Are you aware of business credit scams? Having a business credit does not mean that it actually is a business credit card. In this episode, Merrill Chandler discusses one of the most deceptive practices that business credit providers actually voiced upon us unsuspecting borrowers. He breaks down what business credit cards are and what is not and how lenders scam their customers. Learn about the “wolf in sheep’s clothing” and how personal credit acts like business credit being reported to your profile.

—

Listen to the podcast here

Business Credit Posers

It’s not an insider secret. This is one of the most deceptive practices that business credit providers actually voiced upon us unsuspecting borrowers.

—

We’re talking one of the things somewhere between breaks my heart and makes my blood boil because these are business credit scams where lenders believe we don’t know the rules of this game. These lenders provide what we think our business credit cards and they’re not. They end up reporting on our personal profile, ruining our fundability™, ruining the goose that lays the golden egg and they go in their merry way thinking they’ve done us a solid. We’re going to talk about what business credit is and what business credit is not. Remember, when we do this wrong, we will tell lenders to reject this on future applications.

Business Credit Scams: You’ve got to have the right funding entity so that lenders are funding you as the genius behind the business.

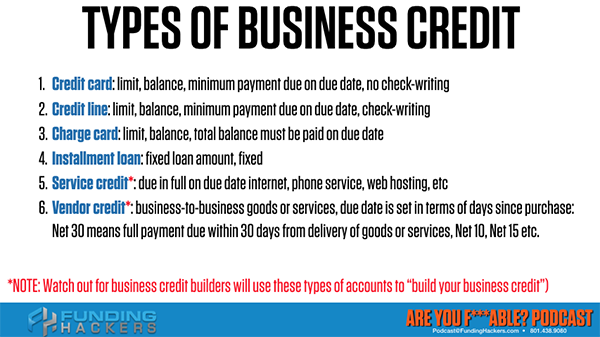

First, let’s get some definition down. There are several types of business credit above and beyond what we’ve talked about on the personal side. Like on the personal, there are credit cards, credit lines and charge cards. Those are the same things that we’ve talked about over on the personal side and in addition there are installment loans. Commercial loans, real estate loans, can also be on the business side. There are two additional types of credit we need to be aware of because in subsequent episodes, we’re going to be talking about how fake business credit builders, they come and say, “I’ll help you build your business credit,” and then they deceive us. Remember, we talked about the PAYDEX score. The PAYDEX is dead. We’re going to be doing a deeper dive into what that means and how people are having us try and build those credit scores.

No business credit lender through cash cards, credit cards and business credit lines use any of those business card building processes. To get to that, we need to understand that there are two other types of business credit. One is called service credit and one is vendor credit. Service is like on the personal side, you can have your internet service, water delivery, phone service, web hosting. All those things are service credit. We call them service providers on the personal, but this service credit is specific to business expenses, etc.

When your personal profile is protected, then you’re taking care of the goose that lays the golden egg. Share on XAll of them can be written off, etc., associated with the business. There’s the vendor credit. Vendor credit is business to business, goods and services. They usually have a net 30. They don’t have charge cards and they don’t have credit cards. Real estate investors may have a carpet service where they’ll say, “I’ll charge you in 30 days.” They may have a roofing. You could have the due date set out 15 days or 30 days. For paper deliveries, if you’re a photocopier outlet and they are charging these charges, but they’re on account for 30 days or so. It’s called net 15, net 30, net 5, etc. Those are the types of accounts that are used with these fake business credit builders. I need you to be aware. This is where we’re going.

Three Popular Business Credit Instruments And How Best To Use Them

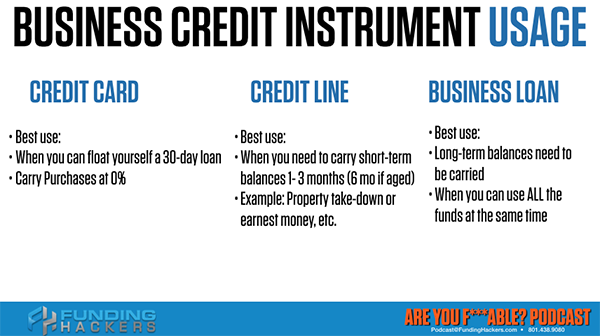

Let’s talk about the three popular business credit instruments and how best to use them. It doesn’t matter what type of entrepreneur you are, what type of business owner you are. These are how the business instruments are designed according to the lenders. When vetting hundreds of banks to help our clients, our students build relationships with the right kind of business bankers. Invariably in these definitions, the lenders use these parameters to see whether or not you’re using their instrument correctly or well and whether or not they’re going to give more money as the result of using it properly. Let’s go over the business credit card. The best use is when you’re floating yourself a 30-day loan and you carry the purchases at 0%, meaning that if you pay it on the due date you gave yourself a 30-day loan and sometimes it’s even longer than 30 days.

Business Credit Scams: Your personal profile is like a porcelain doll, a beautiful thing that you put on the shelf and let lenders be in awe of it.

Let’s say your building period is from 1 through 30 of the month, and it’s not due until the fifteenth. You bought something on the first or second and not due till the second month on the fifteenth. That’s 45 days of a free-float, free interest. There are business credit cards out there that for nine, twelve, eighteen months will let you have 0% if you carry it. Meaning, you go for month to month over two or three months. You can carry those balances at 0%. The problem is FICO is still in the process of validating data and there’s not wide adoption yet of the small business scoring service. As FICO is in charge of all credit scoring, 90% of credit scoring decisions on the personal side are done by FICO.

I guarantee you that FICO is going to take over this business credit scoring as well. They’re not there yet. It’s okay to carry balances. Remember if you carry a high balance, the lender knows. Other lenders won’t know because FICO is not scoring it and is not out in the world, it’s not on a business credit report worth anything. The current lenders know that you’re carrying a balance above 30%, 60% whatever it is and they will add to your credit line or take away from your credit based on how you can pour yourself, how you treat their money. Be aware, the best use of a credit card is that 30 to 45-day float pay it down to zero, don’t carry balances above 7% until FICO starts reporting. Don’t ruin the relationship that you have with this business lender. Let’s look at credit lines. The best use of a credit line, this is literally out of the mouth of credit line issuers.

The lender who issues these credit lines, they’re saying that when you need to carry short-term balances for one through three months. If it’s an older credit line, meaning six to twelve months, they don’t mind if it goes from three to six months carrying a balance. We prefer to keep this under 30% so we tell the lender not to worry, but there are ways around that. We’re going to be learning later in the business credit line building phase that there are strategies that you can do that will augment your use of these lines. We’ll be talking about that in a future episode. If you’re taking down property, you earn this money, you’re covering payroll, you need to buy new computers for your consulting firm, whatever it is they love credit lines. Credit lines are built to carry balances from one to three months and up to six months if it’s aged. If it’s over six months to twelve-month-old, then you can take it to six months and there are strategies again of how to notify your credit issuer.

Notify your lender what you’re doing and how to get them to be on your side and not send you to the risk department. Credit lines, one to three months and if it’s an older instrument then six months is okay, but it’s not designed to go for 12 months or 24 months, that’s not what credit lines are for according to a lender. The final category is that we have a business loan. The best use for a business loan is for long-term balances. If you can use the entire loan amount all at once that’s when you choose a business loan over a credit line. In fact, one of my clients was a gentleman who wasn’t interested in the million-dollar funding formula for credit lines because he could use every single penny. Instead of doing lines, he did business loans to the tune of $100,000 each. He pulled that money and was able to invest it in his projects, in the building of his business and a couple investments that he had his eye on and he used the entire business loan for those purposes.

You have to remember, you’ve got to have the right funding entity so that lenders are funding you as the genius behind the business. The best use for business loans is if a long-term balance needs to be carried then get a loan, don’t get a credit line. If you can use that money all at once, then that’s what you want to use a business loan for. Out of the mouth of business lenders is this information coming from us. Let’s take a look the definition of business credit. The traditional business credit is a credit instrument that is issued in the name of the business with the business being primarily responsible for repayment. That makes sense. That definition does not take into account credit reporting where it’s showing up on the borrower profile and how it’s affecting your fundability™. It’s simply saying business credit is primarily responsible. Business credit is when the credit instrument is primarily responsible for being paid by the business.

What Business Credit Is Not

Our definition is any credit account that does not report to your personal profile, but your EIN or your business was used as part of the application process. If you put the name of your business and/or the EIN of that business and it does not report to your personal borrower profile, that is business credit. Let’s go over an example of what business credit is not. I call it a business credit scam alert. In the next episodes, we’re going to be going up against people who are trying to build business credit using instruments like this. Business credit is not something to report to your personal profile. An example of that is Spark Business. “Spark and Capital One are not true business credit instruments.” There is nothing Capital One puts into the market that is a true business credit card. Capital One, every single thing and Capital One report to your personal profiles that makes any personal credit, even if it says Spark Business on the card.

The question is why is that? If it says it’s a business credit, then it’s a business credit card. I’m going to tell you, it’s not. Here’s why. Every time you use this card for business it raises the utilization on your personal profile because it reports to your personal credit report. Every time you raise your utilization, those balances go up, your fundability™ and your score go down. That is not business credit. That is personal credit. The goose that lays the golden egg is your personal profile. We want true credit instruments that don’t report to the personal.

When you raise your balances on that credit card it doesn’t affect your personal profile. When your personal profile is protected, then we’re taking care of the goose that lays the golden egg. We’re talking care of your funding asset, which is your personal profile. There is no business credit from this cover that is actual business credit. All these cover business credit instruments report to your personal profile. When you use that card for business, it ruins the utilization and the balances on your personal profile and you’re hit. That is not personal credit. There are some credit cards by American Express that do not report and some credit cards do. Some Chase cards report to your personal, some do not. In a different episode, we’re going to be talking about how to ask a customer service representative from any one of these banks, how to find out whether or not it reports to personal.

Business Credit Card Stacking

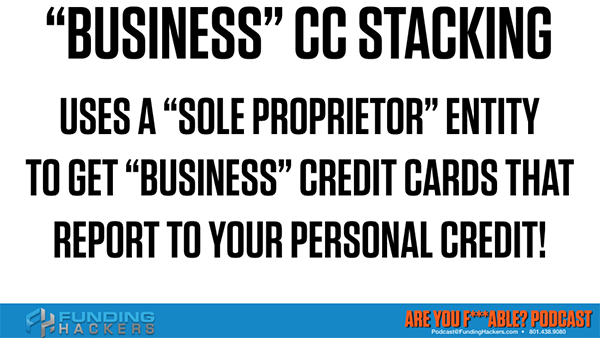

In the next few episodes, we’re talking exclusively about building a business, how to be fundable in your business as well. The first thing we’ve got to do is stop getting credit instruments that we think are for business and they end up on the personal side. Let’s take a look at business credit card stacking. I did a scaling review of Seed Capital, who is a credit card stacker. When I put quotes around business credit card stacking, that means people who say, “I’m going to get you $250,000 for your business.” Go back and read that episode. It’s a scaling reminder. I had a credit stacker who is not Seed Capital direct messaged me and said, “Can we talk?” We spent one hour on the phone and he did his best to defend the tactics for individuals to do this credit card stacking. We’ll cover in a moment, I told him about the 5/24 Rule, about if somebody needs so much money so fast that they’re going to ruin their personal borrower profile they may want to ask is it worth it.

In that case if we go back a couple of episodes, are they a credit or a funding rat? The rat is any credit at any cost. That is behavior that is going to be measured by the lenders. Some business credit card stacking outfits will use a sole proprietor entity to get business credits that then reports to your personal because the sole proprietor is an alter ego. If your sole proprietor and your business entity get sued, they are suing you individually. There’s no protection, there’s no corporate veil like with an LLC or an INC stock corporation. When they get a sole proprietor and they get an EIN, but it’s the sole proprietorship and they’re getting business credit, I guarantee you those credits are going to report to your personal and ruin your profile.

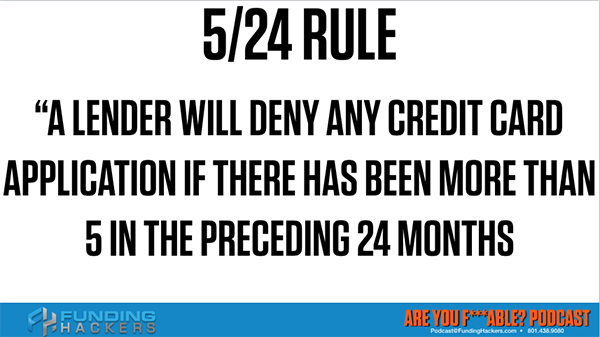

Let’s review because we talked about it once. The 5/24 Rule is important. This gentleman who reported back and trying to tell me the benefits of credit card stacking. He said, “Only Chase uses the 5/24 Rule.” The 5/24 Rule is coming out and FICO Falcon is monitoring all of these. There are several synchronizing databases that are looking for these types of inquiries to implement. There are numerous banks that have joined. I guarantee you over the next 12 to 24 months, more and more banks are going to deny any credit card application if there have been more than five approvals in the preceding 24 months. They’re going to cut it off. If there are more than five in the 24 preceding months, they’re going to drop like it’s hot.

More On These Liars, Cheaters, And Thieves

We are going to be doing Facebook Lives on a number of these on Liars, Cheaters, and Thieves like we did Seed Capital. We’re going to be going over the funding grow, we’re going to be doing Sprout Financial, we’re going to be doing the Midwest Corporate Credit. Anybody who says business credit at 0% interest is lying through their teeth. We’ll cover that in greater detail in subsequent episodes. I’m tired of people taking advantage of borrowers who are not part of the Get Fundable! revolution. If you’re at this episode, you have enough knowledge to protect yourself, your family members, your loved ones, the people at your work or at your school do not have this knowledge. Get them to read the blog. Get them to at least stop stepping on the funding landmines that are killing them.

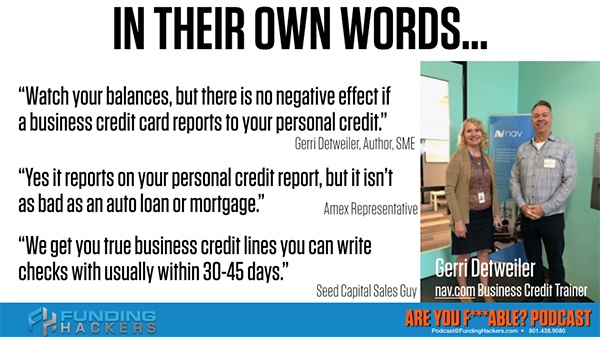

We’re going to be doing a liars, cheaters and thieves on the business credit building scams because this scam is calling a wolf in sheep’s clothing, acting like business credit but actually being personal credit and reporting your profile. Make sure you go to the blog so you can see the pictures. There’s a lovely woman, her name is Gerri Detweiler and she is the Business Credit Trainer for Nav. We’re going to be doing a Nav liars, cheaters and thieves. Nav is the business credit equivalent to Credit Karma. They don’t use legitimate scores. In fact, they use all FAKO scores. They don’t use FICO scores. They sell credit cards, many of which are not business credit cards, but end reporting on your personal profile.

We were invited to a forum. They had a class on business credit and they know exactly who we are. In fact, it felt Gerri was talking to Jessica and me while we were sitting in that class to verify the truth of some of her assertions. One of the things she said, and I pulled it right out of the class, somebody asked her, “What is the negative effect of getting business credit?” She said, “Watch your balances, but there is no negative effect if a business credit reports to your personal credit.” She’s even affirming that she knows that those utilizations are going to get reported to your personal.

Your personal profile, the goose that lays the golden egg, but it’s like a porcelain doll, a beautiful thing that you put on the shelf and let lenders be in awe of it. It’s not a Raggedy Ann you take and play in the mud. She’s literally saying that there’s no negative of a business credit card reports to your personal credit. It contributes to your total credit lines. You’re going to have too much available credit. You’re going to have too higher balances, your utilization gets sucked. It is like having another credit card. The perfect profile is only three to five credit cards in the first place. If you’re going to try and build business credit, you’re going to have way more than three to five cards.

The next was from an AmEx representative because we go in and we want to continue to be updated on the types of accounts that are reporting to personal and reporting to business only. An AmEx representative said, “Yes, it reports on your personal credit report, but it isn’t as bad as an auto loan or mortgage.” It’s worse. An auto loan and a mortgage are loans. In installment loans, we talked about having a far less negative impact by having them and their secured loans which has a less negative impact. A personal credit card is unsecured. It’s the worst possible message. If you have a high balance there, you’re completely irresponsible. He’s comparing loans to unsecured credit. That is the exact opposite of what he should’ve said. That particular of American Express report to your personal credit report, but it’s not bad.

Gerri should know better. She wrote a book on business credit. I can’t speak to it. As a person, she’s a sweetheart, a lovely soul. As a business credit professional, she is not. She is the Business Credit Trainer for NAV and she is not doing their clients a solid, but now again is in the business of selling credit cards. They don’t care if it reports or ruins the borrower’s personal borrower profile. He said, “We get you true business credit lines you can write checks with usually within 30 to 45 days.” The checks he’s talking about are convenience checks and most of those convenience checks are taking a cash advance and it chases those cash advance. Those cash advance checks are 26% interest per day. He even had the audacity to say we get you true business credit lines. They don’t. They’re personal credit cards you can use for business, but you got to tap them up and tap them out and then they abuse, they ruin your utilization, they ruin your 24-month lookback period. They ruin everything about your personal profile.

We’re going to stop here for this episode because in the next few episodes we’re going to be doing a deep dive into business credit scams. What they’re selling you, the joke that they are and then the deceptive practices they’re using to tell you that it’s okay because you don’t know the rules of the game. They’re going to dunk on you and abuse and teach you how to ruin your personal credit in the process. Until next time, this is Merrill Chandler making sure that you are as f***able as you can possibly be. Go GetFundable.com and click on the bootcamp and learn what you can. Take a weekend and let’s do this together. I would love to meet you in person or in live streaming mode.