Have you received an email from FICO about its black market website surveillance service? What does it mean? Should you be worried about someone in the dark net using your identity to set up fraudulent accounts or transactions? You shouldn’t have to, if you know how to set your PBID properly, that is. Merrill Chandler explains how you can do this and directs you to some useful resources that can help you in this regard.

—

Watch the episode here:

Listen to the podcast here:

Black Market Website Surveillance

Should You Be Worried?

In this episode, we’re going to be talking about the black market use of identities, especially how FICO is addressing this Black Market Surveillance process that it does to protect our identities and to notify us if something’s got a little bit hinky. What does it mean? It isn’t necessarily as dangerous as you might think.

—

We are going to be talking about FICO’s Black Market Surveillance. Should we be worried? What does it mean? What is it all about? Is there something hinky going on or is it just a marketing ploy? Let’s take a look at each one of these. What do I mean by black market surveillance? I’ll give you an idea. If you are subscribing to myFICO, you very well may get a version of this in your email. This was sent to an individual. Sky, my producer, got one of these. It was a little bit worrisome for her until we went through this process. That’s what triggered me the desire to do an entire episode about it because there’s so much misinformation out there that I want you to know what is the actual truth.

Your regular myFICO.com subscription has the best identity protection features compared to any of the other identity protection, including some of the popular ones that are advertised over and over #GetFundable Share on XWe’re going to say, “Dear so and so, we have detected your personal information listed on a black market website to be bought or sold.” That can be on the dark web, it could be published in many of these sites like bulletin boards or Reddit boards. They hide all over the net for people to be able to buy and sell information. There are two ways that this can impact you. Before we get to that, I want to discuss the second type of email you might get from FICO. The same thing, “Your personal information is exposed. We monitored traffic on illegal websites on the dark web and we found your personal information. Log in ASAP to find exactly what we found.”

Those are the two different types of notifications. They may come in different forms because FICO is marketing a service to you. Let’s take a look at what you would get when you click on these sites. There are two directions, when you pull into myFICO, if you don’t have anything, mine, for example. I’ve done what it takes in building my personal borrower identity to limit its access to fraudsters. If I click on View Alert Details of Black Market Surveillance, it would say, “Black market website scan, congratulations. We did not find any results matching your personal information.” I’m a public figure. I’m addressing security breaches and personal borrower identity issues over and over. Yet, so far so good. There is a reason why there’s no information on the black market websites’ surveillance system.

Black Market Website Surveillance: Your regular myFICO subscription has some of the best identity protection features.

Let’s say you do have something. This is what happened when Sky pulled hers up. We’ll get into these overviews but on April 01, 2020, Sky’s phone number was found on the Facebook page of a woman named Rebecca Diaz. After incessant grilling and interrogation, she doesn’t know Rebecca Diaz. You might get a list of where something has been found. Sky’s phone number was associated with this user’s Facebook page. The question is, what do we do about it?

When you click the alerts, it’s just generic, but it’s marketing language. “What this alert means to you? This alert indicates that your personal information may have been listed on a black market website. It is important to take action fast to protect yourself from fraud and other identity crimes.” Your regular myFICO.com subscription has the best identity protection features compared to any of the other identity protection, including some of the popular ones that are advertised over and over. Protect your identity and identity alerts. myFICO has the single greatest identity protection process. It comes with your regular advanced subscription, the $29.95 subscription.

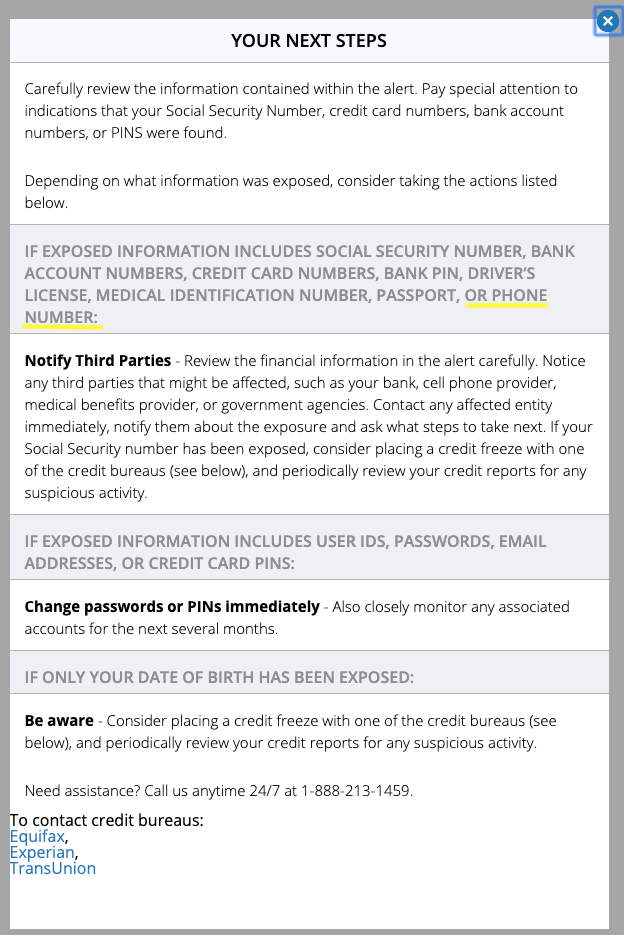

Finally, it gives you an opportunity for the next steps. It’s saying, “Carefully review what’s in the alert.” In Sky’s case, carefully review it and pay attention to indications that your Social Security Number, credit card numbers, bank account numbers, or pins were found. The only thing that was sideways on hers was her phone number. There is no credit card numbers, no bank accounts, but you want to look for those. It says, “Depending on what the information was exposed, consider taking the following actions. Number one, if exposed information includes Social Security Number, bank account numbers, credit card numbers, or phone numbers, then notify third parties, review the financial information in the alert carefully and notice any third parties that might be affected.”

In her case, if her phone number has been listed, you need to check, notify, and put a note on creditors who use that phone number. We’ve been building our PBID for the last 100 episodes. What is powerful about what we are doing is that if we make the fraud bullseye smaller, if we make one version of your name, address, phone number, social, and date of birth, if you only have one of everything, then it is extremely difficult, even if there was a complete breach. Let’s say, somebody got all five of those data sets.

I’ve explained in several other episodes that every one of those data points has corollary information that is used as part of FICO Falcon Fraud Detection Software, as well as comparing against all the databases, Experian, TransUnion, Equifax, LexisNexis, etc. There are two parts. There’s the information, the data points, and then how they’re used. I want to reiterate this because this is important. I want you to build your PBID, but I don’t want you to be afraid of fraudsters. If something gets through the cracks, there are ways to fix that. We even have some modules and eBooks to help you do this. Those links are vital to be able to recover from or prevent identity theft.

Make sure you go to GetFundablePodcast.com and you’ll get the Identity Recovery eBook and the Identity Protection eBook free of charge. Make sure to do what you can to protect your PBID after you develop it. We want you to make the necessary steps if you need to recover if something happens. I always use this story, but this is important and true. Remember, eyes on the prize. If somebody steals my wallet and get my driver’s license, yours likely has your middle name. If somebody tries to use my Merrill Ray Chandler and they go, “I got the address and the name. I’m going to try to set up a fraudulent account.” There’s not a single financial institution on this planet who I have a relationship with and there are no databases. Not LexisNexis, Experian, TransUnion, or Equifax has Merrill Ray on their database because I have built my PBID and it’s bulletproof.

If somebody files a Merrill Ray Chandler application using any of my other data points, it will be rejected out of hand because it will be flagged as a fraudulent application. My PBID bullseye is small that fraudsters are not going to be able to open up. I have never had fraudulent information opened up in my name because I’ve been doing this for a long time. I have built a bulletproof PBID. I want you to build a bulletproof PBID. We want you to establish the PBID data points, get as few as you possibly can by disputing them. All my boot campers, who got a Gold Level Bootcamp, you guys have all of those templates that are dispute templates to isolate and create one version of your name, address, phone number, date of birth, and Social Security number. Finally, there are numerous others. The whole reason why FICO developed its fraud prevention software is there’s a consortium of 9,000 banks that share the application information.

If I file a thing at US Bank and I make $10,000. I put $10,000 on my income. If a fraudster comes in and puts $8,000, $15,000, or $12,000, it’s going to get rejected or it’s going to go to manual underwriting because I’m too far off of what my most recent and previous application was. There are many data points because lenders’ number one loss point of all the money that they invest is not you defaulting, but it’s fraudulent applications. Their commitment is the same as my commitment. They love the idea of a bulletproof PBID. If you haven’t gotten a copy of my book, yet, I go through a very extensive review of developing your PBID point by point. That’s at GetFundableBook.com, but make sure you go to the blog or written version of this and click on those links. We’re giving you the Identity Protection and the Identity Recovery links free of charge. Do everything you can to make this happen. Make your PBID be the smallest possible bulls-eye and it will become bulletproof. I look forward to seeing you in the next episode.

Important Links:

Love the show? Subscribe, rate, review, and share!