Everyone in the funding world has their own goals and motivations for their actions. Sometimes because of this, friction is created that so often impact people’s fundability™ and credit approvals. In this episode, host Merrill Chandler introduces these funding game players and exposes their secret motivations. To win in this funding game, you need to get to know who you are up against. Together with Merrill, we take a deep dive into who and what they are all about.

—

Watch the episode here

Listen to the podcast here

Players Of The Funding Game

We’re going to be talking about how the secret motivations of the funding game players are affecting your fundability™. We’re going to do a deep dive and reveal how these motivations are impacting your fundability™ and your credit approvals. We’re going to be talking about the secret motivations. When I say secret motivations, I’m simply saying that every one of the people and institutions that we’re talking about has a particular “come from.” They may be protecting their intellectual property. They may protect their secret sauce. They may not want to reveal all of their lending guidelines to us, the borrowers. We’re going to do a deep dive into not only who the players are but what they’re all about. First and foremost, one of the greatest things that you have to understand if you’re going to play the funding game to win is that there are different players doing different tasks. Most of us, before I knew, maybe even before this episode, you didn’t even know who’s doing what.

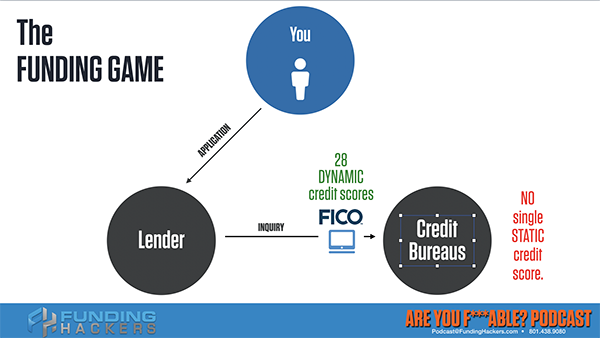

Credit approvals always come from lenders #GetFundable Share on XIf you did know, if what we talk about sounds true or rings true to you, how much have you paid attention to it and operated from this paradigm, from this perspective? Let’s take a look at the three main players and what they do. First of all, there is credit reporting and credit reporting is done by credit bureaus. We call them credit bureaus for ease of reference because there are dozens and dozens of what are called consumer reporting agencies. There are all types of them, but there’s only one group of those consumer reporting agencies that deal with your credit files. We call them credit bureaus. Credit reporting is done by bureaus. Credit scoring is done by FICO. There are a bunch of FAKE-O scores out there and you’ve got to know what’s going on. The difference between FICO and FAKE-O scores, but there are FAKE-O scores that are also done by scores that are not being used intelligently.

Funding Game Players: There is no such thing as a single static credit score. Your score is a dynamically produced process that goes through filtered software.

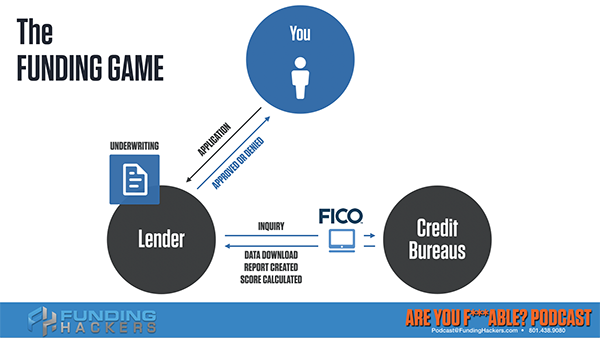

There are other players out there that I call FAKE-O score providers that use scores that are not associated with lending decisions at all. What we need to remember is that bureaus report credit scoring is done by FICO legitimately for lending decisions. The final one is credit approvals. Credit approvals always come from lenders. Lenders always do the credit approvals. Those are the three activities. Let’s take a look at what the relationship is now between those. First of all, there’s you, the borrower and then you file an application to a lender. That lender sends an inquiry to the credit bureaus as we’ve learned in previous episodes. They check your information and hopefully you put together your credit identity, but in this case, FICO software is used to filter that inquirer.

The single most important thing of your fundability™ is staying in automatic underwriting #GetFundable Share on XRemember how I said that it was vital that your application data match your credit bureau data because FICO is the software that is resident on the credit bureau computers and filters for all of that data. The bottom line is that the inquiry filters through the FICO software. There are a couple of things that you got to understand. There’s no such thing as a single static credit score. By static, I mean like a permanent, there’s not a field inside of your credit profile or the credit bureau databases that is labeled score. Your score is a dynamically-produced process that goes through filtered software. There are 83 different versions of FICO scoring software depending on what you’re doing.

There are 28 consumer-facing scores. It depends on the bureau. It depends on the version of the software and all things. You got to understand that your name, address, phone number and score, the score is not one of those fields in the credit bureau databases. Once we know that, then we can start understanding that scores are calculated in real-time upon the submission of your inquiry, the application. The lenders send the inquiry data through the FICO software and that’s when you get a score in real-time right there. That dynamic software is in play 100% of the time.

Once the credit bureau data has been filtered, the data is downloaded, your score is created. That dynamic on the fly score is created and you are in a position to get that what we call a credit report. A credit report is simply a piece of paper or a PDF of your profile caught in a moment and that’s why real-time scores are important because it’s being downloaded at that moment. It goes through underwriting and once you’re through underwriting, the lenders take the score, take the data, take your application and put it through their Automatic Underwriting System, AUS. I’m going to refer to it all the time. The AUS evaluates and then they approve or deny you. The lender is the one who approves or denies you and it’s based on those three main things.

Number one, the evaluation of the quality of your profile and the application information and your.0 credit identity to make sure they know who is actually applying and who they would lend the money to and then the FICO evaluation. We’ve talked about it before, FICO evaluates 40 characteristics of your credit profile. All of those things are done within that 30 seconds to two minutes and you are approved in automatic underwriting. If it stays in automatic underwriting, that’s a two-minute approval. The question is why the funding game is so complicated? What is it about the game that all these hurdles we got to go through? It’s a crazy simple answer. Lenders do not trust you.

The question is, what if they could? This is where I want to spend a few minutes talking about this dynamic and I’m going to cover it several times. The single most important thing about your fundability™ is staying in automatic underwriting. Remember, if they don’t trust you, they have had to go to full documentation to prove every step of the way, every single piece of information, every data point that’s on your application, they need you to prove. We call it full documentation. That documentation is a simple proof of what you’re stating on the app. When we explore this further and when we look behind this Automatic Underwriting System software, you’re going to come to realize that you don’t have to prove anything that they measure from your behavior. The whole process is so complicated. Everything is so complicated because you have to collect your proof of income and your tax returns and your financial statements and all this mess because they don’t trust you.

The question now is what if they could? This is what we’re addressing. If they could, they have designed systems, these Automatic Underwriting Systems, they’ve designed them to allow you to take complete control over your approvals. It’s no joke. The lenders have empowered software to make decisions and lenders waste money when a human being has to approve you. Imagine, if they trust the software so much, but you know what the software needs to approve you, who’s in charge? Who now has full authority over your approvals? That’s right, you do. This podcast is all about answers to the questions of what do they need to know about me to approve me and then to align your borrower behavior with those particular behaviors, those particular criteria. Those funding criteria are all embedded in the software.

We went through the process of reviewing how the application process, how the inquiry occurs and the real-time access of your credit profile. Whether it’s a consumer profile or a professional borrower profile, whatever you have they’re going to evaluate. We’re going to talk about how more and more we can establish a professional borrower profile. When that software looks at it, your approvals happen. If they can trust you, they will lend to you. How do you get them to trust you without needing the full documentation of your financials, income verifications, pay stubs is monitoring your behavior. We’re going to go through every one of those processes and see what you can do to shape your behavior to fit accordingly. I will see you next time.