Did you know that the way you fill out an application in an attempt to get a business credit card or credit line is creating the opportunity for lenders to deny you? In today’s episode, Chief Strategist Merrill Chandler talks about the mysteries in business funding and the reasons why lenders will not lend to you. Merrill provides insights on how to frame you as a business and your relationship with your business. Join Merrill Chandler as he imparts his knowledge on how you can speak the language of lenders and play their game.

—

Watch the episode here

Listen to the podcast here

Business Credits Funding: Why Business Lenders Will Not Lend To You

In this episode, we’re going to take business credits funding to another level. We’re going to find out why lenders aren’t interested in lending to you in certain types of businesses or in the way you fill out your application. Your application may be creating a big, fat no and you don’t even know it. We are always looking for the best money possible. It doesn’t matter whether interest rates are high or low. We want the very best prime plus 0.5%, prime plus 1%. We don’t ultimately care what prime is because it’s all relative to what’s going on. We need the best interest rates possible. Did you know that the way you fill out an application in your attempt to get a business credit card, credit line, even a loan is creating the opportunity for lenders to deny you. We’re going to discuss why that is so. I have to tell a quick story.

My daughter, Sharon, she works at this outfit. It’s in a restaurant. She works at Topgolf as one of the managers there. She sent me a video that while the team is coming and either putting away their clothes, getting dressed, getting ready to go out for their shift, this breakroom is playing The Get Fundable! Podcast. I’ve taught her a lot, but she even wrote me a testimony. I was so proud of her because she’s learning and I love that she cares. Most importantly, she told me this in this testimonial about her dad and his mission in life. She shared that growing up, for 30 years being a member of my family, she didn’t know most of this stuff. Yet, she has a perfect 800 plus borrower profile working on their second investment property. They moved in. They fixed the property. They are getting ready to move out and do it again.

Tactical Decisions

I’m proud of them and everything they’ve done. We have great conversations, but it is not even the principles behind it. We’ve talked about tactical decisions to make. You don’t have the luxury of having family dinner with me and that’s why I’m starting this show. That’s why I want you to keep bingeing this because I want you to have access to everything that I can possibly give you in this relationship. First things first, how many of you are business owners? Would you say that you are a business owner? Would you say that you are self-employed? Are you employed by a business? The interesting thing is those are all the same question. They’re not all fundable. That’s what we’re talking about in this episode. They’re all the same questions, but it’s all about framing.

It’s All About Framing

Talk to an attorney from law school or anybody who’s in law school and they’ll tell you that one of their teachers said, “Whoever frames the argument wins the argument.” It’s been didactic learning for a millennia, right back in Socrates and Plato days. If the lenders are framing the argument, we’ve got to play by their game. If we reframe the argument, then we can play that game and win. It is absolutely true in the best arguments ever. I was from a bootcamp. I was sharing this principle about framing the argument. I told the men to put on their earmuffs. I asked the women, “How many of you frame the argument because if you frame it, you win it?”

Whoever frames an argument wins the argument #GetFundable Share on XI told the women to put it on their earmuffs and I told the men, “If you frame the argument, you’ll win it.” There are a bunch of couples there and everybody got the joke. The point is that framing is everything. Over the next few episodes, we’re going to be talking about how to frame you as a business and your relationship with your business. Framing, what is a qualified funding entity? What is fundable when it comes to entities? It’s all about framing. If you don’t take this seriously, you’re going to step on landmines and blow your crap up. Being a business owner, being self-employed and employed by a business is all the same thing. It’s how you frame it.

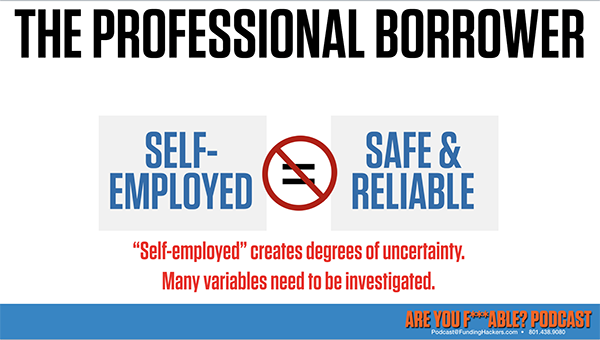

Imagine an application. You’re filling out an application and you go to the dropdown and it says, “Select one: employed, unemployed, self-employed, student, disabled, retired military or other.” Which one of the top three, employed, unemployed and self-employed, is most fundable? If you answered employed, then you are correct. We want to be employed when it comes to filling out an application. Why? If you are self-employed, in the bankers’ eyes and therefore in their underwriting software and their approval software, you are not safe and reliable. Self-employed creates degrees of uncertainty. There are many variables that have to be investigated and that’s what we call the full doc. If you’re self-employed, that’s an automatic trigger to get kicked out into manual underwriting because somebody has to go through, if it’s worth it to them to do a deal with you and to give you a credit liner business loan.

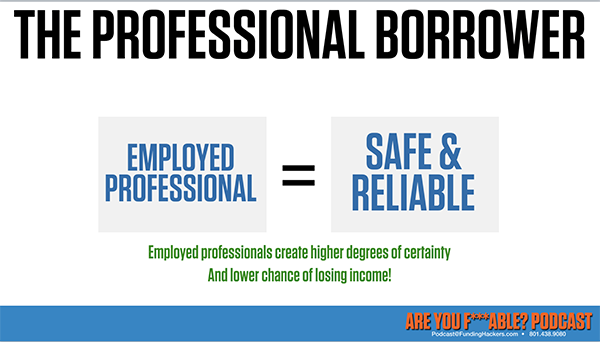

They have to assign one of their employees to go through all the lender criteria and get all the proof. It’s old school manual underwriting. We don’t want anything to do with that. We want to be an employed professional. Is one better than the other? An employed professional is safe and reliable. By the very language, it is predictive of continued employment. Employed professionals create higher degrees of certainty and a lower chance of losing loans that a lender may give you because there’s a lower chance of you as an employer professional losing income. If you are starting a brand new business and you frame yourself as owning a business or are self-employed, those are straight-up deal killers.

An employed professional is safe and reliable to a lender’s point of view #GetFundable Share on XThe story that I have is from one of our bootcamps. The idea was somebody asked me, but I am self-employed. I was like, “You’re calling yourself self-employed.” In the bootcamp itself, we are going back and forth that saying, “It’s about framing.” “I want to tell them the truth.” I was like, “Tell them the truth. Are you employed? Do you receive W-2 or 1099 income from your company?” He said, “Yes.” You are employed by that company. That company is not you. You are the one conjoining both of you under one umbrella. The Supreme Court says entities are people, too. They are separate and distinct entities. If you insist on saying that you are self-employed, you’re not going to get a dime from a lender in automatic underwriting.

Self-employed says that I am in charge of everything in this business. The business doesn’t have an identity without me. You might as well be a sole proprietorship. I’m saying that if you’re receiving W-2 or 1099 income from your business, you are employed by that business. Another example to finish that. We went back and forth several times because he was stuck on the idea that, “I have to be honest and truthful.” I was like, “I want you to be honest and truthful. None of this is about gaming the system. All of this is about creating a relationship with the lender, a relationship of trust.” We want to have a trusting relationship, but you have to give them a language that they understand, a language that lets them want to build a relationship with you so that they can trust you.

Be In The Relationship

You got to be in the relationship before you can trust the relationship. I’m telling you, every single time, whenever I look at profiles, whenever I do a strategy session with clients or individuals who are looking for my coaching, if it says self-employed, that’s a deal killer. It’s unnecessary because if you’re taking money out of that entity, you’re an employed professional. I’ve spoken of this several times but when I applied for my line of credit with Wells Fargo, I got $75,000 in credit line and credit card joint or total. They asked me, “Are you the owner or an officer of the business?” I said, “I’m an officer of the business.” They asked me the question. I am the CEO and that makes me an officer. I do not have to say anything else because an officer of the business is actionable just like an owner is actionable. When I say owner, believe me, they’re going to dock you. This is me projecting onto the software, but the intent of the software is to separate. Is this entity separate from you or is it one amalgamation of identity? We’re going to get into some crazy deep dives about how this works.

Employed professionals create higher degrees of certainty and a lower chance of losing loans #GetFundbale Share on XYou need to know that employed professionals are a powerful way to approach and to frame your relationship to your business, not as an owner. What are lenders looking for in a borrower? As I said, they’re looking for a professional borrower who creates the conditions of trust and more importantly treats lender money with deference and respect. I’m going to tell you to do it right now. Pull out a credit card. I want you to see it for yourself. Whose name is on that credit card? 95% of every audience answers that question and maybe you even answer that question with, “My name is.” I’m like, “You’re absolutely right. Your name is on that, but so is the lenders.” Here’s what I want you to take note, carefully. Somewhere in all of our programming, our financial education or training, the stuff we got handed down from our parents and the training we received. They tell us that because we are creditworthy, we deserve this money. Therefore, this money is ours to do with as we pleased. As long as we pay it on time, according to the terms. Think about that. You very well may believe I’m going to call you out. Probably, at the back of your mind, you believe the money on that credit card is yours to do whatever you want with.

Treat Lender Money With Deference

That’s not true. Do you think there’s a lender in the universe that believes that money is yours? Any lender? They don’t. It’s their money and they are sharing it with you in hopes of a profit and a longer relationship with you so they can count on that profit over and over again. If you treat their money with deference and respect, then all kinds of doors begin to open. A professional borrower creates conditions of trust and treats lenders’ money with deference and respect. It’s that subconscious background behavior, those beliefs that we have that say, “This is my money. As long as I pay it back the way I’m supposed to, I can do anything I want with it.”

Since 2008

That unconscious behavior is being measured by FICO and lender software and they are catching you carrying two high balances. You are putting all your balances on your personal profile instead of your business. All the things we talked about for the last freaking 30 plus episodes, they measure all of that. They’re not going to give you more money or they’re going to limit the amount of money they give you as a result of that unconscious behavior. Another thing that’s important is that since 2008, back in the day in 2007, in one day from two different branches, I got $100,000 each from Chase. I signed on the dotted line, one-page application. It was a free for all. They were not just giving money away from mortgages. They were giving money away, period. I got two $100,000 business lines of credit in my name stated income.

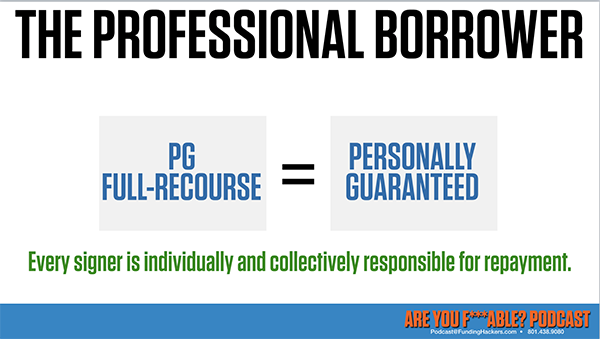

It was awesome, but the thing was, it was not personally guaranteed. Since 2008, there is not a single cash credit card, credit line or a business loan, much less personal that is not personally guaranteed. It’s called PG or full recourse. If you don’t pay it or if the business doesn’t pay it, it comes back on you. There’s a difference. Be very clear. You can be personally responsible for it but still have it and not report on your personal credit report until you go delinquent on it. Then, it reports to your personal. Full recourse, personally guaranteeing doesn’t mean that it’s a report on your personal profile. It means that if your business doesn’t pay up, you end up with bad credit, bad tradeline, collections, judgments. To be a professional borrower, to acquire the credit lines and the loans that you want to have, you have got to treat their money with deference and respect.

You’ve got to frame who you are in the business so that they can understand. You’re speaking their language. If you step on the landmines, it’ll blow up and you don’t have any recourse. You won’t get approved or the tiny test approvals to see if you’re legit. Once you get an approval, it takes the lower the lower approval. You get $5,000 and it takes forever. Do you remember the velocity of your credit? It takes forever. It takes 42 months to get to $100,000 every six months at 30%. The credit limit increases. That’s too long. We want to get a $50,000 so that within twelve months, is $100,000. We’re playing this game as partners with these lenders. We’re speaking the language that they can hear so that we can begin to develop that relationship and trust. Thank you for joining me.

Love the show? Subscribe, rate, review, and share!