How can you have authority over your personal approval? Merrill Chandler reveals some insider secrets to the new source of funding approvals. These days, applying for credit lines, loans, or mortgages can be daunting as the borrower. However, when you shift the power from lenders to you, approvals can be attained rapidly. To fully learn how to power shift, you must understand the underwriting process. He gives a thorough explanation about manual versus automatic underwriting, as well as how you can increase fundability™ and emphasizes the importance of knowing what to put on application forms for faster approval. He also discusses what average utilization is all about and how it is calculated.

—

Watch the episode here

Listen to the podcast here

Manual Versus Automatic Underwriting

We’re going to be discussing a huge shift that’s happening. We’ve alluded to it previously, but we’re going to be talking about a massive shift that has occurred that gives you all the authority over your own approvals. I’m here to tell you that we’ve talked about paradigm shifts before. We’ve talked about becoming partners with lenders. We’ve talked about understanding the insider secrets to the entire funding game. We’re going to talk about the details. We talk about deep dives. This is not skipping stones across the 700-foot lake. This is a full-on deep dive and it’s about the insider secrets to the new source of funding approvals. When I say new source, I’m talking about the same funding approvals: business lines of credit, commercial loans, real estate loans, everything that you are applying for and either getting rejected or being required to give full documentation. We’re now going to be talking about this power shift.

The Underwriting Process

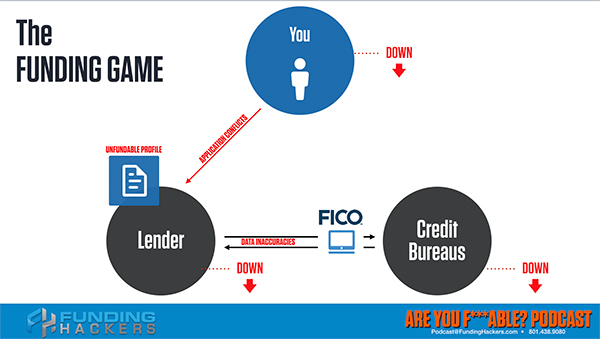

First of all, we need to understand the underwriting process. What is it? Underwriting is a big term simply for what we call the credit approval process. We’ve shown that when we discuss the funding game, the credit approval process requires an application to the lender. The lender fires off the inquiry to the bureaus. It gets filtered through the underwriting software and it comes back. Once they have all of those credit scores and the data, then it goes into the underwriting software. That underwriting software is the new version of underwriting. We call it the AUS, the Automatic Underwriting Systems. There are two types of underwriting. There’s the manual and then there is the automatic. For hundreds of years, it’s always been manual underwriting. By manual underwriting, we’re talking about, “I need proof that what you put on the application is true.” Think of it as proof.

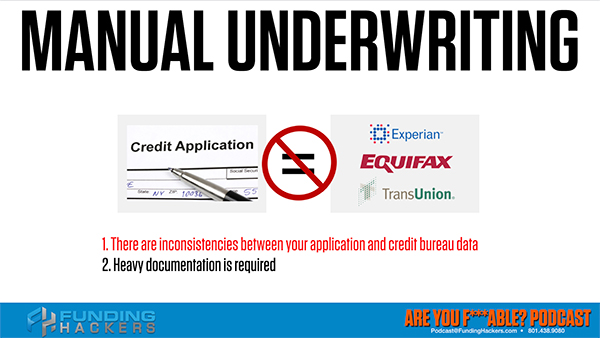

Manual Underwriting

Automatic underwriting doesn’t need proof from the external world like tax returns, financials, pay stubs and proof of employment. It doesn’t need those things. What it needs is to measure your borrower behavior. Let’s go through a manual underwriting first to see how those tranches done for hundreds and hundreds of years. There are two parts to manual underwriting. The first one is where there are conflicts between your application and the credit bureau data. Let’s look back at what we’ve talked about before. When we apply, we fill out an application. It goes to the lender, it runs to FICO and it comes back. What do some of those things look like? Because we’ve said your fundability™ goes down every time there are application conflicts, but what do some of those conflicts look like?

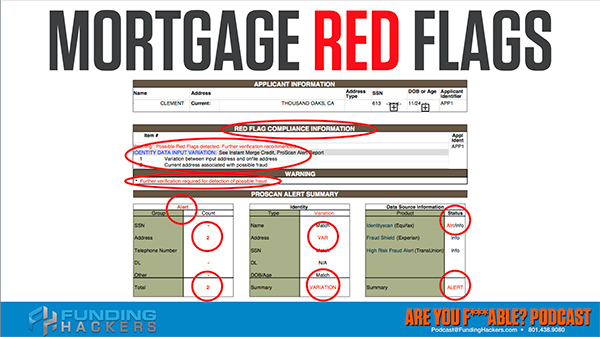

Let’s look at the mortgage. I don’t know if you have done a mortgage, but that mortgage is a key indicator for the health and well-being of your profile because it pulls all three credit profiles from all three bureaus. We’re looking at mortgage red flags. We’re looking at the top half of the first page of the mortgage application. There’s a thing that pops up that says, “Red flag compliance information. Warning. Possible red flags detected. Further verification recommended.” When you hear verification, what you should be hearing is manual underwriting. It says, “Further verification required for detection of possible fraud.” They’re already dropping the F-bomb, the fraud bomb. We look down a little further to find out what it is that’s possibly fraudulent and it says the address. There are two addresses.

It’s saying that there’s possible fraud because there are two addresses listed on this borrower’s profile. For those of you who’ve already gone through and pulled your MyFICO.com credit report to look at all your scores and everything, you have three, four, five. Some of you have a dozen variations of your identity and your name. This is saying that’s possible fraud because there are two. That’s insane. That’s just crazy. There’s an address variation, summary variation alert because there are variations to the identity. Variations from what? Variations from what you put on the credit application. Not just variations on the report itself, but you wrote it down. Remember, they’re looking for fraud. You’re a liar, cheater and a thief until you have proven that you are their partner.

That’s just the nature of the business. We’ve been liars, cheaters and thieves to lenders for the same hundreds of years. That’s why they require proof. When we get what underwriting is all about and this power shift to automatic underwriting, the whole game changes. No more proof. 100% behavior. Having two addresses is possible fraud. Our fundability™ goes down when there are application conflicts. Our fundability™ goes down when there are data inaccuracies between all three bureaus. Our fundability™ goes down when we have an unfundable profile. This unfundable profile is the bottom line. FICO doesn’t give us the approvals. The credit bureaus don’t give us approvals. The lender gives us the approvals and those approvals are based on the fundability™ of your profile. Think of it this way. Remember how we said that credit score is the third or fourth most important funding criteria. We’ve got a lot of comments and feedback. People are writing us on our Facebook pages and they’re asking, “Tell us more about what this means. What does it mean that score is the third or fourth?”

Think of it this way. The first three criteria have to do the quality of your profile, your limits, your balances, your utilization and the actual quality of the accounts. What tier and what value? What are the quality of your profile and the 24-month lookback period? The score comes in to determine how much to give you in the approval and the rate, the interest rate, the fees. The higher the score on a fundable profile, then the less expensive it’s going to cost you and the more they’re going to award you. We said that to get the $500 that the revenue score predicts, we have to have a 760. A 760-credit score is going to create two or three times larger credit limit. I’m harkening back to that. The bottom line to this is that score contributes significantly to your rate and your terms and how much they’re going to approve you for. Whether or not you get approved is based on that 24-month lookback period, quality of profile and your borrower capacity. That is what makes you fundable. How much you get is on the FICO 40 and the score.

Remember that your score can go down based on application conflicts. Your fundability™ goes down if the credit bureaus have bad data between the bureaus, poor reporting between the three bureaus. Your fundability™ goes down if your profile is not fundable. We go through a huge list of all the ways you can be unfundable: too many inquiries, too light a profile, too young, too much available credit, too many accounts. It’s a big list of ways that you can be unfundable. Because there are inconsistencies in your application, then and only then is heavy documentation required because that documentation is designed to approve. It’s designed to prove that you are telling the truth on your application.

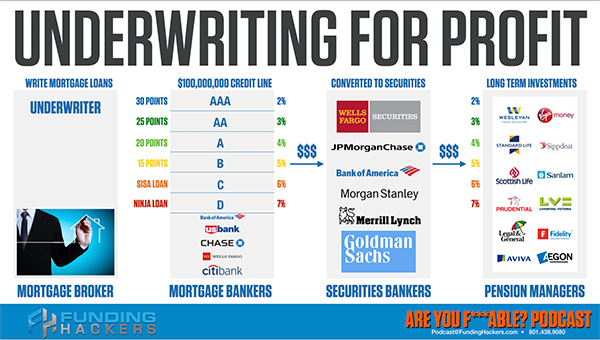

Fundability™ goes down when there are application conflicts, data inaccuracies, and an unfundable profile #GetFundable Share on XWe’re going to take a little bit of a different bent on this because we’re going to talk about why mortgage underwriting takes so long and how we are getting played. In a different section, we’re going to be talking about auto dealers, how they live on the spread. How are they using those different FICO scores to make a profit? We talked about the car dealership one. Now we’re going to talk about the mortgage loan. There are mortgage brokers. Mortgage brokers have loan officers. Their job is to write loans. The next column we have are mortgage bankers. These are the guys who give $100 million credit lines to the mortgage brokers. They trade dollars for loans. The mortgage bankers and all the big banks, credit unions even have these $100 million credit lines given so that a broker can fill those all up.

There is an underwriter that is in charge of each mortgage broker, at least one underwriter for each mortgage broker. For the bigger mortgage brokers, those underwriters are usually in-house, but they don’t work for the mortgage broker. They work for the banker. Their job is to make sure that every loan that comes in gets approved and fits the underwriter guidelines. In this case, we’re talking about Fannie Mae and Freddie Mac loans. When we talk about mortgages, we’re talking about ones that pass what are called conforming mortgages. They conform to the Fannie Mae and the Freddie Mac rules so that they can be sold later. These mortgage bankers sell different levels or quality of mortgages. When you look at it, those trenches are all broken up. They could go from AAA, AA. There’s A, B, C and D paper. This is what’s important because we’re going to go back to automatic underwriting to cover this. I want you to understand how underwriting works.

Let’s say you got 30 points in underwriting. You had a spectacular profile, a great income, great down payments, great everything. Let’s say that you’re knocking it out of the park. To get AAA, you need 30 underwriting points. To get AA, you need 25. To get A paper, you need twenty points. B paper is fifteen points and then a SISA loan, a Stated Income/Stated Assets loan is C paper where you’re saying this is how much you make, they don’t check. There are NINJA loans. These were popular in the debacle of the mortgage crisis. In the run-up to the mortgage crisis, they were called NINJA loans or No Income, No Jobs or Assets. That’s classified as D paper. You don’t need points because it’s Stated Income and No Job or Assets, but you’re also ranked with C or D paper. What happens is that loan package of $100 million is broken up and it’s filled by brokers of all these different levels of quality of loans. Each one of those tranches can be sold by level to securities bankers.

Many of the securities bankers are also the Wells Fargo, Morgan Stanley, JP Morgan Chase. They are part of this process. Those dollars, there are different interest rates provided for each of those qualities. In this case and remember, these are just numbers that we’re using as an example. AAA paper will get a 2% return as a security, as an investment. AA paper gets 3%, A paper gets 4%, B gets 5%, because the higher the risk, the higher the return on the investment. The securities bankers bundle all these different tranches into securities. Those are sold to long-term investments. It can be pension funds, security funds, insurance companies, everybody who’s looking for long-term investments because these mortgages are 30-year mortgages. Some are fifteen; some of them are variable interest. That’s what the tranches are for. Whatever type it fits in, it’s designed and developed to fit a certain grade of mortgage. Here’s what’s fascinating.

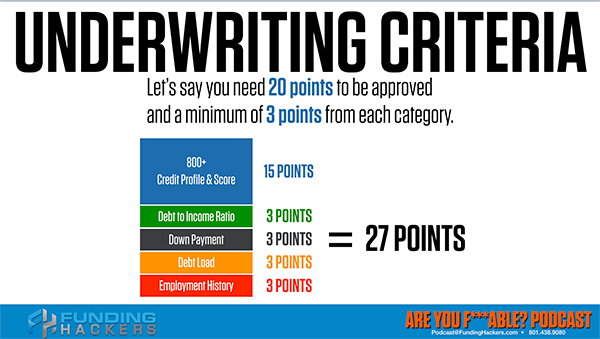

Once it comes over to the long-term investments, those long-term investments are 2% to 7% interest for the yield on those mortgages. We’re going to go back to underwriting because it’s vital. Let’s remember that twenty points is A paper. AAA paper is 30 points, 25 points for AA and that there are corresponding higher levels of interest the lower the grade of paper. A paper makes less for the investors than AAA. Let’s go back to your experience of a mortgage. In underwriting, let’s say you need twenty points to be approved. There have to be three points from each category. Let’s say with employment history, you need a minimum of six months or a year. You have to be employed for a minimum of a year to get those three minimum underwriting points. Your debt load, unsecured debt can’t be over $20,000, let’s say. If it’s under $20,000, you get the minimum points. Down payment, let’s say that the minimum is three points and you need 3% down to pick up those three points. Debt-to-income ratio, let’s say you have a 35% debt-to-income ratio.

You get three points for your debt-income ratio and then the quality of your profile and the score. Let’s say it’s a 740 for a mortgage. At 740 credit score, you get the minimum of the three points. The problem is that those only equal fifteen points in underwriting. In manual underwriting, this is all calculated by hand. In automatic underwriting, it’s calculated in a nanosecond. Notice if we have all of those minimums, a year of employment, less than $20,000 debt, 3% down payment, debt-to-income ratio is 35% and credit score and profile is 740, that equals fifteen points. To get to twenty points, to get A paper, to get a good rate on your mortgage, you need another five points.

That means you’ll get more points if you’ve been employed longer than a year. You’ll get more points if your debt load is less than $10,000. You’ll get more points if you put 10% down instead of 3%. If your debt-to-income ratio is 30% instead of 35%, you get more points. If your profile is a 760 or 800, you’re going to get more points. Between our credit score and everything else, we love that when you optimize your personal profile, you can create a higher yield. You can keep the minimums because you’re increasing. As long as you hit those minimums, underwriting software doesn’t care where the other points come from. If we’ve improved our score and we have a higher quality profile, a seriously fundable profile, we’re going to hit that. Here is how manual underwriting works. Here’s the problem with underwriting. How many of you have taken a month or two months or three months to close on a mortgage? How many of us had just a serious problem because it’s taken so much time?

How many of you have gone to a mortgage broker and literally said, “I’ve got all my paperwork. What do I need so that we can get this done as fast as possible?” You say, “I’ve got an extra 5% from Aunt May, a gift I can add to my down payment. I’ve got a verification of employment. I can pay off my debt so I can have a better debt-to-income ratio. What do you need me to do right now? I want to give you everything so we don’t have to waste time.” What does the loan officer invariably say? “Let’s take your application and see what’s next.” Your application may be fine. He or she is implying that automatic underwriting is possible. We need twenty points for A paper, but remember, 30 points was AAA paper.

Underwriting is a big term simply for credit approval process #GetFundable Share on XLet’s say two weeks go by or a month goes by and they’re like, “We do need that verification of employment.” You’re like, “Why didn’t you tell me two weeks ago, a month ago? Here it is.” They come back and then they say, “Can you pay down that debt so we can lower your debt-to-income ratio?” “Why didn’t you tell me to do that a month ago, six weeks ago? Why are we wasting so much time?” Have you ever asked yourself that question? Why is it such a pain in the ass to close a mortgage? I will tell you exactly why. It’s because they just want to get these points up enough to get you off their back about your rate. They want to hit just enough points to hit A paper because twenty points is A paper and you will be happy and you’ll close that loan. If you would’ve gone to the next level, get 27 points, you would be over the AA and you’ve pushed even further. If you gave them enough documentation and enough proof to get you over that 30 points, then you’re still going to have A paper when it comes to your costs. If they submit to the bankers AAA paper, that is only worth 2% interest to investors, not 4% interest when they barely get past the twenty-point underwriting threshold. We got to understand this.

The reason why they check in and grab one new thing at a time is that if they take it all, they have a responsibility to use it all. They can’t take it all in and pick and choose. “We didn’t need this stuff,” because then that is bad faith in the loan. They ask for one thing at a time to raise these fifteen points until they hit twenty. You get A paper, but as we showed, 25 points, they make less money when they sell that to the insurance companies and the pensions. If you go all the way to 30 points, they have to use the documentation. You’re getting AAA paper so they make less money. They’re wasting our time and wasting our resources in order to hit the bare minimums to get you what they need to satisfy you for A paper. You got the best rates possible, but there is more to this game than you having the best rate possible. They’re making less money the more documentation you give them.

Automatic Underwriting

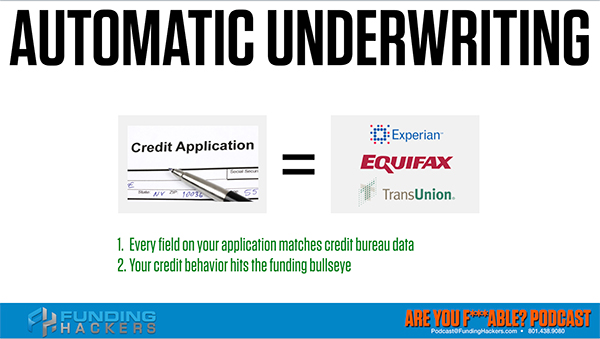

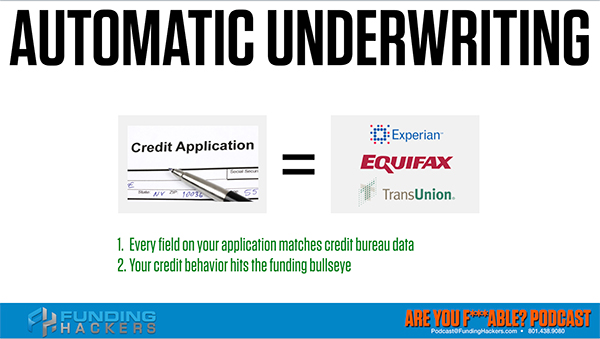

This is naughty. This is us getting played. Forewarned is forearmed. Unless you know a mortgage broker, a loan officer who will play ball with you and will accept all the documentation, you have the ability to tell them you know this game and then try and play the game to the best of your ability. Remember, you may not get a lower rate for having that AAA, so it doesn’t go against you. You’re not losing money by being AAA paper, they are. I’m here to tell you and pull back the curtain just like we’ve talked about. This is complete bs and I want you to be aware of it. Let’s go to the next point. How does automatic underwriting work? It’s the opposite of manual. Every field on your application matches the credit bureau data. That information is vital. They don’t need proof if they can look at your behavior, measure your behavior, check all the databases, check the credit bureaus, check early warning systems, check Falcon, check for fraud, check everything.

When they do not need proof, you’re going to stay in automatic underwriting. Every field on your application matches the credit bureau data and your credit behavior hits the funding bulls-eye, not one of the outer rings where your utilization is 17% where you have tier two and tier three credit cards. There are many behaviors that you’re going to learn about as you continue to binge this information. Those two things, your application has to match exactly. We’re going to talk about how to fill out the application. Every field on your application matches the data and your credit behavior hits that funding bulls-eye. Remember, everything is about predictive analytics. That’s what FICO is. FICO is not a credit score company. As we’ve discussed earlier, there are 83 different credit algorithms for different industries. 28 of those are consumer-facing credit scores. Some of them are lender FICO scores and some are those FICO FAKO scores that we’ve discussed. How would you like to go through an automatic underwriting for personal credit and one for business credit?

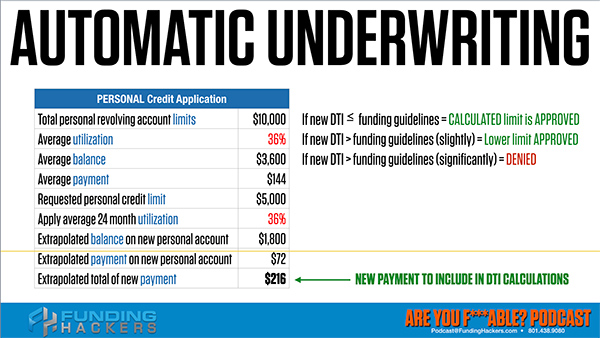

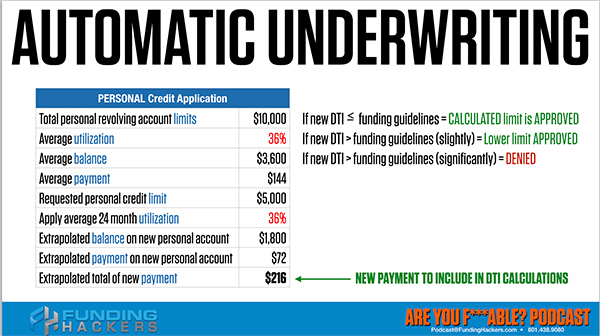

These are examples. Think of a pie chart. Your profile is a pie chart. The pie chart information that I’m sharing with you may be true to the 95th to 97th percentile. The size of the pie may vary based on your profile. I’m using examples of how it works. This is not the from the FICO algorithm. This is the approximations in a general understanding because FICO applies those algorithms to every single profile independently. The size of the pie changes by your profile, the type of profile you have, but the fundability™ principles we’re talking about are spot on. Let’s go over a personal credit application. Personal credit card application. Let’s say all of your personal revolving account limits, all your credit cards total $10,000. Remember how we say that credit scores are third or fourth and the first three or so are based on other guidelines? I’m going to show you what those guidelines are. With total personal revolving account limits, let’s say it’s $10,000.

Your credit cards, it doesn’t matter, but let’s say you have a $7,000 and a $3,000, a total of $10,000. They go back to your 24-month lookback period and see what your average utilization has been for the last 24 months. It doesn’t matter if it’s been zero and it’s been 90%. They’re going to look at the average utilization, the total utilization every month on average. Let’s say in this example that it’s 36%. We took one of our team members to get a car loan. Their recommendation was it’s as long as you keep your balances under 36%. 36% is not a fundable balance, but that’s their company policy. As long as it’s under 36%, you’re good. She’s talking about average utilization.

That’s not okay. You’ll learn in the next few episodes what acceptable utilizations are. Average utilization, let’s say you don’t know what the rules of the game are, so you’ve been carrying 36% on average. The average balance in dollars of $10,000 would make that $3,600. You’ve been carrying a balance on average over the last 24 months of $3,600 and the average payment on that, let’s call it $144. You’re asking for a new personal credit card of $5,000. Here’s automatic underwriting. What they do in a nanosecond is they take that new $5,000, multiply it by the average 24-month lookback period utilization, which was 36%. They take $5,000, multiply it by 36% and extrapolate a new balance on that new account saying, “This is their habit. This is how they treat money.”

They’re measuring behaviors. This is how they treat money over the last 24 months so that we can count on them charging up this new card to $1,800. The new payment on that new account is $72. The total new payment from the $10,000 current and the average utilization is $144 plus the new $72 is $216. If the new debt-to-income ratio is less than the funding guidelines, then the requested limit is approved. They’re like, “$5,000 it is.” It’s all done in a nanosecond. The new payment to include in those DTI calculations, the limits are approved if it’s less than or equal to.

If the new debt-to-income is greater by a little bit than those funding guidelines, it’s approved but a lower limit. This is where your score comes in. The amount you’re being awarded is based on your score. The interest rate that they’re going to charge you on that line is based on your score. This entire calculation has nothing to do with the score. The $10,000 utilization, the 24-month lookback period, the approval is not based on the score. The limit and the interest rate are based on that. Finally, if the new debt-to-income ratio, meaning I can afford this payment, is greater than the funding guidelines significantly, then I am denied. You are denied. These are how they calculate.

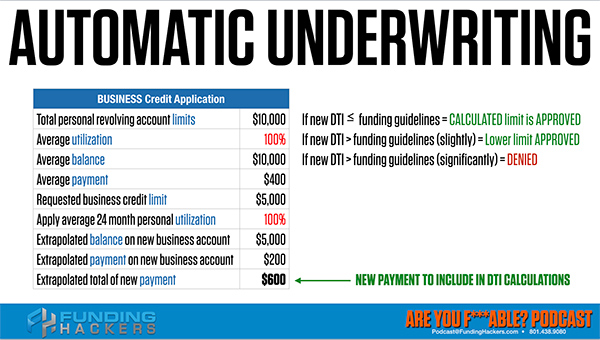

There are a total of 40 metrics, but I’m giving you how automatic underwriting works. They calculate all this stuff on your behavior over the last 24 months. Add another two dozen additional metrics and now you see how this process works. Knowing how this process works can also help you understand how to get the highest limits and the lowest costs. That is for personal credit. It’s different for business credit. Let’s take a look at that example now. On business credit, let’s say we have the new $10,000. It says personal revolving accounts. Remember how he said that 80% of all business approvals are based on your personal profile.

You are killing your fundability™ with a lender if you go into your overdraft account #GetFundable Share on XHere’s an example of that. My personal accounts are $10,000, but I’m applying for a true business credit card. Your average utilization, now they don’t do the 24-month lookback period. They artificially max out all of your personal credit limits. They artificially max out all those $7,000 and $3,000. They artificially max out for these calculations. They say, “What’s 100% utilization?” That balance is $10,000. They’re saying the payment on that $10,000 is now $400, whereas before it was $144. They’re saying that this 100% of the $10,000, we now have a $400 payment instead of $144 payment requested business credit limit. We’re asking for personal limit, but they’ve been calculating the data on our personal profile. The requested business limit is $5,000. They max out that new $5,000 to 100%, which means that we now have a $5,000 balance and that $5,000 let’s say is a $200 payment.

Instead of $216 to get approved for business, they are maxing all of these out and we now have a $600 payment. It’s the same thing. If the debt-to-income ratio can handle that easily, the requested limit is approved. If the DTI is barely above it, they will get higher interest rate and or lower limits. If the new DTI is significantly higher than those guidelines, then you’re going to get denied. The difference between personal and business is with the personal, you have to be able to handle a $216 payment as part of your debt-to-income ratio. Business, you have to handle a $600. There’s a big difference when applying for credit. There are 40 underwriting criteria that FICO uses. There are 40 checks on your behavior, not just the two or three that we’ve examined in this example. Let’s talk about automatic limit increases. Remember I asked how many of you have gone through automatic underwriting and got a 30-second to two-minute approval?

Automatic Limit Increases

You were put on hold if you did it over the phone, all of a sudden they came back. They’re like, “Congratulations, you’re approved.” If you did it online, you get an email a minute and a half later that says, “Congratulations, you’re approved.” That’s automatic underwriting. We’re going to talk about the automatic limit increases. That’s where you have received an email or a letter from your credit card issuer or from your lender saying, “Congratulations, you got free money. We didn’t pull your credit. We didn’t check for income verification. We didn’t check employment verification. We didn’t check your taxes or your financials.” Your borrower behavior triggered an automatic limit increase. You don’t know why. You don’t get to say, “It’s because I pay my bills on time.” Like I said earlier, paying your bills keeps you on the team. It doesn’t put you in the game and it certainly doesn’t give you the ball and it certainly doesn’t let you score. Paying your bills on time simply keeps you on the team. There’s a lot of room for opportunity and growth there.

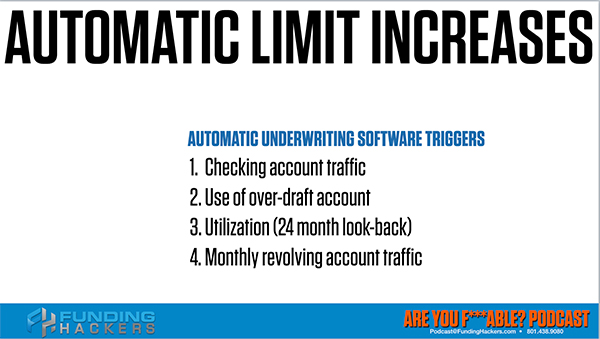

Automatic Underwriting Software Triggers

Let’s talk about what they’re checking for automatic limit increases. The automatic underwriting software triggers the following. There are others, but these are the big ones. If you’re not towing the line on these, you’re not going to get automatic limit increases. The pie is bigger, but I’m giving you what the pie chart looks like. It varies significantly by borrower profile. Automatic underwriting software triggers, checking account traffic and this applies to personal or business. How much money do you have going through your checking account? We have an entire episode on what we call a bank rating. We call it depositor ratings because you’re being evaluated as a depositor. Banks call it bank ratings. It’s the rating they’re giving depositors. Your average daily balance impacts your fundability™. Average daily balance impacts automatic limit increases. It triggers them.

Next is the use of an overdraft account. Sky is my producer and she’s the content manager. She is in charge of making sure that we stay on schedule and giving you enough binge worthy-content. Every single member of my team builds their fundability™ as part of their job description. We spend time and energy on every single individual in our team to make sure that they’re building the best possible personal profiles. I have Millennials who are already creating QFEs, Qualified Funding Entities, that will create an opportunity for them to have a fundable entity in the future. They’re already making it happen. They’re already doing it. This is one of those things that Sky was headed to do.

One of her profile optimization requirements was to get a car loan and she wanted a car loan. It was a great confluence of circumstances. She goes to the loan officer to get pre-approved on an automobile. She had picked out the car and I’d been able to coach her through this, but she met with the loan officer herself because that’s one of the things we want everybody to do is build the confidence to be able to talk to lenders on their own. Even if I were coaching you, I’d still make you go visit them yourself and take notes. One of the things that she was offered is a $500 credit card as part of this transaction. It was a good credit card, but she was also offered a $500 check guarantee card, an overdraft account. In our consultation, I asked her, “Have you ever been close to zero? Is that a thing for you? Do you punch through? Have you used overdraft accounts in the past?” She goes, “No, I never have been close.”

Do not get an overdraft account. Here’s why. It’s a line of credit. It’s usually a small line of credit, $500, $1,000 to protect you against bounced checks. Here’s the problem. While it may save you that $25 to $35 bounced check fee, you only use it when your checking account is below zero. FICO doesn’t measure the use or utility of an account unless there’s traffic on it. You’re at odds. We call it a double bind. These two things cannot be true at the same time. If you use the overdraft account, you get credit for using that account. To use that overdraft account, you have to be at zero on your checking account. Your relationship with the lender, remember they’re grading you by your average daily balance. If you go into your overdraft account, you are killing your fundability™ with that lender.

The recommendation to all of our clients if we’re opening up new accounts is not to get an overdraft account. Don’t do it because we don’t want you anywhere near zero because as someone who is fundable, someone who is owning their fundability™, we want to have good average daily balances and we never want to use the overdraft account. Every single time you use that account, it drops your fundability™. The other automatic underwriting software triggers are the utilization. What is your utilization? In the last one, we talked about 36%. It doesn’t matter that it was zero for eighteen months and 90% for six months. They want to look at the overall average over the last twelve months because that average is your behavior markers. That’s what we talked about. They’re measuring your behavior. You and I either go full doc and prove up or you can give them behavior that they trust, stay in automatic underwriting and have significantly higher approval amounts of limits and loan amounts and have significantly lower interest rates. What they’ll ask was monthly revolving account traffic, whether it’s on business or on personal, whatever instruments you have open, they’re measuring traffic.

The bottom line here is that lenders make more money off of credit card swipes than they make off of interest. Swipe, that’s where they make their money. That’s why the automatic underwriting software trigger, one of the big ones is how much money are you running through your account? How much are you charging? I don’t care if you charge it and pay it off, but they’re counting how many dollars you’re swiping. They also don’t want you to have high utilization, which means multiple payments. Just remember, monthly revolving account traffic. How much are you putting on your credit cards and paying off? Because the more you swipe that card, the more valuable you are to them. They’re going to raise your limits automatically.

Let’s say you’re always using 10%, but you use that 10% over and over every single month and pay it off. They’re going to raise your limit because you have proven over the 24-month lookback period or three months, six months, twelve months and 24 months that you’re swiping 10% or 20%. That’s safe for them. If you’ve got a $5,000 credit card and you’re always doing 10% to 20% and then they raise that limit to $10,000 and now you’re putting $1,000, $2,000 a month, they’re like, “This is looking good.” It goes from three months to six months to twelve months and 24 months. They try $20,000 and then you still keep doing that 10%, you are a golden child. You are the perfect customer because you keep staying within the safe margins of the limit, but you swipe on that credit card. They will raise your limits if you protect their interests and hit those automatic underwriting traffic guidelines.

Let me summarize. For hundreds of years, lenders have had 100% of the power in the borrower-lender relationship. To approve you, they needed proof that what you put on your application was true and they wanted documentation out the wazoo. Over the last few years, they have written software and given all of that approval authority to the software. They lose money if a human being looks at your application. If they have given all approval authority and they don’t want human beings involved in the process, then all of that approval authority resides in the software. If you and I know what that software needs to approve you, who now has 100% of the approval authority over every single loan or line of credit that you do for the rest of your life? You do.