesses that you want to find out which one should be the funding entity, you have got to go to the bootcamp and find out what the criteria are for the best candidate. There is exercise we have to do. I can’t do that on the show because you may have 3 or 4 different LLCs. You might have a stock corporation. You may have 2 years or 10 years. There are so many criteria. You may be doing real estate investing in one and not in the other. Go to the bootcamp, GetFundable.com. Click on the bootcamp button and go to the bootcamp. You can fill out all of the worksheets that are going to help you establish what your fundable entity needs to look like. In previous episode, we reviewed the criteria, but we need to be able to customize which one is going to be your best funding entity. We’ll catch you on the next episode

Important Links:

- Experian.com

- SBCR.Experian.com

- BusinessCredit.DNB.com

- IUpdate.DNB.com

- BusinessCredit.DNB.com/product/credit-evaluator-report

- SB.EConsumer.Equifax.com/bizdirect/smallbusinessselect.ehtml

- Bootcamp – Get Fundable!

blog

April 11, 2020 10:30 amSaved as a favorite, I like your web site!