Besides the 80% that FICO requires from your personal borrower profile, do you ever wonder about the other 20% they are measuring? In this episode, host Merrill Chandler dives deep into this 20% that will round up your fundability™. If your personal borrower identity is your 80%, then the 20% has to do with your business identity. Merrill shares with you how FICO uses your business data to evaluate you and lends some great insights into the world of measuring your business identity for your maximum fundability™.

—

Watch the episode here

Listen to the podcast here

The Other 20%: Your Business Data

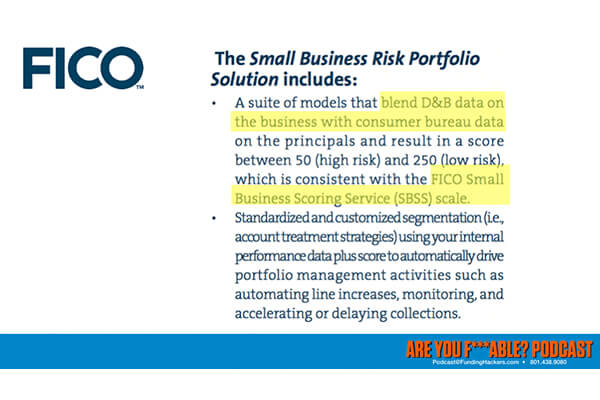

We’re going to take a deep dive into exactly what FICO is measuring besides the 80% it requires from your personal borrower profile and that qualified nature that your personal borrower profile needs. We’re going to be talking about the other 20% to get you fundable. What is that other 20%? Remember when I talked to you about FICO eighteen. I’m back there and I’m sitting with the SBA liaison of the small business scoring service produced by FICO. The SBA, Small Business Administration is the single largest user so far of the SBSS. It’s being picked up by lenders monthly. More and more are adopting the SBSS score for business lending. When I spoke with Dave Smith, he said that 80% all business lending decisions are derived from your personal borrower profile, the metrics, your personal performance data on your personal profile, we rarely ever talk about the other 20%. That’s what this is about. We’re going to be discussing the other 20%, how FICO uses your business data to evaluate you. It’s going to be very different than you might think. Let’s get down into a granular level.

Your personal identity is the sun around which all the planets of your accounts evolve #Getfundable Share on XYour Business Identity

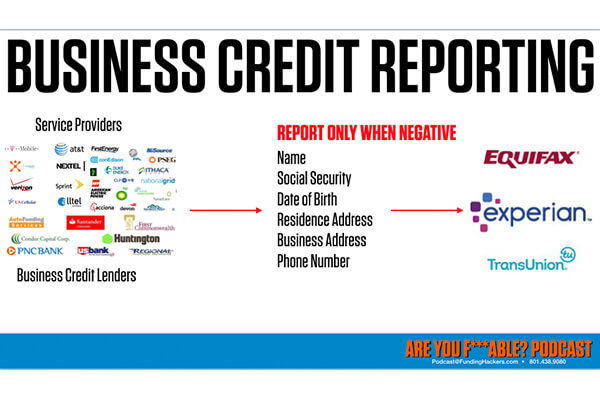

First of all, let’s take a look at your business identity. Remember how we spent tons of time in previous episodes about your personal identity. I called it the sun which all the planets of your accounts evolved. If it’s not singular, dialed in and clear, there’s nothing but chaos happening in your fundability™. Let’s take a look at how your business identity and the various components of your business identity contribute to this. Remember, we’re talking about the other 20%. PBID has to do with your 80%. Your business identity has to do with the other 20%. Let’s get some of the rules of engagement. Every service provider out there who is ultimately going to report to a credit reporting agency. There are three of them. All of your service credit, all of your vendor credit, all of your bank relationships, those service providers and business credit lenders whether they’re tier one, two or three, in true business credit, they report your name, Social Security, date of birth, your residence address, your business address and your business and residence phone numbers, they only report them when you go negative.

Principles On Making A Business Entity Fundable

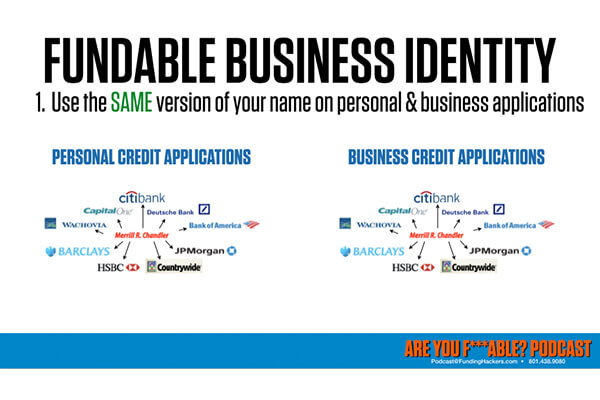

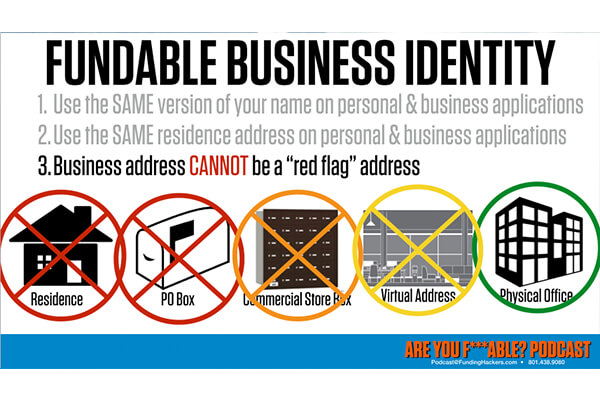

It means if it goes into collections or there’s a judgment or otherwise, the true business credit providers do not report to your personal profile. They only go to Equifax, Experian, and TransUnion, personal credit reporting if they are derogatory. There’s a 30, 60, 90-day late collection. What we have to understand is that, first of all, we only engage true business lending and business lenders because we don’t want any of this stuff reported on our personal. There are several principles upon which your business makes a business entity that is fundable. First and foremost, we want you to be able to use the same version of your name on personal and business applications. This didn’t use to be the case, but because of FICO Falcon, because of the data collection and the automatic underwriting systems that are becoming more and more prevalent among all lenders, we want to use that PBID, the Personal Borrower Identity, in the name fields of your personal credit applications and business credit applications. They’ll say, “What’s your name?” In my case, I’m Merrill R. Chandler. That would be my personal credit applications. If I’m filling out a business credit application, they say, “Who is the owner or officer who is backstopping this application?” I would also put Merrill R. Chandler. The same version of your name is used both on personal applications for credit and business applications for credit.

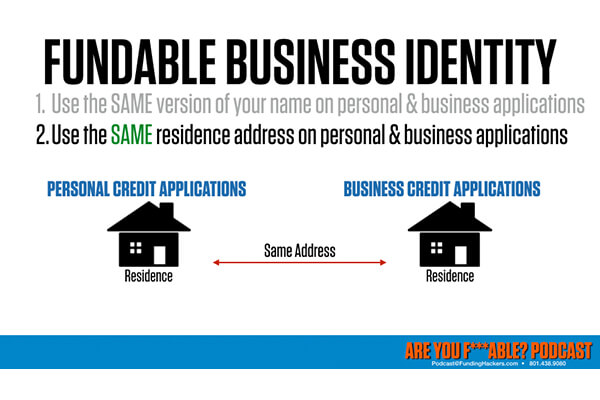

The second principle is that you want to use the same residence address on personal credit applications and business credit applications. That seems nonsensical but the whole problem with Personal Borrower Identity, PBID, and Business Credit Identity, BCID, is that we’re loosey-goosey in how we fill out our applications. That’s where FICO’s application score and FICO’s Falcon fraud detection software is looking for inconsistencies. We talked about a mortgage application that had red ink all over it because there were two versions of an address listed with the credit bureau, it is getting tighter and tighter. These will either limit your approvals or they’re going to get you denied straight out. Principle number two, for a fundable business identity, is to use the same residence address on both personal and business credit applications. It needs to be at that PBID address. Whatever you’ve made your PBID address to be, it goes on your personal and when they ask for your personal information, it’s identical on the business applications. Let’s get a bigger picture as to why this is true.

Number one, in the FICO marketing, when you go to FICO’s website and they’re trying to sell the small business scoring service to lenders, they say that the small business scoring service combines a model that blends Dun & Bradstreet data on your business with consumer bureau data on the principles. That is what we’re looking at. We need to have consistent reporting data from Dun & Bradstreet on the business. The principal, notice it doesn’t say, owner, it could be an officer, it could be the member or the governing member or the managing member of an LLC. The principal, they’re going to combine that consumer bureau data. We’re getting ready to go back out to FICO World 2019. One of the questions we’re asking is more details about what we’re covering. The FICO small business scoring service actually monitors activities that automatically drive portfolio management activities such as automating line increases. FICO is selling to lenders that their software’s job is to tell the lender when it’s safe and when they should offer an automatic limit increase.

Wouldn’t you love to just be on that list, automatic limit increases over and over again? It’s a blend of Dun & Bradstreet’s data on the business with consumer data on the principles. This is what happens when SBSS does a real business credit check. First, you have your personal borrower profile, the data and the score generated by FICO. What happens is it checks certain data points with Dun & Bradstreet. It is not checking the quality of the card, the type of card, the tier, the contribution or even the utilization. It has very minimal data. What it is checking is the identity information. It’s checking your SIC codes and your NAICS codes. It’s checking your address. Is it the same as your personal addresses? Is it a post office box? It’s checking certain data to see how serious or legitimate of a business person you are in their eyes.

When I say legitimate, I have clients who are making literally six figures a month running an internet business out of their home. They tell me, “I want to get more credit lines so that I can expand my business.” I said, “I don’t care how much money you’re making. They want to know that you are a domiciled business, that you have a legitimate business address. Being at your house is not legitimate to them.” Dun & Bradstreet is the purveyor of that information. If you do not get the information from Dun & Bradstreet, if you are not managing it, other people will, and that’s what’s going to be happening in our future episodes. We’re going to be covering what actually happens when you don’t pay attention to your data. The US Postal Service will weigh on your data. I know it’s hard to believe, but they weigh in on your data.

If your personal identity is not singular, dialed in, and clear, there's nothing but chaos happening in your fundability™ #GetFundable Share on XOther business credit bureaus, other lenders will weigh on your data. You have to be in charge of your data. If you don’t have Dun & Bradstreet data, which if you’re working with me, you must, then they’re going to check Experian business credit. Don’t confuse this logo with the personal side. This is business Experian. They’re going to compare not the tier and contribution to the account or the utilization or even the limit. They’re going to compare whether or not as good or bad and your business identity data points, and comparing it against your personal identity data points. They’re checking to see if you are the owner of this business and the application score compare and contrast the data that you provided on the application against what’s on these databases. Finally, if there’s no Experian data, they’re going to go to Equifax business. Not Equifax personal, and see who has reported what about your business to that business credit bureau.

If it sizes up and the data on the personal credit bureaus matches the personal data on the business credit bureaus, you’re going to get a green light and they’re going to get a thumbs up. It’s going to check against your application against the business credit bureau data. There are at least two comparisons. They are comparing your personal credit bureau data against the business credit bureau data of your PBID. They’re going to compare your application with the business credit data about the business start date, employees, all those things. That’s why many people are getting denied or have a business credit unavailable to them because they don’t know what they’re syncing up.

Fundable Versus Unfundable

Let’s look at some of the things that make you unfundable right versus making you fundable. A fundable business identity, number three, the business address cannot be a red flag address. There are versions of red, orange and yellow flag and there’s a green flag. If your business is at your residence and if that address is the same on the business and it’s the same, it’s a red flag. You’re either going to get a flat out denial or you’re going to get such a low approval, lower limit or low loan amount. They’ll be like, “We’re going to do a tester.” The problem is if you get a credit line, you’ve burned the opportunity. If you get it $2,000 credit line or a $5,000 credit line, most of you, that’s not going to serve you much. It takes forever to get from $2,000, $5,000 up to $50,000 or $100,000. If we do it right, we have the right addresses for your business, we’ve synced all this up and we know what we’re doing, then we’ll get started with a $20,000, maybe a $30,000 or a $50,000 and then it’s a way shorter period to get to that $50,000 or $100,000 mark.

The velocity of credit that we talked about says that for every month you spend building your personal profile, you’re going to cut down the time to funding. Making that right has abused the data points as you’re putting on your business application. I don’t care if you’re making $10 million a year, do not use your residence address. You will get more credit and funding approvals if you don’t use your resident address. The next no-no is a PO box. PO boxes and commercial store boxes, meaning the UPS and the Federal Express mailbox, this is where 80%, 90% of all businesses funding fraud has come from. As we discussed previously, the funding and algorithms, the AUS, the Automatic Underwriting Systems shut them down. A PO box is red. A commercial mailbox is orange. I call it orange because there may be some test approvals. If you’re going to get approved, it’s going to be a low test approval limit or loan amount. It’s not worth it, but if you have to, it’s better than a residence than a PO Box. With the clients that I’ve told you who make tons of money, the most that they were willing to do is go to a commercial mailbox, UPS, Federal Express, etc. Those clients are less fundable than the next two, which are a virtual address or it could be a shared office space. You have a receptionist.

The more it is a legitimate commercial business, the more lenders trust it and the more funding they will give you. You get more points in underwriting software by having a virtual address than a commercial mailbox. Finally, the big, huge green light is a physical office. A physical office doesn’t mean you have to go rent or lease your own office. Like a virtual address, you can put your placard up on the door or the wall of somebody that you know. Let’s say you have a mortgage broker friend, an accountant friend. Some of my clients have found it easy if their attorney is their registered agent since that’s the registered agent address they have gotten agreement from their registered agent to office there as well. There’s a receptionist who knows who that individual is because they’re the registered agent. They know who you are, they know how to get ahold of you and that’s all a lending underwriting. If you’re in manual underwriting, that’s all they need to be able to verify that you’re in a physical office.

Remember, we call it 30-minute underwriting. In 30-minute underwriting, if you’re in manual underwriting, from his or her desk can find out, can Google Earth and see exactly where you are officing. If it shows a big commercial building, and then it says second floor or Suite 201 or whatever it is, that’s creating confidence. These are just data points, but the software is designed to create data points. Compare those data points and align it. The only exception to this model right here is if your geographical location actually does require you to use a post office box or a commercial mailbox. If your geography dictates that you can’t use your residence address, then, of course, do what you do. Just know that either there may be lower limits, but more importantly, lenders will categorize by zip code the types of funding thresholds that are available. Remember when we said that the revenue score takes your zip code and your credit score and can tell a lender how much money more or less they are going to be able to make off of you annually.

The true business credit providers do not report to your personal profile #GetFundable Share on XThe same database that’s looking up those zip codes can find zip codes where you are in the remote reaches of the back force of Muskogee, Oklahoma. Whether you’re in Alaska or you’re in Borneo, that’s a foreign country, so there are other prescriptions to that, sometimes your geography dictates something else. I just want you to know that that is a thing. Let’s take a look at the last part of this process. Step number four of a fundable business identity, not total fundability™. Your residence and your business address must be in the same state. I’ve used this example before. I had a client named Ted. Ted was a hardcore real estate investor and he started in California and his personal residence and his business were in California. He did a few fix and flips. I think he had some buy and holds inside of California, but he saw that all the great deals were in Dallas, Texas. He picked up and moved to Texas.

When he moved to Texas, all he did was file a foreign entity filing in the state of Texas for his domiciles state in California. He picked up a business address in Dallas and his new residence address became his new PBID, so it met the criteria. He didn’t lose because lenders don’t want to let go of good borrowers. If you’re a professional borrower, they’re going to want to keep you. We kept running the business loans and lines that he had inside of California and then came to pick up some banks in Texas. He filed the application, the personal and business, following all three of the proceeding things. He used the same version of his name in the application in Texas. He used the same residence address on the personal application and the business application and the business address were different than his residence. He filed applications, developed the relationships of what we call vetted banks. He established new banking relationships in Texas and acquired two or three additional banks in Texas. He has moved to Arizona.

In Arizona, he’s going through the exact same process. He’s picking up some local banks in Arizona. That’s what his plan is. I don’t believe that he has actually acquired the banks because you have to establish 3 to 6 months’ worth of banking relationship before you get the new credit lines. I know that he started the relationships. I don’t believe he has his credit lines yet. Ted knows exactly what he’s doing. It is exactly how you play this game. I’m not saying you need to move. I’m saying the vast majority of states, there are plenty of banks to hit your $500,000 to $1 million in loans and lines of credit. The point is that he followed the rules every time he went to each new entity or each new state. That gives you at least how some of the data points that the software is measuring.

Business identity and the personal identity all conjoined there and they’re comparing the applications against the personal credit bureau data and the business credit bureau data, especially Dun & Bradstreet. Remember, these are broad strokes. There is no straight line to fundability™. If you want in-person attention from me and my team, go to GetFundable.com. Click on the Bootcamp, join the next bootcamp. Let’s get your questions answered. Let’s do those things and see what we can do to keep you moving towards fundability™. My book is coming out. We have the book and the coaching. We’ve got everything to support you, but at least you know what to stop doing so you don’t step on those funding landmines.