There are people who want to take advantage of your ignorance for their profit. The good news is you can save yourself from all these scams if you are well-equipped with knowledge about credit scores and how they function. In this episode, Merrill Chandler reveals how merchants use their knowledge of different credit scores to rip you off and charge you the highest possible interest rate. With all these FICO score versions, Merrill teaches how to identify if you are getting a fake score or not, and cautions us to go to myFICO.com for more reliable credit reports and scores.

—

Watch the episode here

Listen to the podcast here

FICO Score Versions

In this episode, we’re going to talk about how merchants use their knowledge of different credit scores to rip you off and charge you the highest possible interest rate. Are you aware that big-ticket merchants, auto dealers, mortgage companies, Winnebago seven, a luxury car, salesmen and women, these guys know the funding game better than you do? It’s such that they are aware of how to use your ignorance against you and to create vast higher profits for them because you don’t know what’s going on. We’re talking about how those big-ticket rip offs and they’re using FICO score versions. You may not even be aware that FICO has versions. In previous episodes, I talked about that there is the equivalent of a software version like Windows 98 versus Windows 10. For you Mac users, that’s like Mac OS Lion versus Mac OS Mojave. These score versions are creating a nightmare for us and big profits for them. That’s what we’re going to be talking about.

FICO Algorithms

One of the things we need to be aware of is that FICO is about predictive analytics. We know them for credit scores. We know that they’re all about credit scores. That’s all we’ve heard, but they are far beyond just financial or credit scoring. They have a whole bunch of other products that they offer industries. Those industries, they’re 83 total FICO algorithms that are sold to industries. We have the FICO score, but then there’s the FICO application score, which we’ll be doing a deeper dive on in a different episode. That FICO application score measures the difference between the data in your application, the bureaus and all the databases they’re checking against to see if you’re really who you say you are. It’s called the application score.

We’re going to be talking about in an episode soon about the revenue score. Did you know that FICO can take your credit score and your zip code and determine how much a lender is going to make off of you? We’ll be talking about that. There’s a FICO fraud score. That’s how fraudulent is this application as a percentage. There’s FICO pre score. We’re going to be covering in a different episode as well, but FICO pre score determines what mailing list and what offers they send you. We’re going to talk a huge discovery about how you’re lowering your score by being on these lists. FICO does a pre score. There’s a FICO Small Business Scoring Service.

We’ve talked about the SBSS. The Small Business Scoring Service is FICO taking over the entire business funding marketplace with their score compared to Paydex, compared to those other more primitive, archaic and ancient versions of business scoring. It’s the only legitimate business scoring metric out there. There are other scores beyond the credit-related, beyond the financial. There are FICO insurance scores and there are FICO propensity scores for healthcare. What is your propensity? They use the Medical Information Bureau to measure how healthy you are and prone to injury or illness. Imagine that, predictive analytics, the propensity towards health or propensity towards accident or illness, they measure this stuff. We’ll be doing an entire episode on that. Property predictor insurance scores, it’s like the propensity score, but how often is a homeowner going to tap their insurance for their homeowner’s insurance? How often are they going to say that something got stolen? Those are all in the predictor insurance scores.

Then there are FICO debt management solutions. They have a score that manages or predicts the tendency towards default and bankruptcy and that debt management. When is a particular borrower overwhelmed? When are they tapped out in their utilization, their balances, too much consumer debt, etc.? They have the FICO collection score, which is how many collections do you have over your lifetime? Some of these scores, since it’s not credit reporting, they don’t necessarily fall under the protection of the Fair Credit Reporting Act. They’re predicting the future of a particular borrower, etc. Notice they even know how to optimize for mortgage pricing, what to give a borrower for pricing when they’re applying for a mortgage?

The 28 Consumer-Facing Scores

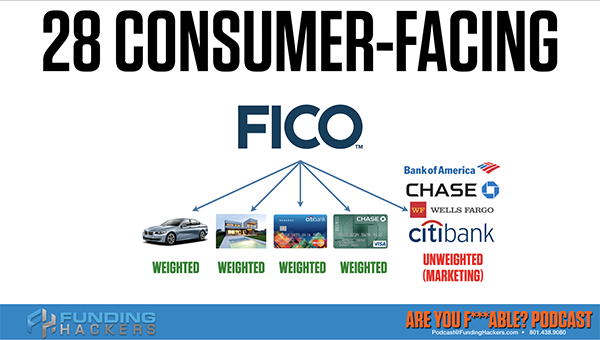

All of these scores, our borrower behavior, our consumer behavior and our insurance behaviors, everything is subject to this big data predictive analytics. Let’s dial this down from those 83 and let’s go to what are the 28 scores that we get to focus on as part of our fundability™. There are 28 consumer-facing scores. Some of them are weighted and some of them are unweighted. A weighted score means that they give a higher value in the algorithm to your previous behavior, good or bad, a higher weighted value to your previous behavior in each of these industries. An auto weighted score means that they’re going to check out how well you’ve performed on previous automobile loans.

All mortgage scores are weighted just like all auto scores are weighted. The weighted score is how well you’ve done on your previous mortgages. Have you missed payments? Have you been behind? They measure if you’ve been a day late on your payment or have you paid late fees and been fifteen days late? It doesn’t have to go all the way to 30 days loss. They’re weighing how you perform on that loan. Remember how we call the performance data? This is where they’re measuring how we are performing on these previous loans. There are weighted personal credit cards and weighted business credit cards called bank card scores. These are all weighted scores.

There are unweighted scores and these unweighted scores are marketing scores. We’re going to be going deep into this and then we’re going to find out how they’re being used against you. The two unweighted scores are over here. Chase, Bank of America, Wells Fargo, all of these unweighted scores, there are two versions of it. When I say version, I’m talking software versions. There’s unweighted eight and unweighted nine. I want to focus and I’m going to do a deeper dive on the unweighted scores because these are consumer goodwill, “Aren’t we awesome? We’re hooking you up and telling you your credit score for free.” All these guys are doing it now. It’s the next big thing in credit scores but they got slapped down because they were pretending that these unweighted scores are scores that lenders use in business decisions. I’m here to tell you that only weighted scores are used in business lending decisions and personal lending decisions.

Let’s look at the number one place where you get access to the unweighted score. Remember those scores you get from your lenders? The very first question you have to ask, “Is it a FICO score? Does it have the FICO registered trademark?” If it’s not registered trademark, then it’s what I call a FAKE-O FAKE-O score. These unweighted scores are FICO FAKE-O scores, meaning a FAKE-O score is any score that is not used by a lender for a lending decision. FICO has a FAKE-O score, that’s the marketing score, and then there are all the other FAKE-O FAKE-O scores. Is it a FICO score? Does it have the FICO logo? What version of the software?

The FICO FAKE-O Score

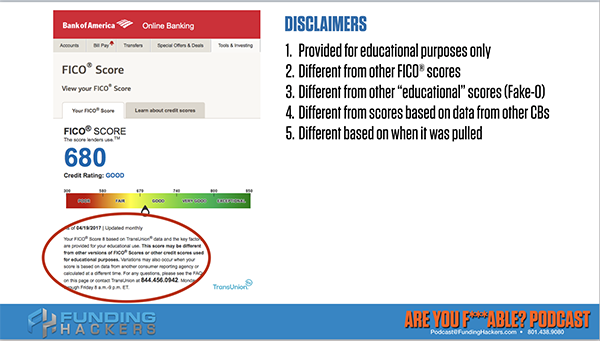

On my personal credit, Chase stopped subscribing to FICO and went to Vantage. That’s a FAKE-O FAKE-O score because nobody uses Vantage. 2% to 3% of lending decisions are based on Vantage. The other 95%-plus are all based on FICO. We’re going to talk about the FICO FAKE-O score. I’m going to do a deep dive here and I recommend that you either watch the video version of this because I’ve got some compelling graphics. I’m going to explain to you so you understand what we’re looking at. I’m looking at Bank of America Online Banking and it says FICO score, “View your FICO score.” From the previous episode, what’s the first thing that they’re implying that is not true? “View your FICO score.” It doesn’t say, “View one of your FICO scores.” It certainly doesn’t say, “View your unweighted FAKE-O FICO score that no lenders use.” Notice that language isn’t there. It says, “View your FICO score,” because they want you to believe that this is a meaningful score because if it’s a meaningful score, they’re hooking you up, they’re solid. They’re a great little lender to take care of you so well.

FICO 8 and FICO 9 are the two unweighted versions of the score #GetFundable Share on XLet’s find out more. Notice there’s a trademark that says the score lenders use. It doesn’t say FICO scores. It doesn’t say that the scores lenders use, it’s still implying there’s one score. There’s never been a mortgage done I believe under heaven in the history of mortgages where they didn’t pull all three bureaus. This is not okay. They’re not disclosing the full truth. It’s all marketing. “The score lenders use,” but they get to say it because it’s a trademark. You could say, “The world’s best friend, TM.” You may not be the world’s best friend, but you get to say it if it’s a trademark. They’re saying, “The score lenders use.” On this example, it says 680 and the credit rating is good. Let’s get into the fine print. First thing’s first, notice it says, “As of 4/19/2017.” Everything that we’re going to talk about is only good as of this moment. Your FICO score eight, they’ve declared. Remember there are unweighted scores, the FICO FAKE-O score is FICO 8 and FICO 9, have unweighted scores. Your FICO score eight is based on TransUnion data. They’re finally telling us, “What bureau? There are two other bureaus? Why aren’t you telling me what those are? That would be more expensive to get those scores as well.” The issue is they’re saying that they’re already in this fine print. They are not disclosing the full truth.

Let’s take a look at the next thing. They’re saying this is provided for educational purposes only, provided for your educational use. Not to compare to what your lenders are going to pull, this is an educational credit score, which we should read as worthless compared to what a lender’s going to pull you. Next, it’s different from other FICO scores. This FICO score may be different than other versions of FICO scores or other credit scores used for educational purposes. They’re saying this FAKE-O score is worthless and it may be used against other FAKE-O scores that are also worthless because we’re not interested in education. We’re interested in what is the lender looking at and am I going to be approved? That’s what fundability™ is. This is complete BS but we don’t even know what the fine print means. That’s what The Get Fundable! Podcast is all about.

Excuse the impertinence, but Are You F*Able means, “Are You Fundable?” Does it also mean that we can take it up the hindquarters if we don’t know what we’re doing? Yes, we are getting totally abused by the system because we are ignorant. You don’t know what’s going on out there and I’m trying to tell you by their documentation exactly what game is afoot and how we should play it. This score may be different from other versions of FICO scores or other credit scores used for educational purposes. That’s what FAKE-O means. You read educational purposes and just replace it with the word fake. Variations may also occur when your score is based on data from other consumer reporting, from other credit bureaus, it’s different from scores based on data from other consumer reporting agencies or calculated at a different time. You may have had the same experience my students and clients all have.

What is insane is that one day later, so much may happen on a credit profile that your score may be up to ten or twenty or down ten or twenty points by one day if it crosses a billing cycle. Have you paid off utilization? There are a number of reasons why your score goes up or down. They had to put in here that as of 4/19, this was the truth of your fake unweighted FICO 8 score. Do you know why they have to put these disclaimers in here? In the previous episode, we showed that it was Experian and Equifax both got sued for pretending to give a consumer, a borrower a score that was meaningful to the lender. They got sued and they lost.

As a result, every single notification of a score has to have disclosing information. Until now, I know you’ve been getting free scores. They’ve been doing this for a couple of years now. Have you read the fine print or have you been filtering it saying, “It’s my score. Here’s my score. Look at this. I’m a 680, I’m a 720, I’m an 820,” and you don’t even know what that means. You didn’t know how to filter it because you don’t know what a fake score is. You don’t know what educational scores actually mean. Now you do. This is badass because what can you do with this information? I’m going to show you exactly what you can do with this information. Let’s take a look.

The Unweighted Scores

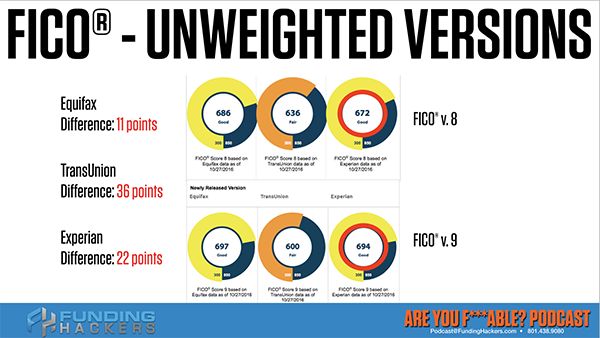

Unweighted versions of the score, there are two of them. There’s FICO 8 and FICO 9. Notice that there’s an eleven-point difference between the FICO 8 and the FICO 9 Equifax. Why is there a difference? TransUnion has a 36-point difference. FICO 8 and FICO 9, in this example, there is a 22-point difference in Experian. Why? That is because the software is getting more predictive with each new release of the software. FICO 9 is more predictive. It’s a better software. This is a higher score on FICO 9 here, but the TransUnion has a higher score. If you compare the FICO 8 and FICO 9 here, Experian has a higher score for FICO 9. Two out of the three scores are better because the FICO 9 is more predictive and that’s why they continue to upgrade those versions. The reason why we need to know this is going to be very important. Remember that your data is the same. It’s being filtered through different software.

The Weighted Scores

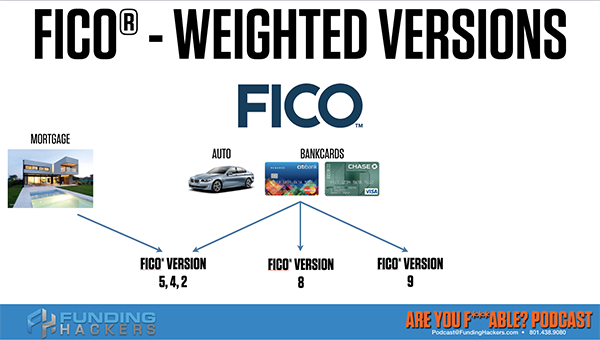

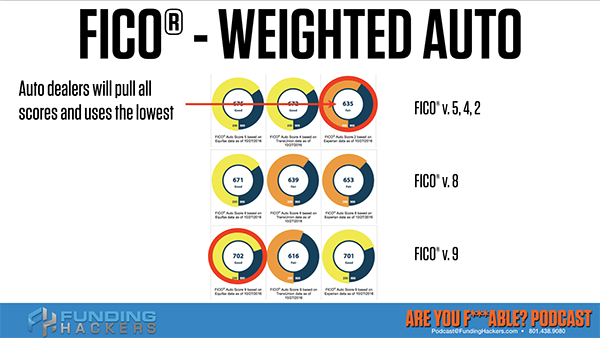

Different software is filtering and calculating the same data. Look at those 11 points, 36 points and 22 points. We’re getting hammered and you don’t even know what software is being used by the lender. That doesn’t count here because lenders don’t use this software. We’re going to see why. Don’t stop reading because I’m going to blow your mind about how you’ve been getting ripped off. Let’s take a look at the weighted scores. There are three versions of weighted scores. Remember, weighted scores are the industry scores that lenders use to evaluate whether they’re going to fund you or give you financing. We have FICO 9, we have FICO 8 and we have what’s called FICO 542 because back in the day, this is twenty years old, 542 stood for Equifax, TransUnion and Experian.

All mortgages currently use FICO 542. They pull three different credit scores when evaluating and they choose the middle score. They don’t choose an average. Whatever your middle score is, that’s what the rate and terms you’re going to get on that. They only use 542. When I was back at FICO, we asked them, “What’s going on with FICO mortgage scores?” They said, “We’re pushing hard. We believe we’re going to get the industry to upgrade to at least FICO 8, which is more highly predictive.” It’s way more predictive than FICO 542 but it’s a huge industry with literally dozens of thousands of brokers and lenders, etc. There’s a lot of inertia to move through that FICO scoring because even though it’s more predictive, it’s also more expensive to make the transition from one version because it’s software upgrades.

The filtering software, every desk of every mortgage broker or mortgage banker out there is using the software in their computer that is 542. Every one of those would have to upgrade, that’s why there’s a little bit of inertia. Auto loans use a 542 and they have auto loans use FICO version eight and they use version nine. It depends on where you go and what dealership you’re using or which lender you’re going to for a preapproval. You’ve got to know what type of auto loan their software is using. There are bank cards. I put up a personal and business bank cards here, but the bank cards use 542, FICO 8 or FICO 9 depending on the outfit. Don’t get confused by Citibank or Chase. I’m saying these are all the bank cards out there. That could be a community bank. It could be a credit union. Why? I’ve got a couple stories for you about how this works, but you’ve got to know that when you walk into a dealership or a lender, first of all, you have no idea what bureau they’re pulling. Second of all, you have no idea what software version they’re using.

You have two strikes against you the second you walk in. As a result, you are getting totally played. If we’re using that basketball metaphor, you are getting dunked on. It’s embarrassing. When you learn this new little thing, the way they’re taking advantage of you, you’re going to have all the power in the transaction. When I found out, I was embarrassed. No wonder because I was getting higher and higher interest rates than I thought I deserved. Let’s do a little deeper dive here into a couple of things that you may not be aware of. First of all, all the weighted scores except for the FICO auto and all the weighted scores for automobiles and for bank cards go from 250 to 900 in their score.

FICO scoring is more predictive but is more expensive when transitioning to another version because of software updates #GetFundable Share on XThe unweighted scores go from 300 to 850. All of these, the weighted auto and the weighted bank card scores go from 250 to 900. There’s an extra 100 points. When you have an 830 auto score, that’s on a scale of 1 to 900, not 850. You’re not near a perfect score. Once again, they give us a little twist of the knife because they don’t tell us that. There is no description in here about why they do that or what’s going on. That’s why I’ve had people call me up. They’re thrilled. They’re like, “I don’t understand. My auto score is 865. It goes to 850. I must be doing awesome.” Of course, their advisor team has to remind them of what you’re learning because every client, every student learns this. We need you to learn this because you need to know the rules of the game. Remember the scoreboard we talked about, all the different scoreboards from the previous episode? This scoreboard goes from 250 to 900, not 300 to 850. Remember, we have FICO 542 in the weighted auto, FICO 8 and FICO 9. Let’s take a look. When we’re comparing these auto scores, notice the difference. 31-point difference in Equifax, 56-point difference in TransUnion and 66-point difference between these scores, 66-point difference in Experian. Those are multiple tiers. In the upcoming episode, we’re going to be talking about the credit score pyramid and why tiers are important because those affect your rates and terms, what you’re qualifying for in interest rate.

The difference between this is that merchants know this game. We’re going to stick on auto dealers but it happens with mortgage brokers as well. How is this information useful? We’re down in the depths, but you came to me because you wanted to know the damn truth. We’ve got to bear with the fact that there are important details that are revealing everything. The very best auto score in this example is 702 and it is FICO score 9 with Experian. Those are the two things you need to know. What version of the software is a lender using? What bureau are they pulling? The worst auto score is Experian, FICO 542. What’s the big deal? Auto dealers will manipulate the spread. Have you noticed when you go to an auto dealer, they’re going to pull five, seven, ten, eleven? They shop you to eleven different lenders, seven different lenders.

First of all, we will get into later about how they shred your profile. We’ll talk about the de-duping period and how they all count against your score, but it shreds your fundability™. The auto dealers are going to manipulate the spread because the reason why they pull a whole bunch of scores is that, let’s use an example. They pull nine different credit scores from nine different lenders, one who uses each one of the bureaus and the different versions of the score. Why do they do that? In this case, auto dealers will pull all the scores and use the lowest score to approve you. They’re like, “We got an approval from Barclays Bank. Here it is, it’s 635. Congratulations, you’ve got financing.” You don’t know the difference. You may have that little fracture in your mind going, “Something’s not right. I went to Credit Karma and I had a 720. This is telling me I got a 635.” The problem is that you need to find somebody who is using FICO 9 and in this case using Equifax, because there’s a 67-point difference between what the auto dealer has chosen for you because they’ve got all of these scores back.

In this example, if they shopped it to nine different outfits, they got all of these scores back, the one they told you got approved with is the lowest one. They get kickbacks and a difference in the spread. They get a referral fee for sending the loan to the lender and they can get a kickback on the difference in the spread. They make money off of two ways and we’re going to be talking about the details of that spread and going into a deeper dive. I’m going even to be interviewing an auto dealer who wants to tell the truth and know how we’re being gamed. The reason why we’re being gamed is that we don’t know and now you do.

Two Tales Of Success

I’m going to give you two tales of success because you can win a game if you know the rules. Let me tell you about my first story. Hannah was our executive team and as we do with every single member of our advisor teams, every employee and team member at GetFundable.com, we go through a personal optimization process. As we did the analysis on our profile, everything, she needed an auto loan to balance out and create her fundability™. We pulled her myFICO.com credit report. That’s exactly what we recommend for everybody. When you pull that myFICO credit report, you’re going to see all of these versions and all of these bureaus for a total of 28 scores that you can look at and monitor. All of our students, all of our clients and all of our subscribers, if you’re going to use a monitoring service, for health’s sake, get the truth. Credit Karma isn’t giving you the truth. There’s no correlation between, “It’s always a seventeen-point spread between my FICO score and Credit Karma but this one is free.” If you’re looking to be fundable, invest in the truth of your situation.

Hannah goes in, pulls her myFICO, finds that her Equifax is her best scores. She shops around to the people who she had business relationships with already, bankers, credit unions, etc. We have a local credit union here in Salt Lake City and her job is to do the talking. I’m there to backstop because we want all of our team members to be up on this and be able to coach clients and coach students in our bootcamps, etc. She asked the question, “What bureau do you pull?” They confirmed what she found out on the phone because we wouldn’t even go in there. She wanted to use her highest scores. If they had pulled a TransUnion or our Experian, we would have gone to a different lender. They pulled Equifax. The loan officer confirmed it.

She asked the next question, which is next to natural for us and you’re learning how to do this right now, “What version of the credit scoring software do you use?” The loan officer’s like, “I have no clue.” I said, “Could you call the underwriting department and ask which version of the software you’re using because we want to make sure that if we get a loan from you, that we’re doing the best for ourselves and we want to know who you’re using, which of the versions of the software. Is it 542, eight or nine?” She calls up the underwriter and the coolest thing, because I’d never seen somebody do this before, the underwriter talks on the phone and the loan officer’s like, “That’s cool. Thank you.” Hangs up with the underwriter. The loan officer turns the monitor around and up in the top right-hand corner it said EQ5. What does that stand for? Equifax 542.

Her best score was exactly what they were using. She had two acceptable scores because scores can be in a tier, a 705 versus a 715 is not going to do anything to improve your interest or your terms. If it’s in a tier, you’re cool. Two of her scores were in the same tier. When she heard that it was Equifax 542, remember this isn’t her profile. We’re talking about the story. She’s like, “I want to do my loan with you,” because it was within the same tier of her best score. She knew what to ask,” What bureau do you pull? What version of the software are you using so that I know that it’s the right and best loan for me?” That’s the cautionary tale number one. If you’re going to go get a pre-approval, she took out the loan and was able to go buy the car. If you’re going for pre-approvals, then you need to know what version of the software and what bureau they’re pulling and make sure it’s your best savings. That you’re getting the best deal possible.

The next one, this is Brad, my partner in the business and Chief Funding Officer. He’s already been on a bunch of the episodes. He’s a brilliant man, knows this game inside and out. What does he do? His daughter wants a car. I believe it was her graduation and that was her next level of responsibility. Dad was going to help her hook her up. She was paying for it, but dad was all-in in making sure that she was able to get the vehicle of her choice. They found the best purchase price for the desired vehicle in Minnesota, maybe it’s because it was winter at the time and nobody was buying cars. Whatever the facts of the case, the best deal on the car itself he found in Minnesota. He made a deal. This is the next level because you can go get a preapproval, a candidate from a lender or you can use the dealership to do the heavy lifting for you. This is what Brad did and it was genius. He told the dealership, “If you can pull anyone of my experience scores, I’ll let you hook up the financing,” because he knows that there’s a referral fee and this and that and the other. The dealership couldn’t play him by offering a nut because he knew what he was doing.

The dealership wasn’t going to be able to go, “I got you approved by a TransUnion score.” We want to narrow the range. Remember how we don’t want it to be more than twenty points? We want it to be less than a twenty-point range, between your highest and lowest score. Brad’s Equifax scores were literally within a few points of each other. It didn’t matter. They were all in the same tier. He said, “If you can pull an Experian credit report and approve me with that Experian credit report, go for it.” It didn’t matter if it was 542, FICO 8 or FICO 9, they were all close. The dealer said, “I’ll do that.” He let the dealer arrange the financing. He and his daughter literally fly out to Minnesota. The finance was ready, signed, sealed and delivered and they drove the car home together. Those are the two ways. Preapprovals like Hannah or let the dealer manage it. Notice, Brad knew what it took to get the best financing possible and limited the scope of the type of lending that the dealer could go acquire on his behalf. Do you see what happens when the rules of the game?

Go to myFICO.com and subscribe to the credit report and get all your scores. You will see that all of this data is available to you and now you know how to interpret it. You now know how to use it on your behalf. You know what a FAKE-O score is. You know what a FICO FAKE-O score is and you know what FAKE-O FAKE-O scores are. You know what the spread is. You know that a dealership is going to try and sell you. Get you approve by because now you know the rules of this game. This is why we spent some time in the weeds. This is why we’re getting a little technobabble because when you know the rules of this game, you will be able to pick the best financing, the best opportunities and limit the scope of anybody who is trying to get you approved because you know how this game is played.

This is pretty awesome. I love this stuff. Keep bingeing, there is so much to learn and we want you to be able to follow this blog for the hundreds and hundreds of episodes that we’re going to be doing because we’re just scratching the surface. We’re just figuring out how to play the game, not how to master it and every time we’re given the ball to dunk on the lenders. This is Merrill Chandler and I will see you on the next episode.