Do you know there’s a hidden cost of doing business? In this solo episode, Host Merrill Chandler gives entrepreneurs a heads-up on merchant fees you have to watch out for when using credit cards as payment gateways. The sales reps, MasterCard, American Express, credit card issuer and all the other people involved charge fees you may not be aware of. Just setting up the payment gateway results in setup fees. If you want to know what happens behind the scenes and what you can do to save money, you need to listen to this episode.

—

Watch the episode here:

Listen to the podcast here:

The Hidden Cost Of Doing Business

We’re going to be talking about merchant fees. The shady, undisclosed, and nightmarish universe of merchant fees and backroom deals. I’m making it sound super bad, but this stuff drips with gucky. We’re going to go into what does it take to get a merchant account, why it’s so hinky, and why there are so many parties are involved in all of the fees they’re trying to collect from you.

—

We’re doing a deep dive on merchant accounts, the ins and outs, and the multitude of fees that are being charged. Some of them are clandestine fees and are out of control. We’re going to learn what we need as entrepreneurs if we’re going to be taking credit cards exactly what you’re up against because, talking about a racket, this is a racket.

A merchant account is actually and technically a credit line. It is a business credit line, even though they check your personal credit for underwriting purposes. They want to know how you treat other people’s money. They can be as low as $10,000 or hundreds of thousands of dollars, depending on usage. One of the things you need to be careful of in using merchant accounts and when you apply for one, they are going to do a security deposit or a pool of funds. Let’s say they take 10% out of all of your merchant fees to start putting in this pool.

I started out with a $30,000 pool that I had to have in order to backstop future fraudulent purposes or if I was going to abscond with money. When I applied for my merchant account, the first one I got was $50,000, and then I had a $30,000 safety net, the security pool that they took 10% out of every single purchase.

When you’re looking at the fine print, make sure you ask that question. Question number one is how much are the held-back funds? How much are they going to use and how much out of every payment? After I pay my fees, then they take an additional 10% to fund this. It was scary so make sure you understand that you’re coming up against that.

Merchants pay for the use of credit cards. Share on XAfter you approve and your fees are negotiated, they’re called swipe fees, and that’s the generic term. They’re known as interchange fees. There are a couple of ideas I’m going to be sharing if you want to know what I’m talking about. I’m going to be as clear as I possibly can for all of our audience. While you’re running, at the gym, out on a walk, or in the car, I want you to be able to visualize what I am speaking about. If you want a shortcut to all of that, check out our YouTube and GetFundablePodcast.com for the episode.

Merchants Pay For The Use Of Credit Cards

What’s important to understand is that it is a heavy application process. They take down everything about your company, not just the revenue. It’s the most invasive credit application I have ever applied for. I’m going to share some of the interview questions that they ask. I’ll describe them to our audience. Merchants pay for the use of credit cards. After you have your swipe fees, there are a whole group of fees. They are fees we pay to make it easy for credit cardholders to buy goods and services from us.

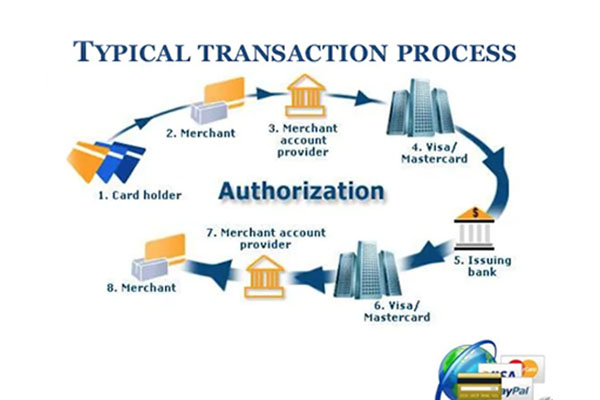

Merchants pay all of the convenience fees for credit cardholders to come shopping at their place of business. They pay to the interchange fees, credit card companies and everything in this process. Over $100 billion a year is collected from the merchant’s fees that we pay to the credit card process. Let’s go to what some of these fees are. Think of this as a flow chart. You got the credit card holder, the piece of plastic or you’re putting it into your website. The second you hit enter or it swiped, it goes through the merchant’s machine, either the online capture device or the swipe at the restaurant or wherever you’re in person. That merchant then sends the data to what’s called a Merchant Account Provider or, in more realistic terms, the interchange.

The interchange is a consortium of all the banks who are part of the Visa, Mastercard, American Express, or the Discover network. Those are credit card processors, but these processors basically do the heavy lifting for the credit card issuer. It gets a little confusing sometimes because American Express credit cards process their own purchases, but as a merchant, you have to have a Visa and Mastercard processing agreement, then you have to have a separate American Express processing agreement, and if you want to take Discover, you have to have a separate processing agreement.

Hidden Cost: There’s a setup fee for the payment gateway that sets you up.

Visa and Mastercard go together because they’re consortium, but you have to have three agreements to take those four types of credit cards. Back in the day, I didn’t even bother with Discover. I would take Visa, Mastercard and American Express. Nowadays, we do but it was too much of a pain to get that one as well. If you can qualify for one, you can qualify for all of them. The credit card issuer gives the piece of plastic to the credit card holder, but the act of processing the payments, that is all these interchange processing consortiums under the umbrella of American Express, Discover, Visa, and Mastercard.

For swipe fees, 3% to 8% of every purchase goes to the credit card issuing bank. What’s interesting is that the credit card issuing bank, these guys don’t mess around. Processing fees cost significantly more for rewards, points, and miles cards. They’ll charge more because banks want to subsidize the cost of your points miles that you or your people are going to be getting.

What’s fascinating is that you’re paying for people’s flights to Jamaica, Mexico, Hawaii, or wherever they’re going on vacation using their points. You, as a merchant, are paying for those flights because these premium and rewards cards cost more when you process them. It then goes to the credit card processor, Visa, Mastercard or Discover.

We go from the credit card holder to the merchant with the swipe or the data entry into the web or the credit card information on your phone. The merchant account provider, which is the person whom you’ve engaged and got the credit line with, doesn’t get the credit line with Visa, Mastercard, the host bank, or the credit card issuer. It’s a credit line that’s issued by the credit card account provider. Some of those fees go to Visa or Mastercard, the processor, and then the merchant account provider charges either used fees. Every transaction can be $0.20, $0.30 or $0.50 per transaction and there’s a setup fee for the payment gateway that sets you up.

The merchant account provider works under the umbrella of Visa, Mastercard, American Express, and Discover. The credit card issuer charged that 3% to 8%, then Visa and Mastercard are the processors and they authorize these payment gateway banks or third parties to collect the data because Visa, Mastercard, American Express, and Discover don’t collect the data. The network is what’s under their umbrella, then monthly and per-transaction fees are charged by these merchant account providers.

That’s how they make their money, then these payment gateways or account providers authorize representatives to go out and market. There are dozens of merchant account marketers. That’s how low they are. Visa and Mastercard do not market their processing. They leave that to the payment gateway, banks and third parties, and then these third parties have sales reps out there. Some of them are individuals and some are entire organizations, but it’s four layers of fees and contacts down from the credit card issuer.

Any logo in the bottom right-hand corner of a credit card is the credit card processor. Share on XWhen we’ve had to research a payment, it’s been a mess trying to find, “Who do I talk to?” We then talk to the payment gateway and they say, “I’m sorry, we can’t talk to you. You got to talk to your rep and send your information to the rep, and the rep will talk to us.” Sometimes we don’t even have access to the people who have the data we need to fix a problem.

It is a straight-up racket. To make things even more confusing, Wells Fargo can be its own authorized representative and its payment gateway because they’re a member of the Visa, American Express, Discover, and Mastercard network, and then be the credit card issuer as well. That’s when they’re capturing all the fees. You get it from Wells Fargo or any one of the banks like BB&T, PNC, and US Bank. All of the big tier 1 and tier 2 banks also have their own merchant account offers, but they may have more difficult underwriting criteria because they’re the big banks, and no merchant accounts are automatic underwriting possible.

Manual Underwriting

It’s all manual underwriting. Swipe fees are split into every one of those areas but know that they include monthly, per transaction, percentage, and setup charges. Another way that they add insult to injury is that they may charge extra fees if somebody does a chargeback. It’s where you go to the credit card company instead of the merchant, retailer, or service provider and say, “These guys didn’t give me what I asked for.” That goes under investigation and there are dispute processing charges. If there is a chargeback, then there’s an additional charge. It is a nightmare.

To go through these really quickly. The cardholder goes through the merchant, the merchant collects the fees or processes the data from the card, then it goes to Visa and Mastercard as a clearinghouse that goes to the issuing bank. If the issuing bank says, “We’re checking their credit limit, how responsible and how close to zero they are. They’re good to go.” If they have that much on their card to use, then it goes back to Visa, Mastercard, American Express, and Discover, the processors, to say, “This is good to go.” It goes back to the merchant account provider and then it goes to the merchant saying, “We’re going to take out the fees, but we’re going to deposit that money from the cardholders’ account into your bank.”

Hidden Cost: Building and maintaining a secure network is the credit card company’s evaluation of you as a company owner.

It usually happens within 2 to 3 days. It’s what most credit card processing outfits are able to do. We can’t get into all the subtle nuances of both the representative and payment gateway relationships and the actual consortium of all the banks that are under the umbrella allowing Visa, Mastercard, American Express, and Discover to process their accounts.

I’ve shared this before under a different context, but these issuing banks or credit card issuers sometimes switch processors. One of our clients came to us saying, “I don’t understand what’s going on. Wells Fargo is co-branding their credit card with American Express.” I went to the Wells Fargo website, and what was actually happening is that Wells Fargo on a particular credit card does Visa and Mastercard on some instruments. On a particular credit card, they were having American Express do the processing.

Instead of going through Visa or Mastercard to process, whenever you use this particular Wells Fargo card as the credit card issuer, they were going to run that fee process, the collection and distribution of funds through American Express. Any logo that’s in the bottom right-hand corner of a credit card is the credit card processor. It is their family, this interchange consortium of parties, sales reps, and payment gateways. All of them are under one or the other of these processors.

That’s a lot. Good news and bad news. As an entrepreneur, small business owner, and real estate investor need to be fundable because they’re going to pull a personal credit profile and evaluate your borrower behaviors. It is manually underwritten, but your profile needs to be legit. The scores tend to be higher requirements because the fundings are so much higher.

They’ll fund a $100,000 to $150,000 credit line, which is different than a $10,000 credit card, so you got to be dialed. I promised that I would share with you how they evaluate you, whether or not they’re even going to give you a credit card. Let’s learn one of the things that they do. I’m going to read to you some of the questions and the subtitles that they look at. It’s building or maintaining a secure network and system.

This is the evaluation of you as a company owner. Do you have a secure network and system so that they can trust you to collect this data? Are firewalls and router configuration standards established and implemented? Is there a process to ensure that the network diagram is up-to-date and complete? You have to provide a network diagram in the funding approval process. Is a firewall required and implemented at each internet connection?

Stripe made a massive impact in the merchant space by saying, 'We'll let you do whatever you want to do until you do us wrong.' Share on XIs inbound and outbound track restricted to only the pertinent cardholder data? Meaning, do you collect twelve different pieces of the card information or only three? The card number, pin, the three-digit code on the back, and the expiration date. There is all manner of things that are being evaluated. They say, “Are your system configurations up? What happens when you get a new system? How often do you update your systems? Has all unnecessary functionality, such as scripts, drivers, feature, subsystem, file systems, and unnecessary web servers, been removed from this part of the process?” We had to get a consultant to help us with our setup in order to be able to take credit cards.

If somebody wants to subscribe to us or our subscriptions, we pay for the fees. No problem, no harm and no foul. It happened so many times. If an individual wants our coaching and they’re like, “I want to use American Express. I want to use a credit card to pay for your coaching.” I’m like, “You’re going to cover the processing fees because I love you and I’m not going to pay for your next trip to Hawaii.”

Call me what you will, but I pass along those fees because they’re arbitrary. If they don’t have a process where a borrower, retailer merchants, service provider and the cardholder pays half, the merchant pays for everything. Most people don’t know about this, but I do. I negotiate with my future clients, saying I’m happy to do a pain-free and cost-free version with an ACH, auto drafts, or other types of payment modeling.

Sometimes I’ve split it if someone’s doing a huge package of coaching, but I want you, the client, to be responsible if you’re using a credit card. If it’s convenient for you, I want it to be convenient for both of us. That is one of the things where I have made a stand for my business, because like you, I know what’s going on in the background. If somebody is trying to charge me 8% because they want extra miles, then we get to have that conversation.

Stripe And Paypal

We have covered probably the important 40% of the details because each one of these stages, the sales reps, payment gateways, consortiums, Visa, Mastercard, American Express, Discover, and the credit card issuer, there are nuances, additional agreements, fees, and charges that go inside of those. I’ve given you the big picture of what they are so that you know when you’re looking to do a credit card with one of these purchases that this is what you’re going to be up against.

Hidden Cost: Everyone on the back end gets paid for having you as part of their network marketing downline.

If we’re going to talk about merchant accounts, let’s talk about Stripe, PayPal and a couple of other groups. With PayPal and Stripe, especially Stripe, if you’re in a qualifying business and you’re collecting what’s called CNP, which is Card Not Present that’s online, the fees are lower if you, as a human being, have that card and are swiping it through a mechanical device, but Stripe has made a huge impact on the merchanting space because it basically said, “We’ll let you do whatever you want to do until you do us wrong especially if the cards are present and you’re not in an offending industry.”

If you’re looking for a merchant account like Stripe and PayPal, they lean into you as the borrower, but they don’t have pre-authorized credit lines. They watch and measure your internal performance data to see where you’re going. It’s like using a charge card. What is the monthly amount that you use? If you’re used to using $7,000 a month, then all of a sudden, you charged $40,000 a month, then they’re going to cut you off and want to do an audit.

There are pros and cons to all of these systems. When it comes to the sales rep, etc., you’re looking for someone that you can trust, who’s going to be transparent, and going to walk you through all the fees to know what you’re up against upfront because every one of these people on the back end gets paid for having to use network marketing downline. If you’re a part of their downline, they’re making money hand over fist over $100 billion per year in this 3% to 8% fees.

Be sure to like love, and share this with any of your entrepreneur and real estate investor friends. Anybody who’s considering having a merchant account or taking credit cards, please share this with everybody. Rate and review. It’s also being broadcast live on our Get Fundable! YouTube channel. Make sure that you subscribe and have access to this information and all the other great information that we do on the show. I will see you next time.