One area for concern when trying to improve your credit score is a mortgage late report from your lenders. In this episode, Merrill Chandler has you covered on how a 30-day mortgage late will affect you. How does it affect the score? How long does it take to recoup? Merrill gets into those questions and gives you an answer while giving you a view on the degradation process, short sale, foreclosure, and more. He then shares some recession-proofing strategies that can especially come handy during this time.

—

Watch the episode here:

Listen to the podcast here:

The Woes of a 30 Day Late

I’m excited to be able to share with you some amazing FICO-driven, recession-proofing strategies that we could talk about. I will share with you some of my learnings from the live seminar series that I’ve been doing with FICO.

—

In this episode, we’re going to be talking about the degradation process of a mortgage. One of the courses that I took at FICO uses this slide deck. As a participant, we get access to the slide deck. I want to share with you since many people are concerned about mortgages, the moratoriums, and the deferral programs that the lenders are doing and how they affect us. How does a 30-day late affect score? More importantly, how does it affect recouping lost fundability™? First of all, a shout-out to the lenders. They are doing it differently this recession than they did in 2008. Whereas then the second the economy crashed, they went into a panic mode and it prolonged the mess of everything. Now, they’re stepping up. They learned so much from FICO and from FICOs training of the modeling of who are resilient borrowers who are risky borrowers during the recession. They built their lending guidelines to tighten up the target and keep lending.

Everybody’s been working on who can I trust to lend to during a recession? It’s all the rage in all the training and everything that’s going on with the FICO training series that they’re going on, of which I am excited to be a part. I’m going to walk through some of the things that FICO is talking about in two ways. One, what is a simulated impact to a report on 30, 60, 90 days, short sales, etc., so we can predict what the fall of a score would look like for different consumer situations and how long it will take to recoup.

Impact Of A Mortgage Late Report

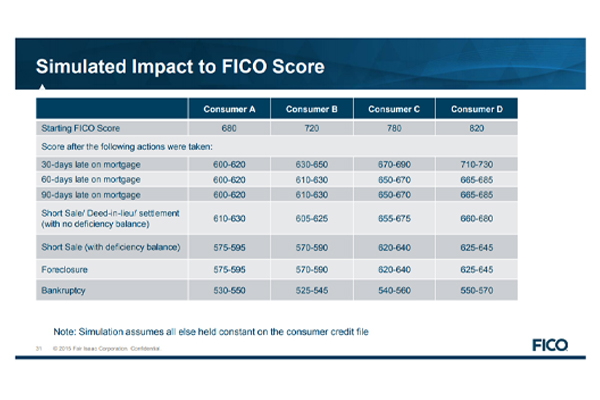

I’m going to be as descriptive as possible. This is a chart straight from one of the FICO training description decks, the slide decks in the presentation. On the left-hand column, there’s a starting score and there are four borrower models. They call them consumer A, B, C and D. We refer to them as borrowers. We want to become professional borrowers, not a rookie consumer. I’m going to use the parlance that I want to train you to use in referring to you and all the other borrowers that may be impacted by these mortgage late situations. It talks about a 30-day late, 60-day late, a 90-day late, and then a short sale or settlement and then a short sale with no deficiency balance and a deficiency balance, foreclosure, and all the way to bankruptcy.

This is the degradation that we talked about a few episodes ago about the tradeline accounts. This is specific to mortgages. The scores that we’re talking about for consumer A is 680, consumer B is 720, consumer C is 780, and consumer D is 820. On a 30 day late, if you have a 680, you’re going to drop approximately 60 to 80 points between 600 and 620 is going to be your score. A 60-day and a 90-day, you’re going to drop to the same level. What that means is regardless of whether you’re 30, 60 or 90, you’re going to lose an aggregate set of points of approximately 60 to 80 points.

30-Day Mortgage Late: Going to a short sale with a deficiency balance and doing a foreclosure are both going to affect you the same.

If you do a short sale, it’s going to be 610 to 630. Why does FICO give you more points for doing a short sale than going late? The reason is that you have terminated that credit experience. That tradeline is now terminated. Because it’s resolved, they’re giving you a 10 to a 20-point increase of that 600, 620. They’re giving you a boost in your score for having completed the transaction. To get to a short sale, you have to go through a 30, 60, and 90 late. Resolving it with no deficiency balance means that your score is going to go up from those delinquencies, the late pays.

If you do a short sale and there is a deficiency balance, it doesn’t matter how much the deficiency is. You did not pay the full amount that you owed on that loan. A deficiency balance means, let’s say you owe a note for $200,000 and then you sell it in a short sale for $180,000. You have a deficiency balance of $20,000. If you have no deficiency balance, your score goes up from those late pays, but if you have a deficiency balance in that short sale, you take a hit. You take another 5 to 25-point hit. You’re going to be in the 575 to 595 range.

Going to a short sale with a deficiency balance or doing a foreclosure is going to affect you about the same. A foreclosure is where they take the property back. Usually, when they take the property back, many times there’s a deficiency balance. A foreclosure means you didn’t try to resolve it. You didn’t try to get the lender’s money back. You didn’t show up as a true partner saying, “I want to take care of your needs like you’re trying to take care of mine when you lent to me.” Foreclosure and short sale with the deficiency balance are about the same because they usually have the same deficiency balance issues attached to it. The foreclosure alone, let’s say you don’t have a deficiency balance on that foreclosure. Even if you paid it off, it means they had to come after you to get the resources to pay back the loan.

That’s not a great message to your lender partners. After a 30, 60, or 90-day late, if it goes to bankruptcy or if you include that mortgage in a bankruptcy, you’re going to get an additional 50 to 70-point deduction off of that short sale. There’s a degradation of the scores for each one of these areas that you go through. Here’s what’s interesting. Let’s go to consumer B. They start with 720. It’s 40 points higher and that is reflected across the board, all the way down to bankruptcy. What I mean is that you’re going to lose about the same number of proportionate points. You’re going to end up a little higher on a 30-day late. Here’s a great thing. If you have a 720 and you’re 30, 60 or 90 days late, you’re not going to fall as much as you do if you’re at a 680. You get points for having that original higher score. It’s still down in the low 600s, but it’s not as low if you started with a 680.

Where it all becomes even if you do a short sale with no deficiency balance, you’re in the same category as if you had a 680. A 720 doesn’t help you. It helps you if you only go through lates and then recoup and get back on plan. If you go all the way to a short sale with no deficiency or a short sale with deficiency, foreclosure, and bankruptcy within 5 to 10 points, you are in the exact same place. Your 720 did not help when it comes to selling the property, going into bankruptcy or foreclosure. Those are important things and that goes across the board no matter how high the score. Let’s look at consumer C. If you have a 780, most people think it’s a smoking score. The good news is a 780, if you stay in the 30, 60, or 90 late, you’re going to be approximately 650 to 690 and you’re going to stay a relatively decent score.

Become professional borrowers, not rookie consumers #GetFundable Share on XTo compare consumer C with consumer A, if you have a 780 to start with, you may be down with the consumer A scorecard group of people and group of borrowers after 30, 60, or 90. The cool thing is at 780, there is a significantly higher score for each one of the degradation levels. Instead of having 600 on a 30-day late, you get to keep your 670. Instead of a 60-day late that goes to 600, you’re going to have a 650 to 670, etc. Where it also supports you is having a 780 with a short sale with no deficiency, you’re going to stay in that same 650 to 675 range. It’s going to help you significantly all the way down until bankruptcy. All bets are off and you’re going to end up within 5 to 10 points of all the other scores at bankruptcy.

Bankruptcy is the great equalizer when it comes to making arrangements or non-arrangements with your lenders to pay them off. You’re walking away from the debt. FICO cleans within 5 to 10 points. It levels the playing field of all people who are in bankruptcy. Let’s go to consumer D at 820. This is now statistically significant, less than 5% of all borrowers are above 800, but it’s the same drop in points. An 820 takes you to 710. You’re still losing at 710 to 730. That means you are still losing that 60 to 80 points. It’s that when you have a fundable 800-plus profile, any negative impact is going to lose the same number of points, but it doesn’t affect your fundability™ as drastically.

If it goes to bankruptcy, all bets are off again. There’s lots of forgiveness on a 30-day late. If you have a 720 and you have one 30-day late, you’re at 710 to 730, but in a 60-day late, you’re in the 665 to 685 range. A 60 and 90 days late, you’re higher than a 680 consumer at the starting point. You could be 60 to 70, 80 points higher, but now you’re in that tier three, tier four unfundable land. If you only keep it to a 30-day late, then you can stay in relative fundability™ even though you may have to prove up in other ways to make sure any future lender lends to you.

The score maintains some stability. You still lose 80, 90 points, but you’re above 700, and 720 and 740 for a mortgage is still a fundable score even though FHA, Fannie, and Freddie require a minimum of three years to re-lend to you after 30, 60 or 90. At least you’re starting from a strong spot. When it comes to short sales with deficiency, balance, foreclosures, and bankruptcies, you’re mid-500s and you are completely out of the game. Having said that, remember, this simulation assumes that nothing else changes.

Recouping From Fundability™ Loss

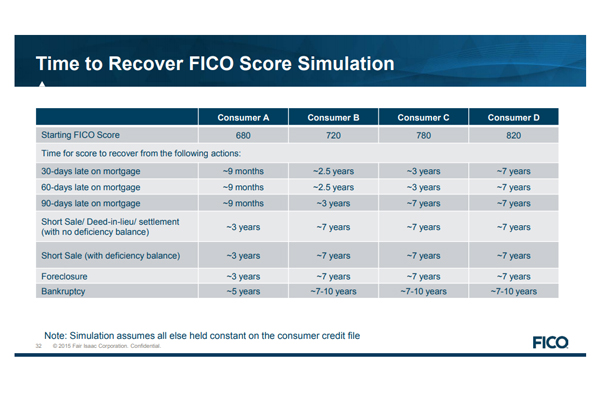

Not multiple lanes, not multiple foreclosures on multiple houses. This is one thing that is changing on your entire borrower profile. Let’s look at the recoup times. First of all, we’re using the same consumer scores and we’re going down. The left column is still the same, starting scores and 30, 60, 90 late short sale with the deficiency. Meaning with the balance remaining, short sale without foreclosure, and bankruptcy. Notice that the time for the score to recover from the following actions gives you a framework. Thirty days late on a mortgage, if you’re at 680, given no other considerations, no other movement. It’s going to take you nine months to recoup to a 680. If you have 720, it’s 2.5 years to come back.

30-Day Mortgage Late: Bankruptcy is the great equalizer when it comes to making arrangements or non-arrangements with your lenders to pay them off.

Seven hundred and eighty is three years and an eight hundred twenty is seven years. We’re not talking fundability™, this is a score simulation. To be honest, this is part of FICO’s and the lender’s shiny object. They want us to see the score impact. I want you to see the score impact. You may not hit 820 for approximately seven years after a 30-day late mortgage, but you’re going to be fundable far sooner than that. That’s why we focus on fundability™ and not score. Think of it this way and notice this logarithmic. You’ve got 9 months to 2.5 years. A 720 and a 780 are going to have the same number of years to recoup a 720 to 780.

It’s fascinating to me because you’ve got 60 points. A 720 is a tier-two for a mortgage. A 780 is a tier-one plus for a mortgage. It might even be close to a double A. The recoup times to get back to 720 and 780 is the same. On consumer D, if you have an 820, it’s going to take more or less seven years to recuperate from anything, and bankruptcy is 7 to 10 years. Meaning you’re fundable after seven years but it’s going to stay on your report for ten and therefore it would be counting against you. Think about that. To get back to a 680, some people will think, “I’m glad I have a 680 credit score because I will be back to a 680 shortly within 9 months, 5 years for a bankruptcy.”

The problem is that score doesn’t represent a highly fundable profile regardless. While it may take a shorter amount of time to get there, you’re also going to be spending another year or two going from a 680 to a 780. Especially if you’re working with us, on average, we’re 100 to 150 points a year in building a fundable profile points that are reflected by myFICO. The coolest thing for me is that no matter where you are, a 30-day late to get back to an 820 all the way down to foreclosure is going to take approximately seven years to recoup and get back.

Why does this matter? Why am I reviewing this? First of all, I want you to know the negative impact of going late on a score. A mortgage is a secured loan. As I’ve said dozens of times throughout all these episodes that real estate-backed loans and lines of credit, a HELOC, do not move the needle as much as unsecured. There may be a more significant impact. This was score based education from FICO about mortgages, not revolving accounts. Those unsecured accounts, especially higher amounts that you would have a deficiency balance, a charge off that isn’t paid may impact negatively far more than a mortgage does. A mortgage is a secured instrument and straight from the chief scientist at FICO.

Recession-Proof Strategies

It does not move the needle as much as unsecured does. Take a look at that 820. I want you to understand that. Let’s talk about the recession. I’m sharing this with you so that you have the ability to create a strategic review of your finances. Remember implementing the doom day protocols. We talked about it in the bootcamp. You’ve got to do the doomsday protocols because you need to know what your cash flow is for your world, for your business world. What is frivolous? What is not relevant? What can we get rid of? You need to do everything you possibly can to protect this financial reputation, to protect your profile and those payments. One of the great things that we’ve talked about before, and I’m going to mention it again. The only thing we do not use to protect your financial reputation is the thing that you can’t recoup.

Bankruptcy is the great equalizer when it comes to making arrangements or non-arrangements with your lenders to pay them off. #GetFundable Share on XYou can buy another house. Sell a house, take the proceeds, and maintain your financial reputation. You can sell a car, a motorcycle, lots of things to garner income and maintain the payments if you’re in survival mode. What you can’t do is you can’t get another 10 years, 25 years’ worth of pension or retirement account money. Our formal stand is that we draw the line at your personal liquid savings and personal liquid retirement accounts. If those are two separate things and you’ve got prospects for further employment or being able to pick up the pieces, then use your savings to protect your investment because you can always accumulate more. When I say investment, protect the investment you’ve put into your fundable profile.

You can always garner more savings. You’ve spent 5, 10, 25 to 50 years on a retirement account, be deliberate about using those funds to protect your financial reputation because it takes a while. It’s easier to let your financial reputation and your partnerships with your lenders go than it is to gather another IRA or retirement account with tens, dozens, hundreds of thousands of dollars. You can’t get those back. If it’s once in a lifetime thing, like a retirement account, then we don’t sacrifice that. If it’s multiple in a lifetime, cars, home loans, investment properties, and apartment complexes. You can get those back on the other side because you will have protected your financial reputation and you will have proven up to the lenders that you are a solid and incredible partner to them and they will lend to you after the recession.

I share these mortgage things with you, this degradation process with mortgages because we got through doing one in our series about collection accounts, tradelines, etc. I wanted to make sure we had a representation of the relationship you have with mortgages on the same. Comment about this if you like what you’re reading. If you have questions about this, go to the Get Fundable Facebook page, like it, and ask questions there. Join us in that conversation. That’s our tribe and we want to make sure that you’re getting your questions answered and that you can participate in all of these further learnings that we get from FICO. We have the honor of sharing it with you.

I’m thrilled that you’re joining me. Keep bingeing. There are many things that are here for you not just to understand and learn, but ways in which you can implement. Go to GetFundableBook.com if you would like a synthesis, the strategies, or the principles of fundability™ so you know how this game is being played. Go to GetFundableBootcamp.com if you want to find out how to implement those strategies and start building your financial reputation. I will see you in the next episode. Have a spectacular day.

Love the show? Subscribe, rate, review, and share!