Just like any relationship, the lender-borrower relationship has its disagreements that can often be solved when both parties reach a mutual decision. As borrowers, we have always felt some bad energy from lenders because at some point, we know they are taking more from us. In this episode, Merrill Chandler discusses a paradigm shift that’s going to change how we perceive lenders and how we can improve our approvals. Shifting our current relationship with lenders, he shares a mindset shift that would allow us to relate with them. Merrill also touches on how personal credit bureaus gather our data and how fiduciary responsibility still makes the lenders the more powerful party in the end.

—

Watch the episode here:

Listen to the podcast here:

Lender-Borrower Relationship: How To Improve Approvals

Distrust Between Borrowers And Lenders

We’re going to be talking about a mindset shift, a paradigm shift that’s going to change how you look at lenders and exactly how you can improve your approvals. We’re going to be talking about what it means to shift the relationship that you have with your lenders. We’re going to change the entire paradigm of borrowers and lenders, how they relate and what’s in it for you if you’re the one to choose first. First and foremost, one of the things that we need to be aware of is that for hundreds of years, lenders have had 100% of the power in the borrower-lender relationship. Over the last few years, those lenders have now empowered, have charged and have transferred the approval authority to the software. We call it Automatic Underwriting Software, Automatic Underwriting Systems, AUS. Lenders lose money when they manually underwrite a loan, credit card, credit line, etc.

They don’t want to do that. They want to make more money and they want to protect themselves from fraud, etc. All of these automatic underwriting systems are developed, are designed to approve you if you match certain criteria. We’ve talked about that before. Borrowers who know what those criteria are, now the software says yes or no, approved or denied or may be approved for a little bit lower limit or a higher limit, but it’s approved or denied. When you know what it takes to get approved, you have 100% of the approval authority. You’re in charge now. We need to understand that with this approval authority in the hot little hands of the software, it gives us a chance to develop a different kind of relationship with the lenders.

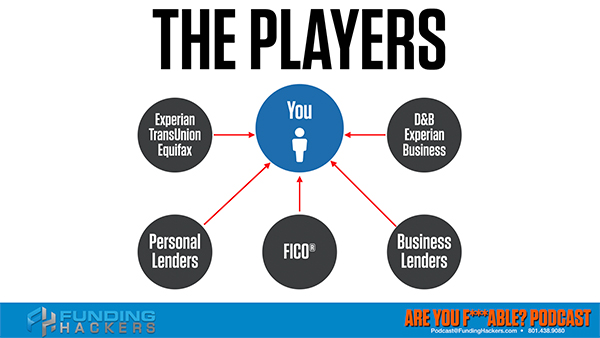

Let’s take a look historically at the players of the credit game. You’ve got the Experian, TransUnion, Equifax. Those are the personal credit bureaus that report to your personal profile. You’ve got your personal lenders or the divisions of these corporations that lend to you personally. You’ve got FICO. You’ve got the business lenders, Dun & Bradstreet, Equifax business credit reporting. They all focus 100% of their attention on you. They’re making money off of you. They’re marketing to you. You are the only player in the funding game who hasn’t had a clue about how the game works and how to win that game. Have you noticed that in the back of your mind, there’s this feeling, the sensation that there’s an adversarial relationship between you and the lenders? It’s like us versus them.

All that information that they have on you feels a little intrusive. It feels a little invasive. They’re measuring our spending behaviors, our credit behaviors so that they can protect themselves from fraud and loss. What if we were to change that perspective? What if we were no longer adversaries? When do lenders make money? It’s only when they lend. It is imperative that they lend in order to make money. We’re setting your goal. Why don’t they lend me money? Because they have to protect, mitigate, and ensure that they do not incur losses. If you’re a private lender, you would do the same thing. You’re going to base all your private loans to friends, family or otherwise, to people that you would trust to return the money and make a profit by it.

When you know what it takes to get approved, you have 100% of the approval authority #GetFundable Share on XLenders only make money when they lend, so they need us. Here’s what’s hilarious. Lenders do not have goals, dreams and ambitions. They have quarterly ROI, Return On Investment, quarter by quarter. They don’t frame their accomplishments the same way you and I do. Your goals, your dreams, your ambitions are the things that drive their profits. If our goals, dreams and ambitions drive profits, how do we create a win-win? How is it that we establish a relationship with the lenders that’s not us versus them? It’s not adversaries. We’re not on the opposite sides of the table, but we’re collaborating on lending. The best way to describe that is by turning this us versus them to a partnership, to create a partnership with lenders. In the introduction to my book, I go into great detail about this. There’s a whole bunch of distrust.

Lenders distrust borrowers because they think we’re liars, cheaters and thieves. We’re going to take advantage of them whenever we can. We’re going to submit fraudulent applications so we can get more money. We don’t trust the lenders because we think they’re going to take advantage of us. I even do an episode that is called “Liars, cheaters and thieves” showing how brokers or lenders are not telling us the whole truth. We have this whole relationship of distrust. The only way to become partners is for somebody to go first. I don’t know how many of you are in a relationship. Somebody has to go first. When you have a fight, somebody has to go first. The thing is the person who goes first frames the relationship.

The Funding Bulls Eye

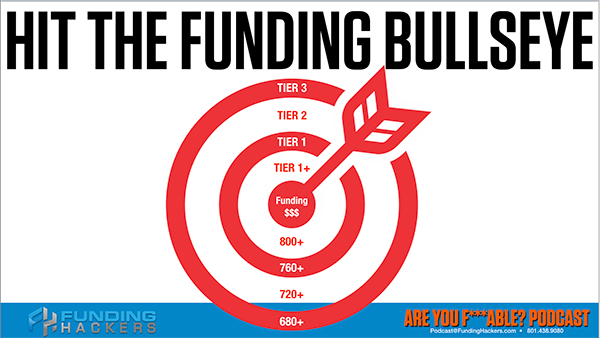

Whether I’m giving you relationship advice now or how to work with your lenders, I’m saying the individual who chooses in first, who comes back to begin to collaborate again, the person who chooses to reconcile, you also get to frame that reconciliation. When it comes to lenders, the way we want to frame this reconciliation is best described by us talking about the funding bulls-eye. When we hit those lender criteria, the approval criteria, they give us money. That’s the bottom line. When we hit the funding bulls-eye, not the outer rings because even though they make higher interest or they may have more fees, they also don’t trust the data as much as when we are dialing in every single data point. We’re filling out those applications perfectly. We’ve cleaned up all of our online data with the credit bureaus, the early warning systems and Falcon.

When we have done our work, we fill out an application and we hit that underwriting bulls-eye, we are doing the lenders a solid, not just us. That’s us choosing into the relationship. When we’re saying, “You can trust us because we have been fastidious about how we have organized and developed all of our data. The way we’re behaving is exactly what you need to feel confident.” When I say you, the underwriting software, even if you bump into manual underwriting because we haven’t got it right yet, the whole point of all those documents is to prove that we are telling the truth. If our behavior tells the truth for us, that’s why we stay in automatic underwriting.

Lenders only make money when they lend, so they need us #GetFundable Share on XWe need to hit the funding bulls-eye. We don’t want to hit those outer rings because there are still problems with the data and those problems will exempt us from being approved or lower the number of our approvals. The easiest way to get those approvals is building a fundable personal borrower profile. We’re going to discuss this in future episodes, step-by-step, every little piece of this. I know it’s a mouthful, but when a lender looks at you, you’re reconciling the relationship. You’re not adversaries anymore. When you come to the table and say, “Here is my data. Feel free to measure it. I am proud of how well I show up.” Over here, we got to know what we’re doing. Every time we file an application, we’re saying, “Check me out. I want you to be able to trust that I have your best interests at heart.”

We’re not saying that in the little notes down at the bottom of the application. We’re saying that with the clarity with which we file that application. Having studied and know what the underwriting criteria, what the approval guidelines are. Every time we submit an app, we’re saying, “Check me out.” The problem is you haven’t known that’s what you’re saying. You’re like, “Please, can I have some money? Here, I’m going to give you the information you need. I may fudge a line here, do a thing here.” We’re asking for money rather than, “Partner, here are my bona fides. I am confident that I have your best interests at heart.”

Fiduciary Responsibility

Do you know what fiduciary responsibility is? We’re going to cover this because everybody puts fiduciary responsibility on the lenders. We’re going to go back and we’re going to do a little bit of math here on some of the other things we’ve talked about. Remember how I said lenders have had all the power in the borrower-lender relationship, but they transfer that power to the software so now the borrowers have power when we know what we’re doing. Think of it this way, fiduciary responsibility is when the more powerful of the parties in a relationship, they have the responsibility to look out for the best interests of the other party. That’s fiduciary responsibility. Take care of the less powerful person in the relationship. Since the power shifted to the borrower, who’s the most powerful person in the relationship? The most powerful party is the borrower.

If you walk into this relationship and you’re like, “Mr. Lender, Chase, Wells Fargo, PNC, BB, whoever, I got your back. My behavior and the way I show up in the world with my personal credit, my fundable business entity, everything about me has your back. I am here to look out for your best interests.” If the power shifted to the borrower, so does the fiduciary responsibility. Ours is the responsibility to take care of the lender and we do that through our behavior. All of these borrower behaviors that are being measured, when we pay our payments exactly the same way, when our reporting date synchronizes with our due date, when we’re carrying the perfect balances to let them know that we are responsible and treat their money with deference and respect.

Lenders do not have goals, dreams, and ambitions. They have ROI quarter by quarter #GetFundable Share on XWhen we have a fundable entity that says, “Your money is safe with me in this entity.” When we can tell them that through our behavior and our data points, the lenders are like, “You got it, partner. You deserve my money because look at all your behavior, you treat it with deference and respect. I’m willing to give you not just some, but more and more.” We’re back to the manual or the automatic limit increases. Every six months, twelve months, new money, more money, because our behavior says it’s safe to give us more money.

Parable Of The NBA Draft

The way I’d like to weave this is the parable of the NBA draft. Let’s say that you are one of those spectacular players coming out of high school. You don’t even have to play college ball because you are a badass on the court. You learned early and young not just the rules of the game, but every time you get the ball, you score. It may be evident to everybody, but I’m going to outline the ball is the credit lines and credit instruments that lenders give you. The team owners are the lenders. They’re looking for borrowers. They’re looking for players who they can trust to not just play on the team but to give them the ball to score. Every time we score that is a return on their investment. It’s a return on your investment. Notice when a scout goes out and looks for you, what they’re looking for are your stats.

Those are your data points. It isn’t just your team win the game or not. It’s how do you show up in all the ways. How often do you foul out? Are you reckless? Do you push the envelopes? Are you the ten-second player? When you’re on the sidelines, ten seconds left, we want to make sure you get the ball because you’re going to have the highest likelihood of scoring. This entire parable, this entire analogy is dependent on you knowing how to play the game to win. Lenders are going to scout you out using all of your data. The way you do that is through your applications, through your borrower behaviors, through all of the FICO 40 and all of the underwriting criteria that lenders look at. They want to win their games. They want to win the championships.

That’s what lenders do but they’re in it for the long game. The Jazz, Bulls, Maverick, all these teams have been around for decades and decades. Players haven’t. Players come and go, but these team owners are in it forever like the lenders, banks and financial institutions. They’re in this forever. They’re looking for the next player to play this game and get them the next championship. They direct the managers. They direct the teams, “Give him the ball.” Every time we get a new credit line, every time we get a new commercial loan, every time we pick up a new real estate loan, every time we pick up more money, we score because we’re spectacular at the game.

I love this metaphor because they are scouting you. They want you on the team. The only way that you can even raise their eyebrows is like, “Have you seen that New Jersey borrower? They are amazing. Look at their stats.” Are you F*able means are you a baller? That’s the bottom line. Do you know how to get the ball and score? Are you a team player? Do you look out for the best interest of the team? How many times have we seen situations where players have done things in their personal lives that not just cast a shadow on the team, but ruin the chances for championships or they don’t get to play or they’re out of the season or financial injury? We don’t know what we’re doing so we have financial injuries, the bankruptcies, the late pays and all the things that knock us completely out of the game for the rest of the season.

They want amazing players representing their teams. Now because you are bingeing how to become fundable, you’re also studying how to be draftable, how to be the first-round draft choice of any player that submits their stats to the team. I don’t want to beat the daylights out of this metaphor, but I already have. Think about it. Do you want to play for all the tier-one, tier-two institutions? Everywhere we’re going to get these credit lines, these commercial loans, they’re huge teams that have lasted forever. They’re doing something right. They know how to make money on their money. They’re looking for players. If we’re a first-round draft choice, we’re also making our millions. They are giving us the opportunity when they give us that ball to raise our numbers and improve our profits, our prestige, the legacies we get to leave our families and loved ones, the time freedom and the money freedom that we get as a result of being a first-round draft choice in the funding game.

Learn the rules of the game. This isn’t rec ball. This is not a pickup game in the streets. This is pro ball. My job is to teach you how to be a pro baller. I’m the coach on the sideline that can only jump up and down and scream at you, but I know how to make you an amazing baller or an amazing player. How you can leverage your skills so that when you shoot, you score on every credit line, every commercial loan or real estate loans. It does not matter the credit instrument. When they trust you, they will give you their money. The way they trust you is by you showing up with your stats. I will teach you everything you need to know about how to improve your stats so that they look at you and say, “That is a number one draft choice.” It is amazing to spend this time with you, inspire you and motivate you to become the professional borrower that you were meant to be. We only lack knowledge. I will see you in the next episode.

Important Links:

Love the show? Subscribe, rate, review, and share!