Take a deep dive into a whole new paradigm shift in this episode where host Merrill Chandler talks about the untold price that you pay for being un-fundable. Merrill explains the ways you could be un-fundable and the literal cost it brings to your pocketbook and dreams. As he offers his definition of success and presents an example on the importance of knowing when priorities may change, he also cites some advantages of being fundable and talks about the relationship of having a good credit score to your overall profile. Watch this episode and avoid being unfundable.

—

Watch the episode here:

Listen to the podcast here:

The Price You Pay For Being Un-Fundable

In this episode, we’re going to knock it out of the park because we’re going to be talking about the untold price that you pay for being un-fundable. It’s a whole paradigm shift here for you to be able to take in and take home. You’re going to love it.

—

In previous episodes we’ve talked about the paradigm shift. Everybody talks out in the marketplace about do you have good credit? “I have good credit, I have great credit or I have bad credit.” What that means, generally speaking, good credit and bad credit means that you have negative accounts if you have bad credit and you have clean credit. You have no negative accounts. You pay all your bills on time and that’s what good credit means. We know exactly that it is meaningless when it comes to your fundability™. The paradigm shift is, are you fundable or not fundable? This episode is about how we’re going to talk, how you are un-fundable and the price you pay, the literal cost to your pocketbook and to your dreams by not being fundable.

Defining Success

First thing I want to ask is what does it mean when you say that you are successful? There are all kinds of different definitions of success. When it comes to your finances, how do you define successful? Unless you have your own definition, you can borrow mine because that’s what I want to share with you. My definition of success is when other people’s money make more money for me than I can make on my own. What I mean by this is that when your money is making money, you don’t have to be spending your time or your energy creating resources to fill the rest of your dreams. Some people call it money freedom. Some people call it time freedom. I call it my money-making money so that I can do anything that I want, including invest in opportunities or spend time with my loved ones and my beloved. I am here to make your dreams come true. That’s what this whole blog is about. To make our dreams come true, we have to spend some time on making our financial dreams come true because for many things, not all things, financial success allows more opportunity for every other definition of success we have.

The question that I have is, do you know what opportunities are coming down the pipe? Do you know when that opportunity is going to be here? I asked this because some of you are real estate investors, some of you or note buyers, some of you are in Amazon, some of your retailers, some of you have a brick and mortar businesses out there, gym owners and estheticians. We’ve got all kinds of clients that run the gamut of business owners, entrepreneurs and investors. Did you know when that opportunity was going to come to you? Did you know when you chose me to be a real estate investor? Did you know when you wanted to leave your W2 job and buy that franchise? Did you know when the opportunity was going to rise right now? More interestingly, do you know when your priorities are going to change?

When Priorities And Opportunities Change

I want to tell you a story about Frank. Frank is a perfect example of opportunities and priorities changing and not being ready for it because you think you know who you are in the world and what you want to do. Frank started listening to Dave Ramsey. Dave Ramsey has amazing advice for certain types of lifestyles. This gentleman, Frank, started listening to Dave Ramsey and by the age of 23, he started moving over into a cash-only framework. He’s like, “I want to get out of debt. I don’t want to owe anybody anything for any reason.” When he was 23, he started moving over. He used an accelerator debt reduction for his mortgage so that he was able to pay it off in five years. That’s admirable if you’re looking to not have any debt.

Financial success allows more opportunity for every other definition of success we have #GetFundable Share on XAfter six months of not making payments on credit cards, car loans, mortgages, things like that, what he didn’t know is that he lost his FICO credit score. A FICO requires the last six months of information constantly reporting for you to have a FICO score. If you’re not reporting that information, then it doesn’t register. He lost his FICO score. Without knowing it, all of his accounts, once they closed, once he paid off the mortgage, once he paid off his last car loan payment, once he closed all of his credit cards and totally cash debt-free and cash only. He didn’t know this, but after ten years of the date of closure, all of those accounts fell off his credit report. Now, he has no credit profile whatsoever. Now, he’s thinking this is awesome. He’s W2 and he’s moving along in his life and then all of a sudden, he is debt-free and credit-free.

He ends up going to a real estate seminar and he’s like, “I want to become a real estate investor.” He’s so excited about the opportunity to become a real estate investor. What he didn’t realize was that his entire framework, everything that would make him successful in real estate investing, he had lost. He did hear that you don’t need your credit and you don’t need money because all the stories, the real estate stages tell you. You can use somebody else’s credit or you can have an owner carry back on the loan. You can have all these different ways of doing this process. He thought, “I don’t need credit.” As many of us have found, it is not that easy. The properties are not that easy to find when he’s looking for not having any credit and not having any of his own cash because he’s just W2 and living hand-to-mouth.

By the time he hits 44, he knows that he wants to leave his W2 job behind and move into real estate investing fully. This is when I meet him at the real estate conferences that I speak at. We have this conversation and he’s like, “I’m looking into becoming a real estate investor. I’m fascinated by it, but I don’t have any credit.” I asked him, “What do you mean by no credit?” He said, “I paid off all my credit cards and closed them, paid off my mortgage, I paid off my student loans and my mortgage. I paid them all off.” “How long ago was that?” I asked. He goes, “About fifteen years ago.” I’m like, “I know that they have fallen off.” There is no record on a credit report that he even exists in the financial world. He has no financial reputation whatsoever.

I gave him the hard facts like, “How’s it going on trying to find these properties with no money down, no cash infusion on your part? How are you doing on finding owners that are willing to carry the paper?” He says, “There are more deals that if I had cash, I would be able to buy it.” “What about Rich Aunt Mabel, where are you going to come up with this money?” He’s like, “This is why I’m talking to you because I understand that I am not fundable now.” Just like I’m telling you, we do not know when your priorities are going to change. You may be W2 right now, you may be a twenty-year veteran of real estate investing or any other type of investment model, but the bottom line is you may not be prepared to maximize because you don’t even know what fundability™ is and you don’t know where the how to best leverage your financial reputation. That’s why you’re with me and we’re enjoying this blog together.

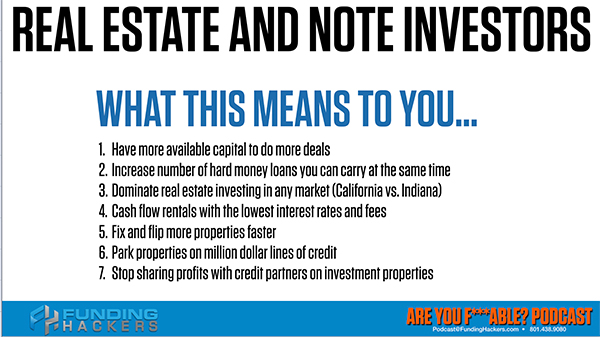

When you are fundable, when you have the power to invest in opportunities and new priorities that come to you, you’re in a position to make entire new changes and make huge pivots in your life. Let’s go over, real estate investors and note investors, what fundability™ means to you? It is being prepared, having a profile, having a financial reputation that lenders are totally ready to lend to and you can have more capital to do more deals. Increased number of hard money loans you can carry at the same time, you can dominate any real estate investing market and that means if you’re investing in California or you’re investing in Indiana, Texas or Ohio where the houses are $75,000 to $100,000, whatever market you’re in, your profile will match lender guidelines so they can help you finance for your buy and hold or help you flip a property or otherwise.

Dominate the real estate investing in any market, cashflow rentals with the lowest interest possible. We’re going to show an example here of how meaningful it is for you to be able to create a fundable profile and then how that translates into actual cold hard cash. You can fix and flip more properties faster, properties on million-dollar credit lines. I’ll be telling you about one of my clients, Michael. He literally has a credit line of $3.5 million that he drops new properties on and pulls them out after their rehab and sells them out on the marketplace. I helped him negotiate that with his lender. There are ways in which you can leverage everything that you’re doing to create million-dollar credit lines for the least expensive money possible.

You can also stop sharing profits on every single one of the deals that you do because you have credit partners or they’re putting money down. I have a client who emailed me saying, “I want to buy my partner out because he put the down payment on an apartment complex. He spent 130 and now they have to split. He’s doing all them the heavy lifting, but he has to split every dime with the person who had the money because he didn’t have the money to take down the property. We can stop diluting our efforts and create the highest possible returns for us. If you’re in business, if you’re not a real estate investor, you’re not a note buyer, what’s extremely powerful is that you will have access to the least expensive money possible, easier financing for your business ventures, faster and shorter startup times.

If you’re engaging in a particular enterprise, the startup time is directly related to capital invested. Let’s you’re building an application. You can either take a year to build an app or three months to build an app based on how much money you have available. Start at times to prove the business concept are shorter and faster, easier financing for investments, greater margins for leveraging, some day trader stock market. When you have resources available to you, you can increase your margins so that your yields are higher in whatever investments that you’re doing. A killer one is a faster turnaround on financing and the lowest possible interest rates. You save on all fees, on all interests by having a fundable profile.

The Causes Of Being Unfundable

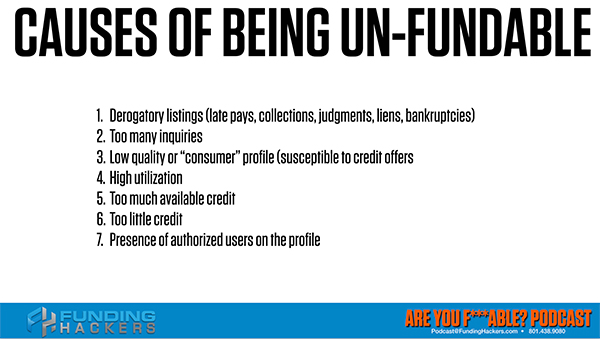

We’ve talked about being fundable lets you take advantage of new opportunities. Being fundable lets you take advantage of the priority shifts that all of a sudden some new thing comes to you and you’re like, “I’m ready to jump on that.” You can’t do that if your financial reputation is not one that lenders will lend to. Let’s take a deep dive then into the causes of being un-fundable. This is the most important thing because as I said, it’s not bad credit, good credit. Get that out of your mind. Catch yourself every time you talk about good credit or bad credit. What I want you to understand is these are seven of the main principles and we’re going to be doing a deeper dive on every single one of these in future blogs. Every single one, we’re going to be addressing in full content.

One of the main reasons for not being fundable is having derogatory listings on your credit. Those are the late pays, collections, your liens and judgments. Some of you haven’t done the math yet, but if you have too many inquiries, you can have an 800-plus credit score and have too many inquiries and no one’s going to pay attention to you. You don’t even know yet how many inquiries you’re allowed every single year. We deeper dive into that. We just got to make sure that we’re covering all the stuff for this blog and stay focused. I’m going to be going through every single one of these things and how to fix it.

Your personal credit is the engine that you need to succeed in fulfilling your financial dreams #GetFundable Share on XToo many inquiries, you may have too much of a consumer profile. You look like a consumer and lenders do not want to lend serious dollars to consumers. You can get any mall store credit card, you can get anything you want from a mall or an online or otherwise, but you’re not going to get a $50,000 business line of credit from one bank, much less ten banks until you have a professional borrower profile. If you look like you have a consumer profile or it’s low quality and we will go deeper there. If it’s low-quality, you’re not fundable and you’re going to get rejected or denied in your applications. The other is you have too high of utilization. I’m going to use an example of what that means, but high utilization means that the balance to limit ratio, how much of your limit you have used or utilized is what they call utilization.

If your utilization is too high, they will deny you. They won’t raise your limits or won’t give you new credit and high utilization, believe it or not is 38%. It’s not 60%, 70%, 80%, 38%. We’ll cover that more in detail, but if you’re carrying balances that are being reported to the bureaus over 38%, you are literally killing the goose that lays the golden egg. You’re telling the lender to reject you. You may have too much available credit. I have clients, I have reward hoppers that come to me and the people who open up new credit cards because it’s interest free for 12 to 24 months and then they get all these tens of thousands of points, but they keep doing it.

Every single time there’s an offer, they get more and more credit. The problem is that you can have too much available credit on your personal profile. If you have too much on your personal profile, you’re not going to get approved for business lines of credit. Just know how utilization and too much available credit are some of the biggest ones that are going to get you denied. You have too little credit. It doesn’t it sound like the three bears. Seriously, it sounds like the three bears, “The porridge is too hot, the porridge is too cold. The porridge is just right.” You have too high credit limits. You have too low credit limits. Believe it or not, there is a perfect credit limit based on your income.

It’s a multiple of your monthly income. If you have too little credit, the automatic underwriting systems at the AUS are not going to pay attention to you because you are outside of their tolerances and you’re too much of a risk. Then finally, the presence of authorized users on the profile. I’ll probably tell this story a couple of times because I don’t know who of you are bingeing all of these and who are picking out by title, but this is important. We had a gentleman come to us who was super thrilled. He was rebuilding his profile after a bankruptcy. When he went through this bankruptcy, we helped after a certain number of years that his profile had a matured aged and we’d helped him get some other trade lines on his profile reporting.

He was back in fundability™ mode. I believe it was a Chase card. He gets his Chase card and it’s $20,000. He is thrilled out of his mind. He doesn’t even know. He’s just thrilled. Because he had been learning the principles of fundability™, he hooked up his friend who still had horrible credit and that friend, he put him on as an authorized user. Authorized users, you don’t need to give your Social Security Number. As the owner of the account, this guy just had to tell him his name, “Give it to Bobby Brown.” Bobby gets a listing on his credit profile saying he’s an authorized user on this guy’s account. It wasn’t one reporting cycle later, 30 days, 45 days after it was open and reported that the new account that our client had gotten for $20,000 from Chase was straight closed.

He emailed his team and he’s like, “What is going on? Why didn’t I get my account? It’s only been open 30 days.” The funny thing was that he put a friend who has horrible credit and has burned Chase and other tier-one, tier-two banks, put him on as an authorized user. Remembering authorized user means you have authority to use the account, so the risk was if this guy is burned off all of his accounts and he’s coming to his friend to get on his account, our client was just trying to hook his friend up, “Let’s help build your credit.” We’ll get into how lame of a process that is and we scolded our client and told them to go watch a couple of the training videos that tell you don’t put anybody on as an authorized user. It doesn’t help them.

Because he put his friend on and his friend had horrible default behavior and his horrible behavior sucked, they closed down the account for our client. You can be un-fundable because of who you authorized to use your account and they closed that thing down. Those are seven. There are numerous others that we are going to be exploring over. You’re going to be looking behind this curtain and seeing so many crazy things just like we’re talking about here in this example of authorized users.

Cooking Your Golden Goose

All of these reasons can make you un-fundable. The problem is many of you have several of them going on at the same time. You are un-fundable over and over again. You can have a 720-credit score. You can have an 820-credit score. Other than derogatory listings, you may have a high credit score and be slaughtered when it comes to your fundability™. Let’s talk about the high utilization because that does affect a lot of people because they don’t know what’s actually happening. Let me tell you about Chris and Nicole and how they successfully cooked their golden goose. Remember, I said that your personal profile is the goose that lays the golden egg. I’m going to show you exactly a number of episodes. We’re going to show how we can destroy that because when we talk about here, when we talked about all seven of those reasons for being un-fundable, every one of those reasons can manifest in multiple ways, and every one of them makes you un-fundable.

Let’s talk about personal credit card stacking that affected Chris and Nicole. They come to us and there were literally hundreds of clients who come to us. They’ve been to Amazon business building and online business, a small business funding seminar, real estate investment seminar, any number of educational stages. They come to us and told us about their problem. Their problem was that when they went to the seminar, they listened and said, “We want to buy this coaching program. We want to get involved in real estate.”

As most of them do, you go to the back of the room and they have somebody who can help you get more credit cards. It’s called credit card stacking. They went back to the back of the room and they filled out the application and they had great credit, high 700s. They went through the process of getting more credit cards to the tune of 21 credit cards for her and 25-plus credit cards for him. They charged those up for two things. First, they charged them up to put on the education. Remember, I said 38%. Once you go over that 38% and it’s a brand-new card, you are in the red zone. You are in danger. You are actually in the risk department at your credit card issuer. You’re flagged if you do anything even remotely close to 38% on your balances within the first 90 days. That means you are risking their money with something that they didn’t see in your previous behavior. You’re going to be monitored carefully. Sometimes they lower the limits and sometimes they close the account.

When your money is making money, you don't have to spend your time or energy creating resources to fulfill the rest of your dreams #GetFundable Share on XIn their case, they charged up to several credit cards and significantly lowered their credit scores. They were in the high 700s where it came down into the mid to high 600s from all of the balances from buying this $30,000 coaching package. They went out with their coaching. They went out and said, “Let’s do a deal.” They were looking for a fix and flip like many of our readers do. When they found the right fix and flip, they had to go to hard money and borrow money. They couldn’t use any of the money that was on their credit cards because with a credit card, you can’t write a check and do a deal. The credit cards, they can liquidate them, but when you liquidate them and transfer that money to a checking account, all of your balances go up and your scores go down. That’s exactly what they experienced. They even had to put some of the fix and flip and the rehab costs on the credit cards. They’re literally up and up and up. Every one of their balances started climbing.

When the bounces got so high, the creditors started lowering their limits. Sometimes lowering their limits below the actual balance. That puts them in upside down or what’s called over-limit and they were getting over-limit charges and now, they’re cashflow pinched. In their business plan, they thought they could make all this happen. The tragedy was they couldn’t qualify for the takeout mortgage, the long-term Fannie, Freddie, that they were doing so that they could have this property and not flip it because they found out they couldn’t flip it. They wanted to turn it into a rental and they couldn’t even get the take out mortgage because their scores had plummeted so low. They were strapped for cash. They’re ruined, cooked the goose and they had no other options. We have a plan for all of this, but when they come to this, what you need to know is there is a way to get out of these circumstances.

Let me walk you through what we did for them. First, we implemented some customized debt-shifting strategies because remember, if the golden goose, the goose that lays the golden egg is your personal profile, then we need to get that all optimized so that lenders look at it and go, “I want to lend them money.” The way we do that is we move the credit card balances over onto business accounts. The business accounts, you have to do it the right way. You can’t just go grab business because in a future blog, we’re going to be telling you that some business credit cards, many business credit cards actually report to your personal and it’s just more personal credit. It’s not business credit. That’s a landmine that will blow you up if you don’t do this right so adult supervision is required. I’m telling you that when you do it right, you move the credit card balances from personal to the business.

We did some personal loans on their personal credit because that’s not credit cards. Once we drew down their credit scores and the fundability™ of their profile enough by that debt to a shifting strategy, then we opened up the opportunity to get two personal loans. That reduced the revolving accounts even more so that the credit card bounces could come down and transfer them once again to the personal loans. We aged the personal loans long enough so that we’d be able to turn those personal loans into highly credible, profile influencing tradelines and then we moved over to the business credit cards and credit lines section of this takeout plan. Once their personal profile was back in play, then and only then could they qualify for the takeout mortgage.

They’ve had it all. They were able to get the property into a 30-year Fannie, Freddie where they were able to create the personal profile, so their golden goose was back in play. Whether it sounds easy or difficult, there is a way to get out of the hole. Most people try and dig their way out of a hole. If you’ve read any of the other blogs, you’ve met Brad. You can’t dig out of a hole. You have to ladder out of a hole or a helicopter pulls you out of the hole, but you can’t dig your way out of a hole. Most of us have that thing. The definition of insanity is doing the same thing over and over and expecting a different result. You continue to try and do the same thing to get yourself out of debt and you don’t even know how debt works. You don’t know how the credit system works yet. You don’t yet know what the lenders are looking for, much less what they’re driving and what behaviors they’re measuring and monitoring. Without that knowledge, we’re bumping around in the dark.

Stop Stepping On The Landmines

Here are a couple of cautionary tales. Remember, I told you that you’re going to be able to stop stepping on the funding landmines. The whole point of this blog is to stop stepping on the landmines. Number one, personal credit card stacking destroys, ruins your personal profile and it prevents you from doing anything else on your personal credit and your personal credit. Let’s switch the metaphor. Your personal credit is the engine that the car requires, that your fundability™ requires to be fundable in business, business lines of credit, commercial loans, everything that you need to succeed in fulfilling your financial dreams. Stop the credit card stacking.

If you haven’t, if you’ve already run into that, then seek help. Go to GetFundable.com and check out the boot camp that we do that helps people live and in color, real live boot camps help you establish what you’re doing. I’m going to be talking about, if you want to fast track, your awareness, all of it. We’re going to cover everything that I have ever thought or come up with or invented with regards to optimization in these blogs. I’m just saying if you want the fast track, there’s a place to go.

The next thing is that you’ve got to understand that more on this later. You need to understand that the 5/24 rule is becoming more and more prevalent with more and more banks. Over the next 12 to 24 months, credit card stacking is going to be shut down completely. A lender will deny any credit card application if there have been more than five applications in the preceding 24 months. That’s the 5/24 rule. Credit card stackers depend on picking up at least five, seven, ten new credit cards usually on your personal. They’re talking about inquiries for credit cards. I’ve talked to some of the big real estate stages and I prophesied, I told them, “It’s coming. You better have a new business model for having people buy your $30,000 programs because being able to pick up credit cards and ruin your clients and your customers’ credit and the process is not okay with me.”

It’s so not okay with me that I’m going to out them. In a different blog, I call them Liars, Cheaters and Thieves episode, but we’re going to be going over the websites of every one of these and many more about what to see when it comes to credit card stackers and the language that they use. The funding grows. I’m looking at their ad and it says $50,000 to $250,000 in business credit. When you go there, business credit is personal credit for your business. See the difference? Same with Sprout Financial, how much funding can you get? Seed capital, which is notorious, “We field growth for over 20,000 startups,” but they don’t tell you that 100% of seed capital is personal credit cards. Remember, you’re un-fundable if you have too much available credit, crushing the soul of your personal borrower profile.

Your credit profile gets hammered. You kill the goose that lays the golden egg just like in the example of Chris and Nicole. Every one of these approved for $416,000 and when we do a deep dive on each one of these, you’re going to see that those funding amounts ended up being on personal credit. I want to cover in the review. When we say bad credit, that’s like saying bad dog. It is a pejorative and it usually refers to derogatory listings as I’ve said. Bad credit in our terms means un-fundable and there’s way more than derogatory listings to make you un-fundable.

Being unfundable costs a fortune #GetFundable Share on XLet’s talk about Robert. Robert came to us. I use client examples because these are live in my face every single day. I and my team are saving the financial souls of borrowers all across the country in every type of business, every entrepreneurial sector, every real estate and note buying. We run into folks in real time, boots on the ground, saving their hindquarters because they are in trouble. If you’re in trouble, do something about it. Let’s talk about Robert. Robert came to us with the credit scores that were 619, 612 and 618, fully un-fundable. He had a number of un-fundable things. Because he was real estate investor, he had too much available credit from a credit card sucking thing.

His utilization was high because everything he had done was based on using his personal credit cards to raise those limits and do his fix and flips. He was a buy and hold real estate investor. Let’s take a look at what those costs are. Let’s say you have an 800-plus profile, not a score. Your profile is worth 800-plus. The points are accurate, but it’s a fundable 800 profile. Notice, I’m just examples here of 4.5% mortgage, which are available. On a $200,000 house, that means your mortgage payment’s going to be about $1,013.

What FICO Loves To See On A Credit Report

Robert couldn’t qualify for that. He was paying 6.5% interest because his profile was in the 620s to 640s and he could only qualify. His payment was $1,264 for that 6.5% interest. As a result, he’s paying over $200 a month times twelve and was over $3,000 per year that he was throwing away. That’s what it cost him every single month for every property. Let’s just talk about what FICO loves to see on a credit report. Let’s say you’re buying four mortgages and they can be multifamily, they can be a single-family, duplex or whatever. If you have four Fannie or Freddie loans on your profile, you got heft on that profile.

I’m going to use that as an example, 312 per year, four properties. There is some asset appreciation over the course of owning these. Ultimately in the end game, it’s worth holding them but he’s losing $12,000 a year on those four homes, just because he’s not fundable. Remember, fundable is not bad credit. It’s too much credit, high utilization, too many inquiries, all seven of those things. He’s paying full 2% higher than he has to because he doesn’t know the rules of this game and he doesn’t know how to manage this fundability™ like you’re learning right now. For some of you, you might be renting out there and I do want to cover the cost of being un-fundable because if you got into a home, especially as things have been ramping up in real estate values or otherwise, let’s use a simple example.

Future Topics

Let’s say you’re paying rent of $1,000 a month. I don’t know where you’re on the country to pay $1,000 a month, but let’s say you are. Cashflow-wise, you can afford a $100,000 home. If that $100,000 home is appreciating 5% per year, so that’s $12,000 grand. You’re losing $5,000 appreciation every year on that $100,000 home, so that’s $5,000. For renting, you are flushing down the toilet, $17,000 per year that’s not going to your nest egg. That’s not okay. We want to make sure that you have the tools and that’s what the whole show is devoted to exploring these things so that you can come with me behind the curtain and see how it really works and recognize that it’s costing you a fortune to be paying rent or to not have the best mortgages or the best auto loan rates or not get business lines of credit so that you can write a check and do a deal. It’s costing you a fortune for being un-fundable.

In Robert’s example, we used a whole bunch of the apprentices. Every one of these, there’s going to be a blog on them. I’m going to talk about synchronizing credit identity data points. We’re going to be talking about investigating what the Fair Credit Reporting Act is and how to investigate violations, not credit repair, actually a deep dive into the Fair Credit Reporting Act and what your rights are so you know. We’re going to learn how to verify statutory terminus dates. Do you realize some of your tradelines stay on for too long and the bureaus for whatever reason, because of bad data management, they stay on too long and it’s creating a drag against your fundability™?

We’re going to be talking about the statutory terminus dates. We’re going to be talking about reconciling inter bureau discrepancies. The bureaus carry are all publishing scores from FICO about their data, but what happens when you have 20, 30, 50, 100-point difference between those? You’re getting killed out there. We’re going to be talking about how to vacate state and federal tax liens seriously. I’m going to tell you if you ever had a tax lien, there are many states. It’s not every single state, but many states will allow you to get rid of those off your credit report. No harm, no foul. There are special amnesty programs for credit, natural disaster programs, etc. We’re going to be talking about how to synchronize lender and credit bureau data points, how to actually monitor the reporting process between creditors and the bureaus. Because FICO can only score and lender underwrite software can only look and evaluate the data that is on your profile. You’re in charge of what that profile looks like and the data points and how to reconcile them.

We’re going to talk about new rules violations. There are new rules about the reporting of public records reporting of the collections. There’s a whole bunch of awesome things for us to talk about. We’re going to be talking about collection accounts, validate and verify letters, settlements. What are the rules of the game on settlements? How the hypothecation of money literally creates an artificial reason for lenders to lower the amount they’re willing to take? We’re going to be talking about that. Also, have you even heard of LexisNexis or even heard of early warning systems?

All of these things are going to be forthcoming. I’m a binger of a couple of blogs and Netflix and everything. I’m just all in. I know you can’t tell that. I know it’s not obvious but when I’m present, I am all into what I’m doing. This is going to be monster coverage, but these are the things that we did when we coached at the boot camp, at any of our clients. Students all learn what you’re going to learn in the blog. Every single thing that we’re talking about is going to be a deeper dive taken. Any credit score when we finished, it was 22 months later but notice the scores and these scores are fundable scores. His new scores were 836, 846, 836 compared to the 619, 612 and 618.

Anything you do is if you base it on your fundability™ paradigm, if you base it on how fundable you are, then no matter what else you do, your lenders are going to look at you seriously. Lenders are going to create this profile. Every one of his high scores was based on legitimate movement shaping and reconstruction of the borrower metrics that FICO and lender software measure. I’m telling you right now, there is nothing that we cannot do that or there is no situation that you can run into that we’re not going to be covering on The Get Fundable! Podcast.

I’m so glad you joined me. I want to make sure that your comment in the notes in the blog. Share this with your friends. Go like us on Facebook if you love what’s going on here and you can get updates even on our Facebook page. We are committed to making sure that you are an empowered professional borrower. That is the point of Get Fundable! Until I see you next time, until my mouth to your ear, we are in this together. Godspeed and God bless.