Have you ever wondered what the different logos on your credit card mean? Stick around as Merrill Chandler explains why there is a lot more going on about this than just an excessive love for brand graphics. In this short episode, Merrill breaks down how co-branded credit cards work, what different credit card processors mean, and how to tell what kind of card you have based on the logos that it has and where they are placed within the card. Plus, learn about the relationship between Wells Fargo and American Express that even Merrill could scarcely believe. If you want to get a more comprehensive understanding of what your credit card is and what it allows you to do, you shouldn’t miss this.

—

Watch the episode here:

Listen to the podcast here:

The VISA And MasterCard Lie

Why The Relationship Between Wells Fargo And American Express Blew My Mind

In this episode, I attempt to bring a vast mess into focus so that we can know exactly what’s going on. What are business credit issuers, co-branding, and credit card processors? How many times have you looked at your credit card and there are logos all over the place? That’s what we takedown on this episode. There are a couple of stumbles that you’re going to absolutely love.

—

Many times, nobody outlines what the landmines are and where to avoid stepping on a landmine. A lot of questions have come in through our boot camps, client interactions, and students. There’s a misunderstanding about what co-branded credit cards are. What do different credit card processors mean and why are there all these logos on a particular credit card? I decided, “We’re going to do a top-down of all of this and describe it through-and-through.”

First things first, we’re going to define what processors are. A processor is a series of logos that you’ve seen that are Visa, Mastercard, American Express, and Discover. By the way, this is going to be an important one to go back to. We will have the graphic files so that you can see what we’re referring to. I want to make sure that we are super clear. We have four logos. There’s Visa, MasterCard, American Express, and Discover. These different logos vary over time. MasterCard has removed the word Mastercard out and it’s just an orange and red bubble. Visa changes its logo. American Express and Discover stayed the same, but they can be different colors.

Let’s describe this. A processor is an individual company that takes the money from your credit card through the merchant account and then distributes some to the retailer or the merchants checking account, some to the bank, and then the processor keeps a little bit of money on the side. Processing fees for most credit card transactions are anywhere between 3% to 5% depending on the industry. Different types of industries will charge your credit card a different percentage point.

Credit Cards: This facet of credit is difficult to navigate unless you have the clarity about what each logo represents and why they’re on a particular card.

Here are the most problematic of all of this whole processing model. Depending on the type of rewards card you’re using, because some rewards cards are super-advanced is 3% or 4% cashback or 50,000 miles or whatever is going on with that particular card, which is embedded in the magnetic strip. The instructions can take out as much as 8% and I’ve even seen 11%. That money doesn’t come out of your pocket. It comes out of the merchant’s pocket or the retailer’s pocket, the person from who you’re buying the goods or services from.

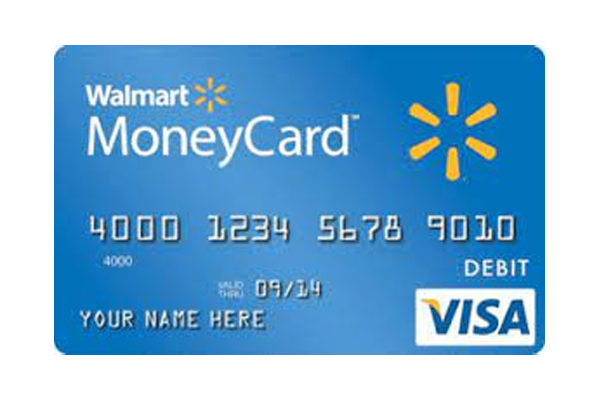

The problem with this is that depending on the card you’re using determines how much money can be taken out of the store, merchant, or retailer’s pocket. Who’s doing the processing is Visa, Mastercard, American Express, or Discover. You’ll always find that information at the bottom right-hand corner. Whatever logo is in that bottom right-hand corner, that is who the processor is. We see a Walmart MoneyCard, and then we see a Capital One. Remember the logo I told you about where they said that Mastercard has even removed the words Mastercard. The bottom right-hand corner says what company is doing the processing of this credit transaction.

What’s fascinating about this is that many times, there are groups out online who are trying to sell you credit services. They’re trying to teach you about credit. They say, “You can get a Visa or Mastercard when you do my program.” A Visa or Mastercard is talking about the processor. They don’t say you can get Chase a $100,000 business line of credit, business credit card, or personal Wells Fargo card. They’re saying you can get a Visa or Mastercard. There’s no such thing as a Visa card and a Mastercard card. They are banks. On the Mastercard one, it’s Capital One. On the Visa one, it’s Walmart. Those are processors.

There's no such thing as a VISA card or a Mastercard card. They are banks. Share on XFor decades, Mastercard has been advertising, “If it’s Visa, it’s accepted in all 27 million places around the globe.” Do you remember those advertisements? We don’t care that it’s a Visa or a Mastercard. They’re trying to sell you, “I need to get a Visa card. I need to get a Mastercard so I can use that.” That’s because whenever you’re in Vienna, Austria, and you’re using your Mastercard, they make the money for that card.

Here’s the thing. Every one of these cards is a processed bank cards. The Capital One is a bank card. The Walmart card is a low-value retail card. Let’s use a couple of other examples. We’ve got a MoneyCard for Visa. We also have a Walmart card for Mastercard. “What’s going on? Why does it have a Discover in the bottom right-hand corner?” It’s because Discover is also a processor and so is American Express. This is where it can be confusing because Discover is both a credit card issuer like Walmart.

American Express is a credit card issuer. It’s also, of course, being processed by American Express. Those are two different parts of the card. When you see those, these are not co-branded. The bottom right logo is the processor and the far left on the American Express card is the credit card issuer, but the co-branding is in the top right where it says Hilton Honors. Notice, there are three logos here. One American Express, credit card issuer, one American Express credit card processor, and then the co-branding is with Hilton Honors. Am I making sense?

If this isn’t convoluted enough, take a look at the next one. One day, I walked into my Wells Fargo. In the past, it has always used Visa Mastercard, but they made a deal with American Express to be their processor. All of a sudden, clients were confused and students were confused. They’re like, “What’s going on? Was there a merger between Wells Fargo and American Express?” We don’t understand until we do.

Wells Fargo made a deal. They dumped Visa and Mastercard and went with American Express to process this particular card. Here’s what’s interesting. Wells Fargo also has a Mastercard. I have one in my wallet. It is Wells Fargo that’s processed by Mastercard and I also have a personal Wells Fargo that’s processed by Visa. When you say, is it a Visa or MasterCard? Those are giveaways and they’re talking about the processor.

Here’s what’s interesting. Every single Visa or Mastercard starts with a four. When somebody says, “What type of card is it?” Those are inane questions. Any card number that starts with a three is American Express. Visa is four. Five is Mastercard. Six is Discover. The Discover logo is in the bottom right-hand corner like a Mastercard and the Walmart MoneyCard is a Visa. Be on the lookout. They’re not co-branding. Any logo that’s in the bottom right-hand corner is simply telling you what is being processed and who the processor is.

Let’s take a look at another one. Many of us may have accounts with USAA. There are large and small credit unions, savings, and loans that are also processed through these different processors and they may change. Your processor is who is on your card. I also want to give you an example of low-value cards. If there is no logo on the bottom right-hand corner, for example, a Target card, that means it is purely retail and it’s a merchandise card. If there’s a Visa, American Express, Discover, or Mastercard processor on the bottom right, that means cash is available.

There are different outfits out there that let you charge up like an Amazon card. It has a processor in the bottom right because for Amazon, you can use cash anywhere and you get points or otherwise. If it does not have a processor in the bottom right corner, it is almost universally a merchandise card for the sponsor. If you have seen any of my previous show, the finance company cards, which is what this Target card is a representative of, will dock your score because they are a consumer finance account. FICO downgrades the value of these cards much more than any other. That’s why we’re distinguishing all of this here.

The whole point is to show you that the bottom right-hand logo is not the co-branding. Since this is a financial institution, this is a tier-three 100% card because it is USA-sponsored, it’s underwritten by itself, and processed by American Express. Finally, I want to go back to the co-branding. There are three logos like an American Express here on the left, the American Express in the bottom right is the processor, and the co-branding is the other logo. Usually, hotels, autos, rental agencies, or even airlines.

That gives us a wrap-up of what is going on out there, why are all these logos on there, and what it requires. That is the key indicator of what type of numbers being processed and who the processor is. I hope I’ve created a little more clarity for you in a facet of credit that is difficult to navigate unless we know. My intention is to create more clarity here so that you know what each logo represents, why they’re on that particular card, and how you can navigate those waters. When somebody sends you a card, you know what it means, who’s processing it, etc.

Let’s fire away any questions we got here. We’ve got a question from Maris that says, “What about a Home Depot card?” The first question to you, Maris, does it have a bottom right-hand logo? If it does, it’s likely you can use that Home Depot card for points. You can use it as cash and use the points at Home Depot. There are brands that you can use as cash which is the Home Depot card with the processor on it. If it’s just a Home Depot card, that means it’s only good for merchandise at the Home Depot itself. That’s how we determine cash cards versus merchandise cards alone.

Maris, we need to make sure we understand. If it has a processor in the bottom right, it’s likely it’s going to be able to use anywhere that type of processor, Visa, Mastercard, American Express, or Discover is taken. There are only four processors. If it doesn’t have that logos, it’s likely limited to the merchandise of that particular store. Great question. Thank you. That’s all I have for you on this episode. We will look forward to seeing you on the inside. Like, comment, share, and blow this up. If you ever have this conversation, send it to a friend. Let them know to read this blog or any of the episodes of Get Fundable because we want to change the world. The best way for us to do that is for you to share it with your friends. Thank you, guys.

Important Links:

Love the show? Subscribe, rate, review, and share! http://getfundablepodcast.com/