Debt consolidation is scary and deceptive if you don’t know what you’re doing. Do not get into something that you know nothing about. That is how they get you. They will trash your credit profile before you know it. Join your host Merrill Chandler as he discusses the dangers of getting in touch with debt consolidators. Learn how they use a homegrown chapter 13 bankruptcy tactic to get you to think you’re paying less than you should. Learn how to protect your credit profile today.

—

Watch the episode here:

Listen to the podcast here:

The Deceptive World Of Debt Consolidators

In this episode, we’re going to be talking about another massive landmine for those who are in debt, feeling a little overwhelmed by debt and who are looking for debt relief. If you’re looking for debt relief, you got to stay away from anything that says, “Debt consolidation.” If you’ve got good credit, a debt consolidation loan may still be viable for you but debt consolidation, save money, cut your payments in half or any of those things. We’re going to do a deep dive now in the stay away from them, run away as fast as you can.

—

As I said in the intro, you know that I have a cold, dark, black place in my heart for financial predators. It does not make me happy. We’re going to explore what the beliefs are out there. Why borrowers are susceptible and the practitioners, the operators, the shysters, the evildoers out there who are willing to take advantage of a borrower’s ignorance.

What Are Loan & Debt Consolidators

Debt Consolidators: The second you make a less than full payment. You are no longer paying as agreed to the original terms of your credit card agreement.

More importantly, how they’re willing to put into sixtremely tiny, fine print the truth and assume the worst about you. Who am I talking about in this episode? We’re talking about, as the name implies, deceptive practices of loan or debt consolidators. They call themselves loan or debt consolidators. Let’s go with DEC sellers because there is a term that’s been used since the ‘70s called a consolidation loan. Many people will group the word loan with debt, “I got a loan from Bank of America.” It’s actually a credit card but they just use the term loan to mean money was given to them, a credit instrument was approved.

As you know me by now, it’s all about the correct use of language so that we know what’s happening out there. It’s never more important than what is going on with debt consolidation. A consolidation loan to consolidate your debts is radically, violently, horribly, tragically, different than debt consolidation. As the providers out there will say and they’ll deceive you with their fine print.

Example Of Debt Consolidation

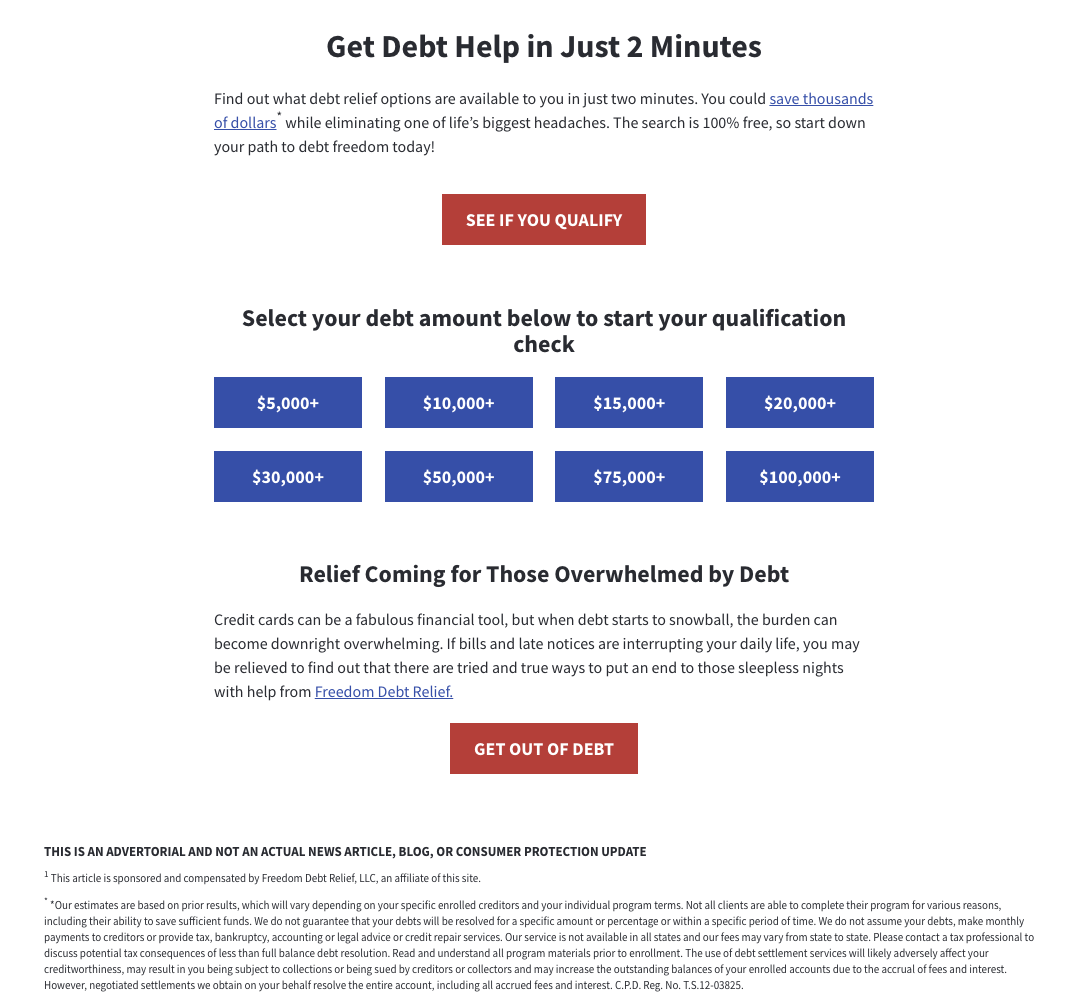

Licensed attorneys are obligated to tell you about your negative credit. Meanwhile, debt consolidation operators aren't so forthcoming in telling you the truth. Share on XFor those of you reading, I’m going to walk you through this so you understand what’s happening. First of all, in principle, you can go to a website that says, “Debt consolidation.” Now, the vast majority of us listen for the word debt consolidation and we’re looking for a debt consolidation loan. That is not usually the case for the people who are advertising debt consolidation. The first thing they’ll do and say, “Get debt help in just two minutes.”

They’re looking for people who are overwhelmed in debt, who is 70%, 80%, 90% utilization on their cards because most people don’t consolidate debt, even using a legitimate loan for a mortgage. That’s a refi. Auto loan, that’s a refi. Most debt consolidation focuses on your revolving debt. The operators come to you and say, “Relief is coming for those who are overwhelmed by debt.”

Homegrown Chapter 13 Bankruptcy And How They Use It

On this website, they’ll give you a chance, “How much debt are you in?” That’s just a ploy. It doesn’t matter how much debt you’re in because debt consolidation companies use a principle of what I have called for 30 years, a homegrown Chapter 13 Bankruptcy. What do I mean by that? What do you mean by homegrown? A Chapter 13 Bankruptcy is where you take all your debts.

You go to a bankruptcy court and your attorney presents all your debts to the bankruptcy trustee, someone who’s in charge of making sure everybody has a fair payout here in the bankruptcy court. They’ll say, “Let’s say you have ten lenders, ten creditors. Let’s pay everybody $.50 on a dollar. Instead of owing $20,000, now you owe $10,000.” The bankruptcy court says, “I’m going to have you pay the court $500 once a month towards this $10,000.”

Once you’ve paid off the $10,000, remember they reduced it by 50% from $20,000 debt, every accreditor let’s say agreed to a 50% settlement. You pay your $500 a month toward this debt. When you are done paying the debt then the credit reporting clock ticks out another seven years before that Chapter 13 Bankruptcy comes off your credit report. There’s the 3 to 5-year debt payoff of that $10,000 and then there are seven years that it’s reported broadcasting your reputation to every future lender that you had a Chapter 13 Bankruptcy.

Debt Consolidators: If you work with debt consolidators, they’re going to trash your credit for you. If you pay less than the full balance, no lender would want to lend to you, no matter how high your score is.

We’ve gone in previous episodes Chapter 7 and it basically erases most or all of your depth. This is the Chapter 13. Guess what the creative predators did? They said, “Let’s mimic this exact same process but let’s not go to the bankruptcy court. Let’s negotiate with the creditors themselves.” Here’s where the mess begins. The principle is similar to Chapter 13.

That’s why I call it homegrown is that these debt consolidation companies will contact every one of your debt holders, your creditors. They’ll say, “Let’s 60%, 50%,” reduce how much you owe. The creditors especially if you’re already 30, 60, 90 days behind or you have super high utilization, will say, “We’ll accept this new payment.” To make it easy, let’s just say it’s also 50%. You owe $20,000. You go to a debt consolidation company.

Instead of a bankruptcy check, send one check a month to the bankruptcy court. They say, “Send to this consolidation company, a check for $500 and we will pay each one of the creditors that you owe. After you have paid all of those creditors then you will be out of debt.” There are so many landmines here. The first thing is the licensed attorneys who take you through bankruptcy are obligated to tell you about the negative credit that’s going to happen as a result of doing a Chapter 13 Bankruptcy. Debt consolidation operators aren’t so forthcoming in telling you the truth because here’s what’s happened.

Credit scores don't approve you. Share on XIn this case, let’s say that you’ve been paying that debt faithfully for a year or two and it’s at 70% or 80% utilization, you’re just tired of it. You think in your mind, you say, “Can I just have one payment instead of paying these 5, 7, 8, 10, 12 different creditors?” We think that’s easier. That perceived lightening of the load, the psychic drag in our minds to pay one bill instead of many that makes it very tempting.

We see an ad and it says, “We can reduce your payment sometimes by half or nearly by half or basically by half.” We’re like, “I want to reduce my payments. That would be so great.” We read along a little further where it says that you’ll only have to make one payment instead of 7 or 10 or however many accreditors you have. We’re thinking, “This is a win.”

Let’s say, in this case, you’ve been faithfully making payments. You’re still paid as agreed but you’re overwhelmed in debt. The psychology for these is, they’ll say, “We’ll negotiate lower payments on your behalf.” Since most borrowers don’t know how this game is played, they think that’s a good deal. They think this debt consolidation company is hooking them up. “I’m doing you a solid,” says the debt consolidation company. Not true in the least because the second they start negotiating. Sometimes a creditor won’t negotiate until you’re late.

The debt consolidation person will either tell you to go late to get better terms on the negotiation or they won’t tell you that you have to go late and will withhold payment or otherwise until they have the best strategic advantage to negotiate with the creditor. Here’s the problem. The second you make a less than full payment. Let’s say, you owe $100 on a credit card and the debt consolidation company gets you for $50. That’s the new payment.

The second you make that $50 payment, instead of $100, you are no longer paying as agreed to the original terms of your credit card agreement. What happens? They give you a 30-day late and then that turns into a 60, 90 all the way to 180. They will put a notation saying, “In credit counseling,” which means you’re working with a debt consolidator.

Debt Consolidators: If you don’t know what to look for, or if you don’t know what they’re trying to do, you’re going to let them pull a credit report.

Now, remember everything on the credit report. First of all, you’re ruining your relationship with the current lender but you’re also broadcasting on your credit profile, a negative reputation, a negative financial reputation that you’re now in debt consolidation and using a debt consolidation firm or many times they call it debt counseling.

I’m not saying that not to do this. I’m saying, know what the hell you’re doing if you decide to do it. Sometimes we can be strapped, sometimes there’s no other way. I’m telling you what the process is so that you will know that the financial evil and landmines you’re going to run into for the next 7 to 10 years of your financial life.

How It Can Screw You Over

Once you’ve paid this lower payment of $50, instead of $100, they’re going to call it 30-days late because you’re not paid as agreed and they’re going to start docking your profile. Now imagine 2, 3, 5, 7, 10 accounts, all being included in this debt consolidation process are going to trash your profile. Most people believe, “If I go 30 days late on one account then I might as well go 30 days late on every account because my score is going to crash.”

One more time, we are seduced by the principle that your score even fricking matters because one 30-day late may take your score 50 or 100 points. It’s true but scores don’t approve you. They don’t. They’re in charge of your rate, your interest rate, your term and charge of the number of future loans and credit limits. What matters is that you went late on 1, not 2, 3, 5, 7, 10 accounts and just threw your whole financial reputation in the trash.

We don’t care about the score. We care about how you look and your financial reputation to lenders. That’s what we care about and lenders, that’s what they care about. They would rather have one 30-day late than 3, 5, 7 charge offs because you just threw your hands up in frustration and gave up. There are options. Every time you work with one of these debt consolidators, they’re literally going to trash your credit for you.

Know what you are getting into before doing it. Share on XIf you pay less than the full balance, including if you put something into bankruptcy and don’t pay it off, more lenders are having what I call institutional memory. Meaning that while something may fall off your credit report after seven years or be deleted through this dispute strategies, the lender remembers that you didn’t pay them in full.

You did not give back every dime that they gave you and they will not lend to you again even if your credit is an 800 plus credit profile. Years down the road, if you owe them money, American Express is notorious for institutional memory. Chase, Wells, top-tier two banks have institutional memory. They do not forget that you owe them money and are unwilling to lend you in the future.

If you have a bunch of credit cards, you burn those credit cards and you trusted these organizations to say, “Let’s do $.50. You’re like, “I’d rather pay $10,000 than $20,000.” You think you’re skating and then later on down the road, you want to buy a house, car, credit card, much less start and finance and fund a business. It is likely that you’re not going to be able to deal with the lenders with the best rates and the best terms.

A Recap On The Process

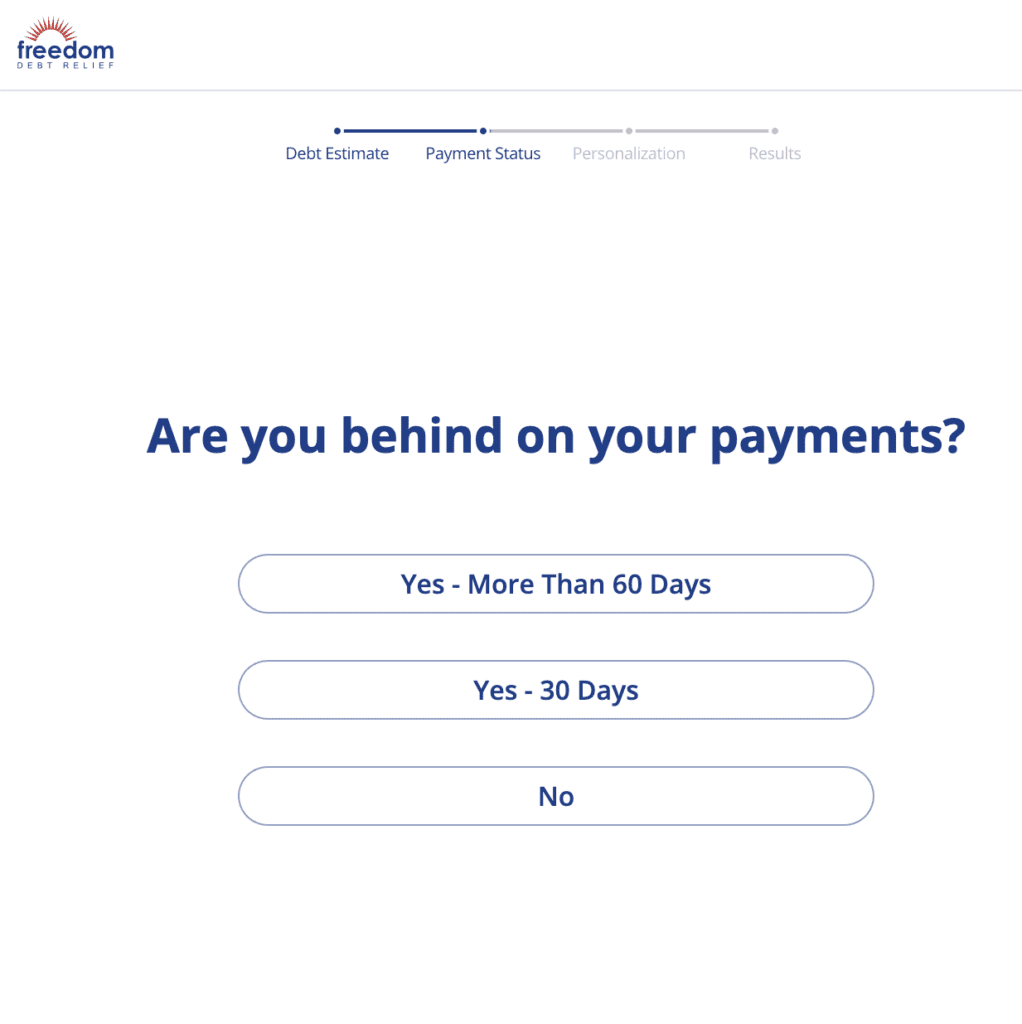

If you have a good financial reputation who are willing to give you the most amount of money for each funding approval. For those of you who are looking, I want you to see this first slide that says, “See if you qualify.” They have you check how much debt you’re in. When you click the button, get out of debt. The next thing that you see is they’re like, “How late are you? Are you behind on your payments?” You say, “More than 60.” Now, remember 60 is how FICO classifies serious delinquency. There are 30 days that are not serious delinquencies especially if you only have one.

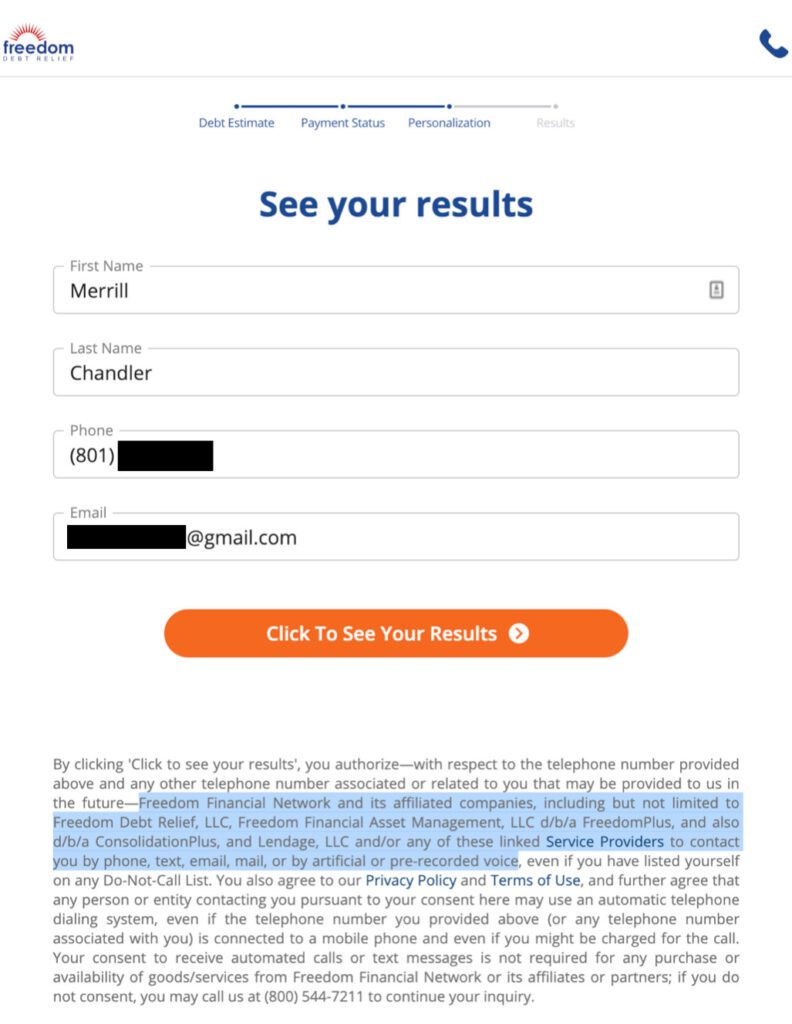

They’re saying, “I’m not behind on my payments.” That gives these operators awareness of what type of service to sell you. Let’s say you click on 30, they’re going to ask you for information. I went through this process prior to this recording and what’s hilarious is I filled out my information but if you’ll notice down, what it says, “Freedom Financial Network and its affiliated companies included but not limited to Freedom Debt Relief, LLC, Freedom Financial Asset Management, LLC, doing business ads, Freedom Plus and also DBA Consolidation Plus and lending LLC and any of our other service providers.” One company has four DBAs.

They’re all marketing to get you the unsuspecting borrower to trash your credit. I filled out my information within five minutes. I had a Filipino operator on my phone asking me questions. I immediately asked to be removed from their list but at the very final of this process, they’re gathering information so they can sell you debt consolidation services. By the way, foreign operators don’t have to be as self-disclosing as United States-based operators. Due to loops in the International Laws, Marketing, Disclosure Laws, etc.

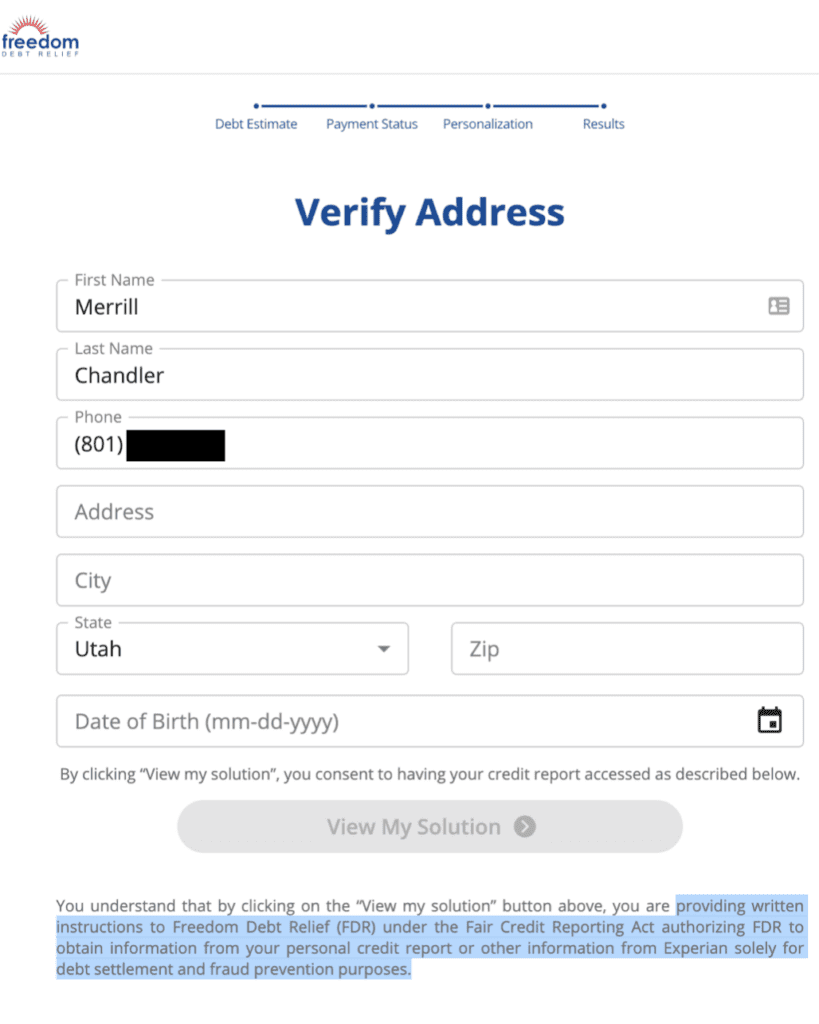

The final one you run into, I highlighted specifically then they ask for your address. I didn’t give them any more information because they asked for a date of birth. If they have my date of birth, you’re authorizing me to provide written instructions to freedom debt relief under the Fair Credit Reporting Act to obtain information from your personal credit report or other information from Experian for the purposes of debt settlement.

They’re going to pull a credit report. If you don’t know what to look for, if you don’t know what they’re trying to do, you’ve now got an inquiry. It could be a soft poll but don’t count on it depending on the operator that you’ve authorized them to pull a credit report. They don’t care about your fundability™. They don’t care about your inquiries.

They want to sell you the opportunity for you to pay them to destroy your credit profile. There are so many ways to get this done that doesn’t have to destroy your whole profile. You’re going to lose points if you go late or pay less than the full balance. Please remember you have got to check out my bootcamp for a huge revelation on all of this, GetFundableBootcamp.com.

We spent two days going over the principles of fundability™, what to do, what to avoid, the landmines and how to miss them. Also, if you would like for all you readers out there in our blog, those will be presented so you can read them.

I know I get excited. I know I yell at the financial universe because there are so many shysters out there. Many people are trying to use your financial ignorance, your financial lack of understanding against you to pillage and plunder your pocketbook, your bank account and most importantly, your fundability™, your credit profile.

Like, love, shout out, share this with people you know that may be in debt, that may be struggling. Please share this. Let’s save the soul of their borrower profile. For my readers, I love your devotion to bingeing this. Please comment, share, subscribe so that you can see what the next thing we’re talking about is to protect you from all of the landmines that are out there that are intentionally set to destroy you and your funding opportunities. This is Merrill Chandler, your host of the Get Fundable! Show and your guide to the minefield of the funding universe. I’m here to help. We’ll see you next time.