Building positive credit profile can oftentimes be tricky. In this episode, Merrill Chandler talks about how critical factors like utilization and aging may affect your profile. He also shares how to tell a lender that you’re a rookie borrower and how your application may be declined or approved. You will encounter some useful terms here such as debt shifters, reward hoppers, travel hackers, and age threshold. All these are necessary for understanding how you can manage your revolving account portfolio.

—

Watch the episode here

Listen to the podcast here

Revolving Account Portfolio Age

We’re going to be talking about how you tell a lender that you’re a rookie borrower and to deny your application. This is a rookie borrower call-out. We’re going to discuss how you on an application, when they pull your credit, to tell that lender that you’re a rookie and that they shouldn’t lend to you. Let’s get some of our terms down so that we understand who we’re talking about. I know this doesn’t apply to any of you. Thank heavens that we know what’s going on and those rookies out there are just horrible borrowers. This will stay between us. Let’s talk about debt shifters.

The Unholy Trinity

The debt shifters are folks who get a new credit card with a new 0% interest offer and transfer their debt because they haven’t been able to pay it down. They want to save money. That’s a debt shifter. I’m not going to point fingers or call names, but I am going to tell you those are rookie moves and we’re going to find out why they are rookies by doing so. The next group that we’re going to call out the reward hoppers. Reward hoppers are folks who are looking for that cashback, who are looking for the rewards, like the Marriotts and the Hiltons, the hotels, etc. In order to get more rewards, 50,000 points, they ask you to open up a new card.

We open up a new card and we show they totally reveal themselves as a rookie borrower, not a professional borrower. They’re getting their assets handed to them because of that strategy. Let’s talk about the last group. Travel hackers. We’ve all seen it. There are people out there who get a million miles. They get a million miles because of opening credit cards, etc. They keep up for the required year. They put it on the traffic that they need to put on it, and then they close the accounts. Travel hackers, you may be getting gazillions of miles on those, but you’re also devastating the fundability of your profile. You’re killing it. Let’s find out what those people over there are doing to totally ruin the fundability of their profile.

Account Aging

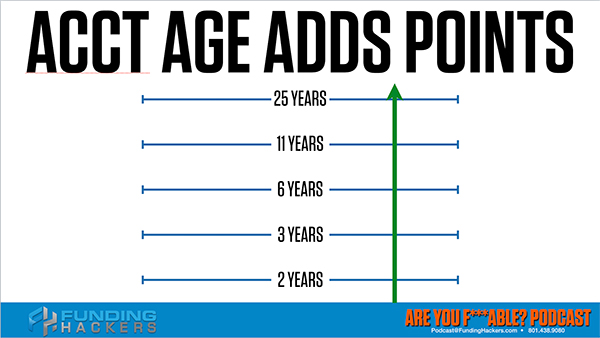

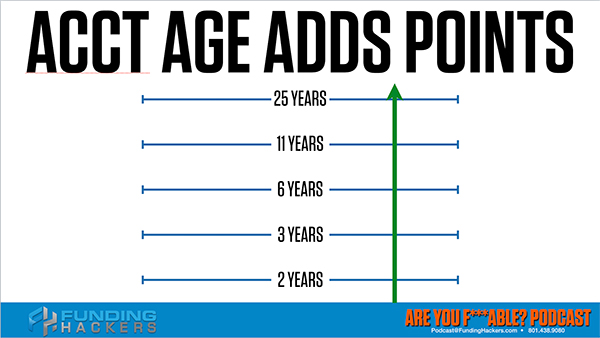

First of all, why is account aging so important? I want you to make a note of these thresholds. What I’m about to tell you, these aging thresholds are true for individual accounts and they’re true for the entire revolving account portfolio. Remember the collection of all your revolving credit. Every single time one of your credit cards or the average age of all of your credit cards, and we’re talking about only open accounts, not closed accounts. When we close them, because we’re travel hacking, reward hopping and debt shifting, we stop the aging process. We don’t get any points when we close those accounts. Think of it this way. When each credit card and when the average age of your revolving accounts portfolio passes two years, then three years, then six years, then eleven years, then 25 years you get FICO points.

There is no greater asset than your financial reputation #GetFundable. Share on XYour fundability goes through the roof for every single one of those thresholds. Notice it’s algorithmic as well, but it’s not quite double the previous period. Two years becomes three years, becomes six years, becomes eleven years, becomes 25 years. Every one of those thresholds, you get more longevity points. I don’t know what to call it. It’s longevity. It’s aging. After your utilization, aging is the greatest contributor to your profile. If you’ve got a six-month-old card versus a six-year-old card versus a twenty-year-old card, individually you’re getting points, but you’re also getting points for that average age.

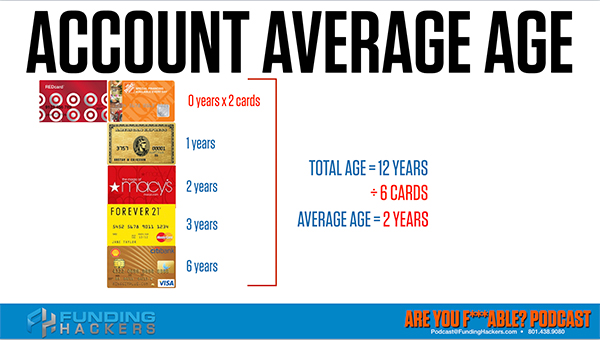

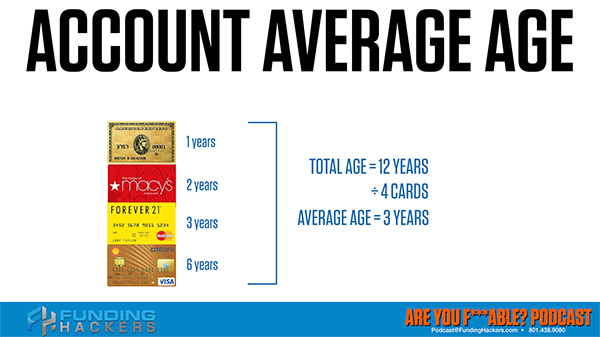

Average age thresholds also are affected going downwards. Let’s say you’re at eleven years and you open up a card and your average age goes to through six years and then it drops through three years, then it drops through two years. You are straight-up ruining your profile. Let me give you an example of how this looks. Let’s say we have a revolving accounts portfolio. It has four cards in it. One six years old, three years old, two years old and we have a one-year-old American Express. The total age of those cards is twelve years. I’m using it in twelve years to make it easy for you guys.

They count all these in months. FICO, they’re in months opened. Twelve years divided by four cards is the average age of the portfolio is three years. Notice that you’re getting points for the two years, but you don’t get any points for the one year because you haven’t hit the two-year threshold. The Macy’s card here is two years old. You’ve got that threshold. The Forever 21, it has hit that threshold and the Citibank Shell card, you’ve hit that threshold of six years. You’re getting points individually for three out of four of those cards. As an average age, which means the maturity of your profile, the maturity of your credit card history is only three years. Let’s pretend, I know this doesn’t happen to us.

This doesn’t happen to us, but it happens to them. You have family members, you’ve got friends who’ve done that. It’s horrible. We won’t judge them. We’re not going to judge them, but we’ve seen it happen out there. They go back to school shopping or they go Christmas shopping and they succumb to a savings pitch. Save 10% on your next purchase. Like little consumer rookie shoppers that they are, consumer borrowers that they are, they now get a Target account and that has zero years. There’s no contribution.

The second you get, remember previously I said you lose credit score points for having the inquiry, but you get as you get a zero month card. It’s a brand new card. You have five cards divided by twelve. Five cards, the total age is twelve years divided by five cards. Your average age for this revolving account portfolio is 2.4 years. Notice it’s a super consumer portfolio. We tried to tell them they went out and they went shopping again. The first one was in the fall or at the end of summer and they went to school shopping and then Christmas came around. They said, “I need another account.” They say, “Come to the 10% sales pitch.”

After your utilization, aging is the greatest contributor to your profile #GetFundable Share on XOur heart goes out to them, compassion, judge the sin, not the sinner. They say succumb to that 10% pitch again and we end up with another card. We end up with another zero year card. We now have six cards. We divide the twelve years of age because we haven’t gotten any new aging on these cards, on this portfolio. We divide twelve years by six cards and now we have dropped from three years to two years. Our portfolio is plummeting in value. Let’s review the unholy trinity of a revolving account portfolio management. The debt shifters, the reward hoppers and the travel hackers open up cards.

They either keep them, so you have too much available credit, which is a huge no-no for becoming fundable. They open them up, keep them open only for the year, and then they shut them down as soon as the 0% interest goes by or as soon as they’ve gotten all the rewards, or as soon as they’ve gotten all the miles. Every time you open one of these accounts, every time those consumer rookie borrowers open those accounts, you plummet both your individual account. You don’t allow them to age. They stop aging because you close them. Those accounts, your revolving account portfolio is hit.

Here’s the thing. These are lifestyle choices, but do you realize that there are business reward cards and there are business travel cards? I don’t know when you’re reading this, but at the time that I’m talking now, American Express business offered a Southwest 80,000 points for one their business cards. It doesn’t report on their personal profile. You need to make sure they still don’t report, but I now get the same benefit, but I’m not ruining the goose that lays the golden egg. I am not butchering the average age of my personal profile. Whereas, because your people don’t know the rules of the game, they’re crushing the soul of their personal profile.

They’re plucking that goose, killing that goose and they’re eating at once for dinner called 50,000 miles on Delta or whatever. We know what’s going on. We’ve got to educate our friends and family because we all have somebody who’s done this. Thank the credit gods that we’re not among them, but we have to stop this behavior. Maybe we do an intervention. Should we do an intervention? “Honey, you’ve got to stop debt shifting.” I have two things I want to say and one has to do with our debt shifting friends. First of all, debt shifting is a means to charge up money that apparently we can’t afford because we keep making minimum payments or we put property or investments or fix and flips or other costs on these credit cards.

We think we’re doing well because we are saving interest. When you charge those upon your personal side, it ruins your utilization. Remember, that utilization, they offer 12 to 24 months of zero interest. The interest is a cashflow thing, but you don’t realize that it’s destroying your personal fundability because you’re now caring for 6, 12, 24 months balances and these balances are far more destructive than the cash that you save being interest-free. Now I know we got to do what we got to do. We have a saying here that cash is king. If it’s going to turn a profit, then maybe fundability can take a backseat for a minute.

That’s why you need coaches or advisors to help you make these decisions. I’m telling you, it can’t be for long-term. Here’s the last thing I want to share on about debt shifting, about these zero interest cards. First of all, rarely do we ever consider that it’s going to be twice as expensive and twice the time before we can get our money back. It always happens. It’s twice as expensive. Twice as expensive and twice the money or twice as expensive and twice the time period. What you don’t realize besides the utilization, which is the strongest argument I have against our friends and loved ones needing intervention to stop doing this. The other powerful argument is that you’re treating your personal credit profile, this goose that lays the golden egg, you’re treating it like it belongs on your financials in the P&L section rather than the balance sheet section.

The Two Documents

For those of you who are familiar with it, you’ll totally get this. For those of us who aren’t familiar, it’s super simple to learn. You have personal financials. You can have business financials, but there are two documents inside of these financials. One is a P&L. That’s profit and loss. That’s your income and expenses. You have $10,000 come in, you have $8,000 go out. In your checking accounts, you have $2,000. That’s profit and loss. That’s income and expenses. On the other side you have assets and liabilities and it measures everything to do with your financial well-being, either personally or professionally. Here’s the problem. If your credit strategy and your debt strategy is over on the P&L, you’re trying to save expenses by not paying interest.

All fine and good, except you are ruining the single greatest financial asset you have in your life. There is no greater asset than your financial reputation. You show me a borrower with $1 million and an unfundable credit score and a profile, and I will show you a borrower with $1 million. You show me a borrower with a fundable profile and $1 million, and I will show you a borrower who can leverage $1 million to $5 million and that’s good for $10,000 to $500,000. It doesn’t matter how many zeroes are behind your numbers. You can leverage your reputation. You can leverage a fundable profile for fun and profit.

When you’re unfundable, when you’ve been carrying balances, even though you’re saving money, you’re killing that goose that lays the golden eggs. Here’s the other thing. If you had $10 million, let’s call it $5 million in gold bullion. That’s an asset. Would you spend money protecting that asset? Yes, you would. The more it’s worth, the more money you would spend to protect it. $1 million versus $5 million versus $10 million versus $100 million. You would spend money to protect that asset. That’s what interest is called. What we want is we want to spend, we want to have the right kind of debt. We call it strategic debt.

Average age tells lenders how long you have been trustworthy with other people’s money #GetFundable Share on XBuilding Your Financial Reputation

We want the right kind of debt and we want it to be minimal but perfectly played and established on your personal profile. We want to age the revolving accounts. We want to have the right kinds of loans. We want the right utilization. The funding cradle, we want the right limits. All of those things build your financial reputation. That’s what we call fundability. When you are fundable, then lenders will invest in you with their loans and credit limits. I know you’re trying to save money, but you keep shifting this debt and you’re paying zero interest, but you are butchering your profile in the process.

Every new card you get lowers your average age. I’m saying let’s learn the rules of fundability. That’s why I want you to read these. That’s why go to GetFundable.com and check out the bootcamp so you can get all this stuff. You need to know how this works. You need to take care of your funding golden goose. You need to take care of the only asset that matters in the financial world. That’s your fundability, your financial reputation. A horse that enough kicking. The same is true for reward hoppers and travel hackers. Those folks out there who do those nefarious things are limiting the value of their revolving accounts.

If you’re trying to get open up business credit lines and be able to write a check and do a deal, grow your businesses and do the things that you want to do out there, every time you open up a new card, you’re limiting lower and lower your average age. That age tells lenders how long you’ve been trustworthy with other people’s money and the less and less it goes. That’s why I said this is called literally tell a lender, “I’m a rookie. Don’t lend it to me.” In this instance, your average age, they’re not going to take you seriously. They’ll continue to give you cards. They are a consumer. They are amateur borrowers and lenders are not going ever to take them seriously.

By the way, it is a negative thing to have net because they stay on your account. Even positive accounts fall off your credit report ten years after they’re close. For that ten years, if you have two, three, five, ten revolving accounts that are closed on your profile or more, you’re just screaming to everybody, “I’m a rookie,” and I don’t want your loved ones to be rookies. I want you to be professional borrowers. I want you to be able to have them create all the wonderful things in their lives. Protect the goose that lays the golden egg. Take care of and nurture that personal profile. Keep reading these because I’m going to continue to tell you exactly how to do this so that you have the best fundable profile possible.