Not many are aware that identity is crucial to being fundable. That is why it’s important to understand how to make your identity part of your fundability™, how to save your identity from theft or fraud, and how to make your identity bulletproof. Merrill Chandler talks about the fundable identity and takes a deep dive into the power of your identity over your funding approvals. Learn all about personal borrower identity – what it means, why it is important, and how to set it up. Walk beyond the hallowed halls of FICO and discover what score engineers and business scoring development teams don’t tell you.

—

Watch the episode here:

Listen to the podcast here:

A Fundable Identity

In this episode, we’re going to be talking about the secret power your identity has over your funding approvals.

—

This is one of my favorite subjects and it blows everybody’s mind every single time that we discuss this in any form, whether it’s an abbreviated conference presentation that I do or just chatting among clients or our tech training. This is crazy important and powerful to your fundability™. I’m going to show you how we’re going to save your identity from identity theft or fraud, making your identity bulletproof. Let’s check out how we’re going to make your identity so much a part of your fundability™. What is personal credit identity? We need to get the definitions down so that we can understand because this is a deep dive. You’ve never heard of this stuff before and you will never hear it anywhere else because you probably aren’t walking the hallowed halls of FICO and talking to the score engineers and the business scoring development teams.

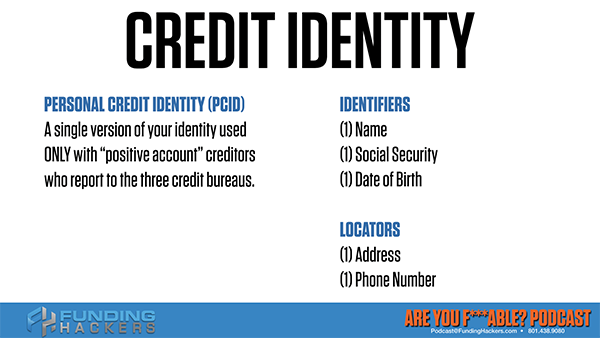

Personal Credit Identity

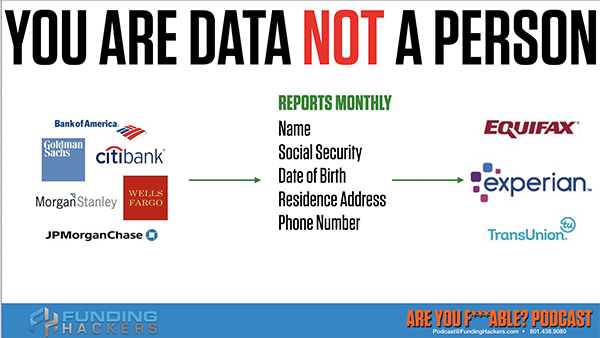

I’ve had that opportunity and we’ve been able to create a magnificent review for you through each one of these. Let’s get into it. The personal credit identity is comprised of two types of data points. There are the identifiers. Identifiers are your name, Social Security number and your date of birth. There are what are called locators. Locators are your address and your phone number. We call them a PCID, Personal Credit Identity. Personal Credit Identity is a single version of your credit identity that is reported by your creditors on positive accounts, meaning one name, one address, one date of birth, one Social Security, etc. One version of your identity that it reports to only personal accounts.

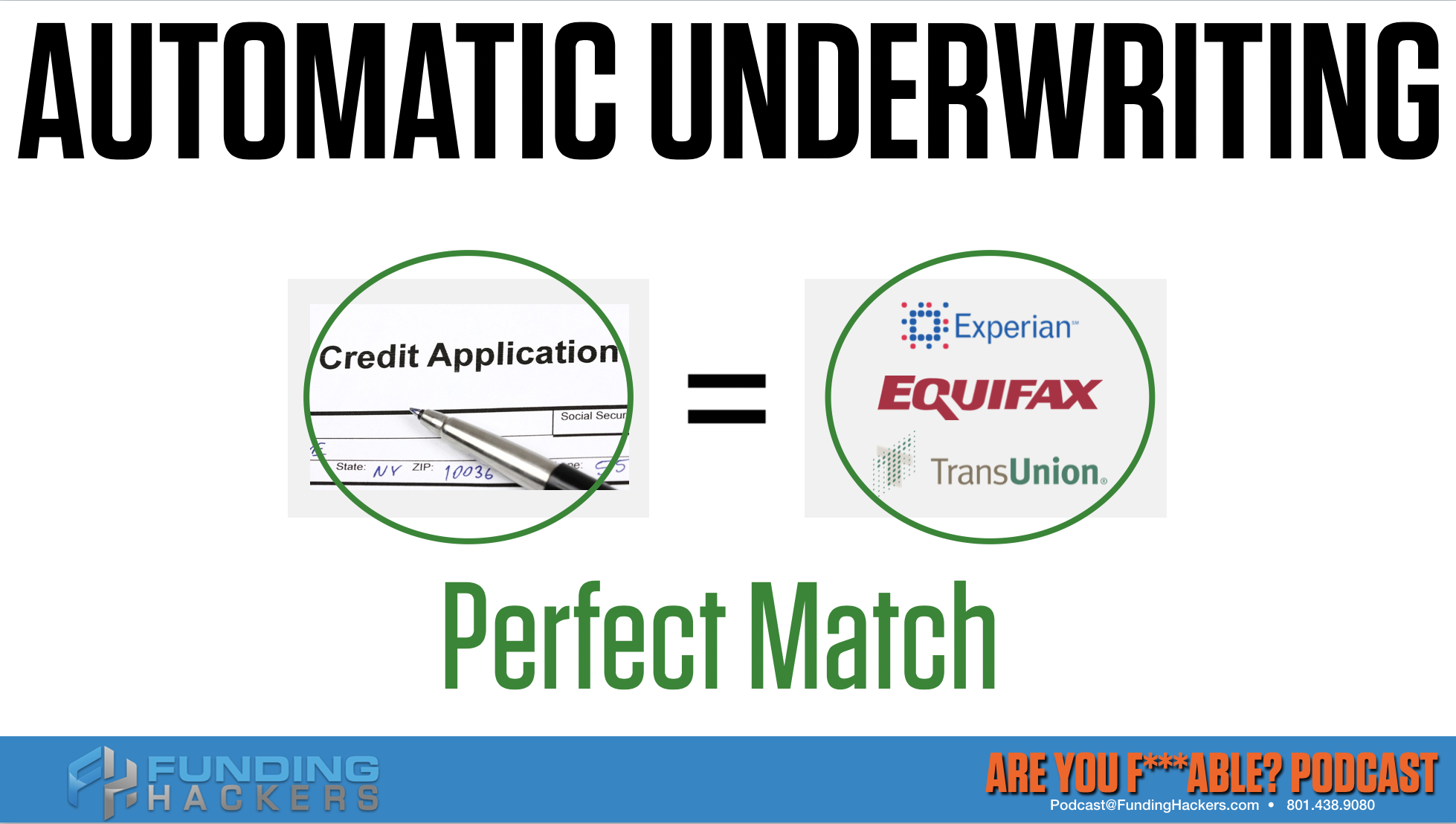

Why is identity important? Because of the three major underwriting criteria, underwriting asks three massive questions, “Who exactly am I lending my money to? Where exactly can I find them? How exactly am I going to get paid back?” Every other borrower behavior, every other data point, everything is aligned to answer those three questions. I keep talking about data, but here’s the thing, you are not a person. Your government identification, your driver’s license is the only link between your human being and the data points that the bureaus, FICO, and lender software measure. All of these, every one of these data points is vital in making you fundable so that you can pass automatic underwriting guidelines.

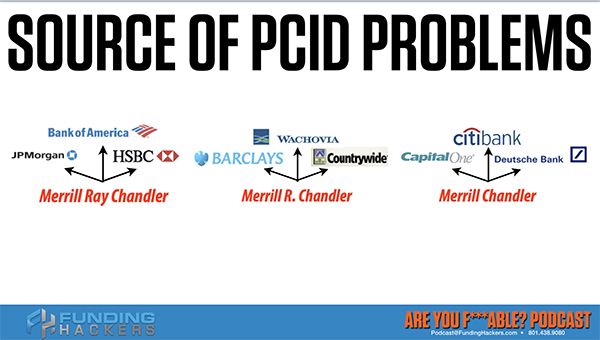

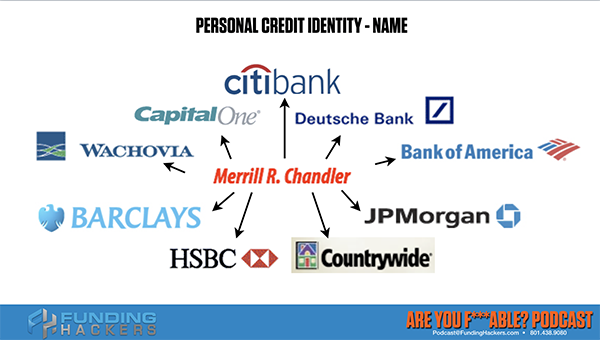

What I want to look at here and remember, we’re talking about data not, “My name is Merrill Chandler. They know me. I go to the bank all the time.” As we’ve discussed and we will be discussing further the movement from manual underwriting to automatic underwriting is a movement from your person to your data. This is why we say that you are not a person, you’re a data point. When we look at your data points, each one of your lenders, each one of your creditors, your lenders are going to be reporting your credit accounts that you have with those lenders, but they’re going to be using your identification information. One or more versions of your name, one or more versions of your address, etc. The more versions you have, the more confusing it is to future lenders. Your creditor may know like in my case, my creditors may know me by Merrill Chandler, Merrill R. Chandler or Merrill Ray Chandler, but future lenders do not. The fewer versions you have of your name increases lender’s confidence.

Messy Credit Identity

The objective of this entire episode is how badly is your identity, your personal credit identity, your PCID being reported? Instead of the bullseye on the target, how far out in the ring are you and what to do about it? The fewer versions increase confidence, but it also improves fundability™. It raises your score, but that’s the latter consequence. It raises your fundability™ and this is why we have to deal with this early on in our fundability™ activities. Let’s take a look at how on earth did you get to have such a messy credit identity? Once we learned all of these, we’re going to be talking about exactly how your identity leads to identity fraud and identity theft.

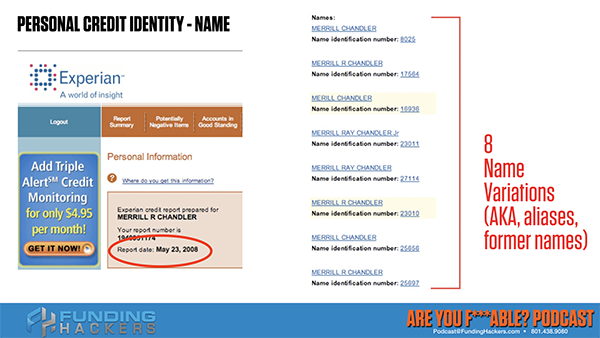

We can stop the vast majority, if not all of those problems by creating this PCID. How did it become such a mess? First of all, let’s use my example. Before I knew what I was doing, I applied under Merrill Ray Chandler, I applied under Merrill R. Chandler and I applied under Merrill Chandler. If someone looks at my face on a driver’s license and at my address information, they’re going to see that all of those are Merrill Chandler, but an algorithm does not do that. The FICO and the lender software algorithms are designed to look for perfect matches, perfect match yes or perfect match no. They’ll look at what happened when I was doing all of my work on this process. There were a total of eight name variations on my credit report.

All of them with different codes and those codes are related to different accounts so they can outline which accounts used which of my identities. No bueno, guys. In fact, it got so bad that before I handled it, before I cleaned it up, there are 29 Merrill Chandlers in the credit bureau databases and thirteen Chandler Merrills. My three Merrill R., Merrill and Merrill Ray, all three of those are combined as part of 29 other ones. The algorithm does not know how to parse out all of this data to create a perfect match. We have made it hard for them to approve us. When we say fundability™, we contribute many times and sometimes most of the time, every one of the borrower behaviors we have done are what’s precluding us from getting approved.

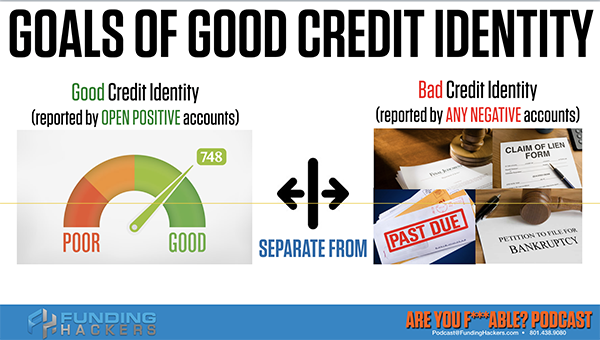

Your behaviors, because of our ignorance, before I knew what I was doing, I was a dumbass when it came to credit. Over the many years, I’ve dedicated my life to find out what it is that the lenders are using and how to score both in personal and business funding approvals. The goals of a good credit identity are to have a single name, address, phone number, etc. A single version of your identity that is used by open and positive accounts and then we want to separate it if you have bad credit in the past or anything that is still reporting on your credit report. If you have derogatory items, we don’t want this good credit identity version of your name, the address, etc., we want to separate those two. We’re not talking about creating a new identity using a CPN or the ITN, which is the new Social Security number. We’re not talking about changing anything. We’re talking about adopting a single version of your identity, whichever one you pick. We’re going to promulgate it out into all of the lenders.

Whatever version of the name you use, every lender has that name. If you’re going to use an address, every lender has that one address. It takes some work, time and energy, but it is worth it. It took me a while, but I created one online identity, Merrill R. Chandler that was at my address and one Social Security number and one date of birth. Many students come to me when they pull a credit report, they’re going to a boot camp and they’re like, “Why do I have two dates of birth? Why do I have two Social Security numbers?” There are many reasons. There can be file merges, something was transcribed wrong when it’s sent out for data entry. There are many ways that you can end up with mixed data points.

Steps To Establishing A Personal Credit Identity

The bottom line for us is that we have to establish this. We’re doing this early on in all of the episodes because you’ve got to start working on your identity now. You’ve got to get this done because if they’re going to lend to you, they don’t know exactly the person they’re lending to. How do you establish this personal credit identity? Let’s go through the steps. If you’re reading this, you might want to pull this up and watch the video version because I’m giving you actual graphics so that you can see how every one of these steps is so important to do.

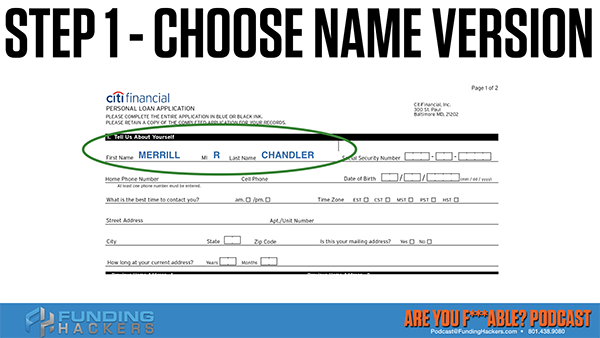

Number one, first of all, you’ve got to choose the version of your name. 60% of all credit apps, whether it’s personal credit or business credit ask for a middle initial. Some still ask for a middle name, like smaller banks, community banks and some even credit unions. We had one story. One of our team members didn’t have a middle name, but she was asked for a middle name on a credit application so she made one up. When she was going through her training as a credit advisor, she had to battle the bureaus because it’s not on her birth certificate. It’s not on her Social Security card, but it was on a couple of applications and therefore the credit bureau started reporting it.

It was the funniest thing we ran into, but as an advisor, she has her own personal experience of what it takes to go to battle, if that’s what it takes, to get your identity straightened out. It is the single most fundable part of your profile, your identity. The next thing that came up is you’ve got to choose one. You’ve got to choose the version of your name and I can’t answer all the questions, but many times I recommend a middle initial, if you have a middle name. If they asked for a middle name, you still put a middle initial, but whatever you choose is got to be the same thing every single time. Otherwise, you’re going to propagate more and more fuzzy information and algorithms do not like fuzzy information. They want specifics. They want identical.

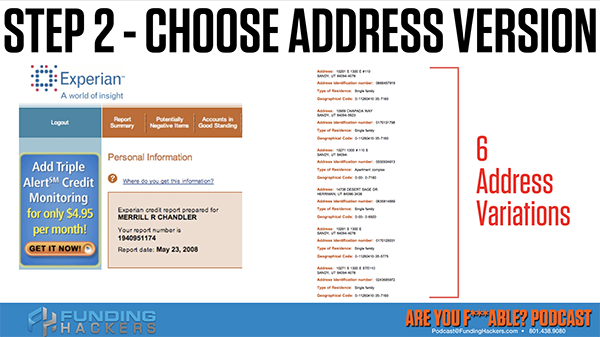

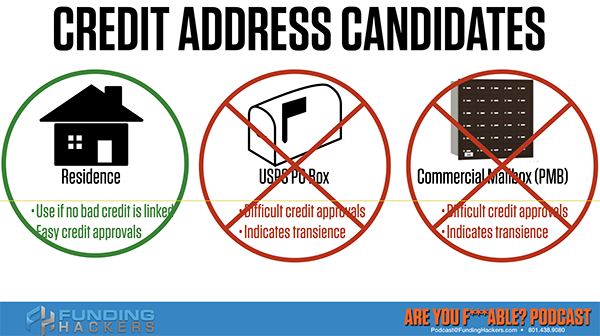

The next step then is to choose an address version. You’ve got to choose a version of your address that is going to be a part of your PCID, your Personal Credit Identity, your fundability™ address. Where can they get ahold of you? There are a number of strategies to do this, but I’m hitting the most that I can for this episode. What are the best identity addresses? I’m going to tell you straight up the good, the bad and the ugly. First of all, the good is a residence, an apartment, a home or a mobile home. It does not matter, but it has to be a resident. The two unfundables are a post office box and a private mailbox or a UPS store mailbox or FedEx stores. They are what I call commercial mailbox facilities or PMB, which stands for Personal Mailbox.

The reason why the last two are negative like the USPS, post office box and the commercial mailbox, that UPS stores is because those are the types of mailboxes that are used by identity thieves to usurp. They file an application and collect the information so they can get the credit card, authorize it and use it in your name. They ruin your profile and fundability™ and make off with bank money. This happened over the last couple of years so stay tuned. Every episode that we do is going to have new actionable intel that you can use in your fundability™, the steps towards creating your long-term fundability™.

Your residence is a fundable location or a fundable address. A post office box or a commercial mailbox is not fundable unless you live in a part of the world where everybody comes to a central post office box or commercial mailboxes. We have clients in Alaska. We have students all over the country. We have some in the Pacific Islands, Guam, etc. that are American territories and they use post office boxes. FICO underwriting systems all recognize those ZIP codes as legitimate places to use a post office box because residences are not there. If you live in a small town to a large city, they’re going to have you identified and wanting you to be in a residence to be fundable. This is to get unsecured credit, especially if you’re working on the business side, unsecured business lines of credit. It is vital that you have these.

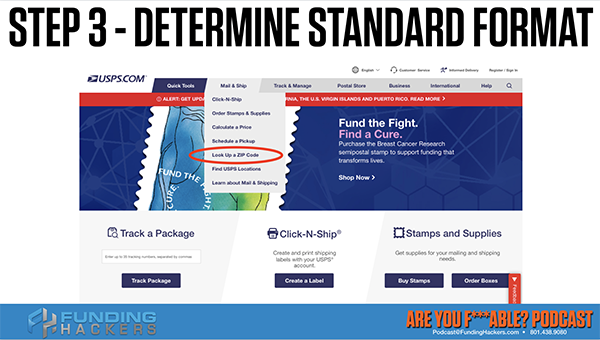

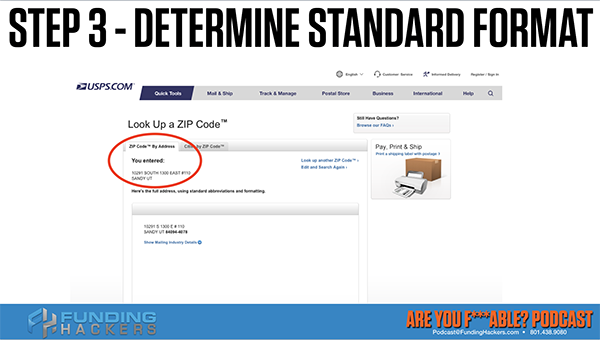

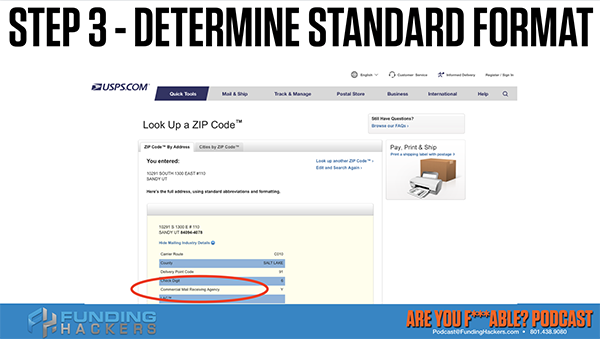

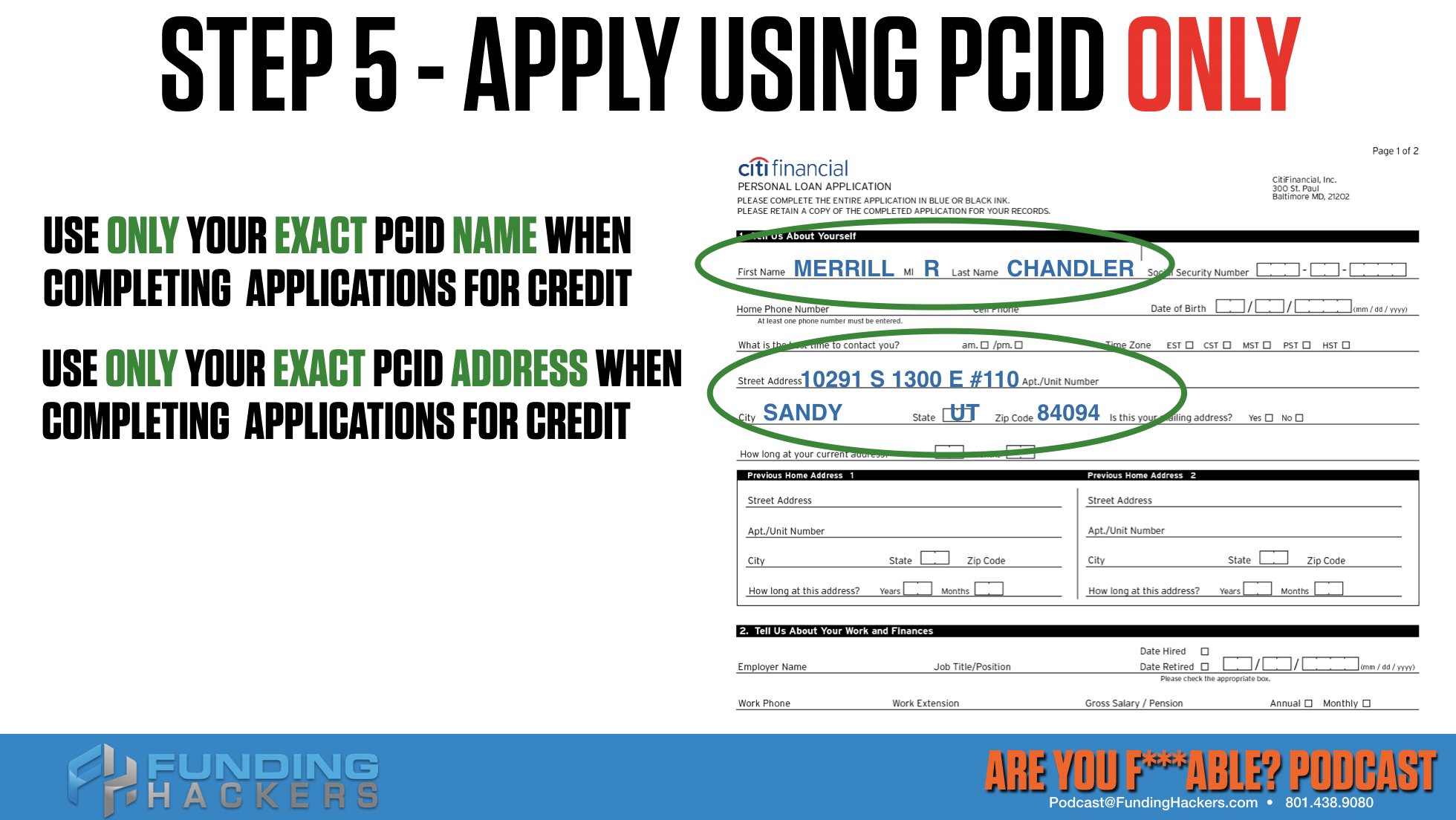

Let’s take a look at step three. What you have to do then is once you’ve picked your address, you have to determine the standard format. I’m quoting from the US Postal Service. If you go to the USPS.com, that’s the postal service website, and look up a ZIP code, it gives you a chance to enter in your information. Try spelling out streets and avenue. In my case, I wrote down 10291 South, 1300 East, 110 Sandy, Utah. That’s my PCID address, but to show you, I’ll put it in here and you notice what comes out. It comes out as 10291 S, 1300 E, 110 Sandy, Utah.

Instead of saying south and avenue and drive, it may truncate it. You need to know what the standard format is because every address in the United States is recorded. It is a function of this United States Postal Service geographical regions. All the databases, FICO, Falcon, the lender underwriting software, all use this as a lookup table to define your address. If you have addresses where you’re spelling out drive and parkway and all that stuff, you need to find the address to use so that you can use the standard format.

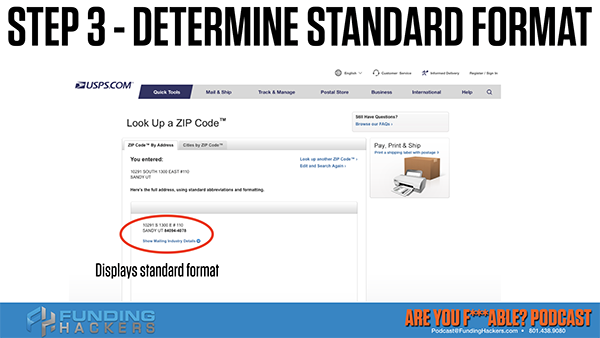

Notice also, when you look up that website, you’ll also see where it says, “Show mailing industry details.” What you find is that it may say a commercial mail receiving agency with a “Y” that says yes. What you’re actually telling is if you’re using this mailbox or you’re using the post office box, they’re going to deny you because they’re using this data to make sure that they can find you. They want to prevent fraud and they want to be able to know that they can send you something that you will receive. Remember those three criteria, “Who am I lending to? Where can I find them? How exactly I’m going to get my money back?” You will find all of that at USPS.com. It’s fascinating when you start looking up what your address is in the standard format.

Data Points, Automatic Underwriting, And The Update Process

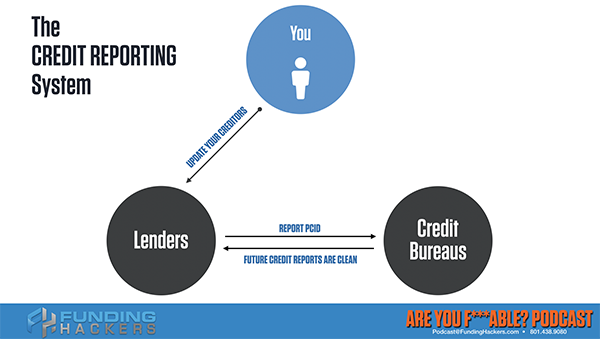

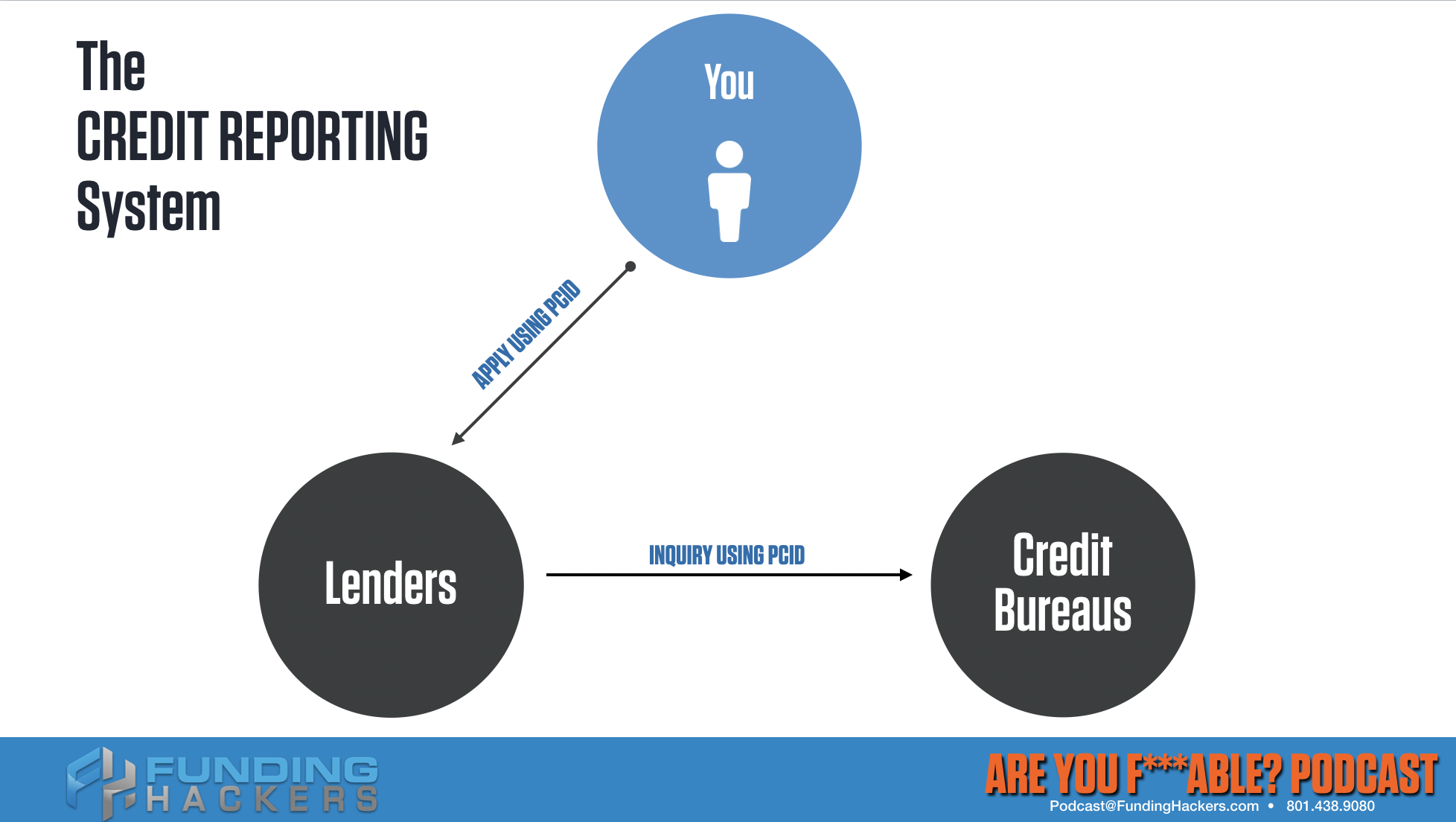

We’re going to need that standard format for step four. Step four is updating your positive credit accounts. The reason is when you update your creditors, those lenders are then going to report that new personal credit identity to the credit bureaus. The bureaus, whenever an inquiry is done, when you fill out an application correctly, you’re going to be using the exact identity that the bureaus are reporting and that the lenders are reporting to the bureaus. Your application data will match bureau data perfectly. We talked about data points and staying in automatic underwriting. All future credit reports will be clean of the old reported data. That’s when you dispute the old data is after you have updated the credit reporting system, after you have updated it.

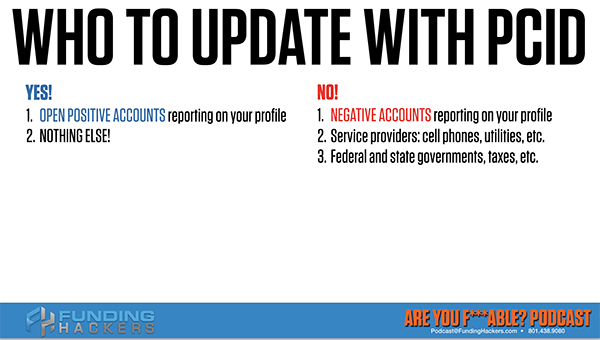

Let’s talk about how to do that. You want to update open and positive accounts reporting on your profile, nothing else. Who you don’t update? Any negative accounts that have a late pay on it or a collection or anything that’s reporting negative. Do not do that. There are some amazing things that you can do in your dispute strategies. The boot camp has some wonderful exercises on how to do all this. I’m telling you, do not update any negative accounts. You also don’t want to update service providers like cell phones, utilities or any of those types of things and don’t update the federal and state governments, your taxes or any of those things. You can keep it. I can be Merrill Ray Chandler here because that’s my birth name, but my creditors don’t need a birth name, they need a consistent name. I use Merrill R. Chandler here and Merrill Ray over here. You don’t have to update it. If it says Merrill R. here for you, your version of that name. If for federal and state governments and for service providers, you don’t have to change it. You don’t change it, I’m saying just don’t update.

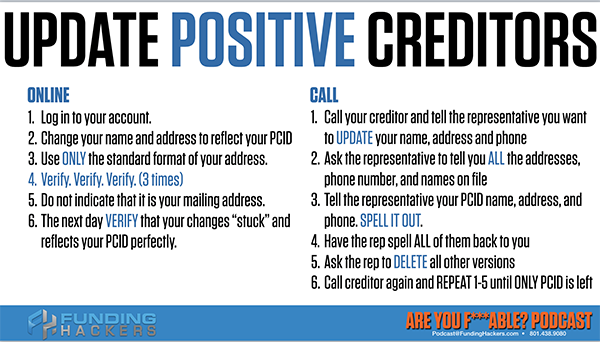

The only ones you update with the new version of your name, the chosen version of your name, the chosen version of the standard format of your address. Those are what you update and only to positive creditors. Let me tell you how to go through the update process. This is still step number four. You’re going to go online. If you have an online account, you log into your account, change your name and address to reflect your chosen PCID. Sometimes they let you change one or both. If they don’t, then you may have to call in and they may ask for your identity.

If my identity says Merrill Ray Chandler and I want it to be Merrill R., then you go ahead and tell them, “To protect my identity from identity theft and fraud, I’ve chosen Merrill R. Chandler as my online financial name, my PCID.” Creditors aren’t going to know what PCID means, but you just say, “My personal credit identity, I want it to be Merrill R. Chandler.” You can use only the standard format of the address and you verify it three times. What I mean by verifying is you are going to call your creditor and tell the representative you want to update your name, address and phone number. Ask the representative to tell you all the versions of your name that are on file and all your addresses.

You’re going to ask for all the phone numbers and you’re going to ask for all the names you have on file. Ask for all of them and then tell them please delete everything except for Merrill R. Chandler. Use the version of the name that you’ve chosen. In my case, Merrill R. Chandler and then I’m asking them to delete all the other versions because they are not relevant. I don’t live at that address. I am not part of that and sometimes they may read a number and you’re like, “That’s my ex mother-in-law’s from twenty years ago. Please delete it.” Get rid of everything that you can and then tell the representative your PCID name, address, all your data and have them spell it back to you.

I spell my name out and they spell it back to make sure that it’s crystal clear. Ask the rep to delete the other versions and then call the creditor again. You’re going to hang up on that phone call. You’re going to call the same number on the back of your credit card and you’re going to ask again until they have deleted all the other ones and they have updated your file with just your PCID. Here is why it’s so important and you’re going to hear me say this episode after episode. You have to verify until you get the same answer three times. We are vetting some business credit cards. We asked Chase three times what their credit reporting is for a couple of their business cards and we got three different answers. You call until you get the same answer three times and most likely, that’s the accurate answer.

You’re going to keep calling your creditor until that PCID is flawless and it’s the only one on their records. Because then, it’s the only one that they will report to future lenders. It’s the only one you will put on your application. Now, you have perfect data sync up between what your application says and what’s on the credit bureau database. You have total control over this, but you’ve got to do the work to make it happen. Sometimes they’re going to ask you security questions when you’re ordering the credit report or you’re talking to the creditor.

You are not a person, you're a data point #GetFundable Share on XNotice that here are all these things, previous employer. Do you have one of these auto loans? Pick the other one. Notice this one. They may ask you, “Using your date of birth, please select your astrological sun sign of the Zodiac from the following choices.” Are you kidding me? Be patient because these are their ways of verifying who you are and you have to prove who you are. As I’ve said in other episodes, the magic turns in our favor when we stop proving up what we put on our credit profile and we start staying in automatic underwriting because all the data points match. They do not ask for identification if they know it is you. Who’s responsible for them knowing that it’s you that’s asking for a credit report or applying for credit? You are, nobody else. Get this straight through your head. Nobody is responsible except for you and you’ve been giving mixed signals, mixed data for your entire life, most of you. This is how we fix it.

Let’s take a look at step five and this is the most important part. You’ve got to clean up all the data. I have entire presentations where I say, “Did you know that you are telling a lender not to approve you by what you put on your application?” This is where the rubber meets the road. This is what that means. Step five is you have to apply using your PCID perfectly. In my case, if I chose Merrill R. Chandler, then whether it says middle initial or middle name, I put in Merrill R. Chandler because that’s what’s on my credit bureau records. When I fill out an application, always use all capitals. Remember back when we’re in first, second and third grade and we’re using the little dotted lines between the two broad lines and we’re making our As, Bs and Cs, we get so sloppy in our writing. Use block letters, all capital because that’s what they record. In this case, I’m going to use Merrill R. Chandler and then I’m going to use exactly my PCID address. I’m going to put in 10291 S, 1300 E, 110, etc.

You have to verify until you get the same answer three times #GetFundable Share on XThe ZIP+4 doesn’t matter. We have not found any material differences between ZIP code and ZIP+4. If you don’t put it in, it doesn’t matter. I never use ZIP+4 because sometimes the lender software, the FICO software adds the ZIP+4 for you so I don’t put it in. I cannot emphasize this enough but your most important activity is making sure that you apply using your perfect singular personal credit identity, your PCID. If I put Ray in here or if it’s not clear and I only put an R in there instead of a two Rs for my name, then I’m going to end up with another one being reported on my bureaus and then I’m not on the funding bulls-eye, I’m in the outer rings.

Those outer rings is where I get lower approvals or denials because the underwriting software does not know who it’s lending to. The software is only looking for perfect matches and the lenders have empowered the software with 100% of approval authority if it matches perfectly. We no longer have to prove what’s on our application. Our borrower behavior they’re measuring, our application information matches the online databases that they check and your approvals are simple, elegant and effortless with higher limits. If I blow it here on my application, I’m going to confuse the software more and I’m out of the game.

Your identity is the first piece of the fundability™ puzzle that's going to make all the difference in the world #GetFundable Share on XWhy is all of this important? It’s very simple. In the funding game, the credit reporting game, when I apply using my personal credit identity, then the lenders submit to the bureaus the personal credit identity, perfectly executed. I have a perfect match between my credit application and the bureau data. A perfect match means now they get to start considering the other information on my application. If I’m going for business, I’m going for personal, only then will they consider me for a loan. If they don’t know who they’re lending to. If the software does not know who it’s going to approve, it’s not going to approve you or your limits are going to be drastically cut.

That is what this episode is all about. The value and importance of your personal credit identity and you have to have this identity in play before anything is meaningful for any of the episodes. I’m telling you, your identity is the first piece of the fundability™ puzzle that’s going to make all the difference in the world so that every activity that you do in any other blog in the universe, at least the software will know who it’s lending the money to. You can watch the video version of this. Do not hesitate to watch it, listen to it three or four times. I know I’m a fire hose and I’m proud of it because I can give you so much information in so little time. You have an amazing day. Godspeed and God bless towards your fundability™.