Did you know that Amazon, Apple, and Venmo destroy your personal fundability™ via “credit cards?” With low fundability™, you’ll find it difficult to get capital for your real estate projects. Today, Merrill Chandler exposes how these big retailers hide the specifics in fine print. To avoid stepping on funding landmines, you need to know the rules of the game. Where to start? Tune in to this episode.

—

Watch the episode here:

Listen to the podcast here:

How The Biggest Retailers Can Crush Your Real Estate Opportunities

I got to tell you. This episode is killer. We’re going to show you how these big retailers are crushing. They’re crushing your future funding opportunities. We’re going to be talking about Apple and Venmo, and even Amazon. When we come back, we’re going to take a deep dive into some dubious marketing practices that are designed to mislead you into acquiring low-value credit and ruin your future funding.

—

You’ve heard it from me once or twice. You may have heard it from me three times, but marketing is such a deceptive business. I have found due to the research of Sky, our production manager and our content manager, in her personal life as a Gen Z-er has run into everything that we’re going to be talking about and we got so mad that we’re doing an episode about it. We’re going to be talking about three companies in particular. Venmo, that PayPal division where you can send money for all kinds of reasons to all kinds of people, Apple, buying anything off of an Apple website, and Amazon, buying anything off of Amazon website.

Real Estate Opportunities: Low-value lenders use the term Visa or MasterCard as a lie. What they don’t tell you is they are credit card processors.

These three are not alone. They’re the ones that happened this week so far in their marketing efforts. Every one of these is online. There are also PayPal and all kinds. We talked about the applications of offers that we get in the mail. This one, we’re speaking specifically to offers that you receive during checkout, right when you’re at the point of the purchase. These are the different offers and the subtle and misleading messages that they send us. Many brands are using cards with special benefits. The cashback is the norm now. It’s not the special thing. These brands are using your loyalty and trust and your face time. Not FaceTime as in the Apple app but you’re actual screen time. With these apps, they’re using that to, if not deceive you, manipulate you, and use your lack of sophistication or your ignorance.

I’m the first one. I don’t want to say that you’re unsophisticated and you don’t have a high-level knowledge of credit and things, but every one of these offers that we’re going to be talking about, I’ve red-lined all of this stuff. They are leading you to a landmine field and they’re dropping you off there. When you do the things we’re talking about, they are going to blow your personal fundability™ up. The interesting thing is and read closely because we’ll get into them and I may reinforce it, every one of these cards that we’re talking about are backed by tier. Two of them are Tier 4 lenders. one is a Tier 2-Tier 3 hybrid fuzzy lender but most of them are backed by Tier 4 lenders.

Real Estate Opportunities: These big retailers want you to have a good profile and give you longer and better terms, but by getting this card, you become less valuable to the next lender.

They’re the Synchrony Banks, the Elan Financials, the Merit Banks, etc. Every one of these cards are Tier 4 and, therefore FICO and lending software are going to zap you with that consumer finance account designation. They’re going to blacklist you and say that you are a consumer. You are not our perfect customer. They do this by downgrading your score. Even if you have a perfect payment history, you’re still getting deemed by having by having these cards.

If you’ve been to my Bootcamp, we’ve talked about like-kind lending. If you have an 800 plus credit score but most of your profile is built on mall store cards, retail cards, local banks, or credit unions, then you’re going to get more of the same. What we’re going to be discussing here is that like-kind lending is these are not even the national Tier 1 and Tier 2 banks. For example, all of them rely on the word Visa, and I’m going to show you what that means, as though a Visa credit card means something. No, but some of us don’t know that, and so they are going to, once again, tell us that means something in their marketing and we’re going to feel special.

Acquiring low-value credit will ruin your future funding. Share on XI’m going to show you how special they try to make us feel. It’s crazy. Visa and MasterCard can be danger signs. If you want to know more about that, I did a show on How Visa and Mastercard Lie. Straight up how low-value lenders use the term Visa or MasterCard as a lie. They want to say that makes them special. What they don’t tell you is their credit card processors, as we discussed. There’s Visa, MasterCard, Discover, and American Express. American Express can be confused that it’s a credit card. Many times, they use American Express to deceive you. They can say, “It’s a Discover card.” It’s processed by Discover but it’s not a Discover card. All of this makes for those of us who do not have the knowledge yet, and if you don’t come to my Bootcamp, GetFundableBootcamp.com and find out all of this stuff because we would take the entire time of the Bootcamp to go through all the ways in which these offers and these credit cards will harm your personal fundability™.

Real Estate Opportunities: Get the 5% back on a card that’s going to move your entire financial reputation forward instead of junky little consumer-based cards that will ultimately harm you in the short and long run.

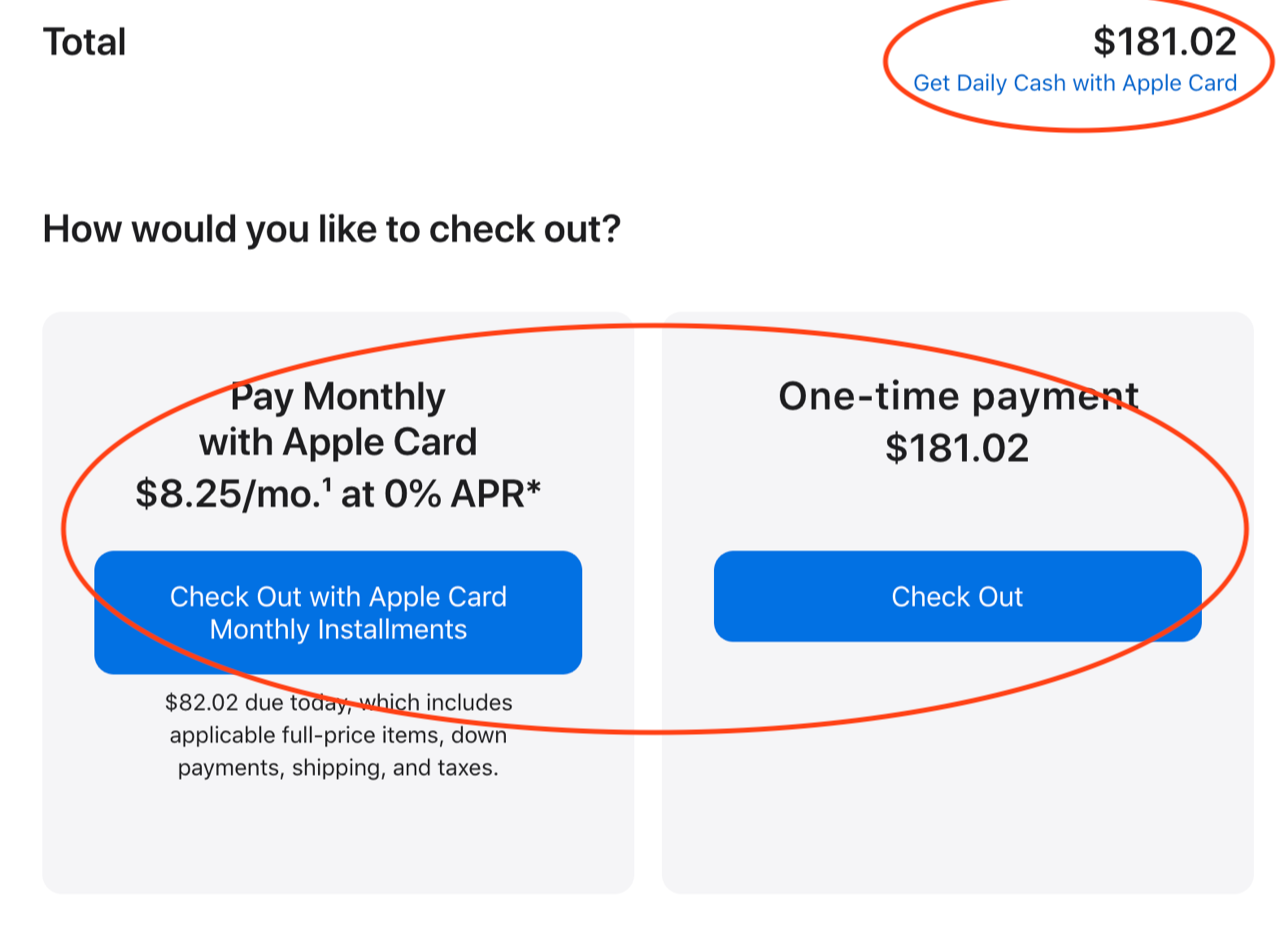

The solution to all of this is due diligence. Meaning, find out, learn, discover for yourself what is important to build your personal fundability™ and right then and there, make decisions, have your borrower behavior support your personal fundability™. More on this insight. The first one we’re going to look at is Apple. I want you to see exactly how this comes to pass. First things first, when Sky was shopping, she was purchasing a couple of things for the office. Notice what it says. How would you like to check out? Pay monthly with an Apple Card, $8.25? They’re already doing the math on the $181.02 purchase if you put it on an Apple Card and they say 0% interest. If you go down into the fine print, it’s a 6-month offer, it could be a 12-month offer based on your fundability™. They’ll say it’s 6 months or all the way to 18 months, depending on what your credit score is and the value of your profile.

Fundability™ is 10X better that credit worthiness. Share on XHere’s what’s crazy. They want you to have a good profile to give you longer term and better terms but by getting this card, you become less valuable to somebody to the next lender. It’s a dirty business. You can check out. I’ve got a couple of pages here from the checkout line. It says, “How do you like to check out? One-time payment of the total amount or would you like to do an Apple Card?” If you go to checkout, then the checkout literally takes you to put in your payment information, etc., but if you say check out with Apple Card monthly installments, you’re going to pull up the next window, which is on our left.

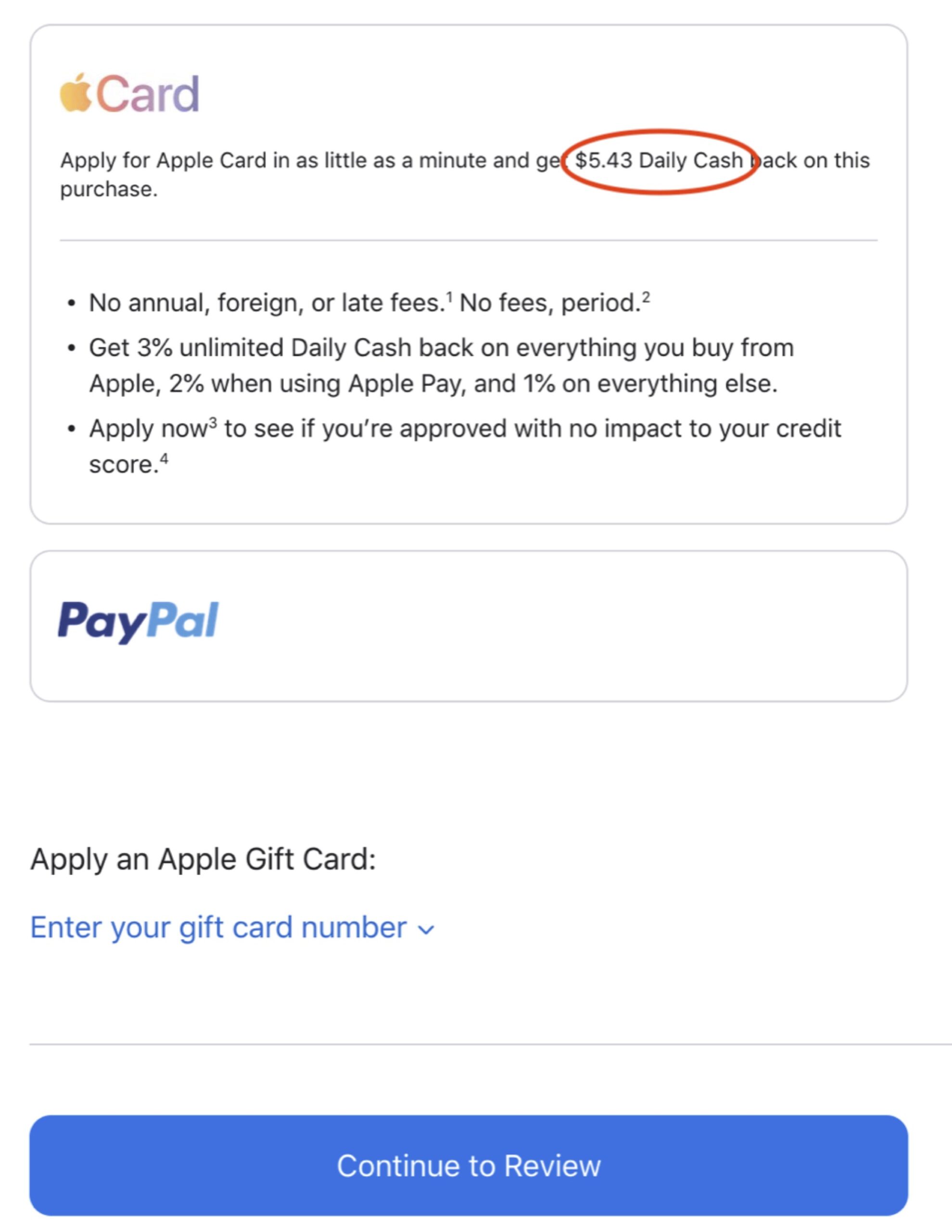

Notice what it says right under that $181, it says get daily cash with Apple Card. In that daily cash with Apple Card, they make it sound like you’re going to get daily cash. Notice over here on the left, $5 for this purchase if you get the Apple Card you’re going to get. It sounds like you’re going to get $5.43 daily cash. Correct? Doesn’t that say? If you’re reading it, you’re going to get $5.43 daily cashback on this purchase. What that means is on the day of purchase now, you’re going to get daily cash of $5.43. You’re not going to get another dime from his purchase, but that isn’t what Apple is saying. Apple is saying you get $5.43 daily cash. I know what the hell I’m doing and I had to read the fine print to make sure that was my assumption, but I wanted to see how they were defining it. It’s crazy. They make it sound like you’re going to get $5.43. One part of us is like, “$5.43 daily cash. That’s awesome.” That will pay off that $181 super fast. The other part of us, that lizard brain of ours say, “No. Something is got to be wrong here and that’s a one-time payment.”

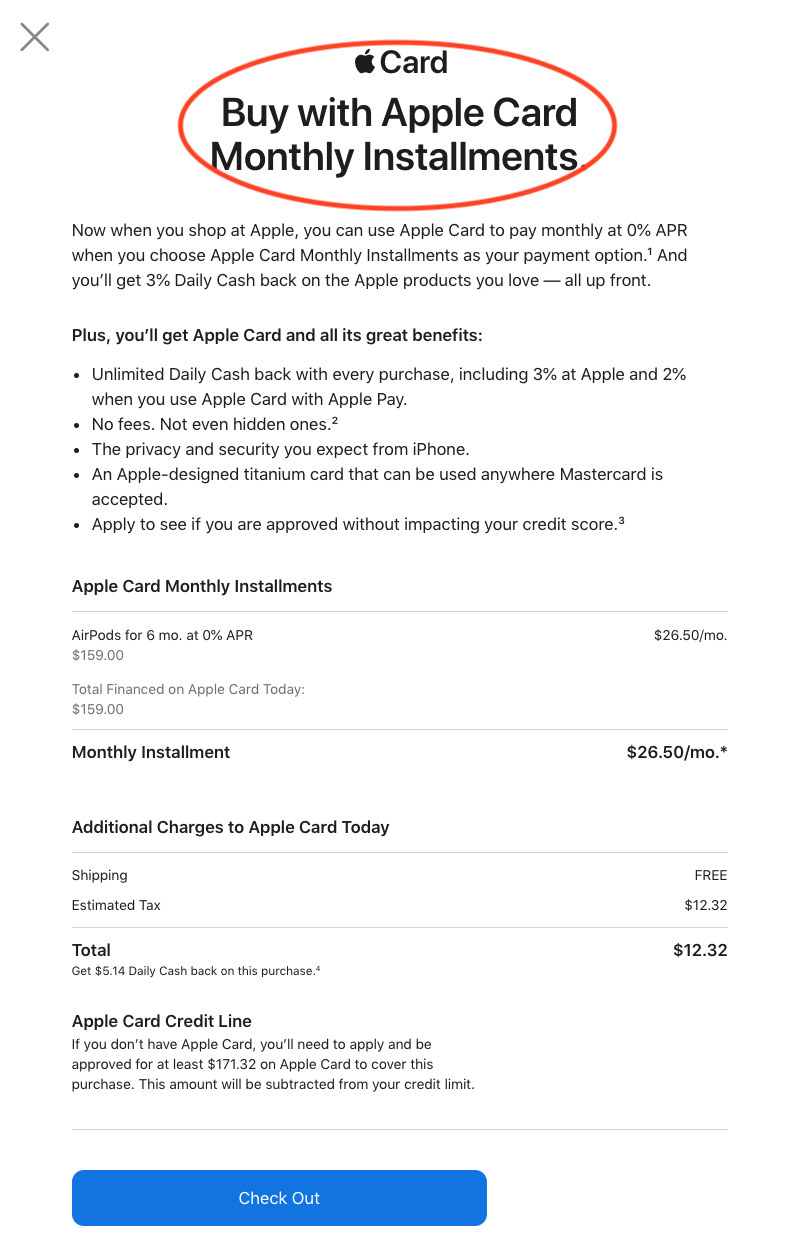

Here’s the thing. If you click on the Buy with Apple Card, it says Buy with Apple Card Monthly Installments. Here’s the next level of misrepresentation. Remember in the Bootcamp, if you’ve been bingeing my show, there are revolving accounts then there are installment loans. The term installment is generally and specifically designed to describe a loan. What it’s saying is Buy with Apple Card Monthly Installments. They’re not saying monthly minimum payments. They’re saying monthly installments. You can make a monthly installment.

Unless we know the rules of the game, we'll step on landmines. Share on XApple

Two things are wrong with this picture. First of all, again, it makes it feel like a loan instead of revolving account but more importantly, if we’re making the minimum payments, as we discussed in the Bootcamp, you’re literally broadcasting to the world, “I can’t afford more than this.” You think you’re going, “I’ve made an arrangement to make monthly payments.” A little lower down that page, it says monthly installment $26.50 per month. They’re saying for $26.50 a month, that’s your payment, but the second you start paying that $26.50, you start registering with the FICO and other lenders who are looking at your profile that you’re only making the minimum payment, and you are downgrading your value to them as a borrower. You’re not a perfect borrower. You are a consumer and the business lines of credit, the high-value credit cards and credit lines that we want are not going to be available to you.

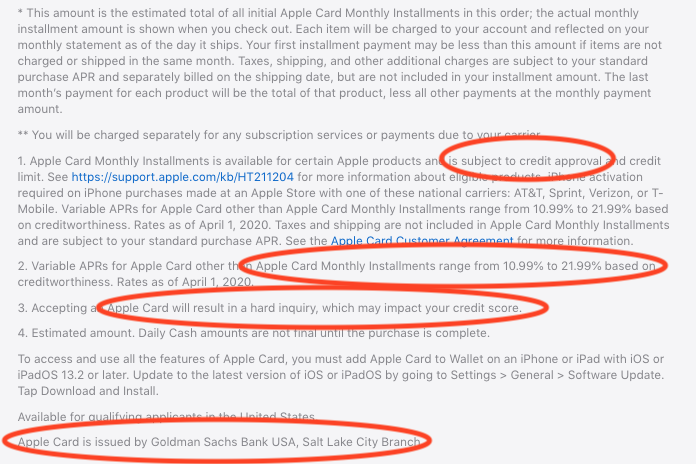

Think of that. It boggles my mind. Monthly installment instead of minimum payment due, which is what the vast majority of credit cards say on their statements. This entire checkout process is an ad for Apple Card. It’s underwritten. Notice it says, these are the footnotes. There are tons. Apply now. All of these are showing that there are four of those footnotes. Those footnotes say, “Subject to credit approval.” That’s typical. Apple Card Monthly Installments range from $10.99 to $21.99. They’re trying to make this sound like it’s a loan, but this is going to end up on your revolving accounts portfolio and is going to harm your revolving profile straight up, no question, and yet notice they don’t say the APR, see a variable APRs but they’re reframing, redesigning, re-languaging all this to say your monthly installments range between $10.99 and $21.99 based on your creditworthiness. We call it fundability™. Go read about that. We did one comparing fundability versus creditworthiness. This has nothing to do with creditworthiness. This has to do with how fundable you are, how well you look to lenders, and they’re even telling you if you’re highly fundable, you’re going to get $10.99. If you’re not very fundable and still get qualified, you’re going to be at $21.99.

It’s important to find out how these offers and these credit cards will harm your personal fundability™. Share on XApple Card is going to pull a hard inquiry, which may impact your score, but it’s issued by Goldman Sachs. It’s mostly online. Its official office, they’re using the Salt Lake City branch, and so that is a Tier 2 bank, just having been upgraded from a Tier 4 bank prior to all of this. Here’s the thing. I love Apple and Apple stock, and I’ve been buying Apples and I had the original fat Mac back in 1984. I had Number 660 Apple printer. The serial number was 660, and yet I got to call it out. This is straight bad juju. The thing is we need to remember here is that in everything that we’re doing, we’re pointing out ways in which they are using your loyalty and your love of their products to harm your profile and they’re using deceptive language. They’re using manipulative language like calling a credit card and calling it installments. All of that is straight bunk. That’s Apple.

Venmo

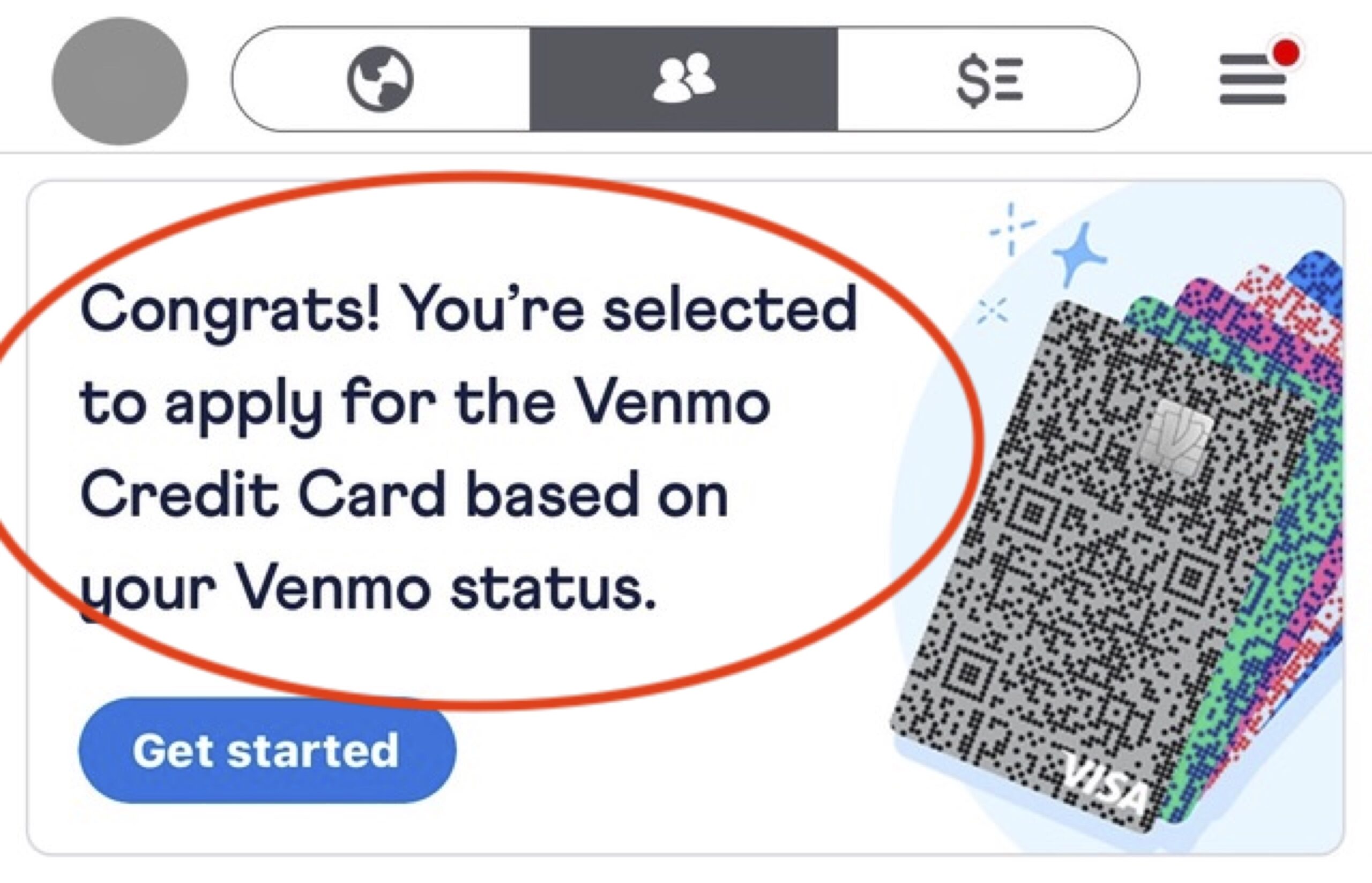

Let’s take a look at Venmo. On Venmo, we do the same thing. We find a Venmo card. It says Apply Now but notice what Sky was faced with when she started to make a Venmo transaction. Take a look at this. Look at the language. Most of us don’t pay attention. “Congrats. You’re selected to apply for the Venmo credit card based on your Venmo status.” There’s so much messaging there. I can’t even tell you. Number one, you’re selected, chosen, you’re important, you’re valuable, and we’ve chosen you. There’s message number one but it’s to apply for the card. You could throw a water balloon into a crowded thing, and they would be all selected to apply. There’s no value there, except for they get to use the word selected and based on your Venmo status. We don’t know what the criteria are for the Venmo status. We don’t have a clue. We’re sitting here and they’re saying you’re selected and because of a mysterious Venmo status that is so awesome.

Meet the Venmo credit card built for you. What’s the only recognizable logo on any of these graphics? The Visa symbol. Once again, they are saying that it’s a Visa credit card and that is a nonsensical phrase. A Visa credit card is meaningless. The Venmo credit card is issued by Synchrony Bank pursuant to a license from Visa USA. The license is simply their ability to process the data and process your purchase. Somebody has to process it and it’s going to be Visa, MasterCard, American Express, or Discover. In this case, they are saying that it’s for Visa and Synchrony Bank straight up Tier 4. They are a predatory seagulls. They backstop so many different financing Things that ruin your fundability™ and your lives.

The message is Visa is meaningless but that’s what they’re counting on. “Meet the Venmo credit card built for you. You’re been selected to have this Visa credit card.” Visa does not have credit cards. Synchrony Bank has the credit card that they put in small letters on the opposite side. If you looked at that card, it would say Synchrony Bank. Everything else is Venmo. This is what we’d call a co-branded card, except it’s in Tier 4, so it’s not co-brand. It’s just another finance card scam. The interesting thing is, is that they’re basing everything about this Venmo card, you get 3% cashback on your eligible top spending category, split and track in the app. With your Venmo QR code, you can split purchases with friends. Venmo does that on its own. They want you to pay them interest and they are willing to not tell the truth and hide the specifics in fine print.

Amazon

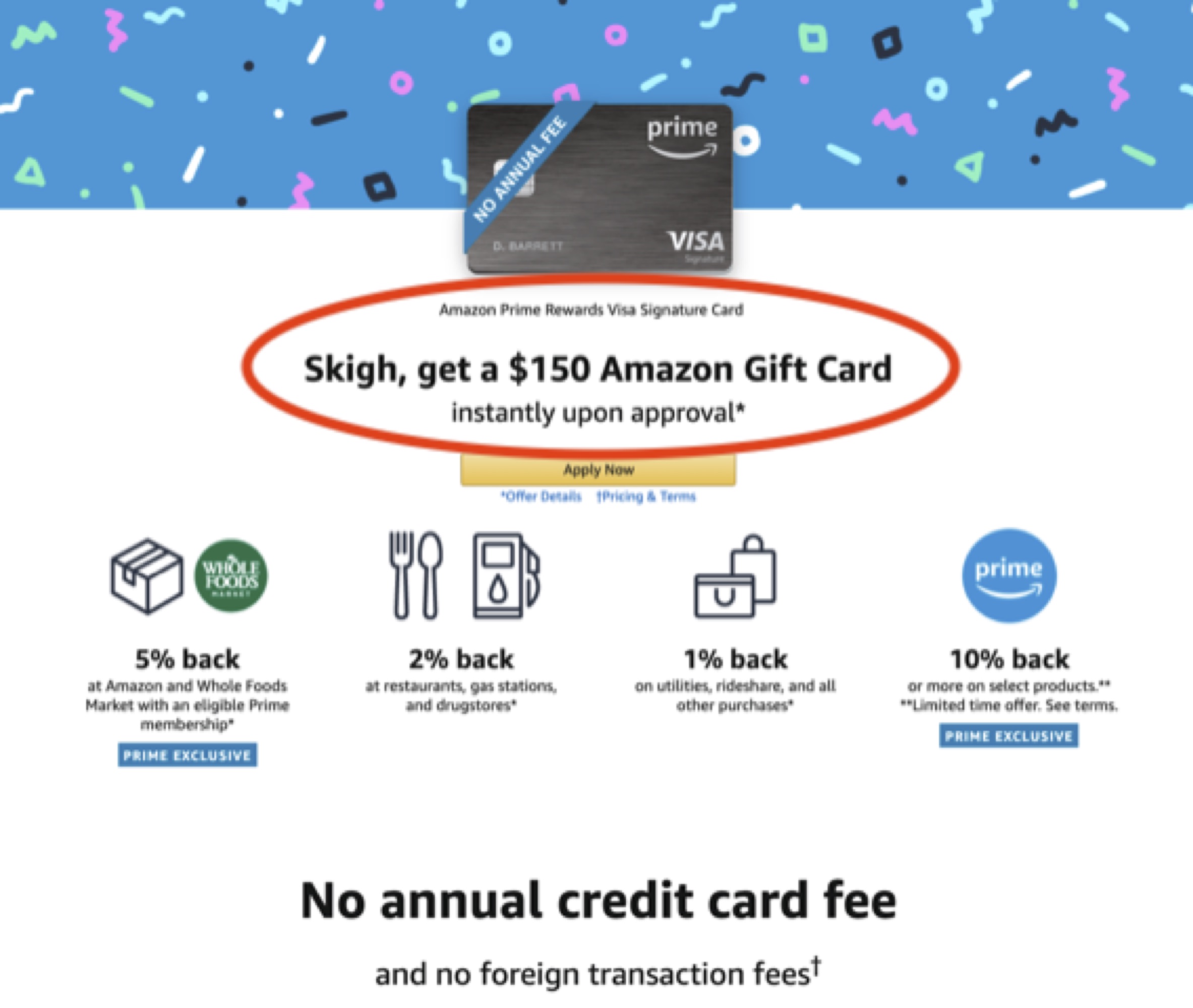

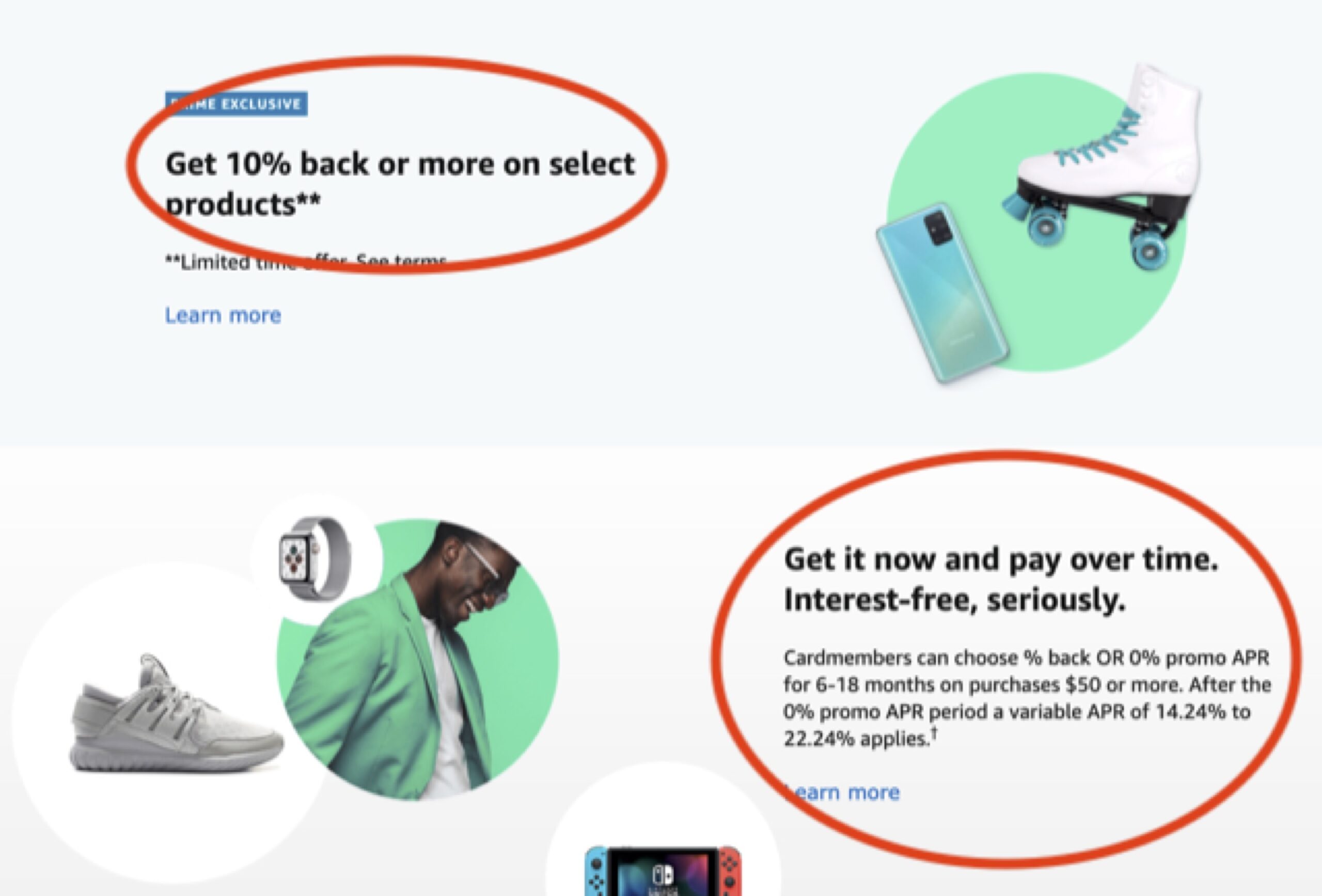

Where are we going to close up as your favorite? Let’s go to Amazon. Sky was also making some purchases for our company. Let’s look at this. First of all, customized to her account. Sky gets $150 Amazon gift card instantly upon approval. Smaller letters, Apply Now. You get 5% back at all the Amazon companies, 2% on some, 1% on others, 10% back on your Prime purchases. There’s no annual credit card fee, etc., but the point is, it is saying right as you go in when I go into my checkout mode, “Would you like to contribute the $150 from this Amazon gift card to your purchase?” It has another button that says Apply Now. Every time you go to make that purchase, they say get 10% back on Prime. Get it now and pay over time interest-free. The interest-free is based on your credit, the same thing that Apple did. It’s going to be $14.24 to $22.24 depending on your fundability™, not creditworthiness. Those are my words and then 6 to 18 months on purchases, you can pay over time based on your fundability™.

Compare it to a stream. Everybody downstream, you’re going to look worse to every single lender downstream if you’re getting any one or more of these cards upstream. You’re going to look worse. Your profile is going to be worse and everything that you’re doing is going to be less valuable to the important lenders. Now you want to go buy a car, house, and get a high-value Tier 1 credit card. You want to go get the Chase Sapphire. They’re a Tier 1 bank with 100% value card and you get all kinds of mad benefits, but they have higher approval underwriting criteria than any of the things we’re talking about because they’re a legitimate Tier 1 freaking bank. All the other banks have similar, valuable offerings, but you let you look less valuable.

In the Bootcamp, I talk about all the mall store cards and throw them all together, online cards. These are the online cards I’m talking about. In-app purchases, Amazon online, Venmo, and any of these things that would be called electronic access all fall into this Tier 4 gunky, junky, ruin your profile, and make it less valuable when you get them. Do you see why I’m a little bit pissed off? I’m glad that we have this opportunity to spend some time together because unless we know the rules of this game, we’re going to step on these funding landmines, and they’re going to harm us, especially auto or car we talked about, business loans, business lines of credit, and anything that’s going to be valuable to move your life forward, you will become less valuable to that lender. For example, they’re saying, “Save 5% or 10%.”

Why don’t you get the 5% back on a card that’s going to move your entire financial reputation forward? Instead of junky little places, junky little cards, consumer-based cards that will ultimately harm you in the short run and in the long run. You saw it here first. Follow us, like us, and give us a review. I want to know what you’re thinking and what you’re saying out there. Forward this, share it, and make sure everybody knows what we’re up against. These are easy fixes if we know. I’ll see you on the inside.