Seeking to become a fundable business is necessary for growth. In this episode, Merrill Chandler continues disrupting your fundability™ beliefs as he talks about several funding entity strategies and the fundable entity types you need. Sharing some examples, he outlines the different strategies that you can apply, noting how different approaches depend on the size and scope of your funding objectives. He also clarifies the difference between a state business entity and a tax designation.

—

Watch the episode here

Listen to the podcast here

Funding Entity Strategies

Hopefully, I have been disrupting a whole crapload of your beliefs, both personal credit and fundability™, as well as business fundability™. We’re going to keep that going with this episode where we’re going to talking about what are the several funding strategies. What are the fundable entity types you need to build your funding strategies? Without the QFE, Qualified Funding Entity, you haven’t got a chance at getting the right kind of approvals you want for your business. Choosing the most fundable entity strategy for your situation. Remember, we’re all different, but the differences that we have must all come together in trying to create the fundable entity type.

Brad and I are back at the FICO world. We were talking to the FICO guys and we’re like, “What are the entity types that are most fundable?” They were like, “You didn’t need to go talk to Dun & Bradstreet because we’re collecting their data, but they’re the ones who have that kind of information.” Brad and I go over to the kiosk, Dun & Bradstreet and I still have the coffee mug that I got from them. We asked, “We’re trying to give people a leg up in becoming fundable, making sure they have a chance at funding their businesses. Do you have a list of the most fundable to the least fundable type of business?” They’re like, “Yeah, no, we can’t give you that data.” “We want to know. How can we share with people what fundable businesses look like?”

They go, “What we do have is fundable businesses by percentage. Now it’s not sorted.” They give us an Excel spreadsheet so I can do the column sorting. They said, “We can give you the funding by percentage. Two things we go back to, remember we talked about the SIC code, Standard Industrial Classification code. The more modern one is the North American Industrial Classification System, which is the NAICS code. Those codes are the ones that are game-changers as we’ve talked about in previous episodes. You’ve got to have the right funding. If you don’t have the right code, they don’t need to look at the name of your business alone. If you don’t have the right code, they’re going to deny your application because you’re not a fundable business.

Dun & Bradstreet had a list of the percentage of most fundable or the percentage of funding by business. They gave us that and as we’ve already talked, there are several ways to create the qualified funding entity, whether it’s a consultancy, whether it’s a marketing company, an advisor company. There are a number of ways to create that funding entity. I refer you back to the previous episode where we talk about the most fundable entities. Now we want the entity type. How do we get to that marketing firm, that consultancy, that advisory a company? This is what we’re talking about in this episode.

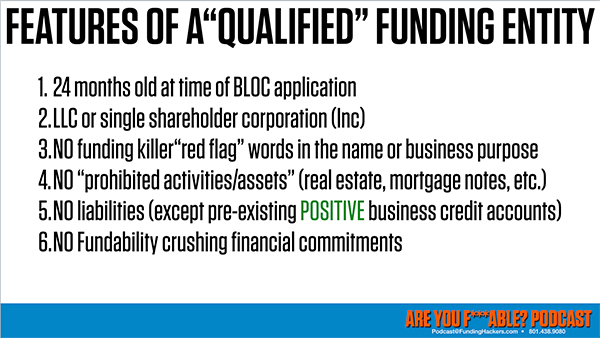

Features Of A Qualified Funding Entity

First of all, the features of a qualified funding entity are the following, number one, at the time of the business line of credit application, it must be at least 24 months old. They prefer 36 months old, but it must be 24 months old. Remember business failures until they’re proximately 3 to 5 years old. Most number of failures occur in that under 24 to 36 months. They want you to get past that 24-month to the 36-month role. At the time of the business line of credit application and remember we’re going to be talking about some strategies about how to develop these business relationships, but it’s got to be 24 months. We prefer in every instance that it’d be 36 months before you try.

We're all different, but the differences that we have must all come together in trying to create a fundable entity type #GetFundable. Share on XNow it also has to be an LLC or a single shareholder corporation like an Inc, an incorporated company, shareholder. Now I’m going to disabuse you. I do this in every bootcamp, every situation, every public address, many people confuse the difference between a state business entity and a tax designation. I don’t want to hear about S-Corps or C-Corps. S-Corp and C-Corp are tax designations. You don’t register an S-Corp in your state. You registered an LLC or an Inc. corporation, a shareholder corporation, or a professional corporation, a PLLC or a number of other sole proprietorship, which we don’t do. We don’t want to do and have anything to do with but don’t confuse the issues.

S-Corp is a tax designation, a federal tax designation. You either have an LLC, most likely an LLC or a shareholder corporation registered in your state. If you have a shareholder corporation incorporated, it’s got to be a single shareholder or you’re not going to be fundable. Now you can have no funding red flag words in the name of the business or the purpose. We’ve already talked about those red flag words. That’s one of the things that we need to be able to harken back to that red flag word sheet. I recommend you go back to that and make sure that you’re not just the name of your business, but your business purpose does not have any of those red flag words.

If you’re my client, I’d tell you to run it by your advisor team because this list is not conclusive, but we’ve already discussed it. Make sure none of those words are in the name or in the business purpose. Now, for all intents and purposes, whenever you do an Articles of Incorporation or Articles of Organization, it’s easiest and best is to say, and the purpose, any legal business activities. That way you’re covered. If you’re starting a new entity as we’re going to be discussing here in a moment, your business purpose could be dedicated to that funding or not a funding entity, but you would use the term a business consultant marketing management firm, etc.

You also don’t want any prohibitive activities or assets. You can’t hold real estate in the qualified funding entity. That’s why we call it a qualified funding entity is it got certain qualifications that it meets. You can’t hold real estate unless it’s your personal home or the business building that you can justify as your business. You can’t have rental properties and apartment complex or property management, none of those things. Those are all prohibited activities or assets. You can’t have any of those owned. Remember an episode or two, we talked about exactly what that means. No liabilities, unless it’s positive credit business accounts in the name of the business, we don’t want to have any liabilities and no fundability™ crushing financial commitments.

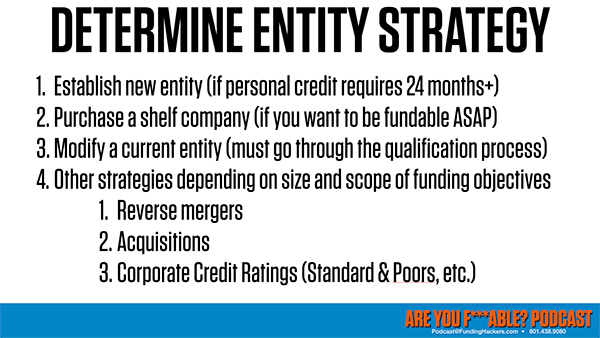

Three Main Entity Strategies

Number 5 and 6 go together, no liabilities and fundability™ crushing commitments are the same thing in many ways. Those are the features of a qualified funding entity. Now we have to do this and we have to establish what those strategies are. Now there are three main ones that we’re going to be discussing. If you got $10 million, $20 million, $50 million company, the fourth one I’m going to talk about comes into play for you. True corporate credit is available to you, but for us, small business owners, the first three that we’re going to talk about is what’s going to be necessary. Number one, the first strategy is to establish a new entity, file for a new entity and start aging.

Now, remember, it requires a minimum of 24 months to be old in age before you can go for business lines of credit. You can do it a little bit sooner. You can try for business loans. We don’t even recommend other than credit cards. We don’t recommend any credit instruments until that 24-month age mark. Some of you, if you’re working on your personal fundability™, you’re in the crapper in the 500s, low 600s, mid-600s. Establishing a new entity may be the best thing for you because you’re going to have to age and optimize your personal profile to such a degree that you need all 24 months. That’s not a bad thing. Here’s one thing you got to know.

There is no zero-zip loss of time in this process. Let’s say you did a bankruptcy. This could take you 3 to 5 years to build your personal fundability™ backup. That 3 to 5 years, if you do it right and you’re building a business relationship according to my structure and guidelines, you’re going to be bulletproof and fundable the second-year personal profile is online. There’s no time loss. If your personal credit requires 24 months or more, I always recommend establishing a new entity.

Now the second strategy is to purchase a shelf company. Now a shelf company allows you to become fundable faster. It’s like compressing time because you’re building or you’re buying an aged organization. They call it a shelf company because you take it off the shelf. It’s already been aged. It’s like you go back in time and start a company. You fast forward and here you are, it’s already three years old. If you’re going to buy a shelf company, it must be 36 months. Do not play the 24-month game unless you want to spend at least twelve months building that business relationship. That’s what I recommend, but you can do the same if it’s 36 months old.

The last one for us, first of all, business and entrepreneurs, small business is you modify one of your current entities and this goes through a significant qualification process. If you modify a current entity, you go back to this list and make sure that it fits everything that the list that we talked about, 24 months old at the time of a business line of credit application, LLC. No red flag words. You have to change the name, etc. Those three, establish what I call a new co, establish a new company, a shelf co, shelf company or modify a company, the entity. I have three Utah companies that are aging right now. Now I don’t use them for funding, but with the stroke of a pen, we can enter into the secretary of state database.

You can change the name, but you keep the aging of the company. There are important things you have to do to make this happen. Again, this is adult supervision is required, but you’ve got to modify an entity so that it becomes fundable. Now for those of you who have larger organizations, other strategies that exist depending on the size and scope of your funding objectives. You can do a reverse merger into a public company. You can do an equity acquisition or lateral merger. You can establish corporate credit ratings like Standard & Poor’s, etc. Those are all the literally $10 million-plus or higher. Those are fun projects.

Modifying an entity is necessary so that it becomes fundable #GetFundable Share on XExamples

You have to determine the strategy you’re going to seek your funding. I’m going to go through a couple of examples that outline each one of these. I shared an experience with one of our clients or one of our students who has gone through this process. Let me tell you about Steven. Steven was doing the work for his wife. His wife had reasonably fundable personal profiles, but they didn’t have what it takes to have a fundable entity that they could build a relationship. Remember, the relationship with the banks is the most critical. Once you’ve got your personal profile in play, everything else comes in after that.

It backstops your business and the data points that are searched as we’ve discussed in previous episodes. My team shared the features and benefits of all of those entity strategies, 1, 2 or 3, new co, shelf co and mod co. They decided to clone a qualified funding entity model and made their shelf company a fundable company. They decided that they wanted to do one of the shelf company, but they had to match every detail, change the names, make it a fundable name, make the SIC codes, the NAICS codes, modify all the business credit reports, etc. Now we provided a comprehensive fundability™ plan step-by-step, what we call traffic cascades.

Everything necessary to create a relationship with the lenders, age them and created the online presence and the real-world presence. Everything so that lenders would look at them all business funding, FICO’s metrics would be hit, the automatic under age system metrics would be hit, etc. We kept them on track for a 24-month period. We created the 24-month plan of which they were going to be fundable about month 13 to 15. Many of our clients ended up being all the crossover point between personal and business at 12 to 18 months. We’ve had many people funded sooner, but they also had special circumstances, where are those cases came into play? They were already on third base with their personal fundability™ and we started the business side.

After we are done, after they cloned that entity, they picked up $110,000 between three banks in their first funding. It works. You have to create a personal, fundable, funding entity. You have to create personal fundability™ first. You have to create the funding entity. Derek and Aisha, they are an awesome couple. This was a feat, a first for my team and even for myself. He lived in one state. She lived in a second state and their business was in a third. There were a lot of considerations that need to be handled. The reason why I bring up Derek and Aisha is because you need to understand that there is a solution to every single funding situation out there, all of them. On theirs, they also did a shelf co, but not only did they do a shelf co, but they wanted more loans than lines of credit.

They were especially interested in what are called property acquisition loans. After their team has built their funding entity with them after they created because they were a partnership, we call our partners, relationships that either include bed, blood or business. That’s what we call partnerships. These guys keyed all of the right personal underwriting triggers so that their personal fundability™ for both of them. They implemented what we call a sunset clause, so that each one of them could, in turn, and acquire new lines on their borrower profile. They backstopped their own set of business loans, business lines of credit and took turns backstopping those loans. Built the collective amount to the tune of $580,000 in a single unsecured property acquisition business credit line plus $90,000 in other credit lines and credit cards.

That’s over $670,000 in their first round. They also passed twelve months in optimizing all of their situations so that they could be fundable. It’s all about building your personal borrower profile, while building relationships with the lenders that you want to establish amazing relationships with. They are going to continue and continue. All of this is vital. Let me finish with Theresa. Some of you may have seen this in other presentations. We definitely have it in our bootcamp. We have her giving us a testimony in her own words. The details are amazing. We’ve vetted her current entity and substantiated and fixed all of the things that were out of alignment with the funding qualifications.

When we say cloning of funding entity, we’re literally taking this funding entity and making your funding entity a current entity that qualified. Our team reviewed her business credit reports to ensure there were no deal killers that no funding time bombs, all NAICS codes, the SIC codes, everything that we’ve talked about over the last half dozen episodes were in play. We’ve vetted banking relationships. We found some red flags. We had to go clean up a number and help her understand the importance of all the details. Do you realize? Not in her case, but we have had clients who’ve gone and got kicked out into manual underwriting because there was a difference between a hashtag or an apartment, using the term suite apartment or hashtag.

People have been denied their borrower profiles or kicked into manual underwriting by the use of which one of those of what is called delimiters, hashtag number 121 or Apartment 121 or Suite 121. Data has to be synched. We found some of the red flags in her situation, showed her and helped her clean those up. Her PBID was not pretty like most of you, you’ve pulled your My FICO credit reports. It’s not pretty guys, MyFICO.com pull that credit report, get that advanced and start using that to optimize your profile or bring it to the bootcamp. Make sure you go to GetFundable.com. Make sure you go to the bootcamp, find out and do all of this in one fell swoop.

Finally, she was about fourteen months in optimizing your profile. Here’s what’s amazing. She goes in there prepared to do full doc. She is asked for her tax returns and her financials. They pulled her credit, reviewed her flawlessly implemented the application as you’ve already learned, her PBID was perfect. Filled out this application. They pulled her profile. We had spent fourteen months optimizing the fundability™ of her profile and they said, “We’re ready to come out. We’d like to come to your place of business and have you sign.” She’s like, “Hold, I haven’t even gotten you the tax returns and the financials.”

They said, “Your credit is fine.” In fact, it’s unusually fine. I’ll let you attend the bootcamp. It’s worth the wait. I’m telling you the truth of the matter. I tell you she got a $500,000 business line of credit first banking relationship. She has numerous now. It’s her first banking relationship. It was stated income, no docs, even though she was prepared to deliver them. This is a thing. Everything we’ve been talking about, everything you’re bingeing, I don’t care if it makes sense. I don’t care if it feels good. I don’t care if you sense that there are conspiracy theories going on out there. What I care about is that you have a personal fundable profile and a fundable business profile. That’s what I care about, a qualified personal profile and a qualified funding entity. That’s what I care about.

If you are not able to do those things, if this is all mental masturbation where you’re getting some good ideas, but you’re not implementing it, go to GetFundable.com and check out the bootcamp. Make it actionable. Better get it while the getting’s good because at this time it was $97 to a ten. It’s nothing. You have got to go to the bootcamp and find out and get the actionable intel, go through the workbooks, go through the worksheets and get your strategy sessions so you can do something about this. I love everything about fundability™ personal and business. I love that you guys are committed. Our numbers are going through the roof when it comes to the number of downloads and plays, unique plays that are happening out there. Thank you. If you haven’t already, leave us a comment. Tell us how we’re impacting or how this information is impacting your life. Let’s do this together. Have a spectacular day. I’m going to leave you here because we got so much more to cover.