How can you improve your game as a professional borrower? The answer lies in using the right inquiries. In this episode, Merrill Chandler talks about inquiries and how they affect your score and fundability™. During this financial crisis, inquiries can also greatly affect how you run and grow your business. Merrill highlights FICO’s de-duping method and the different phases and kinds of inquiries that you need to put to heart.

—

Watch the episode here:

Listen to the podcast here:

Can Using The Right Inquiries Get You More Money?

Myths About Inquiries

In this episode, we’re going to be talking about inquiries. How do they affect your score, how they affect your fundability™ and especially how they affect your financial reputation during a crisis, personal or the global one that’s at our doors? Let’s start with a little bit of myth-busting. The first thing that comes to most people’s minds, and I covered this in my book as well, The New F* Word, is when people think of inquiries, they think of big-ticket items. When you go for a mortgage, an auto loan, Winnebagos, buying boats, whatever, RVs, they’ll say, “It doesn’t matter how many inquiries I have because as long as it’s within a 30-day period, it only counts against my score once.”

Two things are revealed in this. First of all, our preoccupation with the score. When individuals think that it only affects their score, you know they haven’t been to the bootcamp and haven’t read my book. These people do not have the real building blocks upon which their fundability™ exists and what lenders are looking at to approve of you. Yes, it only counts your score once that was negotiated by the lobbyists and it was a freebie that the negotiations between the Fair Credit Reporting Act amendments, FICO, lenders, everybody said, “Let’s combine them all. Why should it hurt your score more if you’re shopping for a car and you pull multiple inquiries? No harm, no foul.”

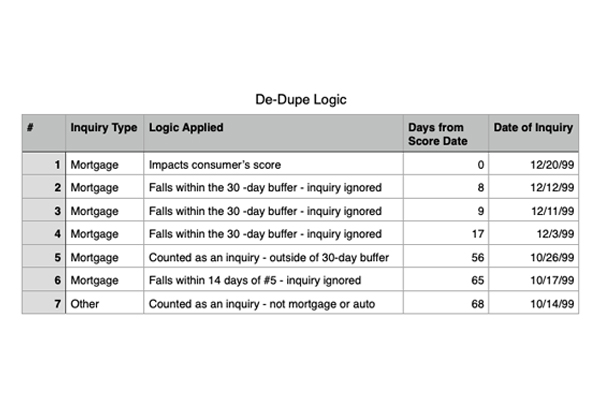

Here’s the thing, it’s true. FICO has a process that’s called de-duping, de-duplicating. I even have a chart. You get an inquiry for a mortgage and it’s on day zero. We’re going to count day zero. You get a second inquiry and it’s a mortgage inquiry. If it falls within the 30-day buffer, the inquiry is ignored. It comes in a week later. You’re going shopping for another mortgage. A third mortgage inquiry, it’s another five days. It’s still within the 30-day buffer of the first mortgage inquiry. You can have as many mortgage inquiries from the day of the first mortgage inquiry through 30 days. If you have a credit card inquiry during that 30 days, it counts as an inquiry. If you have an auto loan within that 30 days of that first mortgage, it counts as another inquiry.

FICO’s funding approval calculations are not relevant past 24 months. Share on XWe use this in the bootcamp all the time. Somebody pulls 7 or 10 inquiries when you go to the dealership. They’re shopping for your loan to find the worst loan to give you. You know what I’m talking about. If they pull those credit reports and those inquiries are within 30 days, like-kind all get counted as one. To use the FICO language, they are ignored. Any non-like-kind inquiries within that 30-day are still counted. The other thing is if on day 31 or day 32 or anytime past that, if you get another inquiry, it starts that clock over again. You have a new mortgage inquiry. You would have one at day zero and no mortgage inquiries count through day 30, 31, 32 or 33. If you get a mortgage inquiry, it starts the clock on day 31, a new mortgage inquiry and any after that for 30 days no longer count. This is called de-duping. We got to make sure we understand what that means when we’re calculating how we’re using it.

Here’s the problem, we’ve been led to believe that this is the only thing that matters. It’s not okay. It’s not the only thing that matters. It’s the last thing that matters because we’re not trying to save your score. We’re trying to save your fundability™. We’re trying to make you fundable. Whether it’s de-duped or not, the misuse or the misinterpretation of how the de-duping process works are going to ultimately count against you. Many of our client’s pool, we recommend that they use myFICO credit reports, my funding hackers or use myFICO credit reports. MyFICO only keeps track of twelve months of inquiries. The reason is because FICO’s credit report is designed to count score. It keeps the most recent twelve months and what inquiries have been pulled. It only counts against the score, like-kind within a de-duping period of 30 days.

Here’s the problem. Your fundability™, if you go to your raw data, the consumer disclosure files directly from Experian, TransUnion and Equifax, those raw data files, they carry the corresponding inquiries back 24 months. Why does FICO only carry twelve-months’ worth of inquiries and each corresponding bureau carries a full 24 months? The raw data that comes from the credit bureaus is what all lender software. It’s even what FICO’s underwriting part of their algorithms and AUS software. When it comes to just the score, FICO only needs twelve months of inquiries because it only counts for the most recent twelve months. All the underwriting software by lenders, etc., count on the bureaus to keep all 24 months’ worth of inquiries.

Credit Inquiries: De-duping means de-duplicating wherein all inquiries but one within a rolling-focused period are excluded from scoring.

Notice we’ve been talking about the 24-month lookback period. Here’s another example of its usage. They don’t care what happened more than 24 months earlier when it comes to your inquiries. It’s not relevant to their underwriting calculations, their funding approval calculations. It’s not relevant past that 24-month mark. Bureaus only keep 24 months. They keep negative credit for seven years, but the vast majority of the record-keeping is for those 24 months. While going out shopping for an automobile, for mortgages, while those may not count against your score, but once in those 30 days, they significantly count against your fundability™ because all the AUS software out there is using all of those inquiries for 24 months. If you went shopping for a car and you’re a dealer, it wasn’t your fault. You didn’t know until the bootcamp. If you go shopping for a car and they pull 4, 5, 7, 10 credit inquiries, that is behavior that AUS software counts as unprofessional. It is a consumer-level behavior.

Two Phases Of Inquiry Usage

I don’t know enough as a consumer and I’m not, I’m not credit shaming anybody. I’m saying, “This is how the game is played.” If I’m teaching you how to dribble in basketball and you don’t dribble, I’m going to yell at you for not dribbling. The funding hackers, all my podcasters who are bingeing, you guys know that you’re adopting more and more your awareness of the rules of this game. No credit shaming. I want you to understand the vital importance of not just knowing but upping your game as a professional borrower. Your consumer behavior is to go to an auto dealer and have them pull 4, 5 or 10 credit reports. Those inquiries are indications of the lack of being a pro and being a consumer. If we’re going to be measured by the credit bureaus and by the AUS software for all 24 months, then we want to carefully determine how we’re going to use those inquiries. There are two phases for inquiry usage.

One is what we call during our optimization, during our growth phase. Two is during the maintenance phase. When I say growth, some of you may be building profiles, some of you may be building a business profile, some are building personal profiles. The growth phase may require the addition of additional revolving accounts. It’s Don Malone’s picking up a mortgage or a car. A business line of credit or business loan or business credit card. Each one of those is going to require a hard inquiry. We’ve got the monitor and meter out the use of those inquiries. There’s a couple of ways to do this. One, that we have taught in the bootcamp and it has been mentioned in various versions, the mortgage podcast, the auto loan podcasts. The first thing you need to do is establish what is the preponderance of inquiries pulled, what bureau and version of the software are pulled for each one of the lenders you’re working with.

After correct fundability™ strategies implementation, it is likely that you can get approved for a loan. Share on XIf you have an auto loan with Chase, you have a mortgage with your credit union, whatever it is, you need to know who they pull. It’s kind of a misnomer. Every single mortgage company on the planet pulls all three bureaus because of they use the middle score, not the average score. The middle score is what they use for funding. If you’ve done it right, if you’ve optimized vertically by version, and if you’ve optimized horizontally by the bureau, you should be within ten points of each other. Therefore, all of your scores are going to be awesome and you’re going to end up in the AA or AAA rates rather than A-minus or B rates when it comes to your mortgage. Having said that, it is so important to know which bureaus are pulling credit reports both in their reviews of your account. That’s how we get soft polls and in your hard polls.

Hard And Soft Inquiries

When they’re doing a credit line increase or they’re giving you a new credit instrument, those are going to be hard pulls. Let’s talk about the other kind of thing that many people are aware of, but we want to get our terms down. There are hard inquiries and soft inquiries, also known as hard pulls and soft pulls. I talk about this a lot in my book. I’ve got a whole section on a huge footnote on the use of inquiries and how they’re best used. A hard pull is when a lender wants a complete review and every data point of your credit profile as reported by the three bureaus and scored by FICO. That’s a hard pull. They want all the data to run through their entire AUS system to approve you.

There’s what’s known as a soft pull. A soft pull is our nomenclature, the colloquial term of what they call an account review. Here’s what’s interesting. If you’re going for a credit card, a business credit line, they’re using the national bankcard score from FICO. They’re going to do an entire hard pull and bring all your data using the FICO 8 Bankcard. Pick a bureau. It doesn’t matter. Interestingly enough, if they’re pulling a FICO 8 Bankcard to approve you, they may do an unweighted eight to review you. See the difference, approve you versus review your account. They’re not going to use the Bankcard score. They’re going to use the regular unweighted score. There are groups out there who approve your FICO. Let’s say they’re using an 8 Bankcard they approve you with FICO, but they use like vantage for the review because there are different functions, different software, different features.

Credit Inquiries: A hard poll is when a lender wants a complete review of your credit profile, as reported by the three bureaus and scored by FICO.

We got to remember that a lot is going on behind the scenes lot going on behind the scenes. If we’ve done our fundability™ strategies and we’ve done implemented them correctly, then it is likely that you can get approved for a loan. You get approved for a credit line or a credit card. Six months later, use a soft pull for an account review and if your performance data is firing on all cylinders, they’ll approve you. Some banks even say, “We can approve you for X. We can get on a soft pull. We can approve you for Y on a hard pull. You tell us.” We coach our clients on which one to use depending on what their optimization strategies are. They’ll tell you, “We can approve you for $2,000 increase or a $5,000 increase, whether it’s soft or a hard pull. Many institutions, many lenders will do one soft pull a year and one hard pull a year. At some point, they need to do an entire count review to see how you’re doing.

There are promotional inquiries. We won’t get into promotional inquiries. Soft inquiries do not report like myFICO advanced credit profile. They will show up in the promotional or the account review section of your consumer disclosure files. There are so many account reviews going on. If they see shaky territory, they do an account review and they see that you’re fifteen days late on your Chase card, but you paid yours on time, they very well may do a hard pull on you to get to see how you’re doing. How does this fit? The key to this is how it fits in a personal financial crisis as well as the global financial crisis. The use of inquiries is measured insanely carefully. They know if you’re pulling a check-cashing inquiry. They know if you’re trying to qualify for a title loan on your car. Each type of lender is graded by FICO.

Not only is there a Tier 4, which is the junk stuff that we recommend because this is why I’m holding this in funding hackers because this isn’t common knowledge and we share on the inside. You may be rejected for later credit down the road because you were getting inquiries at a check cashing or a finance company or if you’re fishing for money, we’re going to get hit. Every time you ask for money from any commercial or retail location, FICO knows it and scores you. In this build phase that we’ve been talking about, ultimately, the perfect profile has only two inquiries per bureau, one per six months. In a year, only two, no closer than one per six months. That allows for an auto loan every few years. That allows for a refinance and allows for credit limit increases or acquisition of other loans. For our clients, we build an entire process of how to use the fewest number of inquiries across all three bureaus. You got to know if you live in California and you’re not careful, you’re going to go get hit and you’re going to have fifteen inquiries on Experian and none on TransUnion and Equifax.

We don’t want to do that. That’s not what we want to do. Inquiries are a powerful way of becoming un-fundable if you don’t know what you’re doing. Make sure that you do everything you can. If you haven’t done so already, sign up for coaching. We’re telling everybody that for right now if you pick up coaching, any one of our coaching practices has the Momentum Mastermind. The eight-week Momentum Mastermind with me is going to be included in your coaching package. Check it out, make sure you are onboard and creating as much fundability™ momentum as possible. It’s momentum mastermind so we can have fundability™ momentum. Binge the podcast and every single thing that we are publishing here. Make sure that you know all of these principles so that you have a leg up in your fundability™. Have a spectacular rest of your day. Be safe.

Important Links:

Love the show? Subscribe, rate, review, and share!

3M 9501

May 29, 2020 3:14 amHello buddy,

I really enjoy your site and your work is very interesting.

I must appreciate your work andefforts.. It is incredible.

King regards,

Mead Valenzuela