Credit bureaus lose money when they give you a Consumer Disclosure. They don’t want to give you this raw data because this information is what they use to establish not just your look-back period, but the metrics that both FICO and lender software use to approve you and will give you higher or low rates or higher or low approvals. In this episode, Merrill Chandler gives us a look at how credit bureaus, specifically TransUnion, list their raw data and how you can understand what they’re saying, why they’re saying it, and how this information makes you more fundable get bigger approval points.

—

Watch the episode here:

Listen to the podcast here:

Into The Madness Part 4: How To Get Bigger Approvals With Your TransUnion Data

We’re going into our next addition, our next version of the Into the Madness Series where we’re going to be talking about understanding how TransUnion’s raw data called the Consumer Disclosure is being listed and how you can understand what they’re saying, why they’re saying it, and how this information makes you more fundable.

—

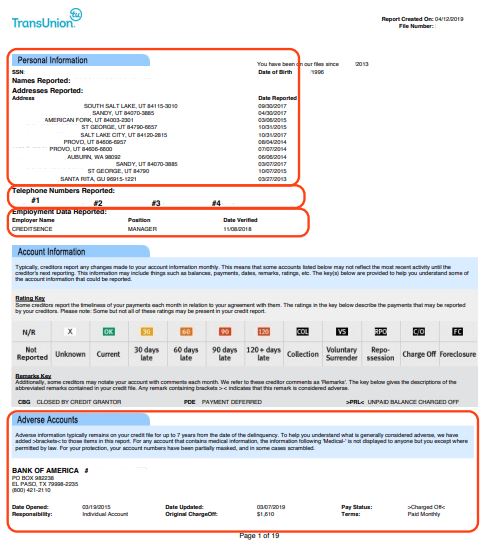

The next thing that we were talking about is this installment of the Into the Madness Series. I love that name because credit bureaus lose money when they give you a Consumer Disclosure. That’s the facts. The other problem is they don’t want to give you all of this raw data. If you have all this raw data and you have someone like me who’s going to walk you through what information is in there and why it’s important or why they’re hiding some of the facts in gobbledygook is because this information builds your 24 months lookback period. This information is what they use to establish not just your lookback period, but the metrics that both FICO and lender software use to approve you and will give you higher or low rates or higher or low approvals. Let’s continue onto TransUnion. We’re not going to be discussing how to dispute inaccuracies or doing an accuracy audit. I’m here to show you how this information positively or negatively impacts you. The first thing we want to look at is the file number. In the top right, it gives us the date of the report.

Getting Bigger Approval Points: Credit bureaus lose money when they give you a Consumer Disclosure.

If you are going to do an accuracy audit, if you are going to dispute some of the things that you’ve learned here in the show, at the bootcamp, from my book, you’re going to want to use that file number in any correspondence about this particular version of the report. Remember, if they improve, delete, change, update, and synchronize things, they’re going to give you a new file number and then you need to operate from that file number. What’s funny is TransUnion, Experian, Equifax all use a different term. File number on TransUnion. I can’t remember what it was on Equifax. We’ll be looking at Experian in the next episode. Under personal information, there will be one or more Social Security numbers. These are blanked out, but I’m showing you where they would be. If you have one or more dates of birth, they’re going to show you how many you have. We have clients all the time whose files are conjoined with a spouse and they may have the spouse’s Social Security number. Juniors and seniors may have two Social Security numbers on their files. Remember, I told you last time in the Equifax when bureaus cast a wide net. They want to bring everything in and then let lender software and FICO software parse out all the data or make sense of the data. Their job is to collect as much as possible. Your job is to give them only one set of identification data. That’s what we build when we build that personal borrower identity.

Getting Bigger Approval Points: When you’ve made a timely payment and paid it to zero in 3, 6, 12 and 24 months, FICO rewards you with credit score points and the lenders reward you with fundability™ or approval points.

Look to see how many dates of birth you have and Social Security numbers are listed. We want only one. Notice where we are describing, there are a dozen addresses. Look at the dates reported. Notice how it goes like in Equifax, 2013, 2015, 2017 back in time for three different 2014s then 2017, 2015 backward again, backward 2017 and 2017. Every one of these except for the Guam one is in the United States. They’re all over the place. This does not send a positive fundability™ message because you can have thirteen former addresses, but as I showed you on mine, I want only one version of my name, one address, one date of birth. Notice they have multiple phone numbers listed. You want one phone number. We’d like to have two employers. It depends on if you’re using all of my strategies. If you’ve been to the GetFundableBootcamp.com, you know that this is vital. This was one of my team members back in the day and it’s misspelled. That’s something that I would want to correct and I want to make sure that if you’re in the entrepreneur real estate investing, if you’re looking to create a qualified fundable entity then you want the fundable entity as one of your employers on each of the credit reports. I said this before, I’ll say it again. FICO’s data is almost irrelevant. We don’t care. FICO downloads its data from TransUnion, Experian, and Equifax.

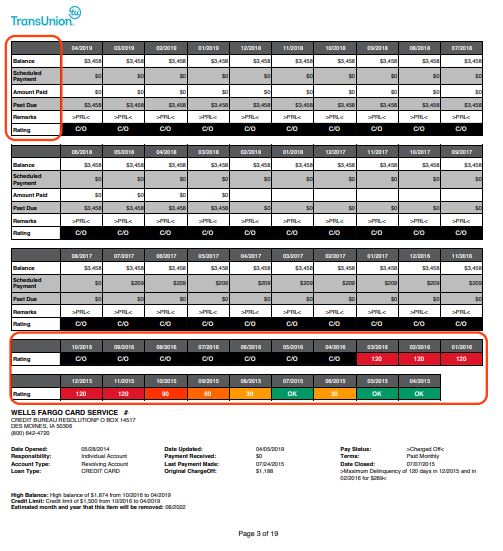

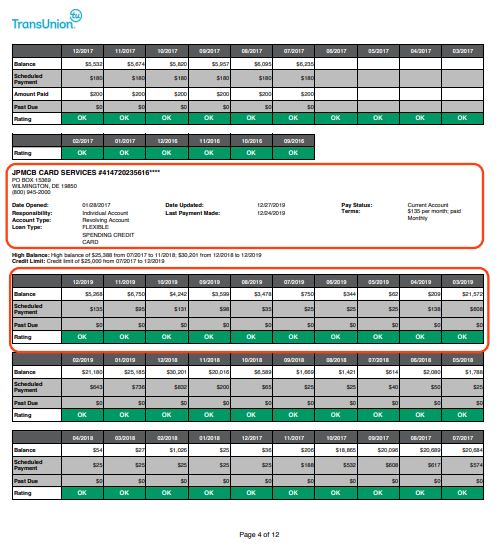

What we want is the data that is in each one of the credit bureaus to be crystal clean and match across all three bureaus. We look at FICO because whatever ends up on FICO is what gets scored. Your myFICO Credit Report is a scoring report. This is the raw data. Let’s focus on cleaning up the raw data at the bureaus and then that will give pure data for FICO or mortgage credit reports or auto credit reports to pull perfect data. That takes us there. This is the same. They have all of their different keys or ratings, the legend for how they’re going to do this. Notice, TransUnion will list all the adverse accounts first. What they’re trying to accomplish is give you a chance to see what is in the way. It gives you the original charge off amounts. It gives you what the amount is, what the status is, etc. When you’re looking at this, we also want to look at what are the balances? When was the scheduled payment? Wherever we talked about the 24-month lookback period, this is where they draw that data from for as long as it’s been open. There’s a scheduled payment for the balance, how much it was but since it’s been charged off, there are no scheduled payments, but it’s showing what’s past due. We’ll look for a positive one of these and you’ll see it’s the next page. Let’s take a look at a Chase card. Here is a date updated, last payment made, and when was it? Some people have said Equifax talks about the date reported.

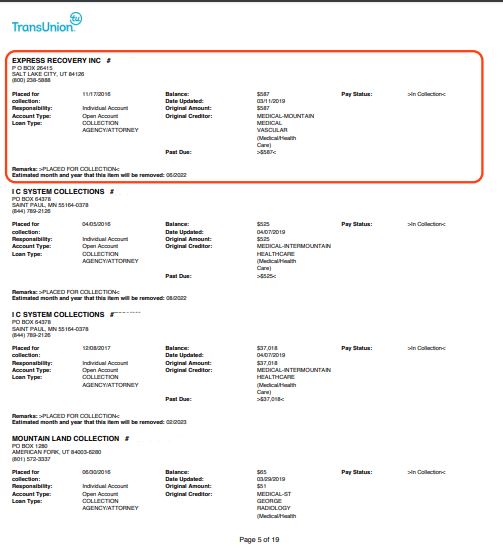

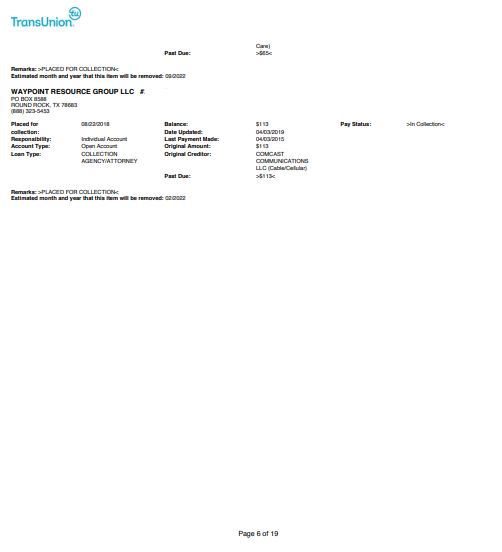

You may want to start with the date updated as the reporting date and then call the credit bureau. In this case, JPMorgan Chase Bank, and ask them, “What is my reporting date?” Do not take this as the number until you vetted it or gotten at least two more answers. Let’s say that the reporting date or the date it’s updated is 12/27. It’s a current account. This is what we want to watch. Notice there’s a balance, scheduled payment, how much is past due? That scheduled payment when they’re giving us what a scheduled payment looks like, they’re calculating when the payment was made. When is it scheduled? It says, when was it paid? Those data points are what they use to calculate whether you paid on time that month. Remember I said, I know for sure that it’s three months, but I believe 3, 6, 12 and 24 months when you’ve made a timely payment and paid it to zero on those dates, your FICO rewards you with credit score points and the lenders reward you with fundability™ or approval points. The underwriting software that the lenders use is going to look and see when was it due and when was the last payment made? You can see month-by-month all of these are given across, etc. Let’s take a look at how they do collection accounts like in Equifax. Here, you’ll notice that the original creditor was Mountain Medical. It’s in the collection, it’s the status but it’s an individual account, not joint. It’s been placed for a collection at a collection agency or an attorney.

It gave us when it was placed because this is medical, it will remain on a credit report for seven years unless you have found in your audit that it shouldn’t belong there and the credit bureaus agree with you. This is how a collection account is reported. If they do not have much of this, if you only have 2 or 3 of these accounts that are listed, if you only have certain information, if you don’t have an amount, date, and creditor, there’s what’s called a minimum amount of information that must be reported for this to stay on your credit profile.

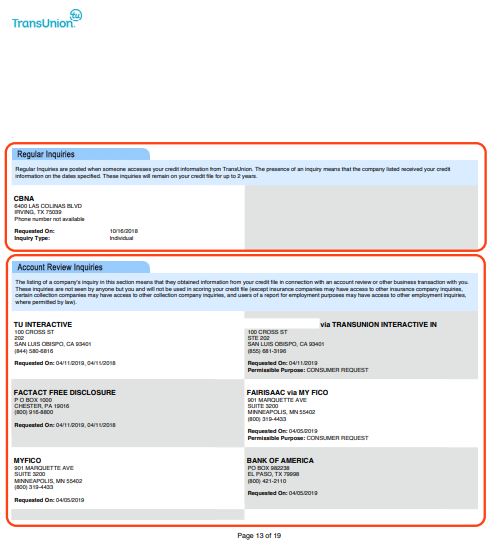

Don't replay the game according to the way they are trying to take advantage of your ignorance #GetFundable Share on XThose are collection accounts and that’ll be a fascinating episode because there are many cool things that you’re going to be able to see about how collections work. The next section is for regular inquiries. A regular inquiry is also known as a hard inquiry. This is for an express business purpose. It says that it was for Citibank National Association of Banks. National Association means all of these Citibank branches are part of the banking process. That’s what NA stands for, it’s National Association of Citibank Branches. When it was requested and since it’s the TransUnion report, it’s reporting the TransUnion. Notice the account review inquiries. TransUnion is when this was pulled. There was a FACT Act Free Disclosure when that was requested.

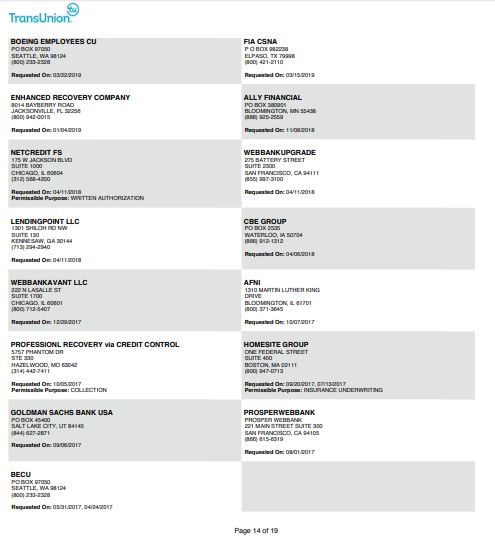

When it comes to 4/11/2019, 4/11/2018, this is the process of getting it from the AnnualCreditReport.com. This team member had a myFICO account and when it was requested, then you’ve got TransUnion Interactive which is also here, Fair Isaac via myFICO and Bank of America. All of these account reviews are reviewing. They’re checking out, “Is this person worth sending an offer to?” We need to be opted out so we get fewer to none of these. Here’s a Goldman Sachs loan. Here’s a Prosper loan. Each one of these is marketing pitches. This is determining whether or not they want to send this particular borrower any advertisements or any opt-ins so that they can become an offer client.

As we’ve said in previous episodes, we are at cause in our financial and borrower profiles, we are not at effect. We do not respond to these offers. If they come, we do not accept the offers. We do not fill out the application. We never use a promotion code or an opt-in code or an activation code. If there’s a code or if there’s a number you put in there, we never use those because that’s where you end up on more or less and more susceptible. You’re sending a message to FICO which interprets that as you being open to more credit. If you like an offer from Wells Fargo or Chase or wherever, you then call that institution or if there’s a branch, you go to that institution and ask them to tell you about this offer but where you do not have to put in a redemption code. I’m not saying that some of these offers are not good.

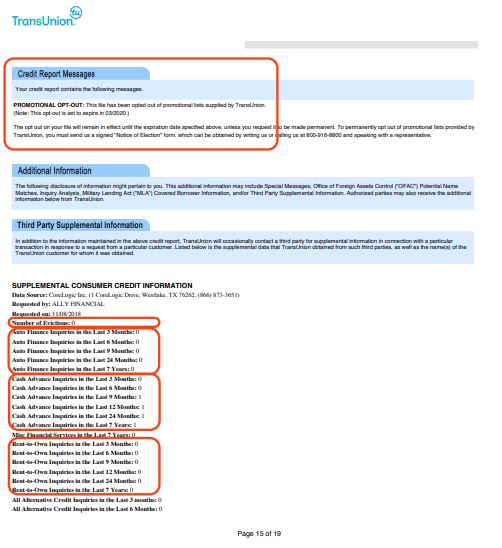

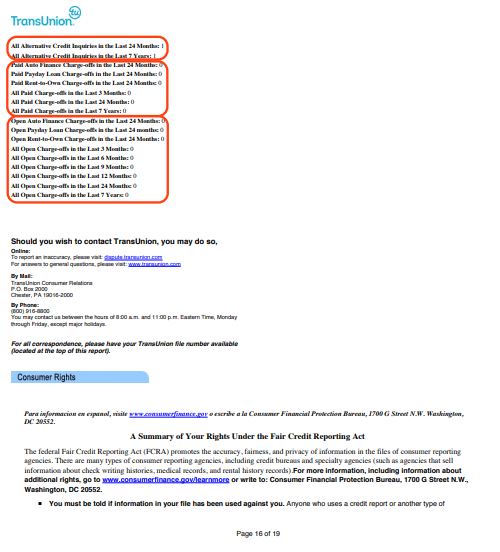

I’m saying don’t replay the game according to the way they are trying to take advantage of your ignorance. They have not trained us on what’s going on. That’s why you and I are in this together and we’re about making sure that they do not leverage their knowledge over us. The next section was a credit report message. This individual has opted out so some of the offers have been cut out completely and this opt-out is set to expire in 2020. Notice a third-party supplemental. I want you to see this. I’ve given you the feedback to go to GetFundableBehaviors.com so you can see the 150 potential possible FICO behaviors and you’ll be able to see for yourself the 40-plus or minus that FICO uses. This is vital because one of the things that you’re going to see there and you’ll notice that they are triggering it here. You have to go to a different place to get public records but the number of evictions, they’re counting how many times you’ve been evicted. Auto finance inquiries, 3, 6, 9 and 24. Cash advance inquiries, rent-to-own inquiries. These are all hard money predatory lenders, subprime lenders. If you’re going to these places for money, they are counting against you. Auto finance inquiries are not for an auto loan through a lender. Auto finance is one of these, “We carry our own paper. Come in. Everybody gets funding.” In Salt Lake City, it’s called State Street where all of these little auto dealerships that carry their own paper, those are more expensive and are also subprime loans.

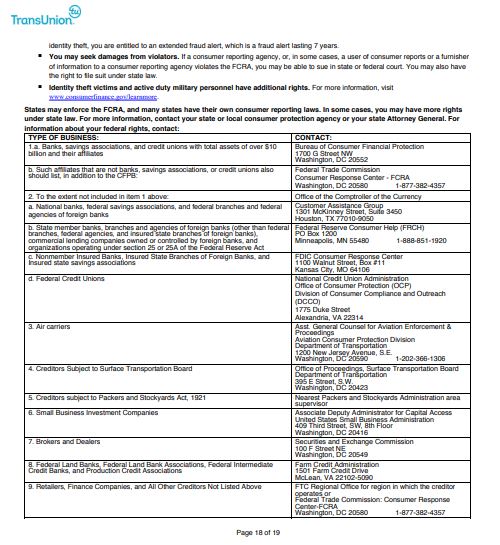

When somebody says, “I want to be able to pull credit.” They find out the type of business and in this case, auto finance inquiries are going to show that that’s the type of inquiry, the cash advance. When subscriber pulls credit, they report it as one of these subprime outfits and then they’re counting it against you. Even people that are close to us, sometimes we’ve got to do what we’ve got to do. I’m not judging what you have to do to make it, to survive, much less thrive. What I do care is that you know the impact and then you and I are square. Know the impact and what it means. With my book or the GetFundableBootcamp.com, you can find out what to do about it and how to void it or how to recuperate from it by getting a deeper dive into this or watch all 60-plus, whatever we have so far of all of our bootcamps. Notice paid charge offs, open auto charge offs, all open charge offs. They keep track of everything that’s in the hard money or we’re in a difficult place and we need to use extraordinary measures to get money, they measure it. This is how you can have a consumer rookie borrower profile instead of a pro borrower profile. We want to show up that every one of these is measurements of your behaviors. That’s what we want to protect against then all of the other information, consumer rights, etc. through the end. Each one of these is different.

There’s work to do for this particular individual, and we want to make sure that you are aware of what is required to create one identity, one Social Security, one date of birth, one name, one address, one phone number, and two employers if you’re implementing. You only need one employer if you’re not implementing the qualified fundable entity strategy. If you are then you need to have two employers in this section. That’s what I’ve got for you for TransUnion. In the next episode, we’re going to be discussing the last of our Into the Madness Series and we’ll be discussing Experian. I will see you on the flip side and have a spectacular rest of your day. I love that you have joined me for so long in becoming fundable. This is all about fundability™ and I’m glad you joined. You have a spectacular day. God speed and God bless.

Important Links:

Love the show? Subscribe, rate, review, and share!

Wegmans Ithaca

November 5, 2020 12:19 amHello. This post was extremely interesting, especially because I was

looking for thoughts on this subject last Thursday.

King regards,

Lunding Hessellund